In this article, we explore Levered and Inverse ETPs (exchange-traded products); their purpose, the circumstances in which they tend to succeed and fail, and the research questions associated with them.

Levered and Inverse ETPs: Blessing or Curse?

- Colby J. Pessina & Robert E. Whaley

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

In 2019, the SEC proposed that all brokers and advisors be required to determine whether or not their clients understood the risks of investing in levered and inverse exchange traded products before selling such products to them. The SEC moved on this requirement in response to a series of fund failures. For example, after losing 96% of its value in a single day, Credit Suisse closed its Daily Inverse VIX short term ETP (XIV). Unfortunately, the issue seemed to go beyond investor education as fund collapses continued to occur.

Citigroup’s VelocityShares 3x Long Crude Oil exchange-traded note (UWT) nearly tanked on 9 March 2020, when its benchmark index dropped 73.5%, just shy of the 75% acceleration clause that would have triggered termination. On 15 March 2020, ProShares announced the liquidation of its UltraPro 3x Crude Oil (OILU) and UltraPro –3x Crude Oil (OILD) exchange-traded funds (ETFs).

One question occurs: Why do these products even exist?

The authors of this article are motivated to provide an answer. They discuss the intended purpose and under what conditions these funds are likely to fail. They describe the basics of expected performance and review how issuers have actually matched the targeted benchmark performance. Major points are summarized below.

What are the Academic Insights?

- If standard asset pricing assumptions are used then it follows that the expected return of levered and inverse ETPs will be zero. If the benchmark return is positive, the value of the levered or inverse ETP is zero. If negative, the value is also zero (Cheng and Madhavan, 2009). This theoretical result makes the ETP undesirable from a long-term perspective or risk management perspective. The authors conduct Monte Carlo style simulations that confirm these expectations.

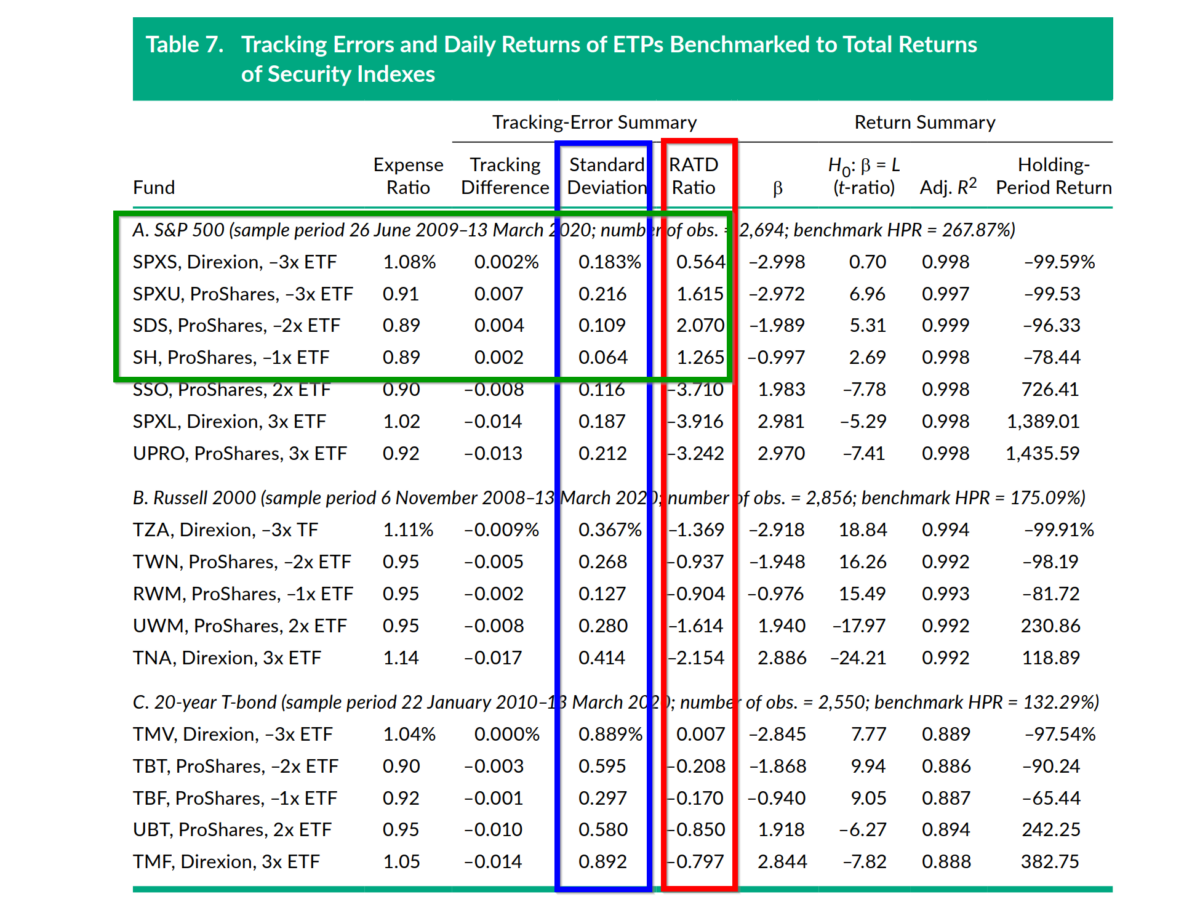

- The analysis of tracking error (TE) provides insight into how well issuers have matched the benchmark return. Thirty-five funds were examined with results presented in Table 7 below. TE is defined as the difference between daily returns of the securities-based benchmark and the fund. The authors convert TE into a risk-adjusted return (RATD). A similar analysis was conducted using futures-based benchmarks. It appears that ETPs based on the SP500 have outperformed other products on a risk/return basis.

Why Does it Matter?

Levered and inverse ETPs seem to be a blessing, but only under limited conditions. If the investor has a firm directional view of the market, these products offer an attractive opportunity. Trading costs, barriers to trade (no account minimums, commission-free), and bid-ask spreads for levered and inverse ETPs are very low, especially when compared to trading similarly in the futures market. Smaller retail investors may be prohibited from using futures to implement a directional trade due to minimums required, both personal and account-based. Institutions may also be prohibited from using derivatives for a variety of reasons. Levered and inverse ETPs may fit the bill for those entities.

The Most Important Chart from the Paper

Abstract

Levered and inverse exchange traded products (ETPs) are designed to provide geared long and short exposures to the daily returns of various benchmark indexes. The benchmarks may be any reference index, but the popular ones are indexes of stocks, bonds, commodities, and volatility. The problem with these products is that they are not generally well understood, particularly those with futures-based benchmarks. Levered and inverse ETPs are neither suitable buy-and-hold investments nor effective hedging tools. They are unstable and exist only as mechanisms for placing short term directional bets. Levered and inverse products are not, and cannot be, effective investment management tools.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.