In this article, we examine the academic research about what millionaires invest in.

Millionaires Speak: What Drives their Personal Investing Decisions?

- Bender, Choi, Dyson and Robertson

- Journal of Financial Economics, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

By surveying a sample of 2,484 U.S. respondents, each of whom has at least $1 million of investable assets,18% of whom have at least $5 million, and 4% of whom have at least $10 million, the authors examine four categories of factors (investing in equities, concentrated stock ownership, cross-section of stock returns, and active equity investment managers), to find out :

- What drives these investors’ investing decisions?

What are the Academic Insights?

The study finds the following:

#1

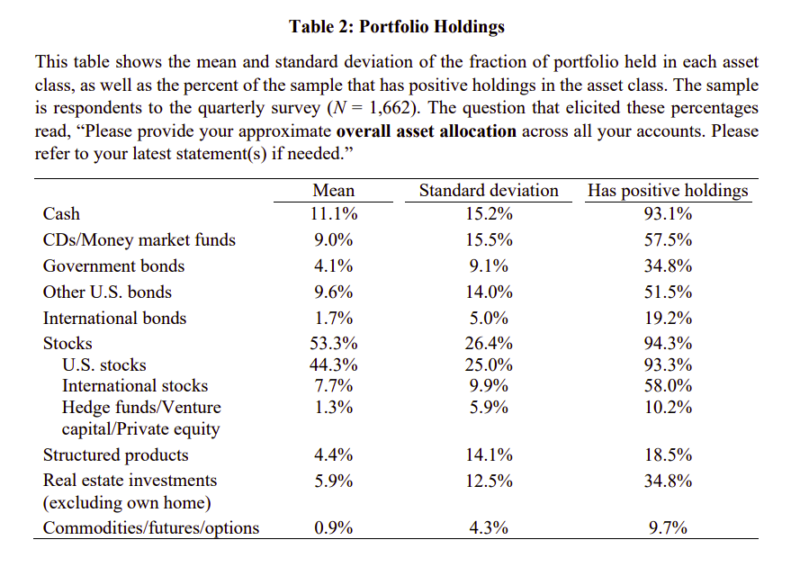

On average, respondents hold 53% of their portfolio in equities. Non-participation in equities is rare—only 6% of respondents hold no stocks. There is a strong home bias in respondents’ equity holdings: 83% of their stocks are U.S. stocks.

Only 10% hold any assets in hedge funds, venture capital, or private equity, but conditional on doing so, they allocate 13% of their portfolio to these funds. Professional advice, time until retirement, personal experience with markets, rare disaster risks, and health risks are the most important factors in determining their portfolio equity share.

#2

12% report that more than 10% of their net worth is currently invested in the stock of one and only one company, and an additional 3% report that more than 10% of their net worth is currently invested in the stock of each of two or more companies. A surprisingly high 67% report that their concentrated position has no effect on their total amount invested in equities; slightly more say that the concentrated position causes them to hold more in stocks than less in stocks (14% and 12%, respectively). Standard portfolio choice theory predicts that their total equity position should decrease.

The belief that the concentrated position is a superior investment seems to be the predominant motive for foregoing diversification. In fact, 46% say it is the belief that the stock would provide higher returns on average while 33% answer it is the belief that it would provide lower risk.

#3

47% of respondents think that value stocks are less risky than growth stocks, while only 135 say the reverse. Consistent with a belief in a positive relationship between risk and expected return, respondents collectively believe that value stocks have lower expected returns than growth stocks, although with considerably less conviction: 24% say value stocks have lower expected returns, compared to 22% who say the reverse. Additionally, more people believe that high-momentum stocks are riskier rather than safer (28% versus 8%), and more also believe that high-momentum stocks have lower expected returns than higher expected returns (27% versus 10%). 34% believe that high-profitability stocks have higher expected returns—consistent with the historical data—versus only 11% who believe the opposite.

38% say that high-profitability stocks have less risk, versus only 8% who believe the opposite. Generally speaking, these responses cast some doubt on rational explanations for why these stock characteristics are associated with different expected returns. These results also challenge many prominent behavioral theories of characteristic premia. Models with non-standard preferences often assume that investors have rational expectations which are inconsistent with our respondents’ beliefs about how characteristics vary with expected returns. Theories with heterogeneous investor beliefs (perhaps sustained by overconfidence) fit these findings better.

#4

45% report that they had invested in active equity investing while 49% report that they had not, with a further 6% report being unsure. Those who answered positively cite the following as motivations: advisor recommendation (45%), higher average returns (44%), and hedging demand (23%).

Additionally, 42% of respondents agree or strongly agree that past returns are strong evidence of stock-picking skill, but only 33% agree or strongly agree that there are decreasing returns to scale in active equity investment management. Overall, the pattern of responses suggests that a significant amount of active investing through funds by the wealthy is driven by a belief that they can identify managers who will deliver superior unconditional average returns.

Why does it matter?

One surprise that emerges from the study’s results is how similar the wealthy are to the average household in terms of their beliefs about how financial markets and the economy work, and in terms of the role of non-standard preferences in their decision-making (Choi and Robertson, 2020).

The Most Important Chart from the Paper:

Abstract on what millionaires invest in

We survey 2484 U.S. individuals with at least $1 million of investable assets about how well leading academic theories describe their financial beliefs and personal investment decisions. The wealthy’s beliefs about financial markets and the economy are surprisingly similar to those of the average U.S. household, but the wealthy are less driven by discomfort with the market, financial constraints, and labor income considerations. Portfolio equity share is most affected by professional advice, time until retirement, personal experiences, rare disaster risk, and health risk. Concentrated equity holdings are most often motivated by the belief that the stock has superior risk-adjusted returns. Beliefs about how expected returns vary with stock characteristics frequently differ from historical relationships, and more risk is not always associated with higher expected returns. Active equity fund investment is most motivated by professional advice and the expectation of higher average returns. Berk and Green (2004) rationalize return chasing in the absence of fund performance persistence by positing that past returns reveal managerial skill but there are diminishing returns to scale in active management. Forty-two percent of respondents agree with the first assumption, 33% with the second, and 19% with both.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.