In this article about asset pricing theory, we examine the research on the impact of technological advances that displace human labor in favor of machine capital to asset pricing.

Automation and the displacement of labor by capita: Asset pricing theory and empirical evidence

- Jiˇrí Knesl

- Journal of Financial Economics, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Advances in technologies and automation prompted this study which answers the following question:

1. Does displaceable labor affect firms’ value and exposure to technology shocks?

What are the Academic Insights?

The author develops a general equilibrium model of optimal technology adoption with heterogeneous firms that monopolistically compete in product markets, and heterogeneous households that experience uninsurable idiosyncratic labor-income shocks. While automation can benefit an individual firm, it entails adoption cost. By studying the occupational characteristics from the O∗Net database, stock information from CRSP, and the composition of the labor force from Occupational Employment Statistics (OES), the author finds:

1. Firms with a high share of displaceable labor have more negative exposure to technology shocks.

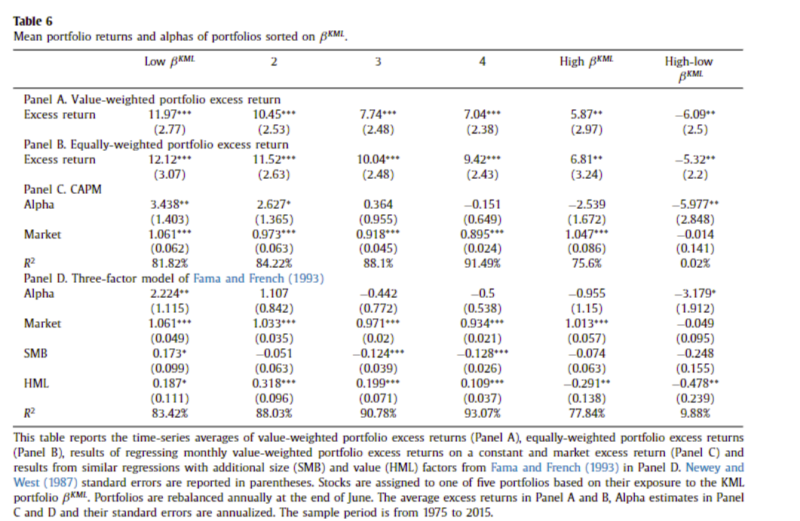

2. A long-short portfolio sorted on this variable mimics macroeconomic measures of technology shocks. Negatively exposed firms earn a 4% annual return premium consistent with displacement risk from technological progress.

Why does it matter?

In a competitive environment, firms’ automatable labor increases riskiness. This paper shows that automation becomes a costly necessity for firms and erodes potential rents from technological improvements while efficiency gains are passed on to consumers.

The Most Important Chart from the Paper:

Abstract

I examine the asset pricing implications of technological innovations that allow capital to displace labor: automation. I develop a theory in which firms with displaceable labor are negatively exposed to such technology shocks. In the model, firms optimally adopt technology to gain competitive advantage; but in equilibrium, competition erodes profits and decreases firm value. Empirically, I find that firms with high share of displaceable labor have negative exposure to technology shocks. A long-short portfolio sorted on this variable mimics macroeconomic measures of technology shocks. Negatively exposed firms earn a 4% annual return premium consistent with displacement risk from technological progress.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.