Factor strategies need to be rebalanced in order to maintain their factor exposure. But different factors decay at different rates and this affects how they should be rebalanced. For example, momentum needs to be rebalanced more than value. This study digs into these questions.

Factor Information Decay: A Global Study

- Emlyn Flint and Rademeyer Vermaak

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

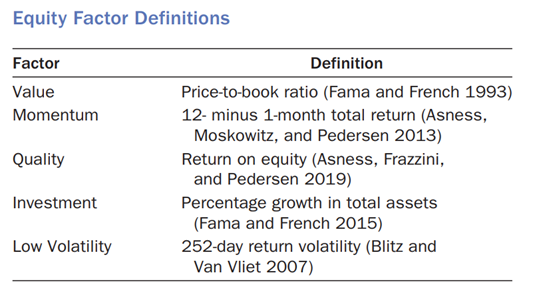

The authors argue that factor exposures are random variables governed by a specific distribution that drives the behavior factor exposures over time. Five factors are examined including value, momentum, quality, investment and low volatility, over 12 developed and emerging markets for the period 2002-2019. The five factors analyzed are drawn from academic studies using well-known factor definitions. Definitions and academic references are presented as follows.

Distributions for pure and long/short factor strategies are calculated and then analyzed over a 36-month holding period. Information decay is calculated as a factor “half-life” and was found to be the longest for the value factor. Optimal rebalancing periods based on global half-life results of the lower tail or worst-case scenarios of the targeted factor exposures are suggested by the authors.

- How rapidly do factor exposures change over the future holding period as information about the factors evolves?

What are the Academic Insights?

- IT VARIES CONSIDERABLY. However, Value exhibited the longest half-life and Momentum + Investment exhibited the shortest. The results in terms of “half-lives” for each factor averaged globally and then calculated by individual country, are presented in Exhibit 9 below. Estimates of the optimal rebalance periods were obtained using the overall global distributions.

- For value, the pure and quartile portfolios median exposures remain higher than the universal threshold of 0.50 (and so are left blank in the exhibit). The lower quartile half-lives are long at 25.3 (and 32.9 for long/short) months. With the exception of Japan, Korea and Taiwan, where the exposures were relatively short at 1.6, 0.0, 0.7, respectively, all other countries exhibited similarly higher half-lives. The estimated optimal rebalance period was 3-4 months.

- Low volatility exhibited the next slowest performance in half-lives with the pure portfolio median larger than 36 and lower quartile portfolios at 12 and 12.9 months. Again, Japan, Korea and Taiwan exhibited much shorter half-lives relative to the remainder countries included in the sample. The estimated optimal rebalance period was 5-6 months.

- For quality, the median half-life was 25.9 months for the pure factor and >36 for the quartile. Once again, Japan, Korea and Taiwan turned in very slow half-lives at 10-14 months. The US, in contrast, was an outlier at 10.3 months. The estimated optimal rebalance period was 4-5 months.

- Hands down, investment and momentum factors decayed more rapidly than any other factor. When only the lower deciles were examined, the decay was especially rapid for the investment factor relative to momentum. The estimated optimal rebalance period was three months for momentum and one month for investment months.

Why does it matter?

At least two insights may be gained from this research that benefit portfolio management objectives. Practically speaking, a direct estimate of how a particular factor exposure evolves over a holding period provides information on optimal rebalance schedules. In addition, the ability to plot the estimates of the factor returns combined with knowledge of the optimal rebalancing periods per factor provides a picture of the expected returns for a single or multifactor investment strategy.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This research addresses a simple but important unanswered question in the factor investing literature: How do the factor exposures of equity factor strategies decay over time? The answer to this question has two important practical consequences. First, understanding how a strategy’s factor exposures change over time informs the optimal rebalancing period. Second, when coupled with factor risk premia estimates, it describes the term structure of expected returns per factor strategy. To answer this question, the authors conduct a large scale, empirical study of five well-known factors—value, momentum, quality, investment,

and low volatility—across 12 developed and emerging markets over the last 20 years. They calculate factor exposure, or information, distributions per market for both pure and quartile long–short factor portfolios and then analyze how these distributions decay over a 36-month holding period. In order to formally measure the rate of information decay, they introduce the idea of a factor half-life metric and use the global half-life results to propose optimal rebalancing periods per factor.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.