This article studies whether index investing has implications for the informational efficiency of stock prices.

On Index Investing

- Coles, Heat and Ringgenberg

- Journal of Financial Economics, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- Does the rise of index investing change information production in the economy?

- Does it affect the informational efficiency of stock prices?

What are the Academic Insights?

The authors augment (and improve) the Grossman and Stiglitz (1980) model of endogenous information acquisition by including a choice by investors where investors choose to be passive, active, and publicly informed, or active and privately informed. They also use the Russell Index reconstitutions as a source of exogenous variation in passive investing from 2007 to 2016.

- YES – By using three different measures of information production (Google search volume, EDGAR page views from the Securities and Exchange Commission, and buy-side analyst reports) – the authors find that more index investing leads to less information production about individual index stocks. Specifically, they find that Google search volume falls by 3.8%, EDGAR page views fall by 14.1%, and the number of analyst reports falls by 10.8%.

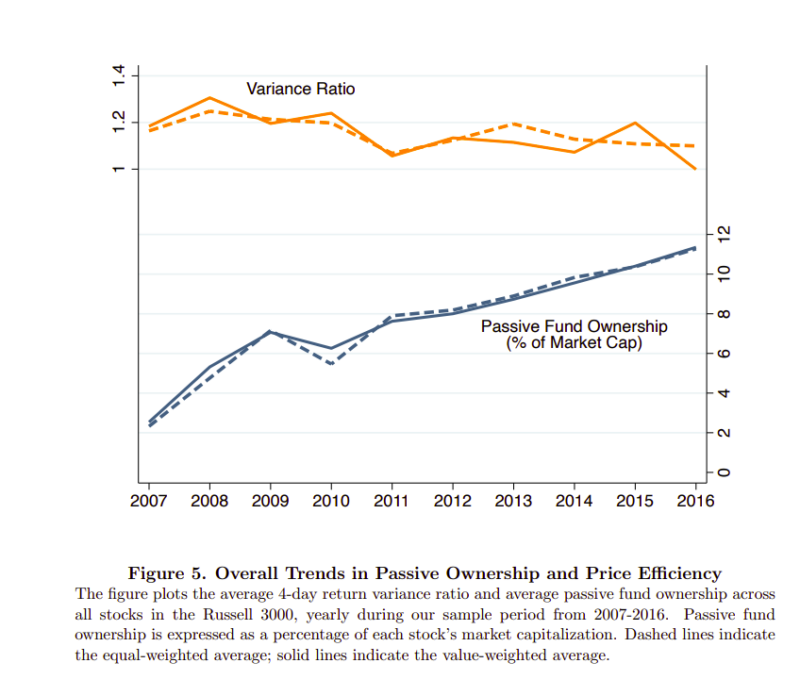

- NO – By studying three different measures of price informativeness – variance ratios, anomaly mispricing, and post-earnings announcement drift- they find that there is zero change in the informational efficiency of prices.

Why does this study matter?

The authors provide the first empirical evidence that explicitly tests a diverse set of predictions on price efficiency in the presence of index investing by different academics. They confirm that index investing changes the composition of the investor base, which alters market dynamics and information production, but active investors respond to ensure that price efficiency is unchanged.

The Most Important Chart from the Paper:

Abstract

We empirically examine the effects of index investing using predictions derived from a Grossman-Stiglitz framework. An exogenous increase in index investing leads to lower information production as measured by Google searches, EDGAR views, and analyst reports, yet price informativeness remains unchanged. These findings are consistent with an equilibrium in which investors choose to gather private information whenever it is profitable. As index investing increases, there are fewer privately-informed active investors (so overall information production drops), but the remaining mix of investors adjusts until the returns to active investing are unchanged. As a result, passive investing does not undermine price efficiency.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.