This article studies whether or not people invest in a similar way as their family members do, and what the potential impact of social investing interaction on society may be.

Social Interaction in the Family: Evidence from Investors’ Security Holdings

- Knupfer, Rantapuska and Sarvimaki

- Review of Finance, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- Why do investors tend to hold the same securities as their parents?

- Does social interaction within the family influence the intergenerational correlation in security holdings?

- Do family members causally influence each other in their security choices, or are there other channels that explain the correlation across generations?

- How do the intergenerational correlations in security choice affect portfolio choice?

- What are the implications of shared security holdings for wealth inequality?

What are the Academic Insights?

By analyzing data from the investor population in Finland (during the period 2004-2008) as well as employing various methodologies and identification strategies to explore the role of social influence within the family, the authors find the following:

- Because individual securities are a more natural topic for investment-related discussions than abstract risk-return concepts supporting the role of social interaction in shaping security choices across generations

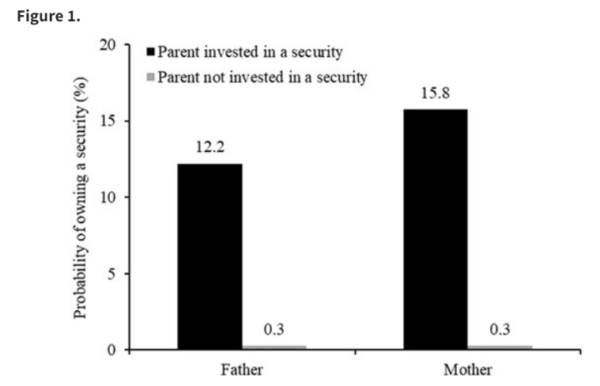

- YES – Social interactions and information sharing within the family do influence the intergenerational correlation in security holdings, hence it plays a significant role in shaping investment decisions and preferences. Additionally, the article provides empirical evidence that family members who are more likely to communicate with each other, such as mothers (mother–child interactions being a more important determinant of investment decisions than father–child interactions) and family members who share geographical proximity, display stronger correlations in their security choices. Finally, the findings indicate that social influence runs not only from parents to children but also vice versa, implying bidirectional influence within the family.

- The authors check alternative possible explanations such as correlated risk aversion, shared educational backgrounds, and occupations. They find that, while these factors may explain why family members hold certain types of assets or have similar risk preferences, they do not fully explain the specific choice of securities. In fact, the analysis finds a significant increase in the likelihood of investing in a security when a parent buys the same security, even after controlling for time-invariant preferences. This suggests that social influence within the family is a key driver of the security-choice correlation across generations.

- It affects portfolio choice by influencing the composition and attributes of portfolios across generations in terms of returns but mainly in terms of risk. In fact, the holdings of identical securities make investment decisions more correlated across generations, potentially reducing the risk-sharing benefits that could be achieved through diversifying across different securities.

- Wealth inequality increases. In fact, the shared security holdings exacerbate wealth inequality by increasing the dispersion in the families’ returns on wealth. The other side of the coin is the lack of diversification within the family increases idiosyncratic risk.

The authors perform a number of robustness checks that confirm the above results.

Why does this study on Social Investing Interaction matter?

This study adds evidence to the literature on social interaction by confirming empirically that investors acquire investment ideas from their family members. This mechanism however has two negative side effects. It decreases the strength of risk management within the families because it reduces some of the insurance benefits family members could achieve by diversifying across different securities. It also causes wealth inequality to rise by increasing the dispersion in the families’ returns on wealth.

The Most Important Chart from the Paper:

Abstract

We show that investors tend to hold the same securities as their parents. This intergenerational correlation is stronger for mothers and family members who are more likely to communicate with each other. An instrumental variables estimation and a natural experiment suggest that the correlation reflects social influence. This influence runs not only from parents to children, but also vice versa. The resulting holdings of identical securities increase intergenerational correlations in portfolio choice, exacerbate wealth inequality, and amplify the consequences of behavioral biases.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.