Academic research, including the studies “Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks,” “Lottery Preference and Anomalies” and “Do the Rich Gamble in the Stock Market? Low Risk Anomalies and Wealthy Households,” has found that there are investors who have a “taste,” or preference, for lottery-like investments – those that exhibit positive (right tail) skewness and excess kurtosis. This leads them to irrationally (from a traditional finance perspective) invest in high-volatility stocks (which have lottery-like distributions), driving their prices higher, and resulting in poor returns.

Short squeezes, with their resulting price surges, are of interest to investors with a preference for lottery-like distributions. A short squeeze occurs when many investors bet against a stock by selling it short (hoping to buy it back later at a lower price), and its price shoots up instead. Short selling is risky because losses are unlimited (unlike going long, where losses are limited to your investment). Thus, if a shorted stock unexpectedly rises in price, short sellers may have to act fast to limit their losses. They may be forced to act to meet margin calls. Because short sellers exit their positions with buy orders, their exit can push prices higher, which leads to more covering of short positions, creating a vicious circle. The rapid rise in price can attract buyers looking to “jump on the bandwagon” to exploit the short squeeze. The combination of new buyers and panicked short sellers can lead to stunning and unprecedented increases in valuation, to levels well above anything that could be justified by a stock’s fundamentals – such as occurred with GameStop. This opportunity, along with the excitement created on social media investment sites such as Robinhood and Reddit that short squeezes can generate, presents an attractive target to lottery skewness-seeking investors.

The evidence

Ilias Filippou, Pedro Garcia-Ares, and Fernando Zapatero contribute to the literature on the preference for lottery-like distributions with their November 2022 study, “Betting on the Likelihood of a Short Squeeze,” in which they examined if retail investors were attracted by stocks with a relatively high likelihood of a short squeeze occurring and the profitability of trading on that likelihood. They identified securities that could attract the attention of skewness-seeking investors because of a potential short squeeze using IHS Markit’s proprietary measure and the Data Explorers Increasing Price Squeeze indicator (DIPS). DIPS compares securities lending data (change in beneficial owner inventory quantity and loans) to cash market data (average trade volume and close price) to determine the likelihood of a rapid price increase: “[It] provides an objective measure that mitigates conceivable data mining concerns.”

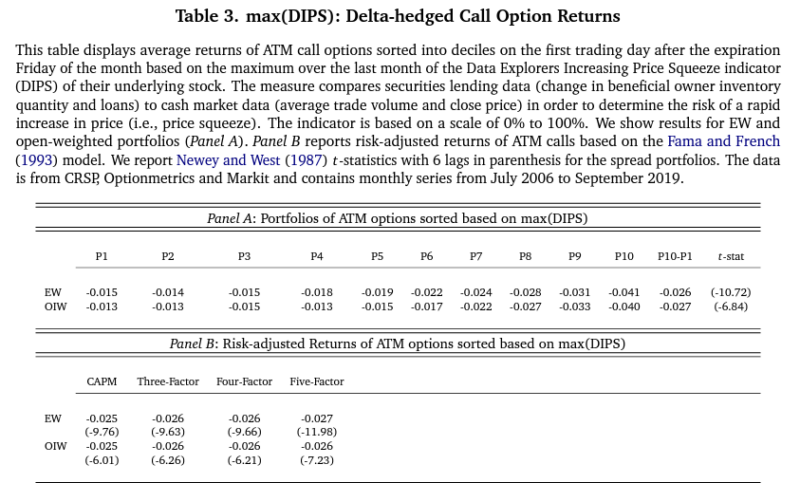

Their analysis focused on call options written on the stocks susceptible to a short squeeze rather than on the stocks themselves because prior research has shown that in the case of optionable stocks, skewness-seeking investors favor call options over the underlying stocks; the implicit leverage of options magnifies the effect of positive jumps. Their analysis used delta-hedged returns, as it has become customary in the options literature; delta-hedged returns isolate the option-specific part of the return from that due to changes in the stock price.

Sorting stocks based on their Max(DIPS), their proxy for skewness, on the first trading day following the expiration of the options, they computed the average percentage of stocks in each bin that experienced one daily price increase of more than 15% during the following month (until the next month’s expiration day).

Considering only options that expired in the next month and choosing options closest to at-the-money, their data sample covered stocks on the NYSE, AMEX, and Nasdaq over the period July 2006-September 2019. Following is a summary of their key findings:

- Stocks with higher Max(DIPS) tended to be smaller stocks with lower prices, lower trading volume, and lower institutional ownership. They also had higher idiosyncratic volatility, higher turnover, and were more illiquid.

- Options attached to stocks with higher Max(DIPS) had lower call premiums, higher implied volatility, higher bid-ask spreads, and higher option-adjusted spread ratios.

- The difference in the percentage of stocks with a 15% or more price jump increase between the decile of stocks of the highest Max(DIPS) and the decile of the lowest was very significant –Max(DIPS) was a good predictor of short squeezes leading to sizable positive price jumps. Similar results were found when the hurdle was increased to 20%.

- Stocks with a high likelihood of short squeezes attracted lottery skewness-seeking investors.

- The larger the blockholder ownership proportion, the higher the Max(DIPS) – fewer shares available for trade led to a higher likelihood of a short squeeze.

- Investors were willing to pay a premium for securities that might experience a positive price jump because of a short squeeze.

- Call options were the security of choice for investors betting on a short squeeze.

- The delta-hedged return of the spread portfolio was negative and significant, indicating lottery seeking on the part of the investors on high Max(DIPS) securities.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- Alphas were negative and statistically significant.

- Comparing Max(DIPS) with other measures that reflect the depth of short positions on a given stock (such as short float and days to cover), Max(DIPS) contained similar information to those measures. Still, it helped explain options returns over and above other lottery measures.

- Consistent with anecdotal evidence that over the last several years retail investors have been responsible for at least a good part of the lottery-seeking activity based on the likelihood of a short squeeze, there was a positive correlation between the time-series average of popularity in Robinhood and Max(DIPS).

- Max(DIPS) strategy delivered negative and statistically significant returns regardless of the level of volatility.

- Short-selling constraints did not drive the results.

- In line with the preferences of lottery investors, results were stronger for out-of-the-money call options.

- Delta-hedged returns of portfolios of puts sorted on Max(DIPS) also showed statistically significant negative returns.

Investor takeaways

Short squeezes are often associated with a large positive jump in the price of a stock. Filippou, Garcia-Ares, and Zapatero demonstrated that skewness-seeking investors try to identify securities that could experience a short squeeze in the near future and are willing to pay a premium for them. That results in an overvaluation of the options and, on average, negative returns. Investors are best served to avoid investments with lottery-like distributions. One way to do that is to turn a blind eye to social media sites like Robinhood and Reddit so you don’t get caught up in the hype and excitement. That’s another example of why retail investors are called “dumb money.” Forewarned is forearmed.

Fund families whose investment strategies are based on academic research, such as Alpha Architect, AQR, Bridgeway, and Dimensional Fund Advisors, have long excluded from their eligible universe stocks with lottery characteristics because the historical evidence has demonstrated that limits to arbitrage allow securities with these characteristics to become overvalued.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-582

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.