Momentum Everywhere, Even Cross-Country Factor Momentum

By Larry Swedroe|May 24th, 2024|Larry Swedroe, Factor Investing, Research Insights, Other Insights, Momentum Investing Research|

There is strong empirical evidence demonstrating that momentum (both cross-sectional and time-series) provides information on the cross-section of returns of many risk assets and has generated alpha relative to existing asset pricing models.

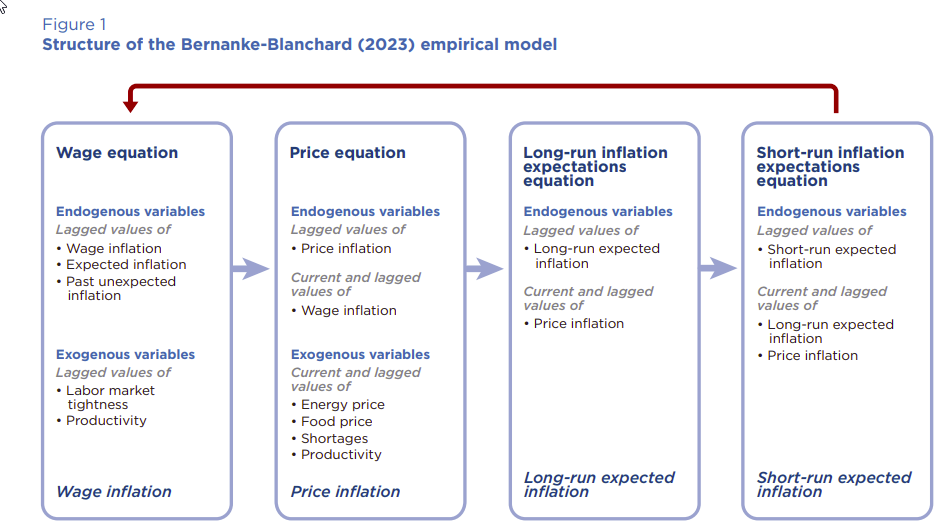

Postpandemic Inflation in Eleven Economies

By Elisabetta Basilico, PhD, CFA|May 20th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Macroeconomics Research|

This paper explores the applicability of the Bernanke-Blanchard (BB) model across diverse economies, revealing commonalities and differences in inflation dynamics post-pandemic.

Social Media: The Value of Seeking Alpha’s Recommendations

By Larry Swedroe|May 17th, 2024|Research Insights, Larry Swedroe, Guest Posts, Behavioral Finance, Active and Passive Investing|

The finding that the recommendations from SA articles resulted in statistically significant risk-adjusted alphas (returns unexplained by conventional academic models using factors such as the market, size, value, momentum, profitability, and quality for equity portfolios) is surprising given that the empirical evidence shows how difficult it is for institutional investors such as mutual funds to show outperformance beyond the randomly expected (as can be seen in the annual SPIVA Scorecards) because of market efficiency.

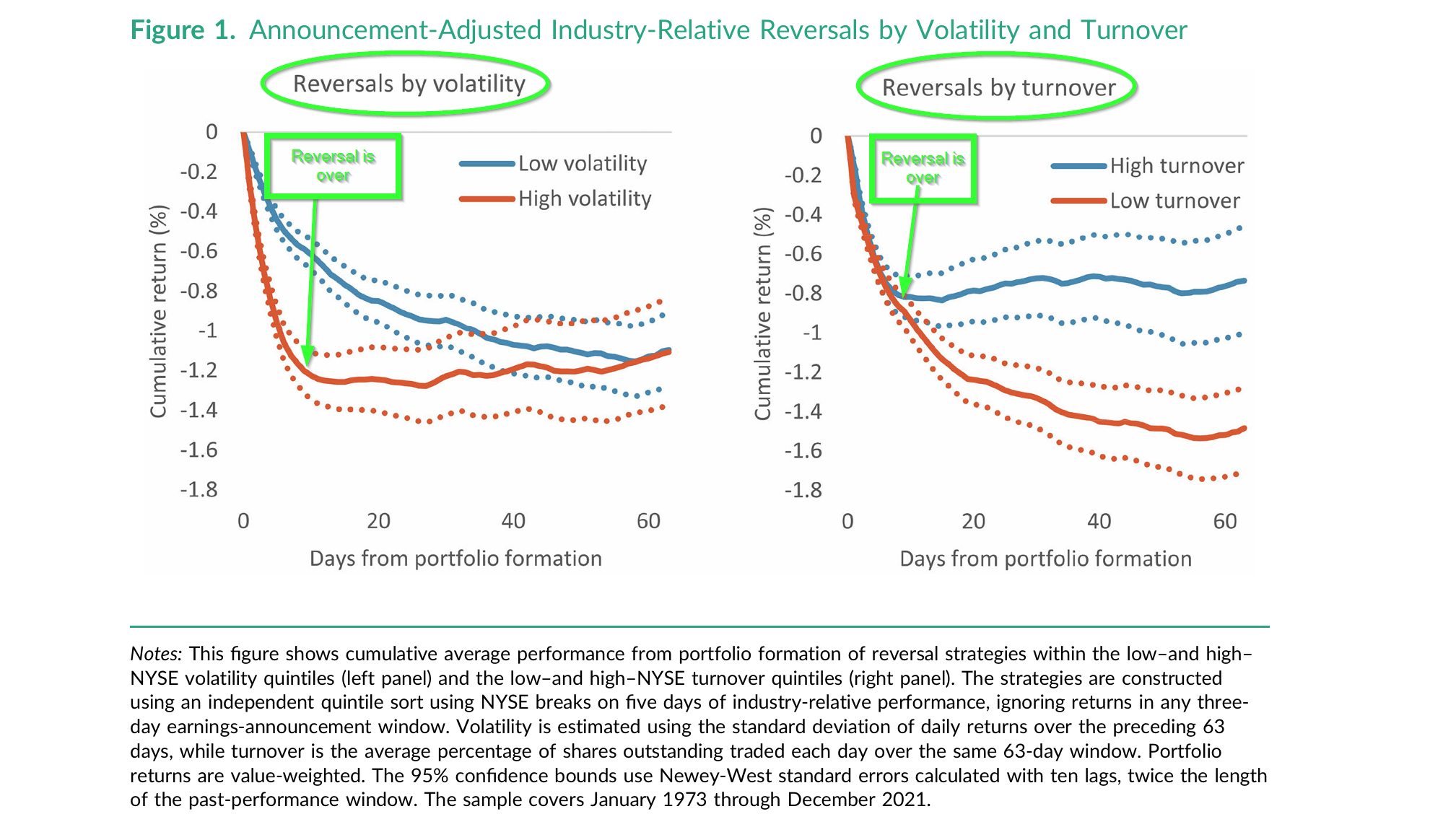

How Volatility and Turnover Affect Return Reversals

By Tommi Johnsen, PhD|May 13th, 2024|Volatility (e.g., VIX), Transaction Costs, Liquidity Factor, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Higher volatility is associated with faster, initially stronger reversals, while lower turnover is associated with more persistent, ultimately stronger reversals

Using Machine Learning Programs to Forecast the Equity Risk Premium

By Larry Swedroe|May 10th, 2024|Larry Swedroe, Factor Investing, Research Insights, Guest Posts, AI and Machine Learning, Other Insights, Macroeconomics Research|

To date, the best metric we have for forecasting future equity returns and the ERP is current valuations. An interesting question is whether more complicated methods using newly developed machine learning models can provide superior forecasts.

Global Factor Performance: May 2024

By Wesley Gray, PhD|May 7th, 2024|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

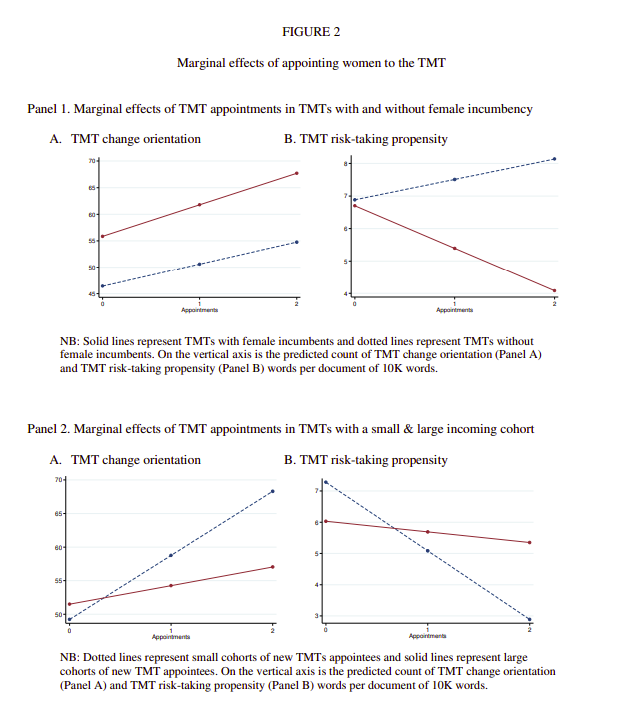

What Changes after Women Enter Top Management Teams?

By Elisabetta Basilico, PhD, CFA|May 6th, 2024|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance, Corporate Governance|

How do female appointments to top management teams (TMTs) affect a firm's approach to knowledge-related strategic renewal?

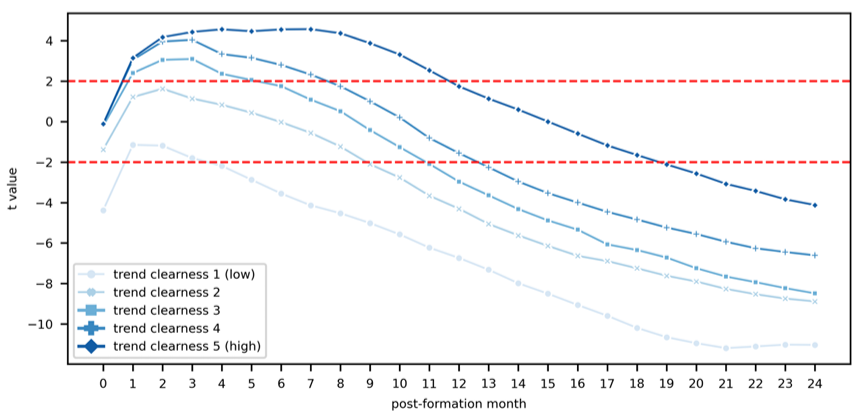

Momentum and the Clarity of the Trend

By Larry Swedroe|May 3rd, 2024|Larry Swedroe, Research Insights, Factor Investing, Guest Posts, Other Insights, Momentum Investing Research|

Momentum continues to receive much attention from researchers because of the strong empirical evidence.

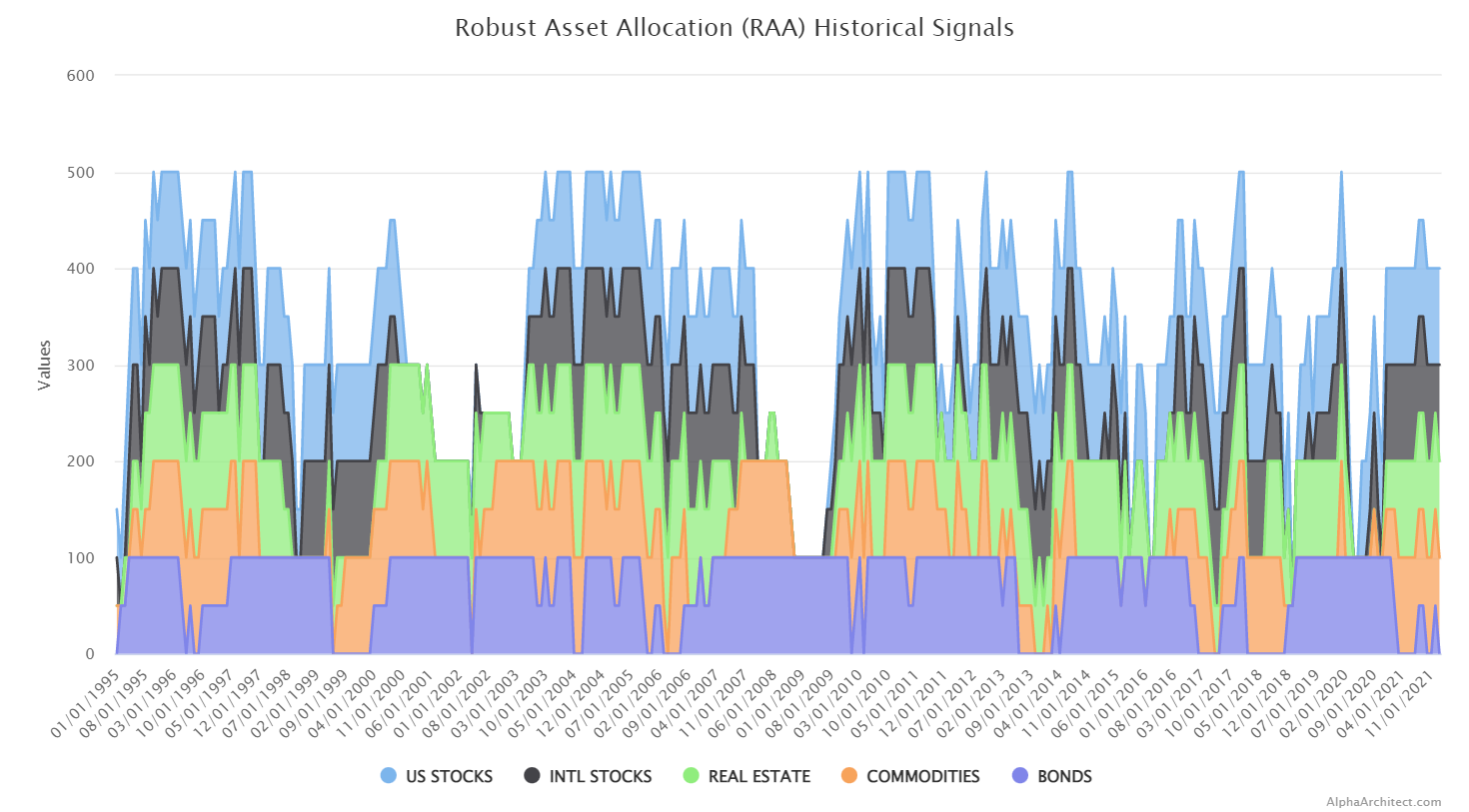

DIY Trend-Following Allocations: May 2024

By Ryan Kirlin|May 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation Index

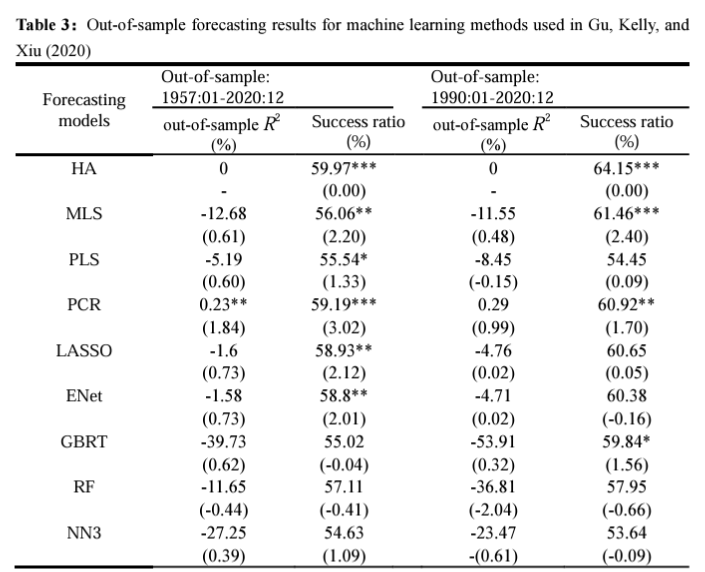

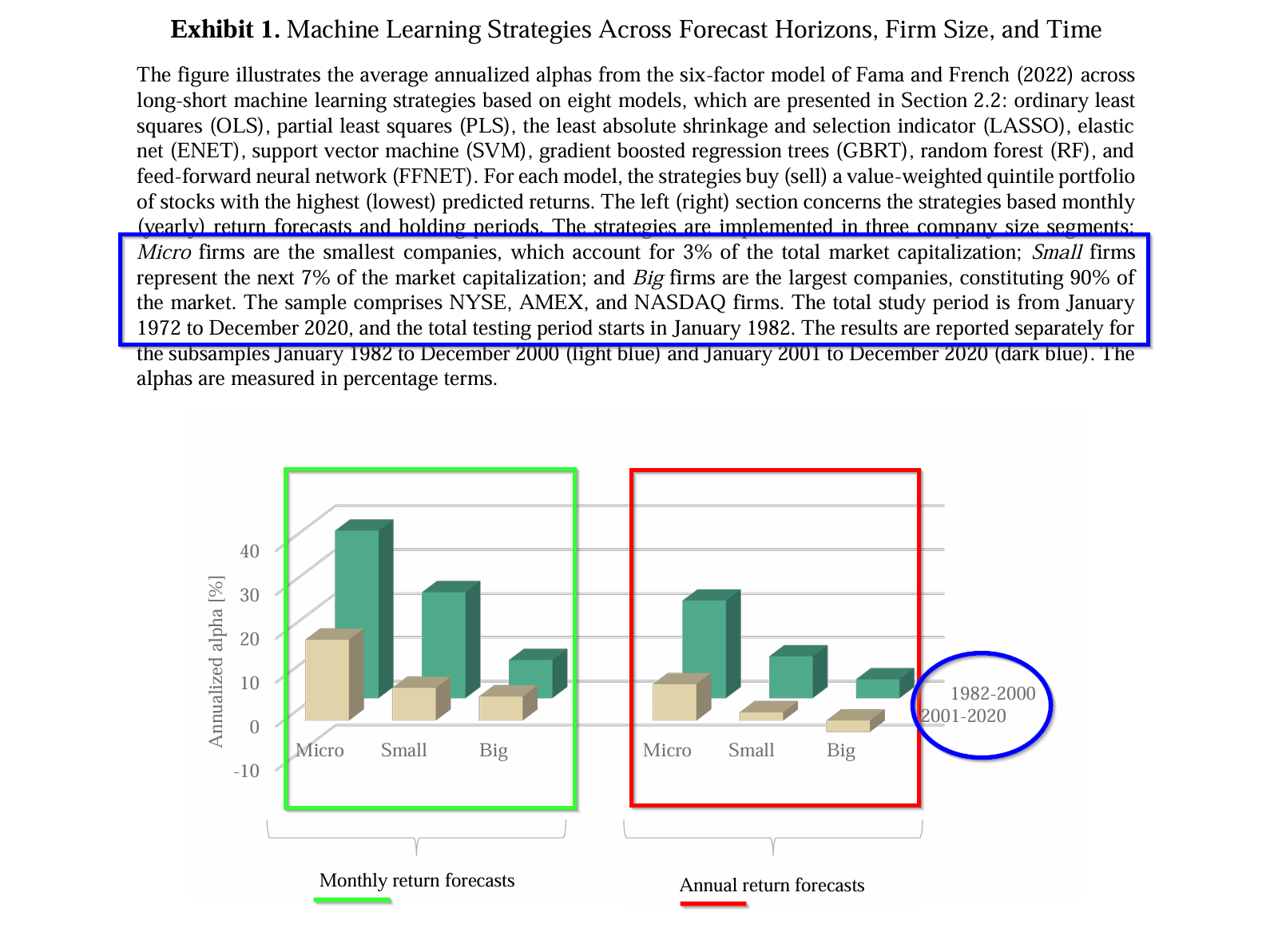

Can Machine Learning Improve Factor Returns? Not Really

By Tommi Johnsen, PhD|April 29th, 2024|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

Can AI models improve on the failures in predicting returns strictly from a practical point of view? In this paper, the possibilities are tested with a battery of AI models including linear regression, dimensional reduction methods, regression trees and neural networks. These machine learning models may be better equipped to address the multidimensional nature of stock returns when compared to traditional sorting and cross-sectional regressions used in factor research. The authors hope to overcome the drawbacks and confirm the results of traditional quant methods. As it turns out, those hopes are only weakly fulfilled by the MLM framework.