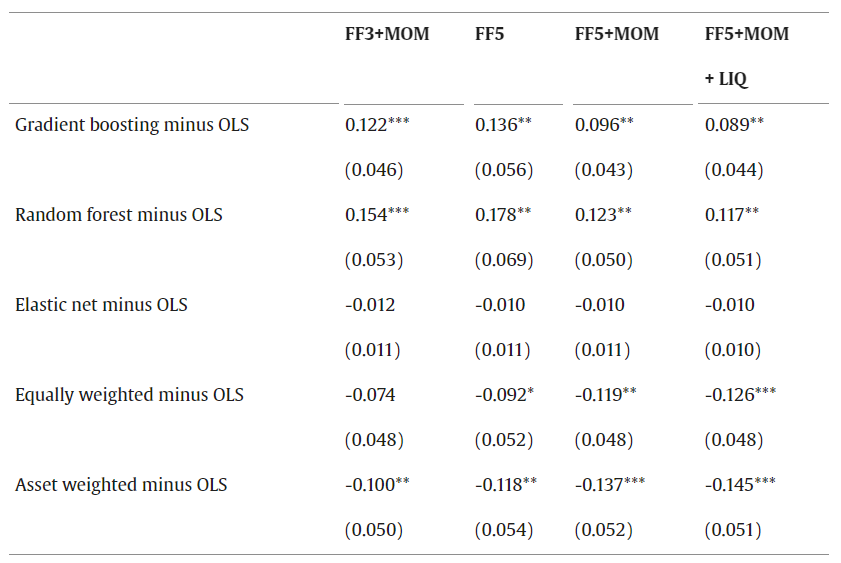

Can Machine Learning help to select mutual funds with positive alpha?

By Elisabetta Basilico, PhD, CFA|December 19th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning, Corporate Governance|

Can machine-learning methods be used to predict the performance of active mutual funds, specifically in terms of alpha net of all costs? Answer: yes.

The Temptation of Factor Timing

By Larry Swedroe|December 15th, 2023|Research Insights, Factor Investing, Larry Swedroe, Tactical Asset Allocation Research|

The timing of equity factor premiums has a strong allure for investors because academic research has found that factor premiums are both time-varying and dependent on the economic cycle.

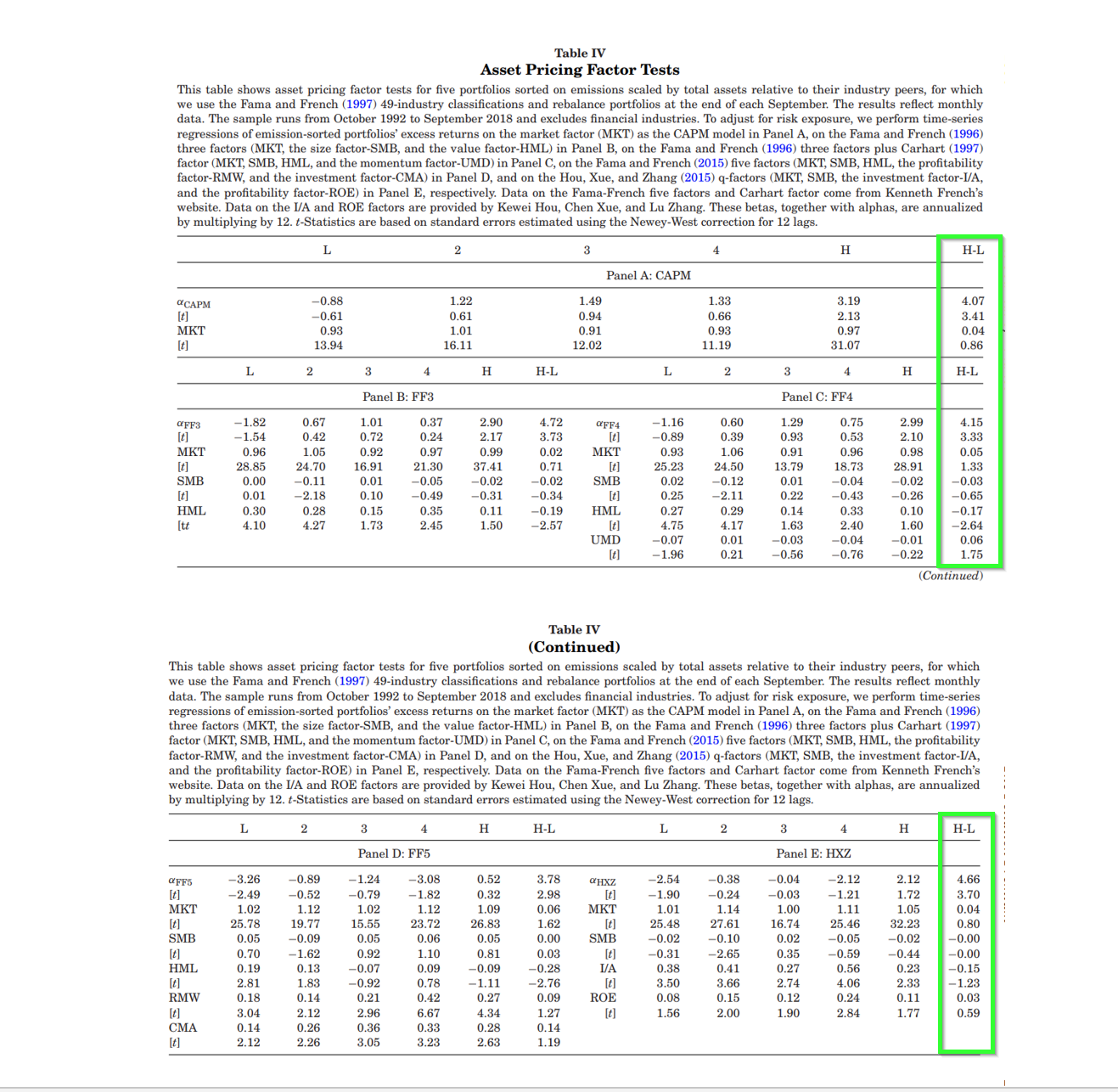

Do Polluters Earn Higher Expected Returns? Yes.

By Tommi Johnsen, PhD|December 11th, 2023|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

Hence, the major research question examined here is: What is the impact of industrial pollution on market pricing? Short answer: polluters have earned higher returns.

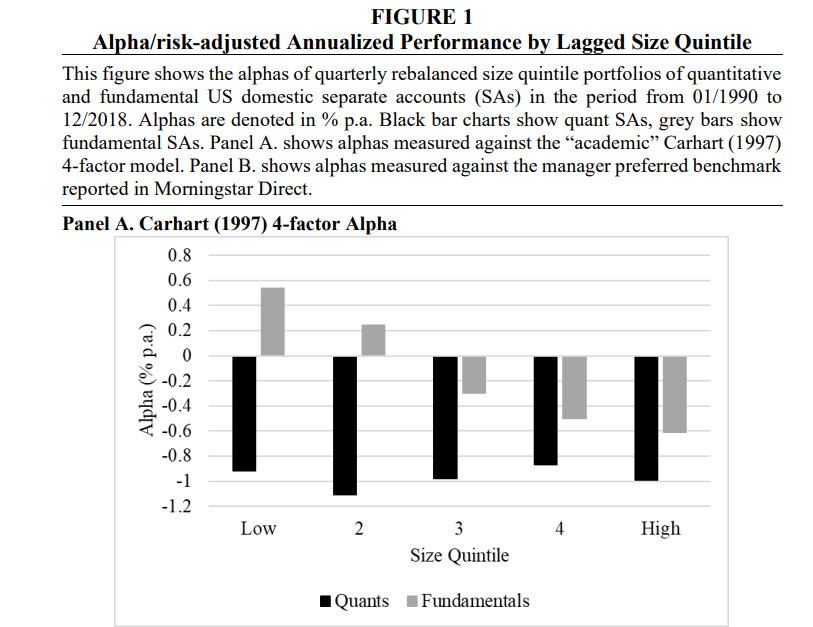

Diseconomies of Scale in Investing

By Larry Swedroe|December 8th, 2023|Liquidity Factor, Factor Investing, Research Insights, Momentum Investing Research, Active and Passive Investing|

While the research shows that fund managers are skilled, skill doesn’t translate into outperformance due to the diseconomies of scale.

Global Factor Performance: December 2023

By Wesley Gray, PhD|December 7th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

Untangling Behavioral Finance and the Psychology of Financial Planning

By Elisabetta Basilico, PhD, CFA|December 4th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Corporate Governance|

The article discusses the importance of integrating psychology into the field of financial planning and highlights the need to understand and address the psychological aspects of financial decision-making and client relationships.

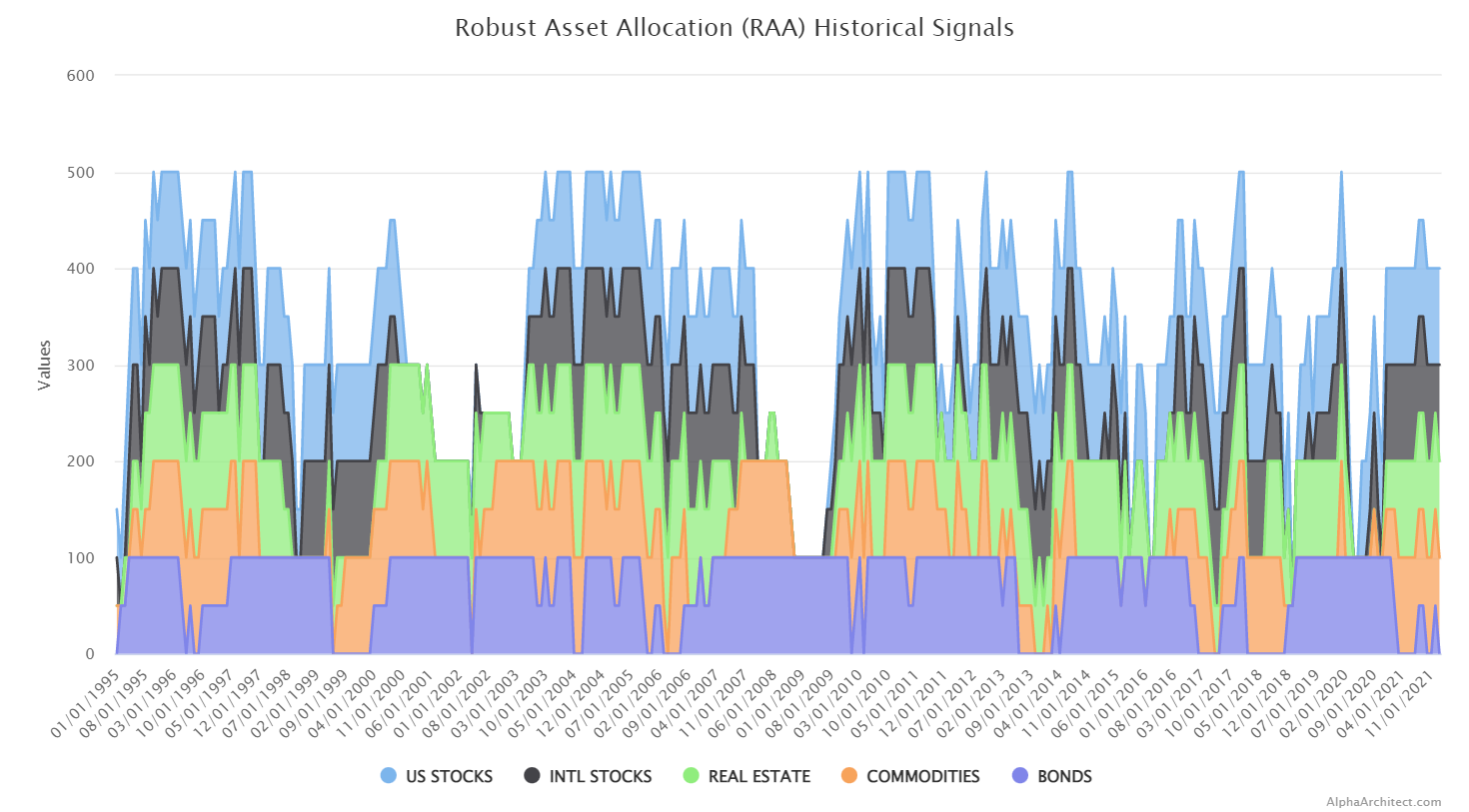

DIY Trend-Following Allocations: December 2023

By Ryan Kirlin|December 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. No exposure to commodities. No exposure to intermediate-term bonds.

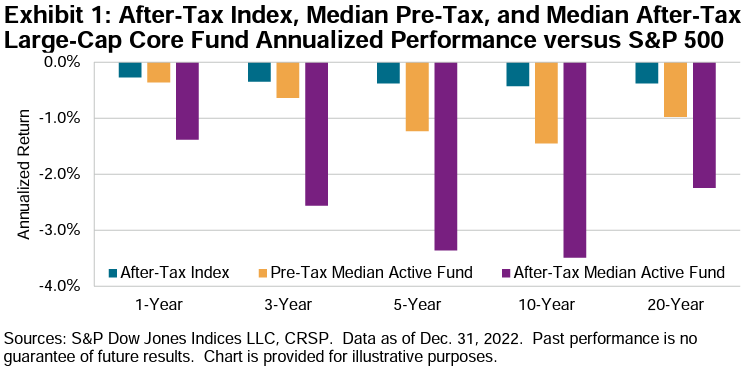

After-Tax Performance of Actively Managed Funds

By Larry Swedroe|December 1st, 2023|Larry Swedroe, Research Insights, Tax Efficient Investing|

Ignoring the impact of taxes on the returns of taxable accounts is one of the biggest mistakes that can be made.

Is now a good time to buy bonds?

By Jonathan Seed|November 28th, 2023|Research Insights, Guest Posts, Fixed Income|

As pundits wrestle over the cause, implications, and sustainability of the recent massive moves in interest rates, I’ll instead delve into the two terms most often blamed for these shifts in rates: R-star and the Term Structure Premium. Unfortunately, what most want—a measure of them—is unknowable. But we can benefit from understanding the theories and models behind these terms. We can glean guidance on what we need, namely a better understanding of the risks and rewards of buying longer-maturing bonds at current rate levels. I contend that now is a good time to secure future cash flows by buying bonds, although determining the precise amount to invest remains a challenge.

A new twist on momentum strategies: Utilize overlapping momentum portfolios

By Tommi Johnsen, PhD|November 27th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Momentum investors utilize different timeframes to identify high momentum equities: past 6, 9, 12 months as an example. Obviously, there is a significant degree of overlap in momentum stocks identified across various past time frames. However, there has been little research focused on understanding the characteristics of momentum stocks formed on six and 12 months that overlap one another. The authors refer to the subset as “overlapping” stocks and suggest they constitute the largest proportion of the profitability of the momentum strategy.

![Source: Bloomberg’s John Authers and Isabelle Lee, Points of Return[/ref]](https://alphaarchitect.com/wp-content/uploads/2023/11/Real-Bond-Yields.jpg)