What Is an Exchange Fund? A Way to Diversify Without Triggering a Tax Bill

By Jose Ordonez|June 4th, 2025|Research Insights, Strategy Background, Tax Efficient Investing|

Investors with large, concentrated stock positions often find themselves stuck between a rock and a hard place. On one hand, holding on to a single stock position exposes them to unnecessary risk. On the other, selling that stock can mean paying a hefty capital gains tax bill. What most investors don’t realize is that there’s a third option—a relatively obscure yet entirely legitimate strategy that can help diversify away single-stock risk without triggering immediate taxes: exchange funds.

Raising Capital from Investor Syndicates with Strategic Communication

By Elisabetta Basilico, PhD, CFA|June 2nd, 2025|Elisabetta Basilico, Research Insights, Factor Investing, Academic Research Insight, Other Insights, Behavioral Finance|

The structure of investor syndicates—hierarchical or flat—significantly impacts the flow of information and investment decisions. In hierarchical structures, differentiated incentives can lead to persuasive cascades, while flat structures promote truthful information sharing.

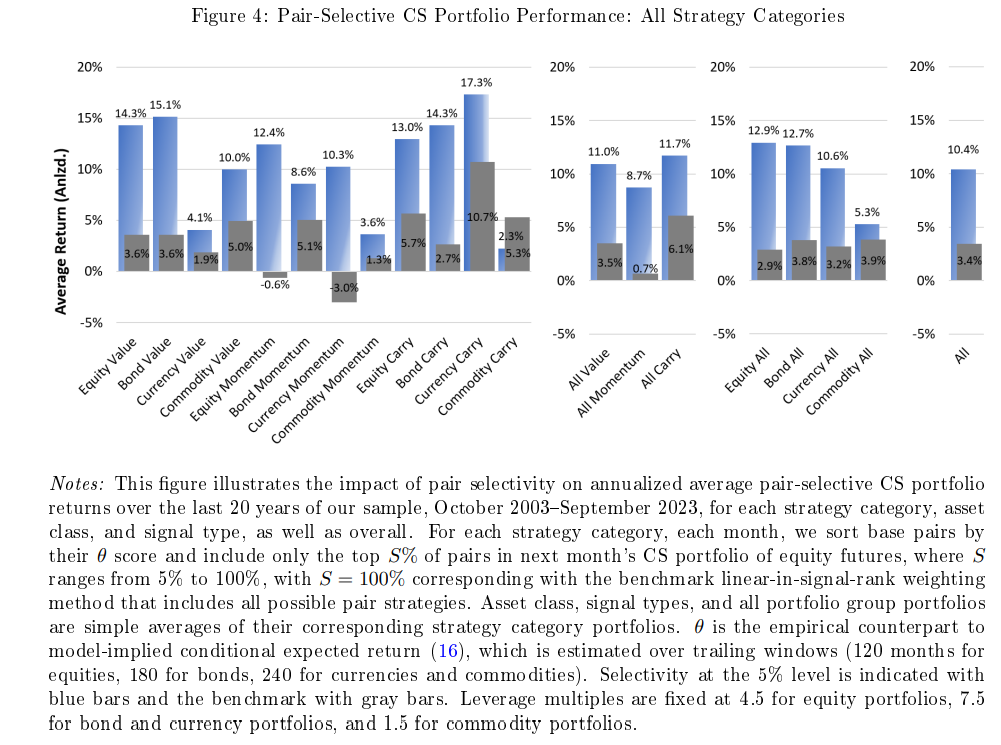

Unlocking Cross-Asset Potential: A New Approach to Portfolio Construction

By Larry Swedroe|May 30th, 2025|Larry Swedroe, Research Insights, Factor Investing, Other Insights, Tactical Asset Allocation Research|

Christian Goulding and Campbell Harvey, authors of the study "Investment Base Pairs," proposed a groundbreaking framework for portfolio construction that challenges traditional approaches in modern finance. Their research focused on leveraging cross-asset information to optimize investment strategies and improve returns across diverse asset classes. Here's an overview of their investigation, key findings, and takeaways for investors and advisors.

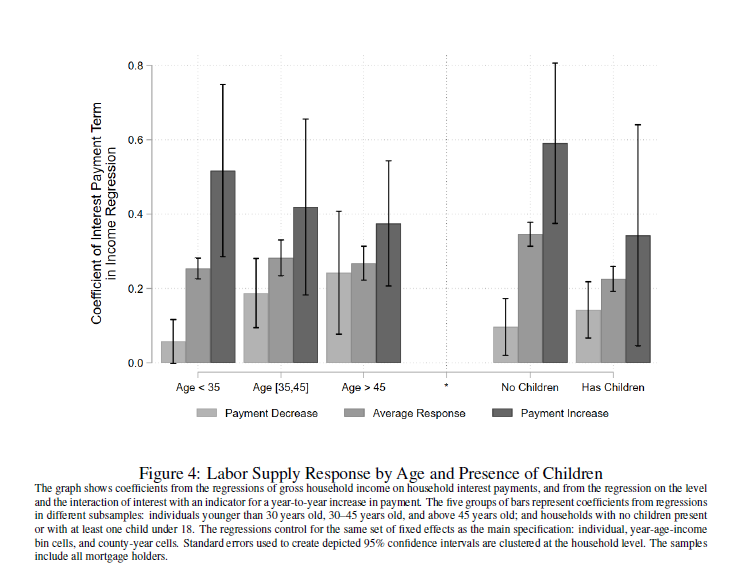

Working More to Pay the Mortgage

By Elisabetta Basilico, PhD, CFA|May 27th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Behavioral Finance|

The study examines how households adjust their labor supply in response to changes in mortgage payments due to fluctuating interest rates.

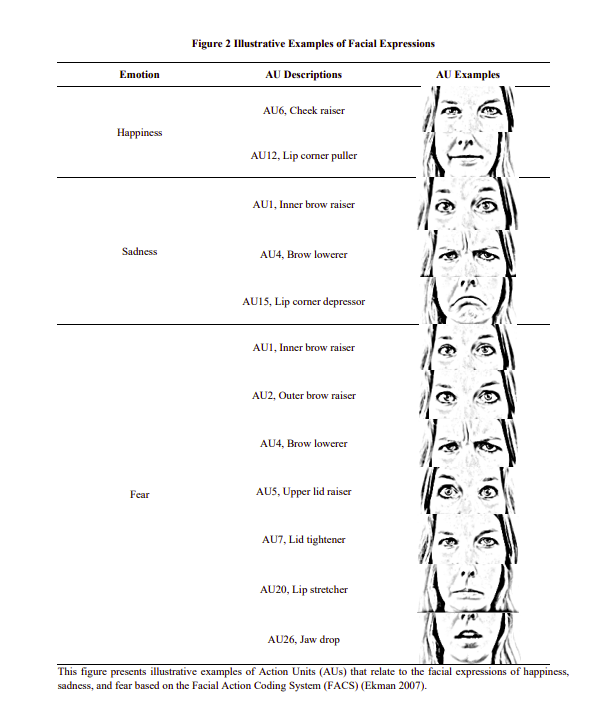

A Good Sketch is Better than a Long Speech

By Elisabetta Basilico, PhD, CFA|May 21st, 2025|Elisabetta Basilico, Factor Investing, Research Insights, Other Insights, Behavioral Finance|

In the evolving landscape of financial technology, innovative methods are emerging to assess creditworthiness. One such approach involves analyzing borrowers' facial expressions during loan applications to predict delinquency risk. This study explores this novel intersection of psychology, machine learning, and finance.

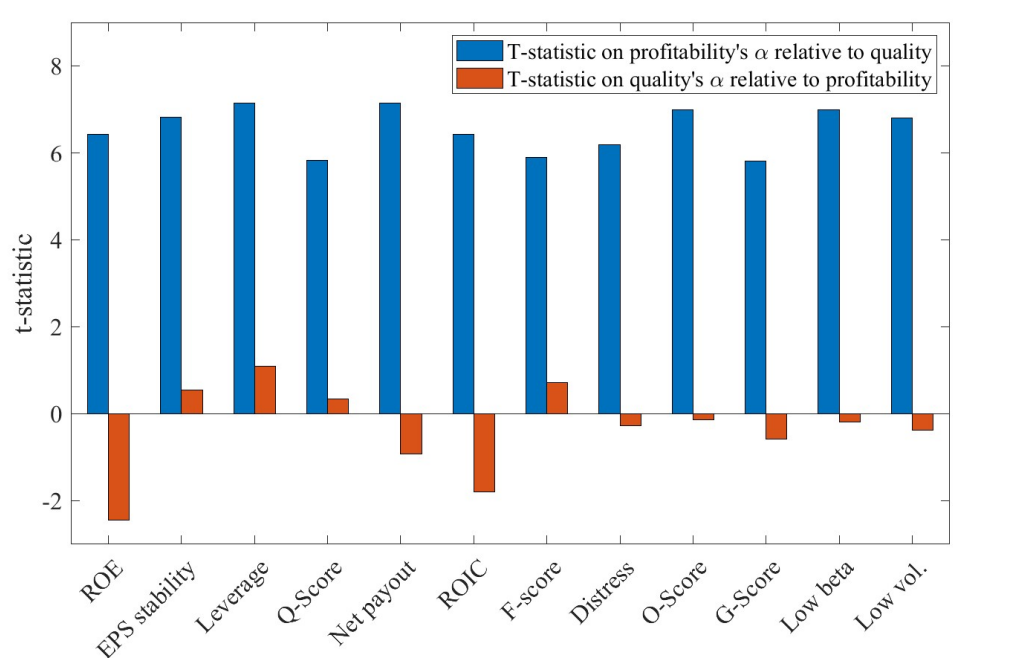

Profitability Retrospective: Key Takeaways for Investors

By Larry Swedroe|May 16th, 2025|Profitability, Intangibles, Quality Investing, Factor Investing, Larry Swedroe, Research Insights, Other Insights, Low Volatility Investing|

Profitability subsumes all of the quality factor, explaining both the performance of the strategies the investment industry market and the factors that academics employ—none of the quality factors generated significant positive alpha relative to profitability, the other Fama and French factors, and momentum.

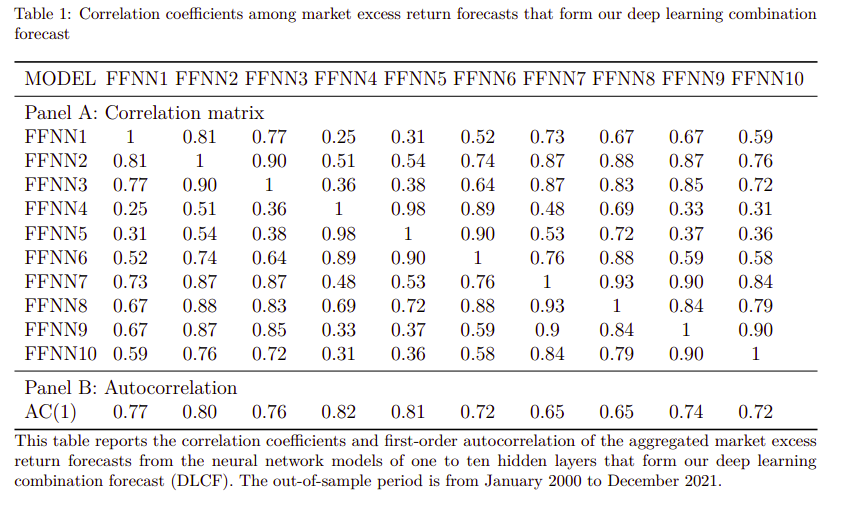

The Virtue of Complexity in Return Prediction

By Elisabetta Basilico, PhD, CFA|May 12th, 2025|Elisabetta Basilico, Predicting Market Returns, Factor Investing, Research Insights, AI and Machine Learning, Other Insights|

This article explores how researchers forecast market returns by aggregating expected returns from individual stocks.

Cut Through the Noise! These Two Factors Tend to Drive Portfolio Success

By Jose Ordonez|May 8th, 2025|Podcasts and Video, Factor Investing, Research Insights, Investor Education, Value Investing Research, Momentum Investing Research, Size Investing Research|

Let’s break down how to build a robust factor portfolio—without getting lost in the weeds. We investigate which equity factors have the strongest historical returns and diversification benefits from a long-only perspective.

The Aggregated Equity Risk Premium

By Elisabetta Basilico, PhD, CFA|May 5th, 2025|Elisabetta Basilico, Research Insights, Factor Investing, Other Insights|

This article explores how researchers forecast market returns by aggregating expected returns from individual stocks.

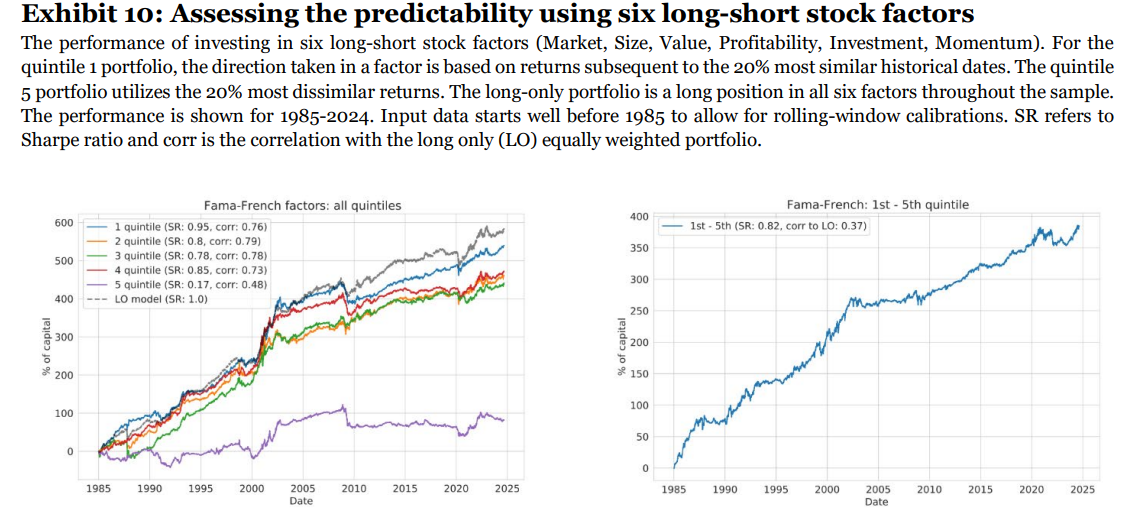

A New Approach to Regime Detection and Factor Timing

By Larry Swedroe|May 2nd, 2025|Research Insights, Factor Investing, Larry Swedroe, Other Insights, Tactical Asset Allocation Research|

The financial research literature has found that the performance of assets (and factors) can vary substantially across regimes - factor premiums can be regime dependent. Unfortunately, the real-time identification of the current economic regime is one of the biggest challenges in finance.