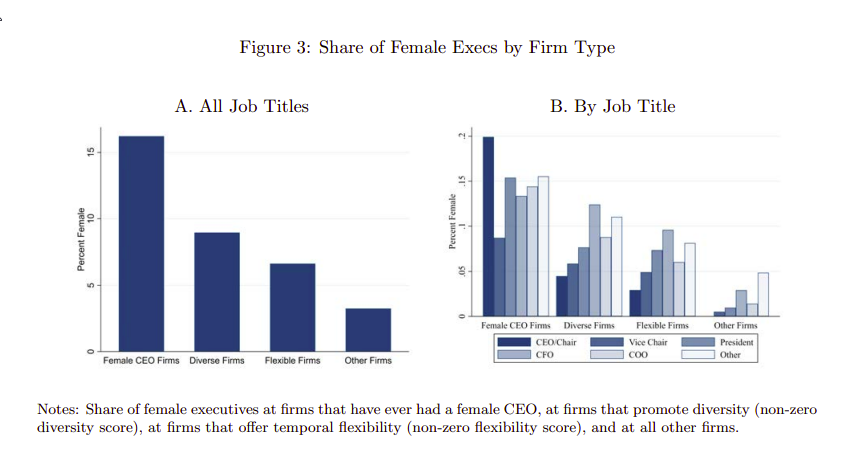

The Gender Gap Among Top Business Executives

By Elisabetta Basilico, PhD, CFA|July 3rd, 2023|ESG, Research Insights, Women in Finance Know Stuff, Basilico and Johnsen, Academic Research Insight|

The article aims to provide insights into the gender gaps in executive employment and compensation, explore the role of corporate culture and temporal flexibility in these gaps, and understand the factors influencing gender differences in entry, exit, and pay among top business executives.

Diving Into the Performance of Factors

By Larry Swedroe|June 30th, 2023|Larry Swedroe, Research Insights, Factor Investing|

Researchers have raised questions and led to research into how many factors are needed, the replicability of originally reported results, and the decay of factor performance over time.

Where Large Language Models and Finance Meet

By Tommi Johnsen, PhD|June 26th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

BloombergGPT is a large language model (LLM) developed specifically for financial tasks. The authors trained the LLM on a large body of financial textual data, evaluated it on several financial language processing tasks and found it performed at a significantly higher level than several other state-of-the-art LLMs.

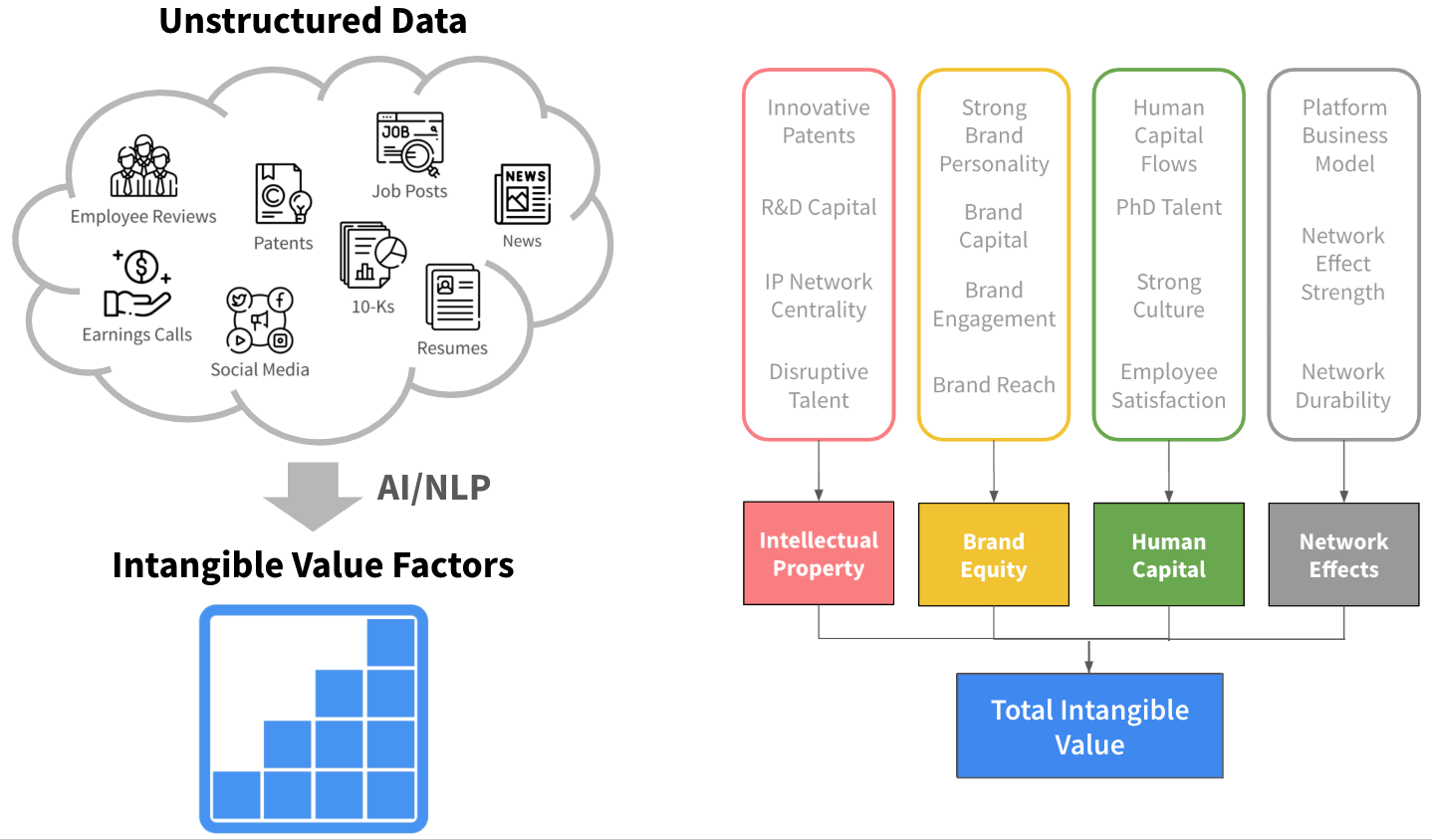

Intangible Value: Modernizing the Factor Portfolio

By Kai Wu|June 23rd, 2023|Intangibles, Research Insights, Factor Investing, Guest Posts|

The “Intangible Value Factor” (IHML) can play an additive role in factor portfolios alongside the established market, size, value, quality, and momentum factors. This Six-Factor Model avoids the problematic “anti-innovation” bias of traditional factor portfolios and can be easily implemented using ETFs.

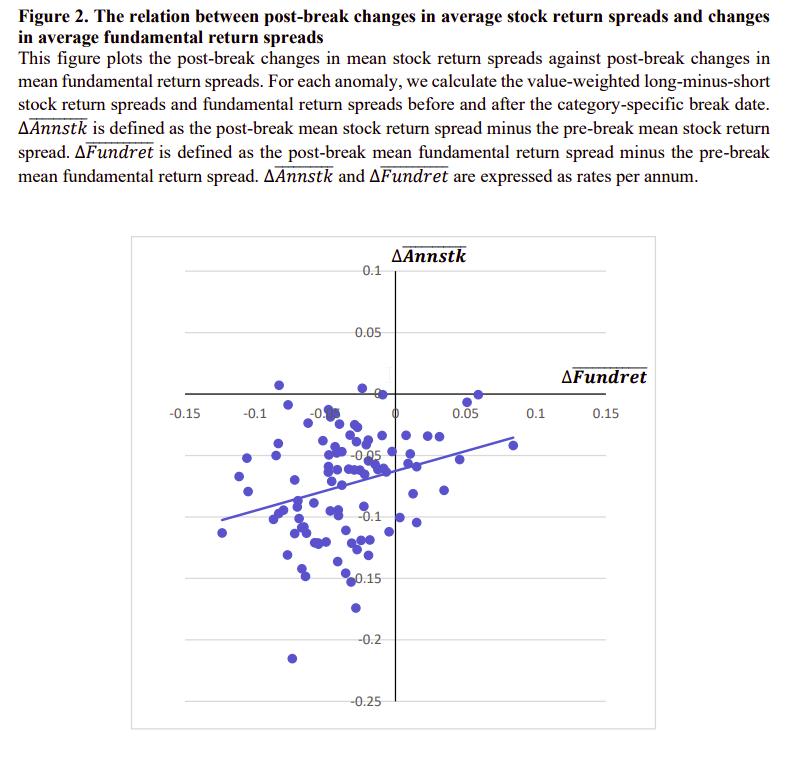

Fundamentals and the Attenuation of Anomalies

By Elisabetta Basilico, PhD, CFA|June 22nd, 2023|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Value Investing Research, Momentum Investing Research|

The article aims to explore the possibility that changes in fundamentals play a role in the attenuation of stock market anomalies, offering an alternative explanation to the prevailing arbitrage-based explanation

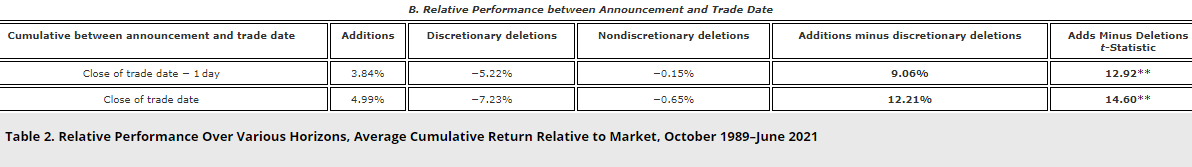

Improving Performance by Avoiding Negatives of Index Replication

By Larry Swedroe|June 16th, 2023|Price Pressure Factor, Index Updates, Research Insights, Larry Swedroe, Guest Posts, Investor Education|

There are several significant, well-documented benefits of index funds. In addition to outperforming a large majority of actively managed funds, they tend to have low fees, low turnover (resulting in low trading costs and high tax efficiency), broad diversification, high liquidity, and near-zero tracking error (generally assumed to mean that they incur negligible trading costs).

Long-Only Value Investing: Size Doesn’t Matter!

By Wesley Gray, PhD|June 15th, 2023|Research Insights, Factor Investing, Key Research, Value Investing Research|

Summary: no difference in average returns between large-cap and small-cap portfolios. There you have it. The small-cap sacred cow has been slaughtered.

Industry classification and the momentum factor

By Tommi Johnsen, PhD|June 12th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

This paper finds that the level of industry classification plays a significant role in the performance of industry momentum strategies.

Global Factor Performance: June 2023

By Wesley Gray, PhD|June 7th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Download

Do we invest like our family members?

By Elisabetta Basilico, PhD, CFA|June 5th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

This study adds evidence to the literature of social interaction by confirming empirically that investors acquire investment ideas from their family members.