Negative Screening and the Sin Premium

By Larry Swedroe|June 2nd, 2023|ESG, Larry Swedroe, Factor Investing, Research Insights|

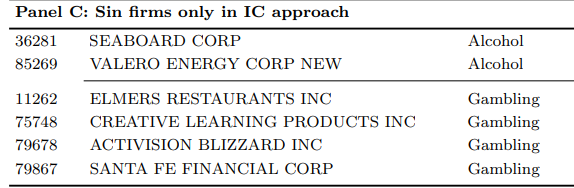

While most sin stocks in the IC method were also identified as sin in the TA method, there were 57 firm-year cases where a company showed up as sin only in the IC method—these were false positive sin stocks as identified in the IC method.

DIY Trend-Following Allocations: June 2023

By Ryan Kirlin|June 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Partial exposure to domestic equities. Full exposure to international equities. No exposure to REITs. No exposure to commodities. Partial exposure to intermediate-term bonds.

Can ChatGPT Help You Read Financial Statements? Yes.

By Tommi Johnsen, PhD|May 30th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

Can chatbots, like ChatGPT, be used to interpret and condense lengthy financial disclosures into shorter but relevant documents?

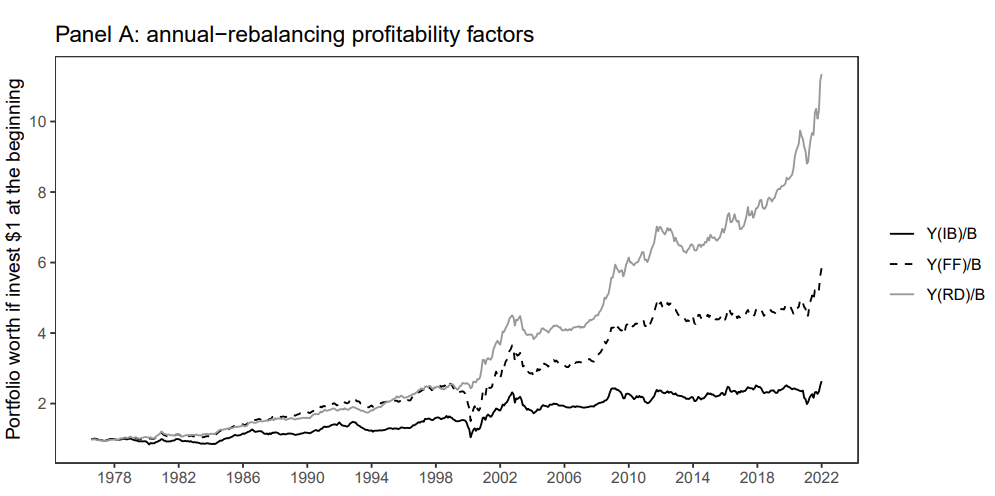

Intangible-Adjusted Profitability Factor

By Larry Swedroe|May 26th, 2023|Intangibles, Research Insights, Factor Investing|

Not accounting for intangibles affects not just value metrics but other measures (such as profitability) that often scale by book value or total assets, both of which are affected by intangibles—and investors recognize at least some of their value.

2023 Democratize Quant Conference Recap and Materials

By Wesley Gray, PhD|May 23rd, 2023|Factor Investing, Research Insights, Investor Education, Conferences, Value Investing Research, Momentum Investing Research|

We recently hosted our 6th Annual Democratize Quant Conference. This post is a recap of what we heard and some resources we can make available to the public.

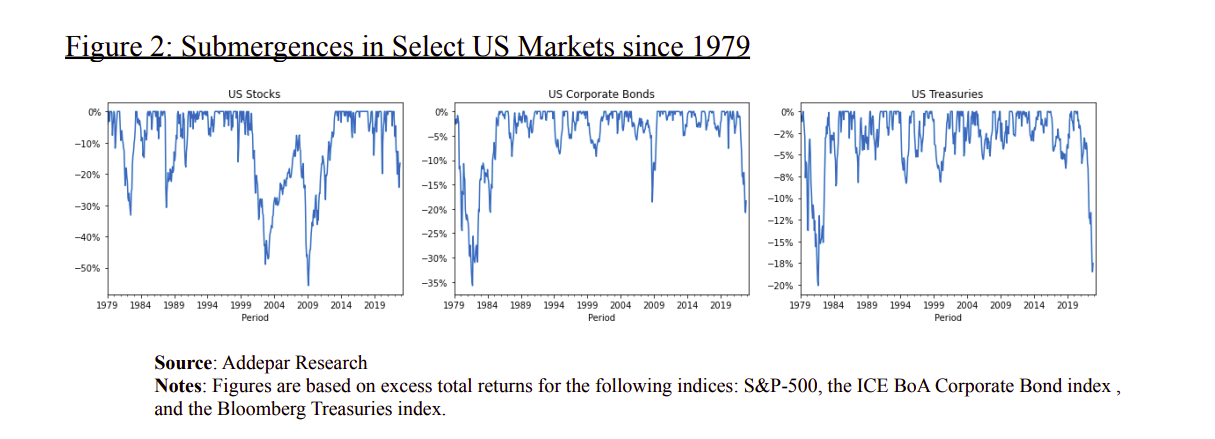

Submergence: A Tool to Assess Drawdowns and Recoveries

By Elisabetta Basilico, PhD, CFA|May 22nd, 2023|Empirical Methods, Research Insights, Basilico and Johnsen, Academic Research Insight|

According to research by the authors, stocks and bonds have been submerged for about 75% of the time since 1980; and treasuries have been submerged 80% of the time. Submergences are therefore both commonplace and significant, which means that handling them is very important for investors and their investing strategies.

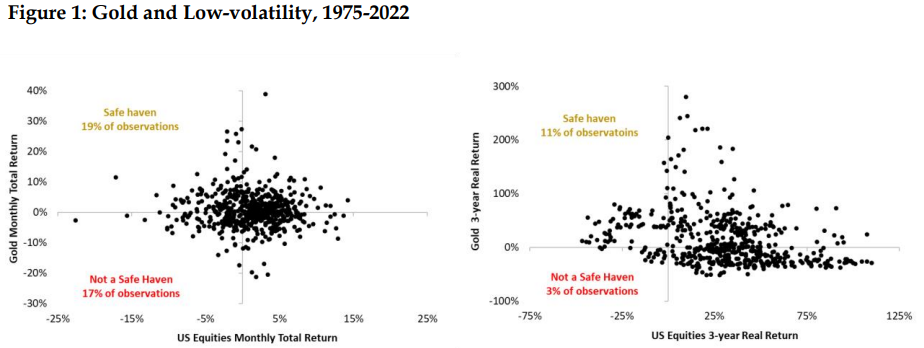

Gold as a Safe-Haven Asset

By Larry Swedroe|May 19th, 2023|Inflation Investing, Larry Swedroe, Research Insights, Guest Posts|

I’ve received calls from clients inquiring about moving assets to gold. When I asked them why, three reasons dominated.

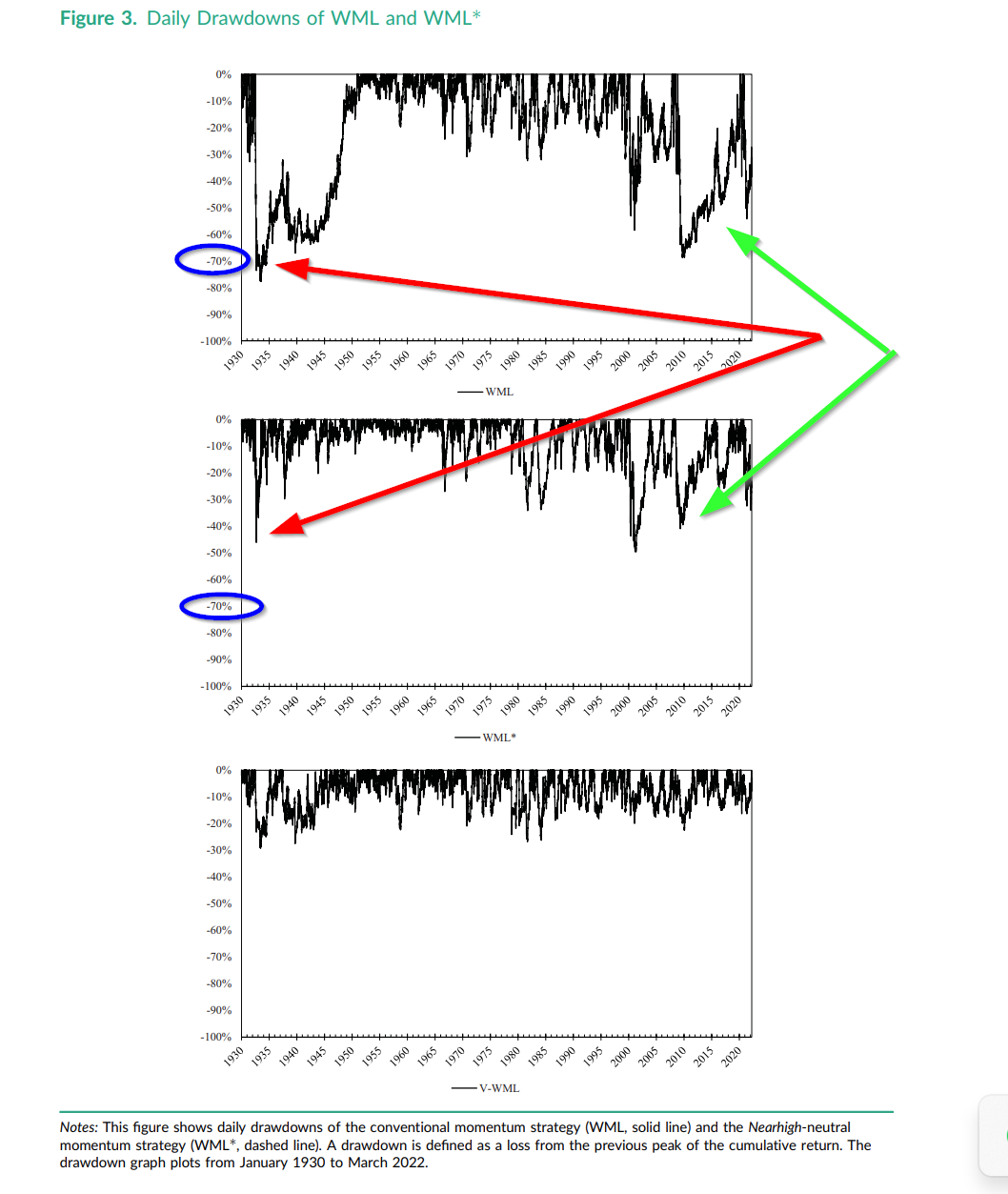

Reducing the Impact of Momentum Crashes

By Tommi Johnsen, PhD|May 15th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Momentum crashes are a blight on the performance of momentum strategies. Although there has been a fair amount of research on the topic, few practical solutions have emerged to mitigate the impact on portfolios. In this study, the authors document the outperformance of stocks, in terms of momentum, far away from their peak position relative to stocks very near their peaks. Turns out the outperformance is very large. It also accounts for the majority of negative momentum performance.

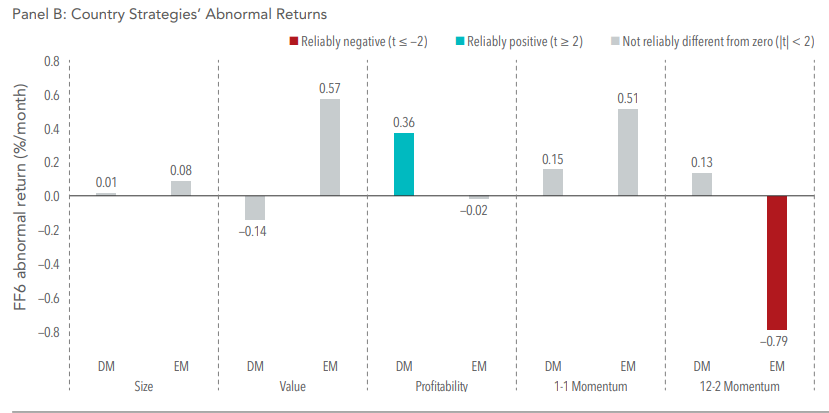

Pursuing Factor Premiums at the Industry and Country Level

By Larry Swedroe|May 12th, 2023|Larry Swedroe, Factor Investing|

This article examines the research conducted by Dimensional to determine the efficacy of an industry or country approach to factor investing.

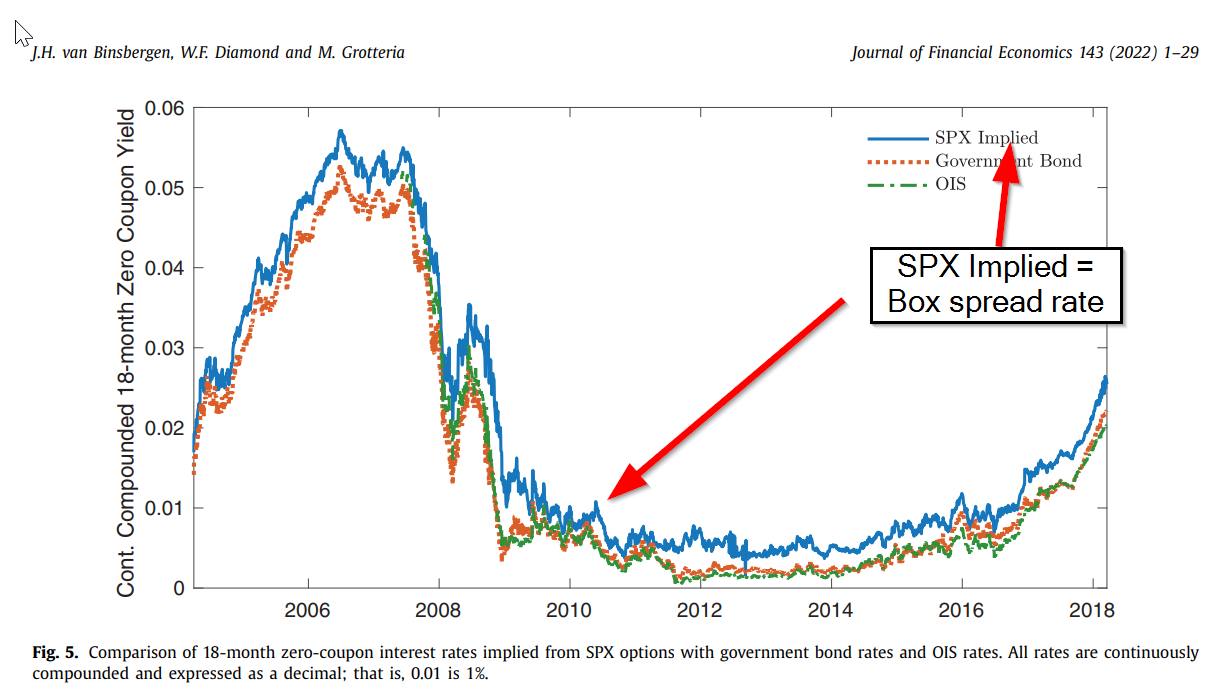

Box Spreads: An Alternative to Treasury Bills?

By Wesley Gray, PhD|May 10th, 2023|Options, Fixed Income, Key Research, Tax Efficient Investing|

Box spreads represent an opportunity to borrow and lend via the options market, at similar (and often better) rates than those that are available in the treasury bill market.