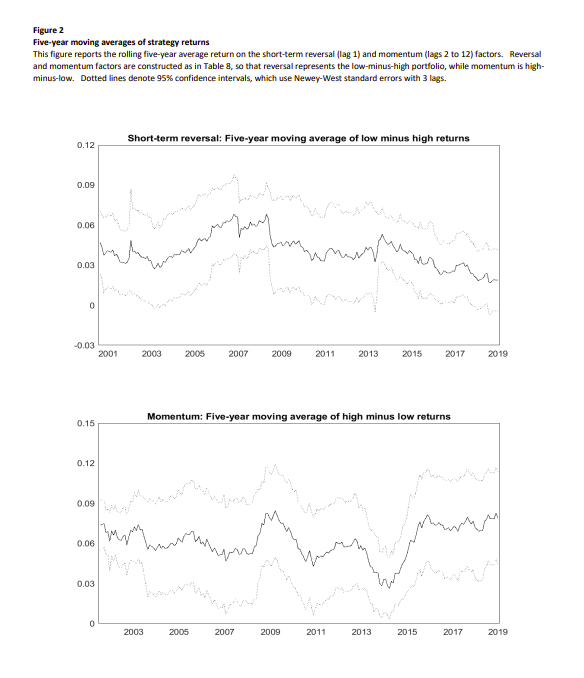

Volatility scaling is useful for factor timing

By Tommi Johnsen, PhD|December 12th, 2022|Volatility (e.g., VIX), Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight|

This paper investigates the effects of volatility scaling on factor portfolio performance and factor timing.

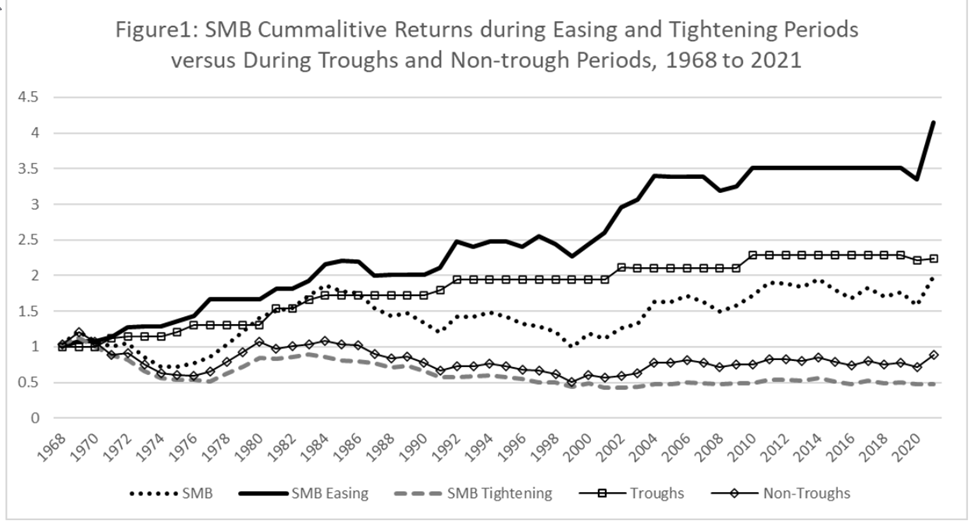

The “Resurrected” Size Effect and Monetary Policy

By Larry Swedroe|December 9th, 2022|Research Insights, Larry Swedroe, Size Investing Research|

Given that tightening monetary policy increases economic risks, Simpson and Grossman provided compelling evidence of a risk explanation for the size factor. For those investors who engage in tactical asset allocation strategies (market timing), their evidence suggests that it might be possible to exploit the information. Before jumping to that conclusion, I would caution that because markets are forward-looking, they should anticipate periods of Fed tightening and the heightened risks of small stocks.

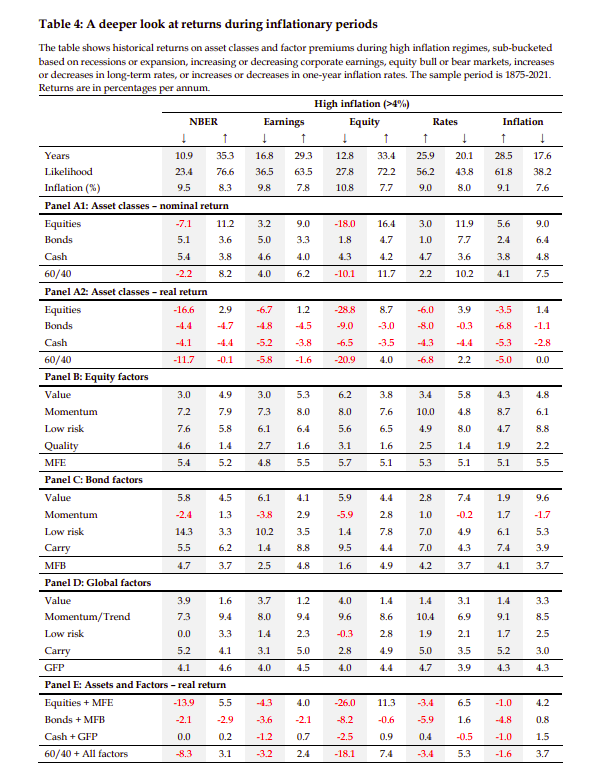

Investing in Deflation, Inflation, and Stagflation Regimes

By Elisabetta Basilico, PhD, CFA|December 6th, 2022|Inflation Investing, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight|

In this article, we examine the research on investing during inflationary regimes such as deflation, inflation, and stagflation. Factors perform relatively well in all regimes on a real basis.

Trend Following and Relative Sentiment: Complementary Factors

By Larry Swedroe|December 2nd, 2022|Relative Sentiment, Research Insights, Larry Swedroe, Trend Following|

Since it is likely that both the Relative Sentiment and Trend Following strategies will underperform at some points in the future, “a 50-50 combination of TF and RS might reduce the emotional volatility an investor may experience from holding only the underperforming strategy.”

DIY Trend-Following Allocations: December 2022

By Ryan Kirlin|December 1st, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

No exposure to domestic equities. Partial exposure to international equities. No exposure to REITs. Full exposure to commodities. No exposure to intermediate-term bonds.

Want to Get on a Corporate Board? Who You Know Matters

By Tommi Johnsen, PhD|November 28th, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

Here's what the research says about how to get on a board of directors.

Does Momentum work in Option Markets?

By Elisabetta Basilico, PhD, CFA|November 21st, 2022|Options, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

This paper explores the question of option momentum by examining what the research says about the performance of option investments across different stocks.

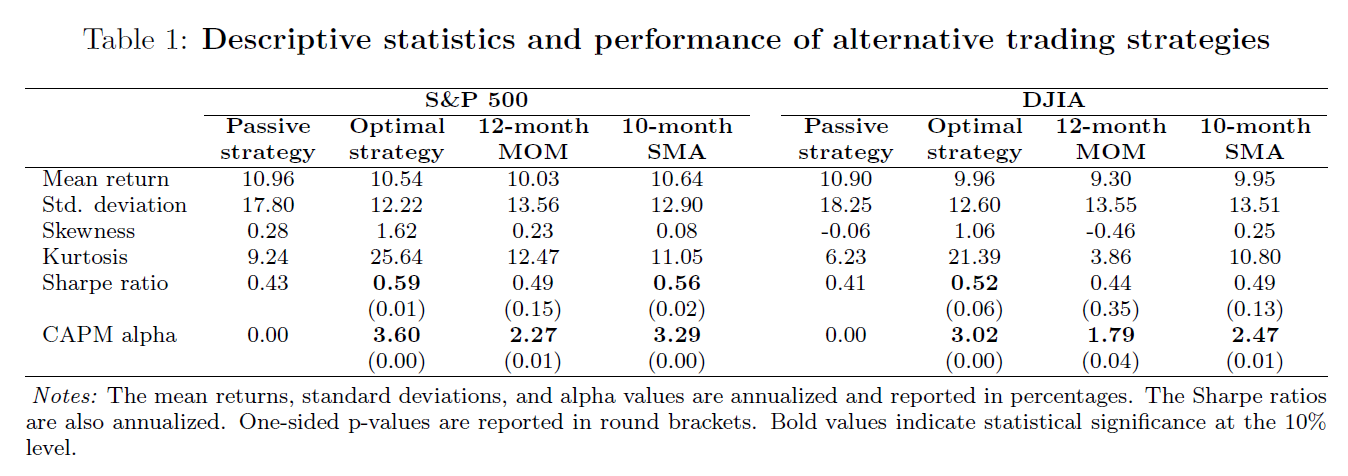

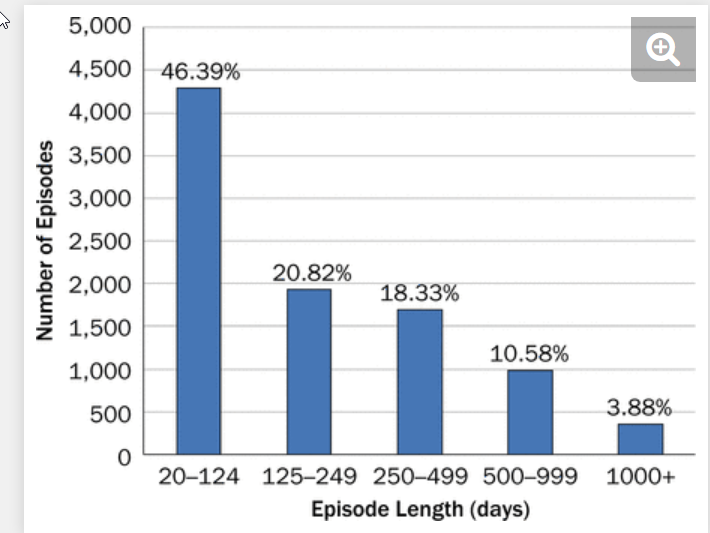

Optimal Trend Following Rules in Two-State Regime-Switching Models

By Valeriy Zakamulin|November 19th, 2022|Research Insights, Trend Following, Guest Posts|

We examine trend-following rules when the stock returns follow a two-state process that randomly switches between bull and bear markets.

Active Managers are Subject to the Same Biases as Individual Investors

By Larry Swedroe|November 18th, 2022|Research Insights, Larry Swedroe, Behavioral Finance|

Are active managers victims of the same bias as individual investors? That is the question we’ll explore in this paper.

Is there a theoretical foundation behind industry and factor momentum

By Tommi Johnsen, PhD|November 14th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Industry and factor momentum should be viewed as recent developments in the wider momentum story, although these aggregated measures of momentum lack any theoretical foundation.