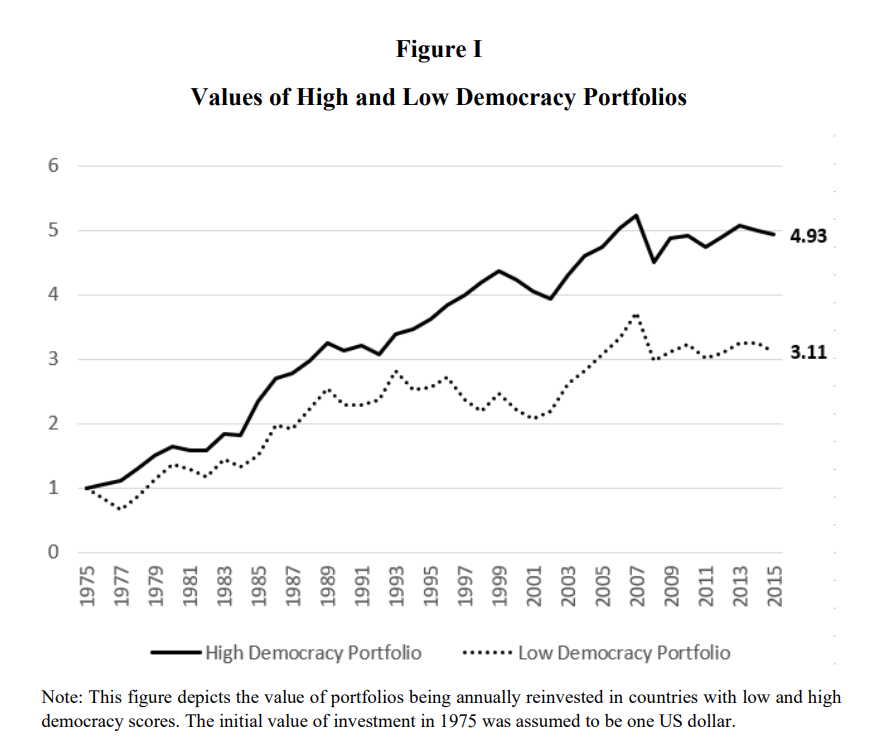

Is Democracy better for the stock market?

By Tommi Johnsen, PhD|October 17th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, Macroeconomics Research|

We examine the question of whether or not democracy leads to better possible outcomes for the stock market.

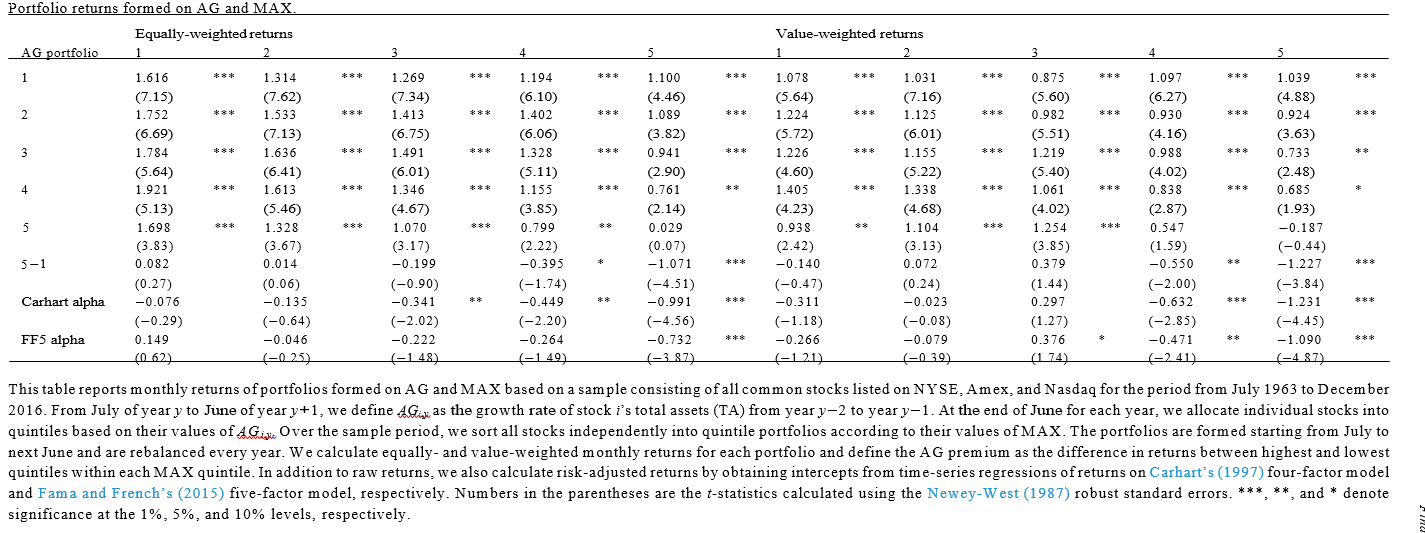

Lottery Demand and the Asset Growth Anomaly

By Larry Swedroe|October 14th, 2022|Quality Investing, Larry Swedroe, Factor Investing, Research Insights|

It is well documented in the literature that over the long term, low-investment firms have outperformed high-investment firms—with the negative relation between asset growth (AG) and future stock returns particularly featured by the overvaluation of high AG stocks.

What is the Story Behind Trend Following?

By Ryan Kirlin|October 12th, 2022|Research Insights, Trend Following|

Trend Following is simply buying an asset when it is going up, *and,* you sell that asset when it is going down.

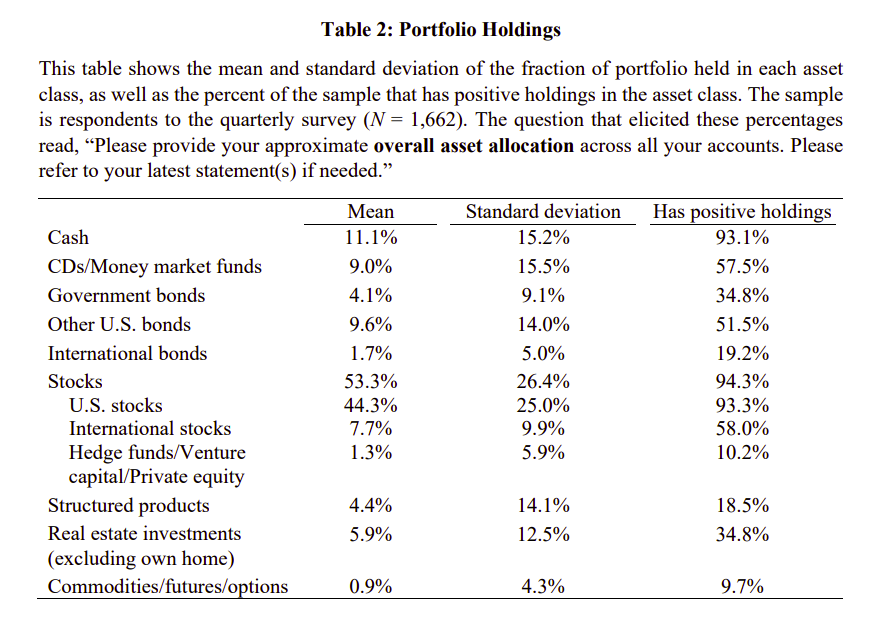

Pulling the curtain back: what do millionaires invest in?

By Elisabetta Basilico, PhD, CFA|October 10th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

In this article, we examine the academic research about what millionaires invest in.

Global Factor Performance: October 2022

By Wesley Gray, PhD|October 7th, 2022|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

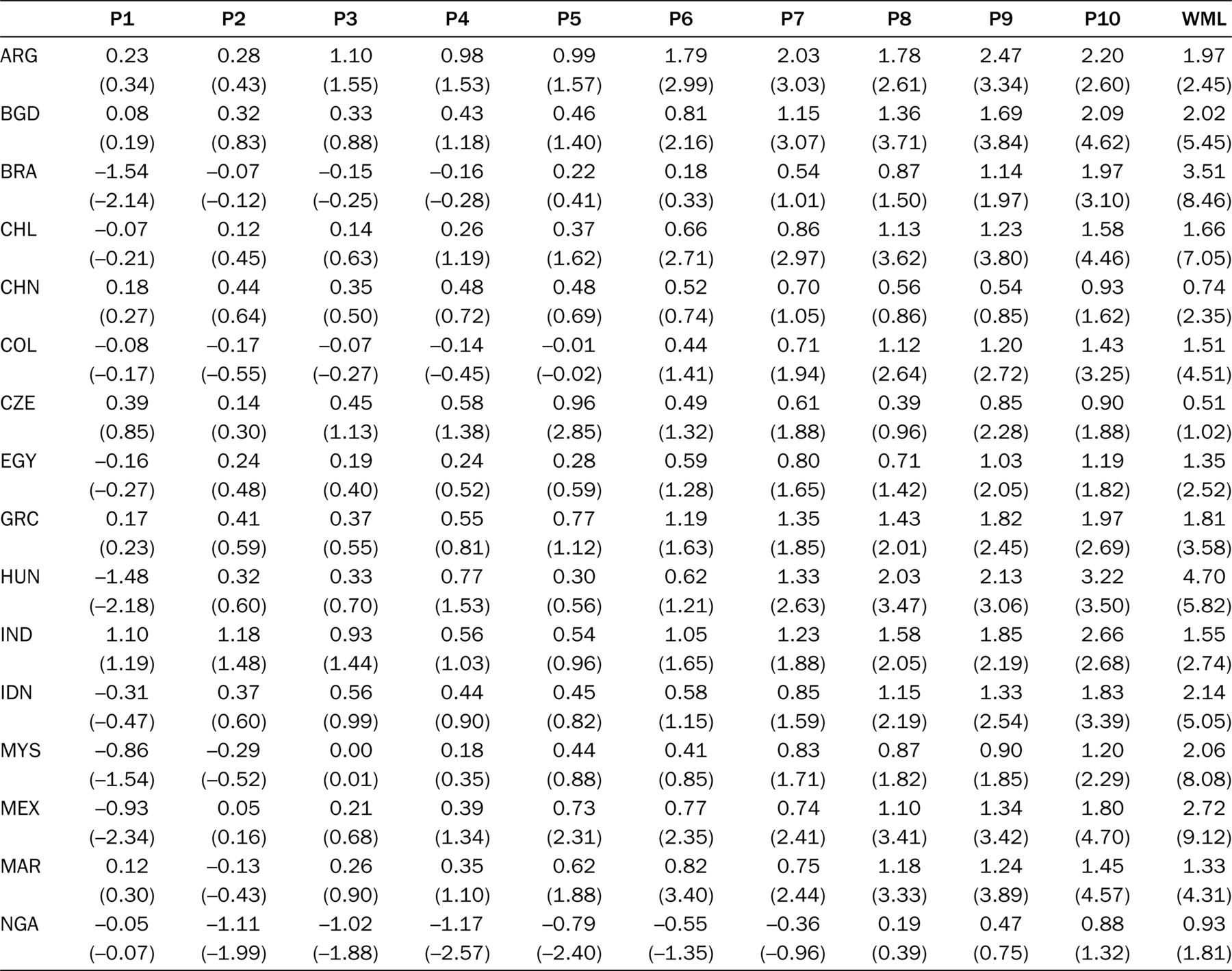

Momentum Everywhere, Including Emerging Markets

By Larry Swedroe|October 6th, 2022|Volatility (e.g., VIX), Larry Swedroe, Research Insights, Momentum Investing Research|

Atilgan et al. contribute to the momentum literature with “Momentum and Downside Risk in Emerging Markets.”

DIY Trend-Following Allocations: October 2022

By Ryan Kirlin|October 3rd, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

No exposure to domestic equities. No exposure to international equities. No exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds.

Does Gender Affect Reactions to Market Sentiment Shifts?

By Tommi Johnsen, PhD|October 3rd, 2022|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Momentum Investing Research|

Does gender matter in institutional investing?

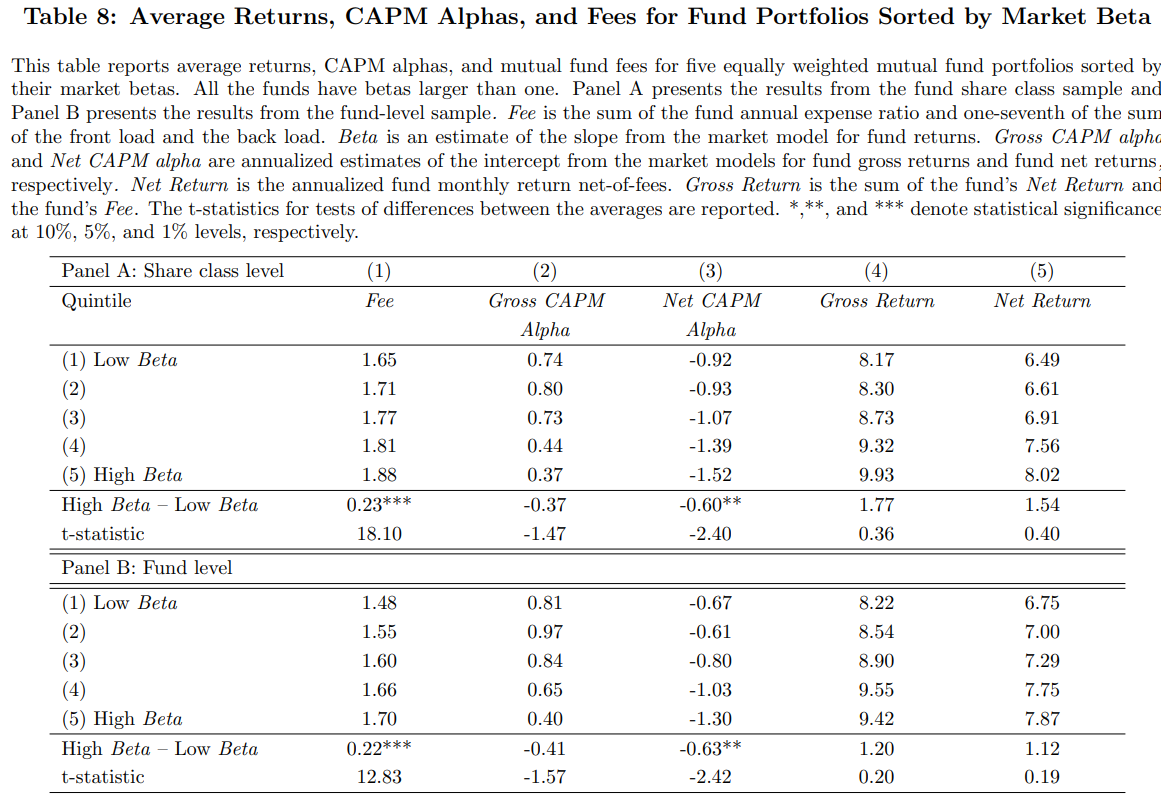

The Relationship Between the Demand for Leverage and Management Fees

By Larry Swedroe|September 30th, 2022|Transaction Costs, Research Insights, Larry Swedroe, Academic Research Insight|

This article discusses what academic research says about the relationship between the demand for leverage and management fees.

Portfolio Architect as a Tool for Growing Your Business: Today at 12pm EST.

By Wesley Gray, PhD|September 29th, 2022|Research Insights, Tool Updates|

Scott will demonstrate how he uses our Portfolio Architect tool to simplify the investment model discussion with clients and how the tool can save you time creating marketing material.

If you are a current user of our tool, we highly recommend you attend this discussion.