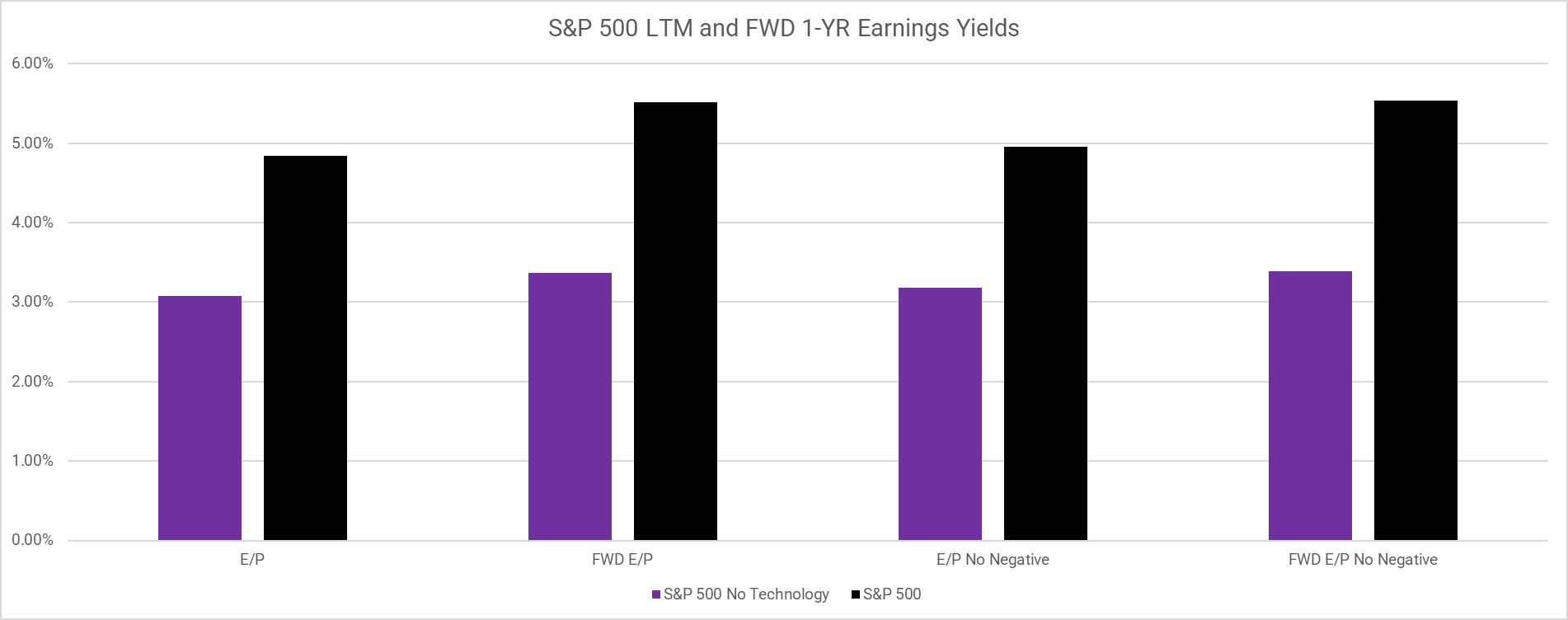

S&P 500 Valuations with and without Technology

By Ryan Kirlin|May 27th, 2022|Research Insights, Value Investing Research, Active and Passive Investing|

A few quick charts for our readers. As we all know, technology-related sectors and names have been crushed. But is blood in the streets? Not really.

Strategies to Mitigate Tail Risk

By Larry Swedroe|May 26th, 2022|Crisis Alpha, Quality Investing, Research Insights, Factor Investing, Larry Swedroe, Trend Following, Academic Research Insight, Momentum Investing Research|

Investors care about more than just returns. They also care about risk. Thus, prudent investors include consideration of strategies that can provide at least some protection against adverse events that lead to left tail risk (portfolios crashing). The cost of that protection (the impact on expected returns) must play an important role in deciding whether to include them. For example, buying at-the-money puts, a strategy that eliminates downside risk, should have returns no better than the risk-free rate of return, making that a highly expensive strategy.

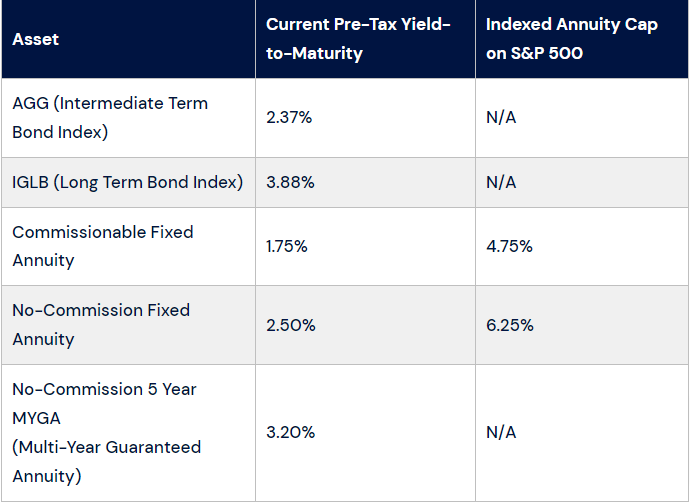

Life Insurance Instruments May Help Improve After-Tax Wealth

By Rajiv Rebello|May 25th, 2022|Research Insights, Guest Posts, Tax Efficient Investing|

Fee-only fiduciary advisors often summarily dismiss the use of life insurance solutions as financial planning tools—perhaps due to past experiences trying to get clients out of poorly structured, high expense policies. In this post, Colva Actuarial Services and Colva Capital principal Rajiv Rebello explains how fiduciary advisors can properly structure life insurance products and utilize low-expense/no-commission products to provide better after-tax diversification and returns for the fixed income portion of their clients’ portfolios as opposed to investing in bonds directly.

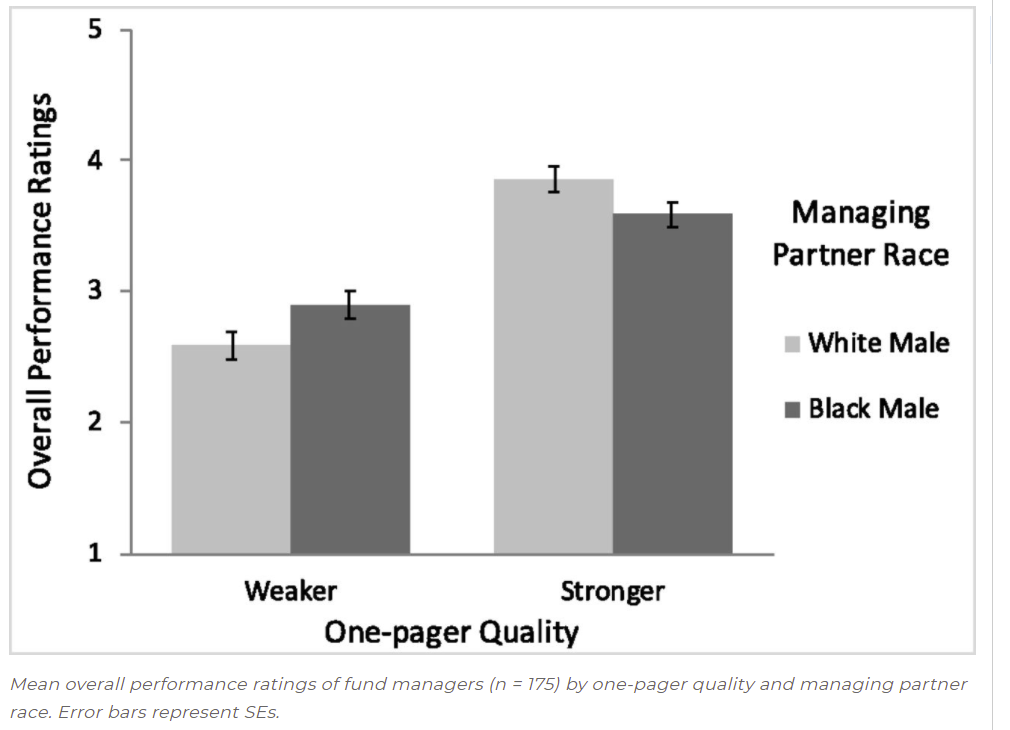

How Race Influences Asset Allocation Decisions

By Elisabetta Basilico, PhD, CFA|May 23rd, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

Of the $69.1 trillion global financial assets under management across mutual funds, hedge funds, real estate, and private equity, fewer than 1.3% are managed by women and people of color. Why is this powerful, elite industry so racially homogenous? We conducted an online experiment with actual asset allocators to determine whether there are biases in their evaluations of funds led by people of color, and, if so, how these biases manifest. We asked asset allocators to rate venture capital funds based on their evaluation of a 1-page summary of the fund’s performance history, in which we manipulated the race of the managing partner (White or Black) and the strength of the fund’s credentials (stronger or weaker). Asset allocators favored the White-led, racially homogenous team when credentials were stronger, but the Black-led, racially diverse team when credentials were weaker. Moreover, asset allocators’ judgments of the team’s competence were more strongly correlated with predictions about future performance (e.g., money raised) for racially homogenous teams than for racially diverse teams. Despite the apparent preference for racially diverse teams at weaker performance levels, asset allocators did not express a high likelihood of investing in these teams. These results suggest first that underrepresentation of people of color in the realm of investing is not only a pipeline problem, and second, that funds led by people of color might paradoxically face the most barriers to advancement after they have established themselves as strong performers.

Value Investing: Headwinds, Tailwinds, and Variables

By Ryan Kirlin|May 20th, 2022|Factor Investing, Research Insights, Value Investing Research, Tactical Asset Allocation Research|

Investing is no different. A question we regularly get in the current environment is "How does inflation affect value stocks?" Well...it depends. I could show you some data on how value stocks did in the 70's (period of high inflation) versus how they did in the 90's (low inflation). But if WW3 broke out tomorrow, wouldn't that variable quickly top all other variables? Probably. So let's table that variable.

Trend Following: Timing Fast and Slow Trends

By Larry Swedroe|May 19th, 2022|Factor Investing, Larry Swedroe, Research Insights, Trend Following, Academic Research Insight, Momentum Investing Research|

A large body of evidence demonstrates that momentum, including time-series momentum (trend following), has improved portfolio efficiency. Research has found that there are a few ways to improve on simple trend-following strategies. Techniques that have been found to improve Sharpe ratios and reduce tail risk include volatility scaling and combining fast and slow signals as well as combining long-term reversals. These have been incorporated by many fund managers into investment strategies. Cheng, Kostyuchyk, Lee, Liu and Ma provided evidence that machine learning could be used to further improve results. With that said, a word of caution on the use of machine learning is warranted. The powerful tools and the easy access to data now available to researchers create the risk that machine learning studies will find correlations that have no causation and thus the findings could be nothing more than a result of torturing the data. To minimize that risk, it is important that findings not only have rational risk- or behavioral-based explanations for believing the patterns identified will persist in the future, but they also should be robust to many tests. In this case, investors could feel more confident in the results if their findings were robust to international equities and other asset classes (such as bonds, commodities and currencies).

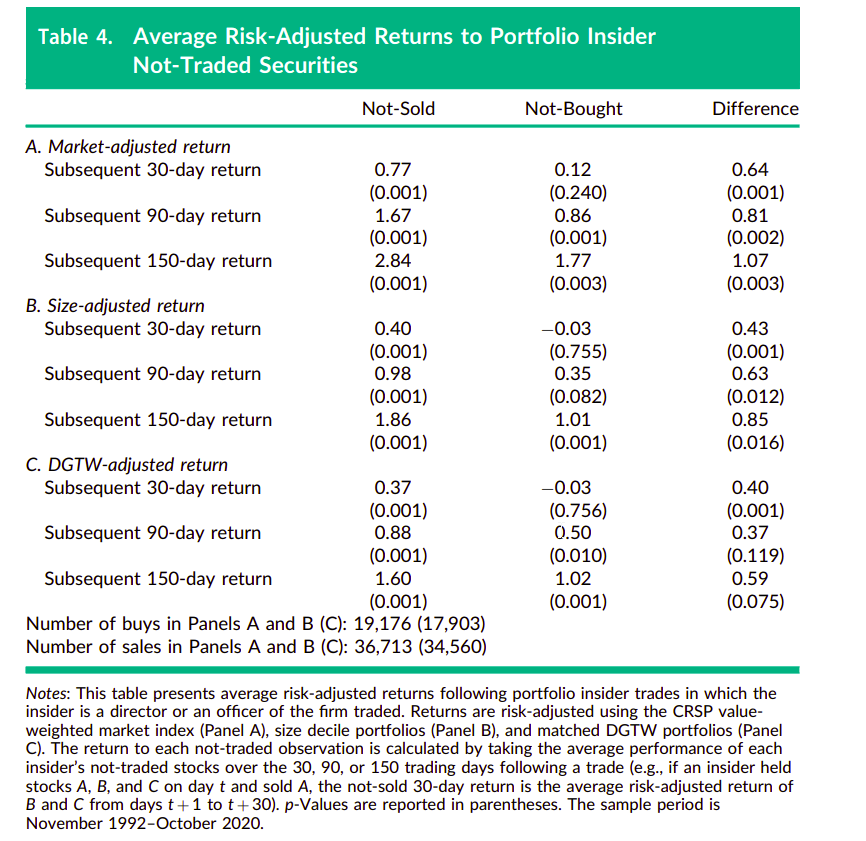

Form 3 and Form 4 Alpha: Focus on What Insiders Don’t Trade

By Elisabetta Basilico, PhD, CFA|May 16th, 2022|Insider and Smart Money, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

Some individuals, e.g., those holding multiple directorships, are insiders at multiple firms. When they execute an insider trade at one firm, they may reveal information about the value of all—both the traded insider position and not-traded insider position(s)—the securities held in their “insider portfolio.” We find that insider “not-sold” stocks outperform “not-bought” stocks. Implementable trading strategies that buy not-sold stocks following the disclosure of a sale earn alphas up to 4.8% per year after trading costs. The results suggest that even insider sales that are motivated by liquidity and diversification needs can provide value-relevant information about insider holdings.

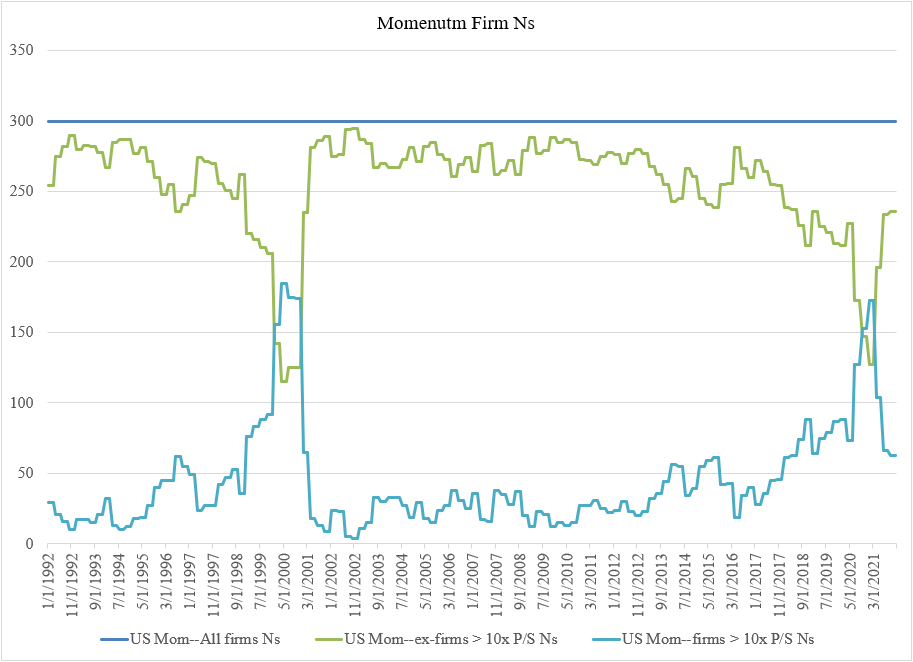

Momentum Investing: What happens if we boot stocks over 10x P/S?

By Jack Vogel, PhD|May 13th, 2022|Factor Investing, Research Insights, Momentum Investing Research|

This was a simple question posed to me by one of our blog readers--what impact does excluding stocks trading at 10x P/S have on a Momentum portfolio? A good question--especially for those who are "value" investors that are interested in momentum. For most systematic value investors, the prospect of adding stocks trading at over 10x P/S sounds ludicrous. Since I didn't know the exact impact, I went and ran the tests described below.

Institutions Trading Against Anomalies: Are Their Trades Informed?

By Larry Swedroe|May 12th, 2022|Relative Sentiment, Research Insights, Factor Investing, Larry Swedroe, Academic Research Insight|

An interesting question is do the trades of the more sophisticated institutional investors against anomalies provide information on returns? To answer that question, Yangru Wu and Weike Xu, authors of the study “Changes in Ownership Breadth and Capital Market Anomalies,” published in the February 2022 issue of The Journal of Portfolio Management, examined whether the entries and exits of informed institutional investors (or ownership breadth changes) interact with the aforementioned 11 anomaly signals studied by Stambaugh and Yuan can be used to improve the performance of anomaly-based strategies. They explained that they emphasized institutions’ new entries and exits because they could be triggered by private information and correlated with future earnings news, thereby capturing useful information regarding future stock returns. To determine if the trades of the institutional investors were informed, they sorted all stocks into 10 decile portfolios based on quarterly changes in ownership breadth. Their data sample covered all NYSE/AMEX/Nasdaq common stocks from May 1981 to May 2018.

Global Factor Performance: May 2022

By Wesley Gray, PhD|May 10th, 2022|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|