Is Sector-neutrality in Factor Investing a Mistake?

By Larry Swedroe|April 7th, 2022|Research Insights, Factor Investing, Larry Swedroe, Academic Research Insight|

Long-only factor performance is more likely to degrade from sector neutralizing—keeping the sector component produced better long-only factors in 78 percent of the trials. The largest negative from sector neutralizing occurred for the value-weighted long-only factors that trade large stocks, arguably the most investable portfolio.

Global Factor Performance: April 2022

By Wesley Gray, PhD|April 7th, 2022|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

Gaining an Edge via Textual Analysis of FOMC Meetings

By Tommi Johnsen, PhD|April 4th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning, Macroeconomics Research|

How investors understand and use central bank communications, aka FEDSPEAK, is oftentimes cryptic and difficult to analyze. This study attempts to provide some clarity to this issue by applying textual analysis to both high-frequency price and communication data, to focus on episodes whereby stock price movements are identifiable and on investors’ reactions to specific sentences communicated by the Fed.

Trend is Generally Your Friend…Unless You are a Bond Investor…

By Ryan Kirlin|April 1st, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

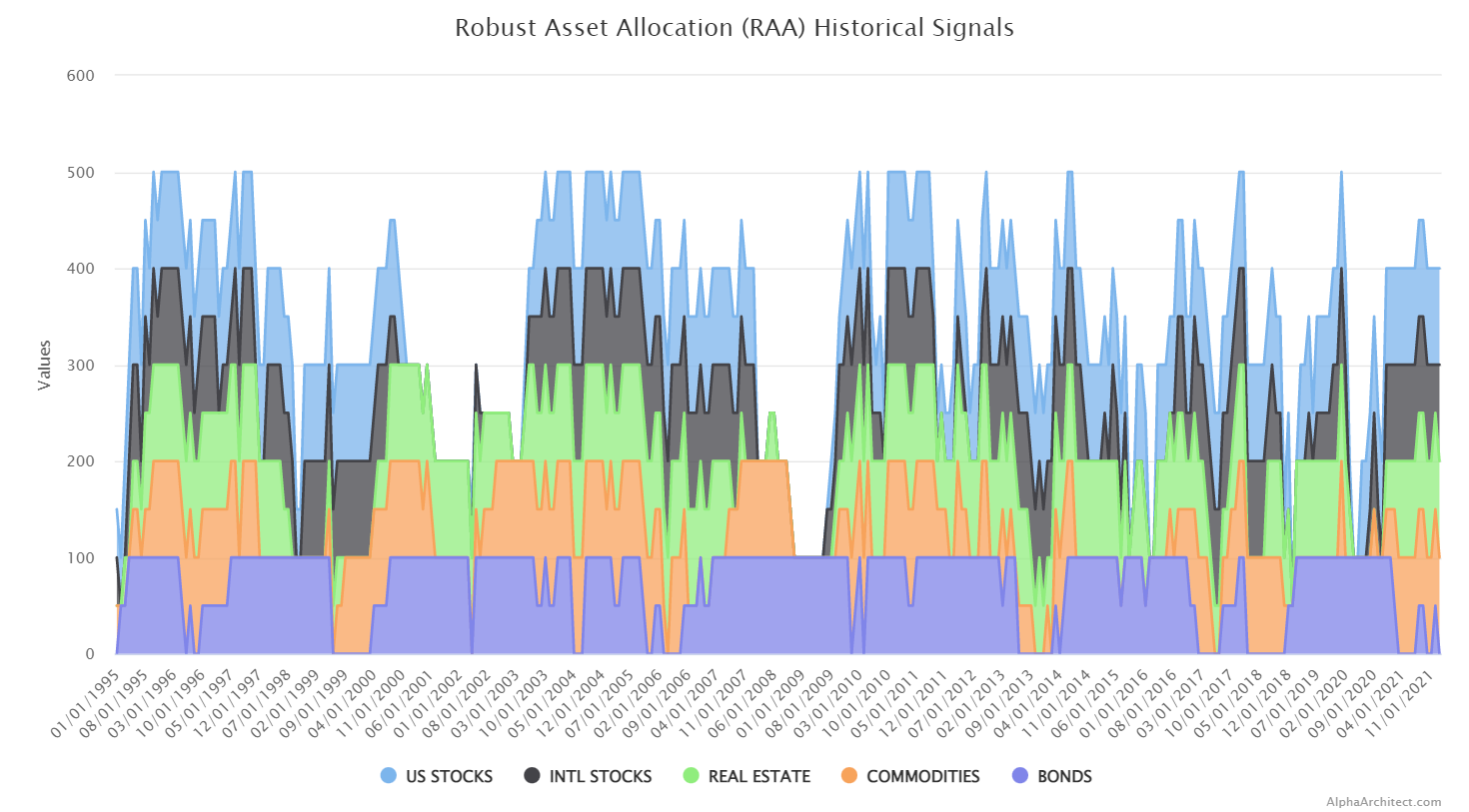

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

Are Stock Market Bubbles Identifiable?

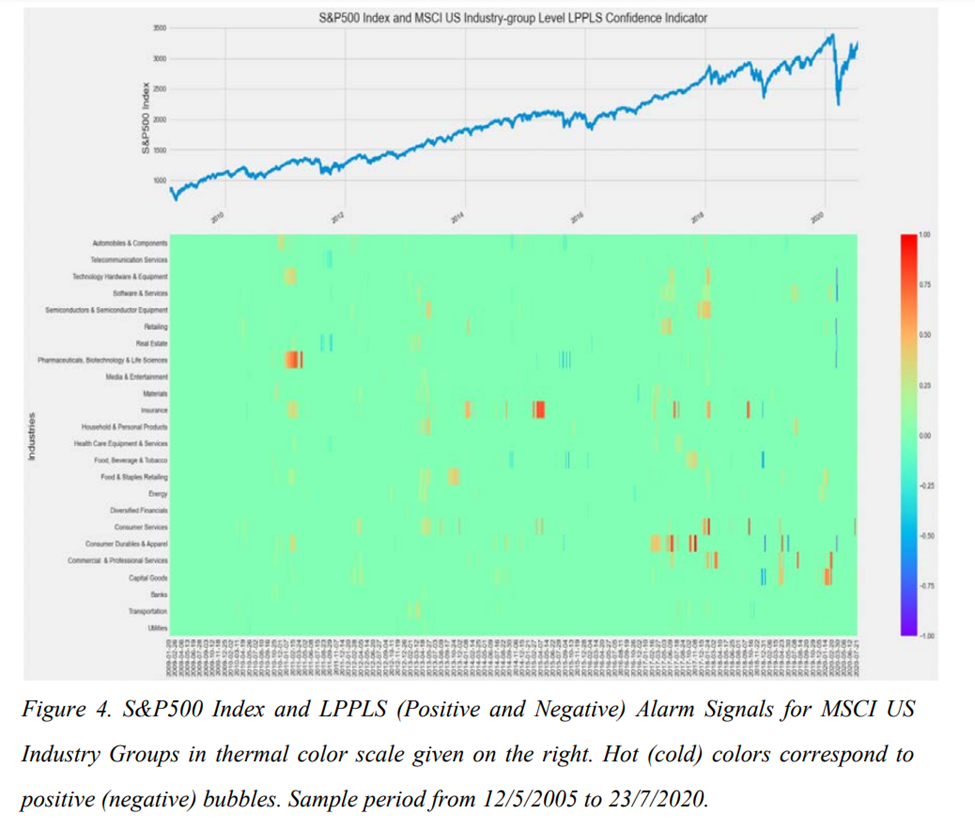

By Larry Swedroe|March 31st, 2022|Volatility (e.g., VIX), Research Insights, Larry Swedroe, Trend Following, Academic Research Insight, Tactical Asset Allocation Research|

Robin Greenwood, Andrei Shleifer, and Yang You authors of the study “Bubbles for Fama”, published in the January 2019 issue of the Journal of Financial Economics evaluated Fama's claim that stock prices do not exhibit price bubbles. Based on a fixed threshold for the industry price increases (e.g., a 100 percent price run-up during two consecutive years) to filter their events and to analyze what happens afterward, they examined U.S. industry returns over the period 1926‒2014 (covering 40 episodes) and international sector returns (1985‒2014).

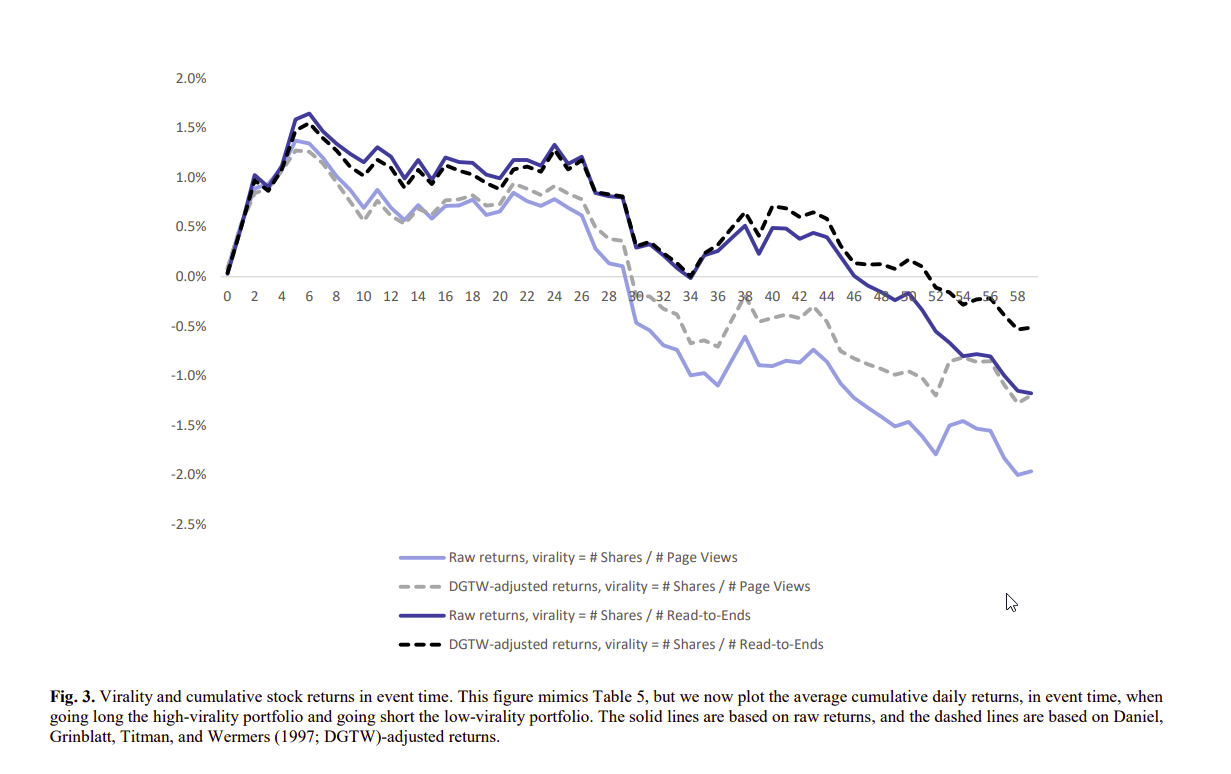

Which Articles Should You Read on SeekingAlpha.com?

By Elisabetta Basilico, PhD, CFA|March 28th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

The authors hypothesize that impression management consideration can also significantly determine investors’ conversations. This, in turn, can cause investors to inadvertently propagate noise with wide-ranging implications for the quality of investors’ investment decisions and asset prices.

2022 Democratize Quant Conference Recap and Materials

By Wesley Gray, PhD|March 25th, 2022|Research Insights, Factor Investing, Investor Education, Conferences, Value Investing Research, Momentum Investing Research|

We recently hosted our Democratize Quant Conference (sign up here for updates).

This post is a recap of what we heard and some resources we can make available to the public.

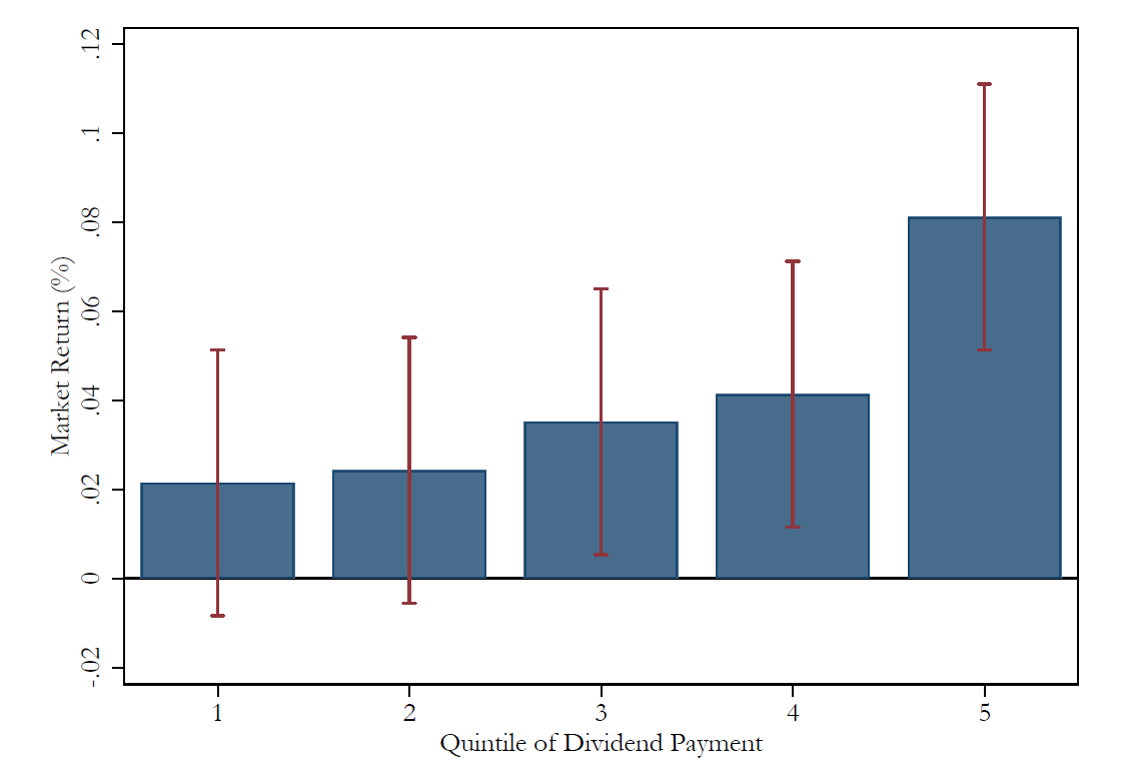

Can Investment Flows Affect Prices? Yep.

By Wesley Gray, PhD|March 25th, 2022|Dividends and Buybacks, Price Pressure Factor, Factor Investing, Research Insights, Academic Research Insight, Behavioral Finance, Tactical Asset Allocation Research|

Traditional finance theory suggests that stocks prices always reflect their fair market values based on publicly available information. Or in academic parlance, the "semi-strong" form efficient markets hypothesis serves as the null. What are the implications of this hypothesis? Well, the hypothesis suggests that the only reason a stock price will move is due to a shift in fundamentals (either through a change in expected cash flows or via the discount rate). But what about supply and demand shifts?

Employee Satisfaction and Stock Returns

By Larry Swedroe|March 24th, 2022|Intangibles, ESG, Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, AI and Machine Learning, Behavioral Finance|

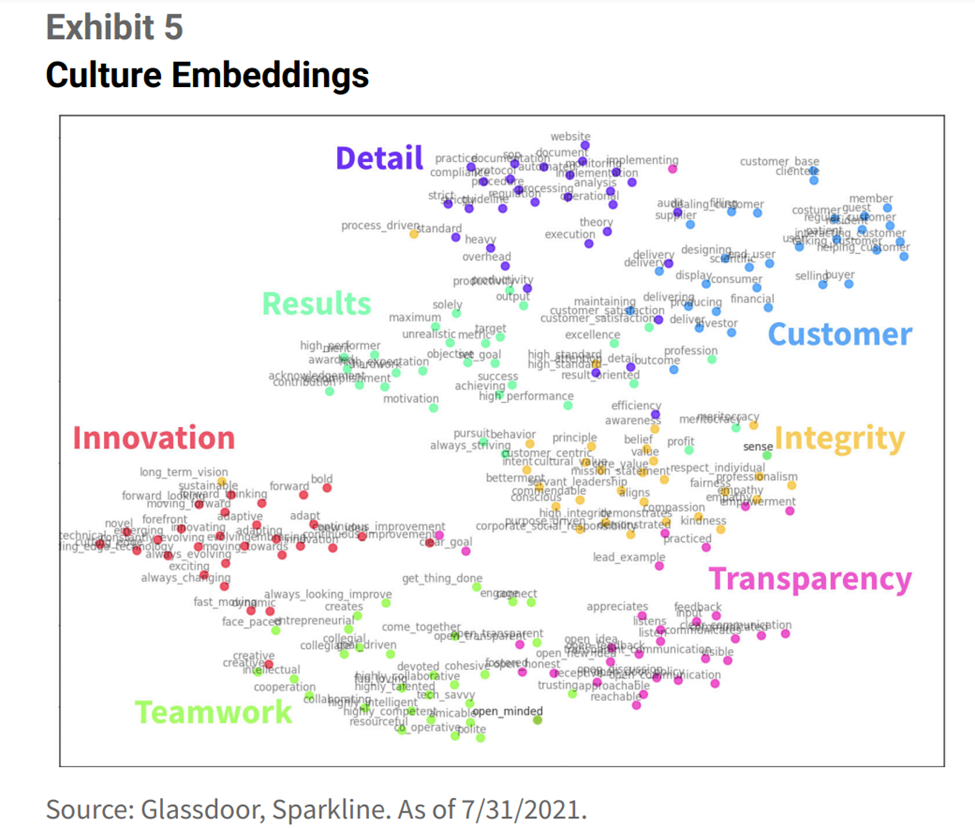

“Employees are our greatest asset” is a phrase often heard from companies. However, due to accounting rules requiring that most expenditures related to employees be treated as costs and expensed as incurred, the value of employees is an intangible asset that does not appear on any balance sheet. That leaves the interesting question of whether employee satisfaction provides information on future returns.

What Percentage of Women Serve in Senior Investment Roles?

By Elisabetta Basilico, PhD, CFA|March 22nd, 2022|ESG, Women in Finance Know Stuff, Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Corporate Governance|

There is a “Pink” elephant in the room. The paucity of women in the key investment and decisión-making roles in finance is that “pink” elephant. While women are represented at 33%, 37%, and 63% in the law, medical, and accounting professions, respectively (Morningstar 2016), the percentage of female investment decision-makers in investment pales in comparison at less than 10%. And it gets worse if we look at sub-sectors. Take private equity, it’s 6% (Lietz, 2011), hedge funds at 3% (Soloway, 2011), or investment banking documented in this scorecard, at a global median of 0%.