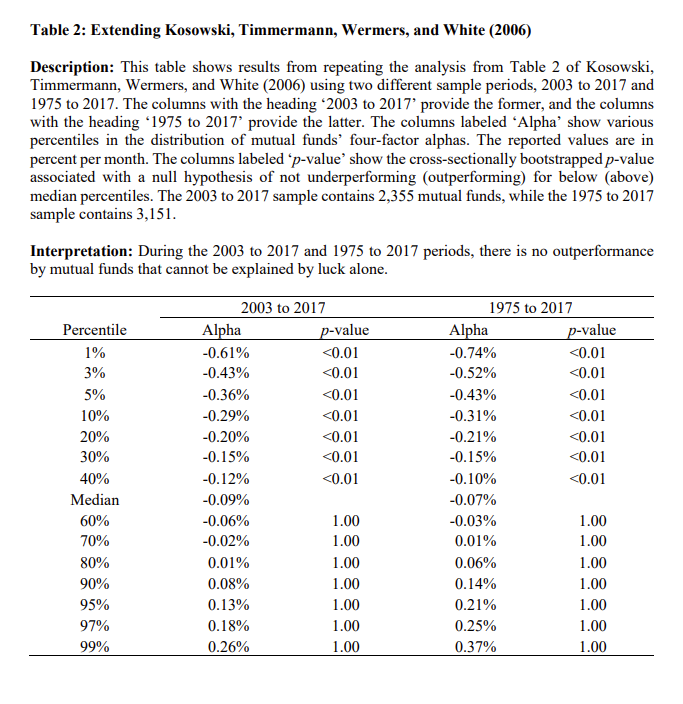

Can the Best Stock Pickers Still Beat the Market? An Out of Sample Test

By Wesley Gray, PhD|September 14th, 2020|Financial Planning, Research Insights, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing|

Can mutual fund stars still pick stocks?: A replication and [...]

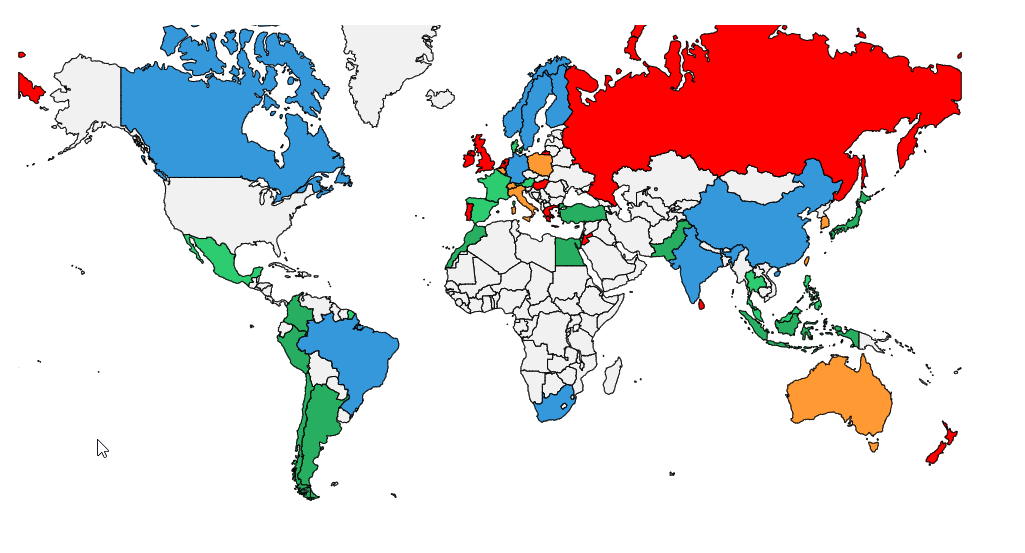

Can We Use the Shiller CAPE Ratio to Forecast Country Returns?

By Rich Shaner, CFA|September 10th, 2020|Factor Investing, Research Insights, Value Investing Research, Tactical Asset Allocation Research|

Utilizing an Amended CAPE Ratio to Derive a Country's Expected [...]

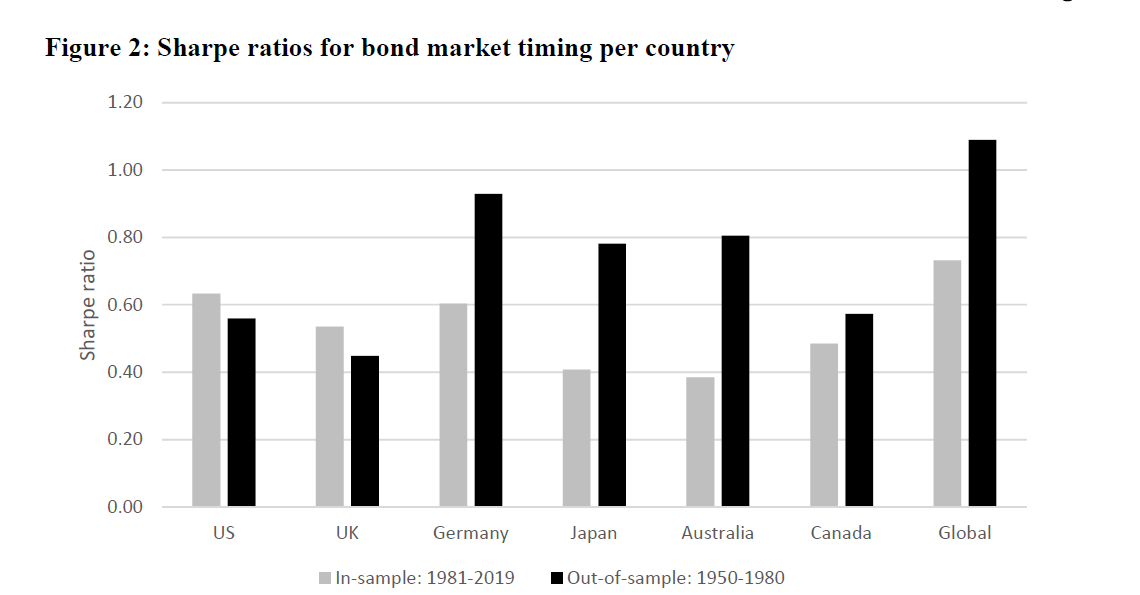

Predicting Bond Returns? Focus on GDP Growth and Inflation Indicators

By Wesley Gray, PhD|September 8th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning, Fixed Income|

Predicting Bond Returns: 70 Years of International Evidence Guido Baltussen, [...]

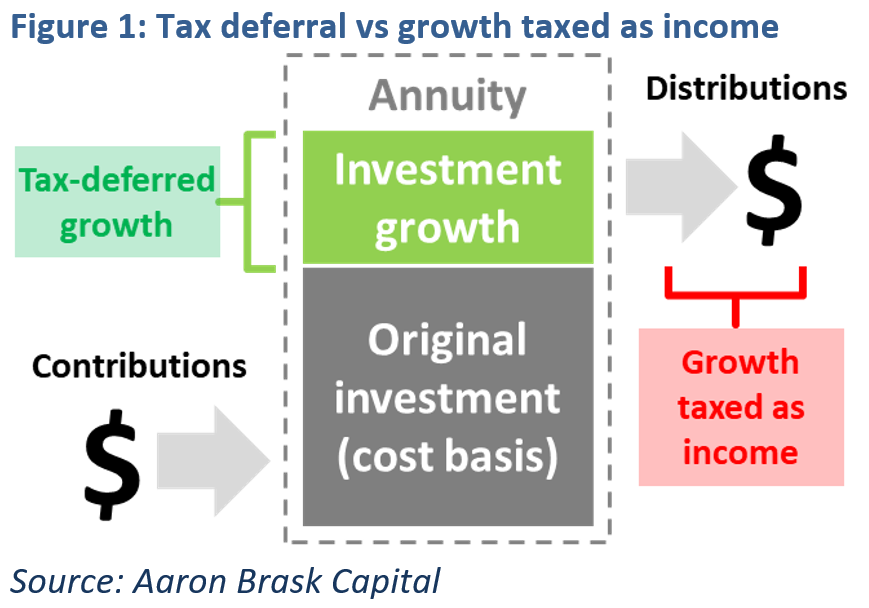

How to Optimize Fixed Annuity Tax Deferral

By Aaron Brask|September 3rd, 2020|Financial Planning, Guest Posts, Tax Efficient Investing|

Annuities are popular tools for retirement income planning. While stigmas [...]

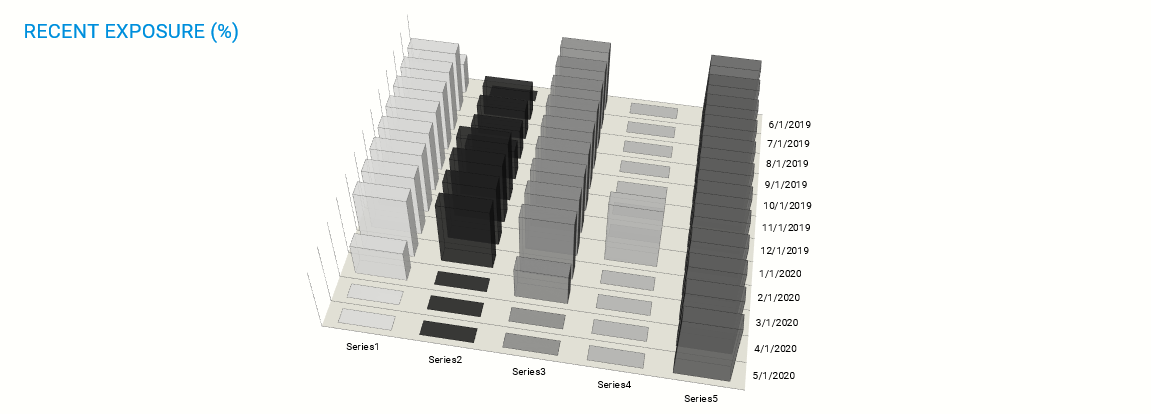

DIY Asset Allocation Weights: September 2020

By Ryan Kirlin|September 2nd, 2020|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

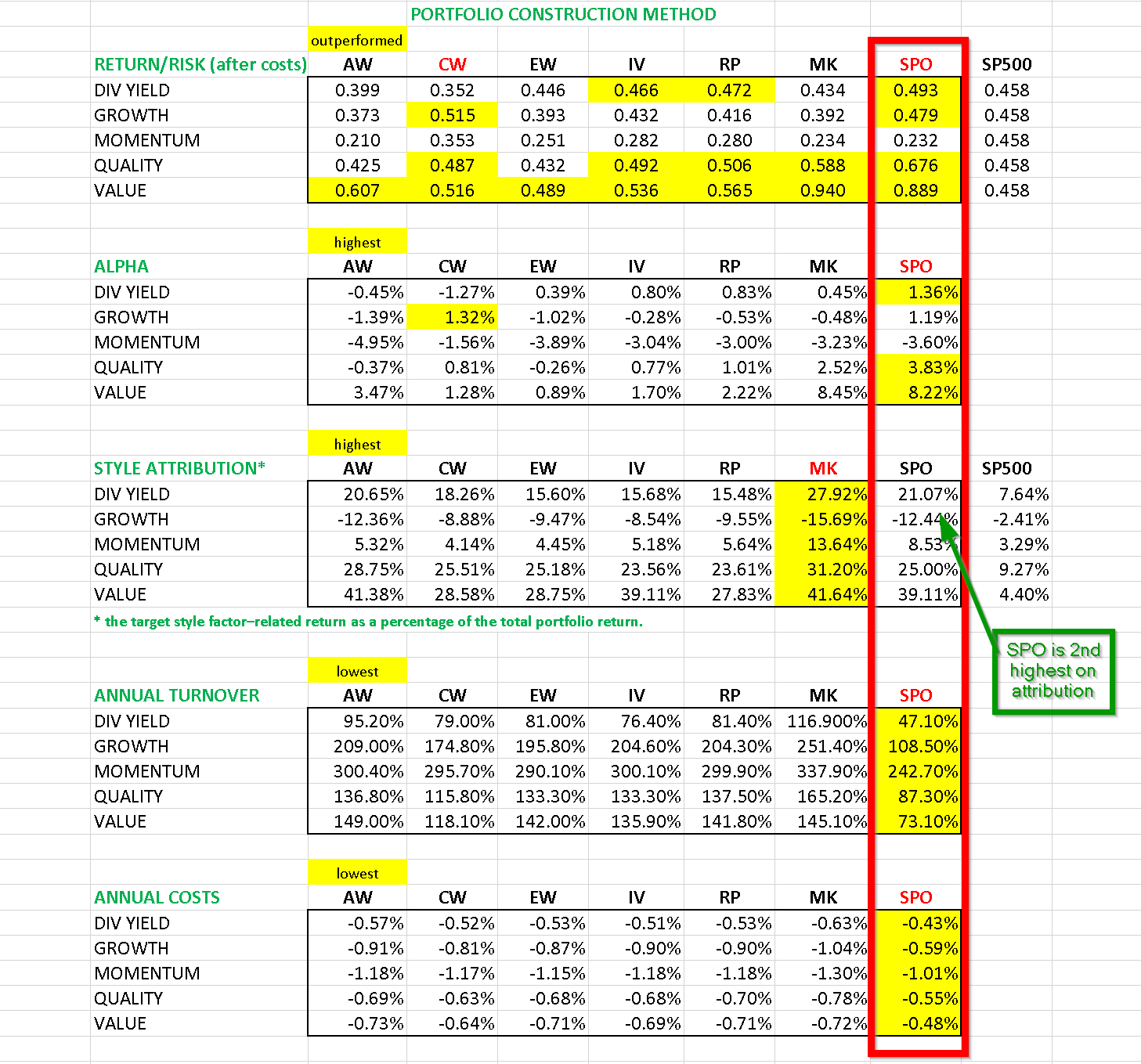

Effects of Portfolio Construction on the Performance of Style Factor ETFs

By Tommi Johnsen, PhD|August 31st, 2020|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

This article discusses the research surrounding style factor ETFs, specifically [...]

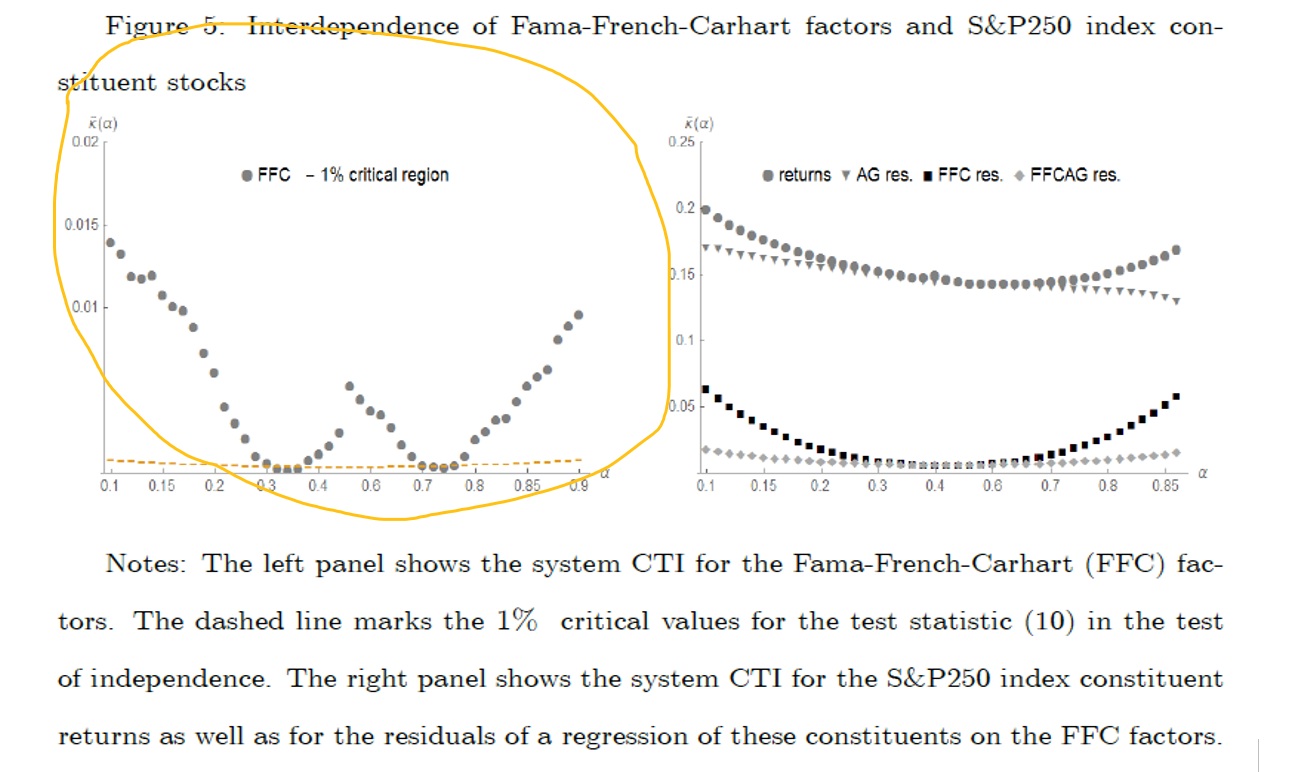

How to Measure and Understand Portfolio Tail Risk Events

By Evarist Stoja|August 27th, 2020|Crisis Alpha, Factor Investing, Research Insights, Guest Posts, Academic Research Insight|

Arnold Polanski, Evarist Stoja, Frank WindmeijerJournal of Applied Econometrics, 2019A [...]

Does Gold do What it is Supposed to do?

By Rich Shaner, CFA|August 24th, 2020|Crisis Alpha, Research Insights, Academic Research Insight|

Gold, the Golden Constant, COVID-19, "massive Passives," and Déjà Vu [...]

How A Great Team, and 2 Quant Geeks with no Clue, Survived The Leadville 100 Trail Run.

By Wesley Gray, PhD|August 22nd, 2020|Research Insights, Business Updates|

Editor's Note: this post has nothing to do with finance. [...]

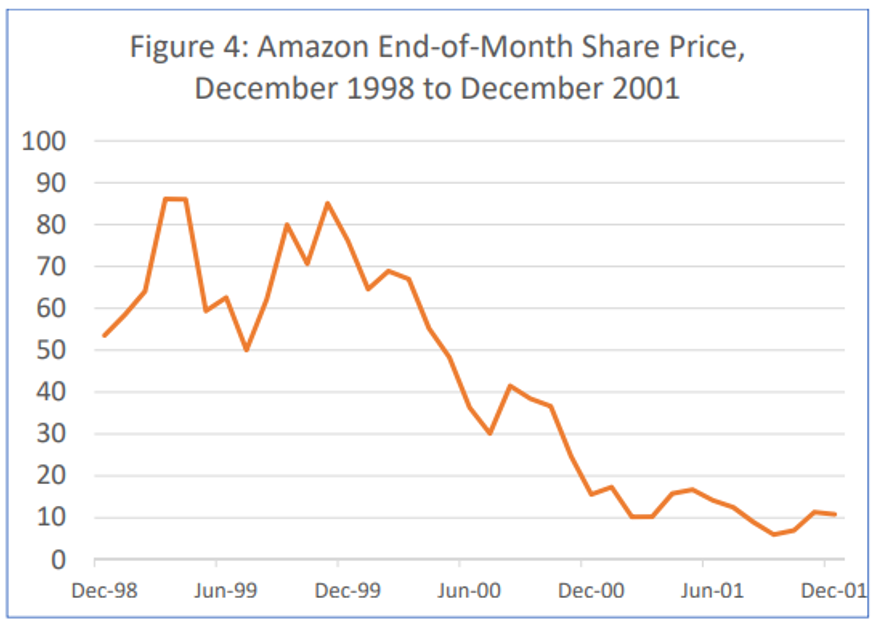

Even Great Investments Experience Massive Drawdowns

By Larry Swedroe|August 20th, 2020|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Value Investing Research|

Editor's Note: The ability of value investors to adhere to [...]