All of us are faced every day with a myriad of choices, but if you’re like me, you don’t spend much time thinking about how the choices you make affect your decision making. Luckily, we have academics at famous universities who get paid to sit around and do just that for us.

In a groundbreaking paper, “Making choices impairs subsequent self-control: a limited-resource account of decision making, self-regulation, and active initiative,” by Vohs, Baumeister, Schmeichel, Twenge, Nelson, and Tice, the authors discuss how the mental act of making choices depletes our finite supplies of decision making capacity. One of these studies was so great I have to recount it here. It involved that familiar lab rat, college students, and one of their famous pastimes, procrastination.

The researchers took a group of 26 students, and divided them into the “Choosers,” and the “Non-Choosers.” The Choosers had to spend some time selecting classes they would take to take to satisfy their degree requirements. The Non-Choosers were told to peruse the course catalogue, but not make any choices. Next, the researchers told the students that they would be given a math test that was predictive of real-world success. Then they told the students that studies had indicated that 15 minutes of practice would enhance their scores, and the students were given a packet of practice material and told they could practice for the next 15 minutes, if they wanted to.

Now here’s the best part: the researchers strategically placed magazines and a video game next to the work space. Now we all know that magazines and video games are like catnip for college students, so clearly this study had appropriate incentive structures. Next, the researchers retired to the room next door to observe them through a one-way mirror. (And I would add I always thought there was something weird and voyeuristic about researchers watching through a one-way mirror, but I guess that’s the price of progress in social psychology)

I bet you can guess what happened next. As the authors succinctly put it, “…after making choices, people spent more time on self-indulgent activities and less time on effortful studying.” Or as I would even more succinctly put it, the Choosers blew off studying for the math test. But you would never do that! Would you?

What’s interesting to me about this study and the others in the paper, is that they make clear that people’s internal resources for numerous executive functions, such as decision making, are limited, and can be depleted when we expend energy on them. Furthermore, when our stores of energy are depleted we tend to make worse decisions, or default to making no decisions (which of course is a decision in itself).

Next, consider the following study, which is not as humorously compelling in its design, but still relevant to our discussion of choice. Academics Lyengar, Heitman and Herrmann created a choice template that allowed consumers to make specific choices related to customizing a new car. It included everything from the rear view mirror to the engine. They divided people into two groups. The first group had to make its initial choices from a very large set of choices, and then made subsequent choices in descending order by number of choices available. The second group made choices in the opposite order: it made its initial choices from the very smallest set of choices, and from there saw increasing numbers of choices in ascending order. It turns out the first group had a much harder time choosing, became tired quickly and began going with the default option, and wound up less satisfied with their cars.

Now stop and think for a minute about how this applies to investing in stocks, which involves making multiple, complex choices on a constant basis. You have to choose securities from among thousands, select the very best along multiple dimensions, choose how to size your positions, and then when to buy more, trim them, or sell them. You have to decide what industries you want to be in or not be in, and what kind of financial attributes, such as leverage or dividends, you might prefer or are comfortable with. You have to make decisions about how much risk you are willing to take, how to allocate your funds, how to rebalance your investments over time, and how much cash to hold at any given time. You have to interpret news and changes in operating results and how they impact your holdings, and make decisions on the basis of your interpretation. What’s a poor resource-challenged investor to do?

To take a real-world example, let’s say you are a non-professional investor, but you have some business and finance skills and manage your own portfolio. One day, after you have been working all day at your job, making numerous complex decisions, you have depleted your ability to make high level, executive resource-intensive choices. You have been traveling and are behind on your work, yet it’s urgent that you make some difficult portfolio decisions for your multi-hundred thousand, or multi-million dollar portfolio. What do you do? Punt. You are overwhelmed and tell yourself you’ll deal with it later. You default to doing nothing. Just like the procrastinating students. Just like the consumers trying to design cars beginning with the huge range of options. Now it may be that doing nothing is the best choice – in investing that is often the case. But sometimes it’s not. If you want to manage your own portfolio, you have to make decisions from time to time, and you cannot control when that will be. And when you try to make decisions with diminished executive functioning reserves, you could cost yourself a lot of money.

Now suppose you are a professional investor, or perhaps an analyst. You’ve been making decisions all day, your choice-making resources are drained, yet you need to make some specific progress on identifying your next buy, and you’ve narrowed your list of candidates to five stocks. What do you? You haphazardly choose one because it’s at the top of the pile and dive into the 10-K to begin focusing on the company. Before you know it, you’re committed and you either A) buy the company without really considering the others on your list, or B) waste a bunch of time before realizing this company is not for you. Does this kind of thing happen in the real world? I have to believe it does.

Now in many respects, Turnkey Analyst can help you manage these kinds of choices, and make you a more effective investor.

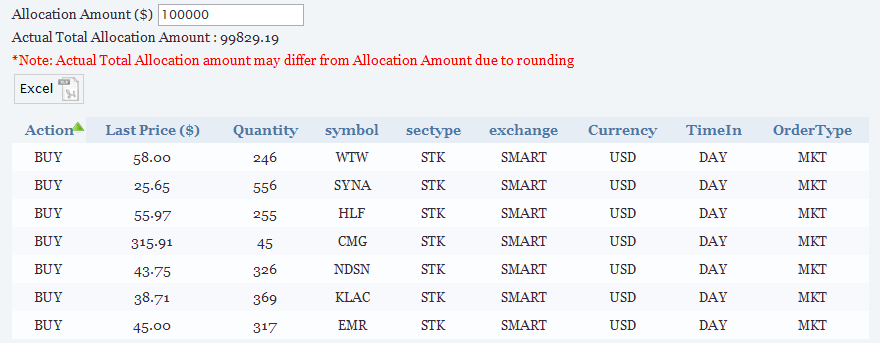

For the non-professional investor, you can take decision-making completely out of the equation by relying on a quantitative screen that is very likely a better investor than you are. Let the screen make your picks and rebalance quarterly, consistent with the findings of a rigorous academic study. Never again will you default to poor decision making because your executive function reserves are gone. Let’s say you want to maintain a portfolio of ~30 stocks, with a quarterly rebalance. Every quarter you run your screen, and get 7-8 new names to purchase. Below is a screenshot from Turnkey Analyst’s “Create Trade” screen, which has run a screen on your behalf, and allocated $100,000 to seven equities. Turnkey Analyst has taken the tough portfolio decisions out of your hands, and literally created your rebalance trade with the push of a button.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

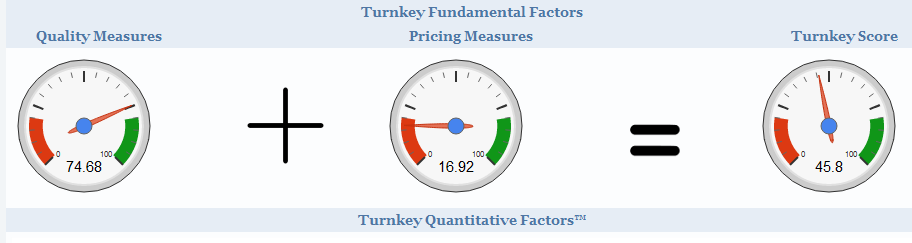

For the professional investor, if you want a sound basis to narrow your choices when you are considering a group of stocks, you can rapidly assess such factors as its economic moat, financial health, recent operation improvements, how likely you are to find fraud, and how cheap it is along numerous metrics. Let’s say you see a news piece on Amazon.com, Inc. (NMS:AMZN), and you want a quick check on whether the stock might be worth a closer look. Below is a screenshot from the Turnkey output on Amazon.com. Notice anything?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

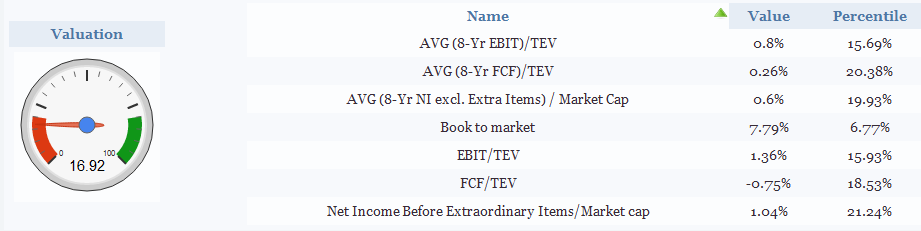

It appears the company has scored well on quality measures, but on pricing, there is something going on worth paying attention to. Moving down into Turnkey’s “Shareholder Yields” section, we take a look at the various outputs, as per the screenshot below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

As you can see, AMZN scores poorly across a range of valuation metrics. Book-to-Market is below the 7th %ile, and both long and short term EBIT and FCF to TEV ratios are roughly in the bottom quintile of the comparison universe. With a composite Turnkey Valuation score of 17%, AMZN looks very expensive by almost any measure. It could be time to move on and look at some other options.

In this case, Turnkey Analyst’s Company Reports analytics have taken numerous complex choices off the table, allowed the user to rapidly zero in on the valuation issues, and reduced them to a few simple choices. This is reliable, academic-based, quantitatively driven analysis you can depend on.

So simplify your choices. Don’t fall victim to decision fatigue. Or at a minimum, try to reduce its impact on your financial life. Turnkey Analyst is a valuable tool for investors that enables them to short circuit this commonplace behavioral pitfall of investing.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.