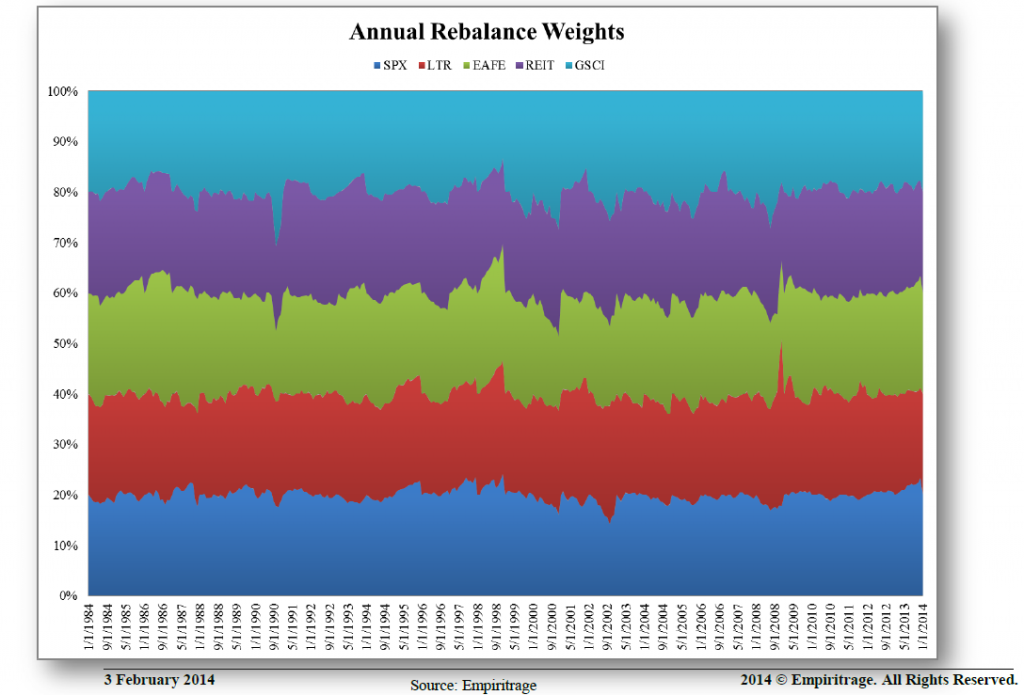

We did a quick study on monthly vs. annual rebalancing for the IVY5 asset allocation portfolio.

We did buy and hold and moving average rule variations.

Result: little difference between monthly and annual return rebalances.

Source: http://empiritrage.com/2014/02/03/annual-versus-monthly-rebalanced-asset-allocation-performance/

Why?

Buy and hold weights don’t differ that much from monthly equal-weight rebalanced weights

Let’s recite: activity does not equal value.

Again: activity does not equal value.

And one last time: activity does not equal value.

Okay, I still disagree with that statement because my system 1 refuses to believe it, but whatever…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.