Our Global Value Momentum Trend Index (“GVMT” or “GVMT Index”) is a globally diversified equity strategy that leverages trend-following to manage tail-risks.

The strategy can be summarized as follows:

Buy cheap stocks; buy strong stocks; own beta if trend is your friend.

Turns out that this simple statement summarizes our research findings over the past decade. And as many readers know, we’ve openly shared most of our research via this blog. But instead of having the reader explore over a thousand blog posts, we provide the CliffsNotes version, see below:

- Value investing: buy cheap stocks (see our research category on value investing)

- Momentum investing: buy stocks with strong relative strength (see our research category on momentum investing)

- Trend-following: invest with trends (see our research category on trend following)

Discussing permutations on the value, momentum, and trend themes can get repetitive, but one thing is clear from years of financial market research: value, momentum, and trend are arguably the undisputed factor kings. Few phenomena have the empirical breadth and depth to match these subjects. For example, here are two pieces looking at over 200 years of data on the concepts of value, momentum, and trend:

The Global Value Momentum Trend (“GVMT”) Index is our best attempt to compile a strategy that wraps our three favorite strategies into one system.

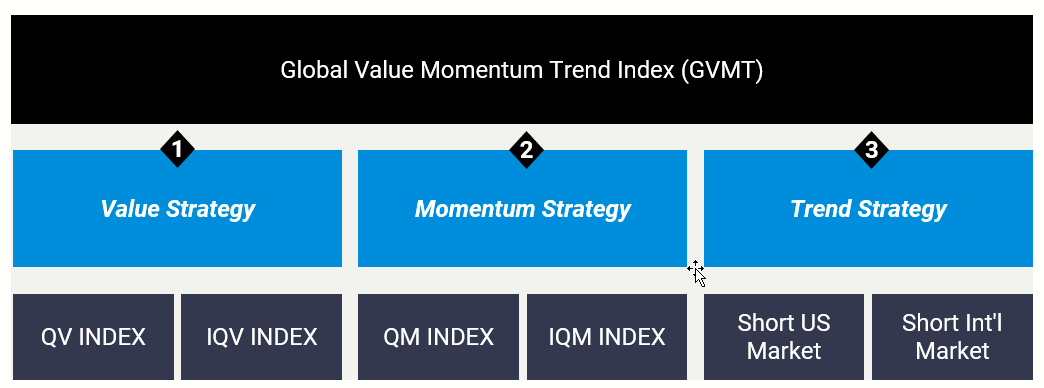

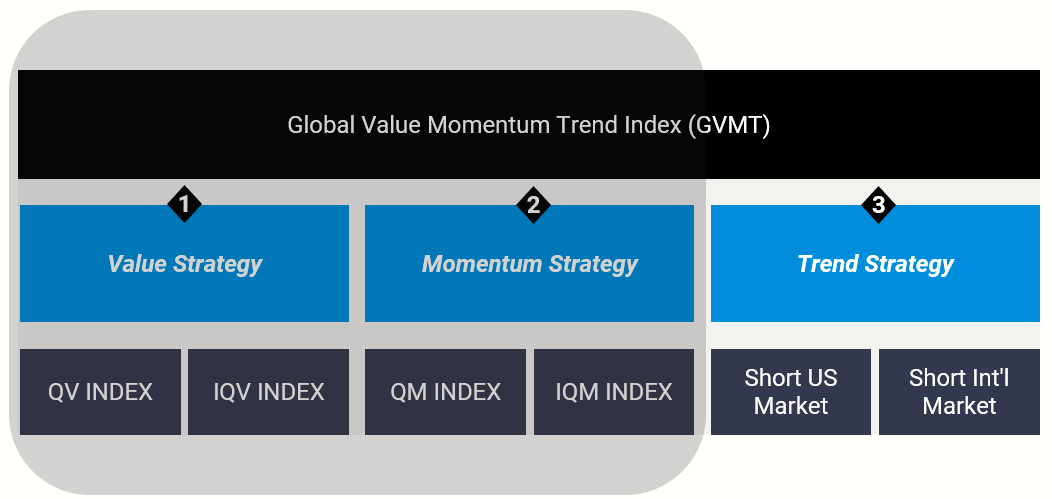

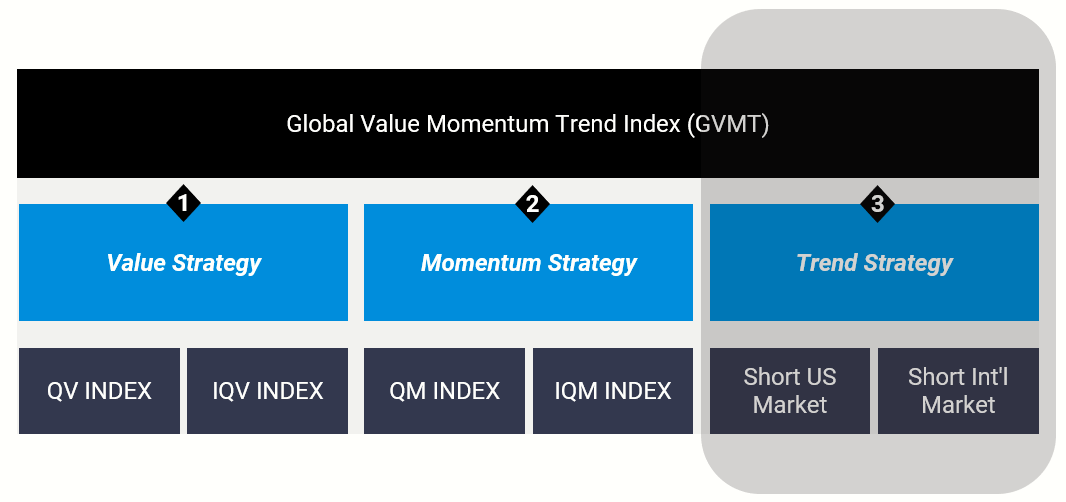

The three components of the system (value, momentum, and trend) are pictured in the figure below:

We have developed our own algorithms to capture these three exposures and we explain in this post how each component works.

Before we start, a few caveats are in order.

- First, we want to be clear that our Index is not the holy grail of investing.(1)

- Second, the Index is designed for a segment of investors that are 1) long-term oriented and 2) are willing to invest the time to understand our process.(2)

In summary, GVMT is definitely not for everyone.

With that said, there are various ways in which an investor can use our unique alternative exposure.

- Core Satellite: Bolt GVMT on a core low-cost beta portfolio.

- Factor Diversification: Deploy a targeted allocation alongside large-cap global factor exposures.

- Alternative Exposure: Add the exposure in the alternative bucket, as a diversifier and a possible replacement for long/short equity.

- Core Equity: Own as a core global equity exposure with a built-in risk management system.

In the end, GVMT can be deployed in a variety of ways, all with different costs and benefits. But at the core, the Global Value Momentum Trend Index (GVMT) simply represents a transparent and systematic approach to the following:

Buy cheap stocks; buy strong stocks; own beta if trend is your friend.

We hope this piece helps investors better understand our Global Value Momentum Trend Index.

Note: For those who want to dive right into the specifics of the Quantitative Value Indexes, please visit our index website.

A PDF version of this is available here.

An Introduction to the Global Value Momentum Trend Index

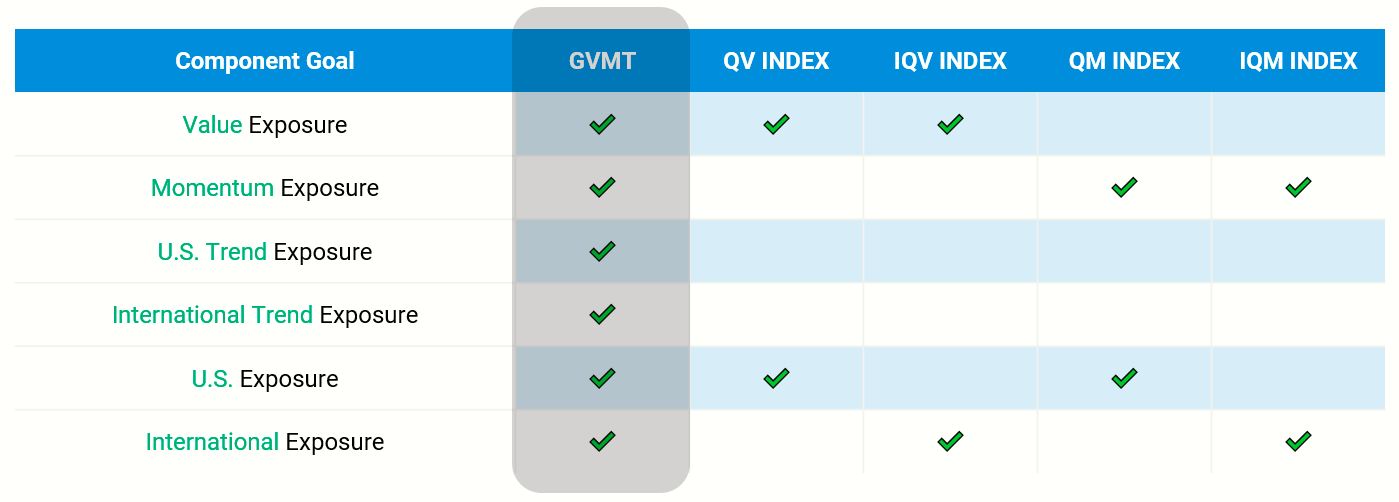

Here is a breakdown of the GVMT Index exposures:

GVMT consists of 3 core components:

- Value Strategy: The strategy consists of a combination of our U.S. and International Quantitative Value Indexes (QV Index and IQV Index).

- Momentum Strategy: The strategy consists of a combination of our U.S. and International Quantitative Momentum Indexes (QM Index and IQM Index).

- Trend Strategy: The strategy consists of a combination of two trend-following exposures (US and International).

We will walk through each of these components and/or reference the appropriate materials to learn more about each aspect of the process.

Components 1 & 2: Global Value and Momentum Equity

In this section, we will discuss the first two components of the GVMT Index strategy: the value strategy and the momentum strategy. The goal of these 2 components is to construct a global equity portfolio with high expected returns (which also means generally higher risk). We believe our value and momentum strategies are differentiated from the rest of the pack for several reasons:

- High active share and differentiation

- Strong research and development expertise (we literally wrote the books on quantitative value and quantitative momentum)

The basics of each system are outlined below:

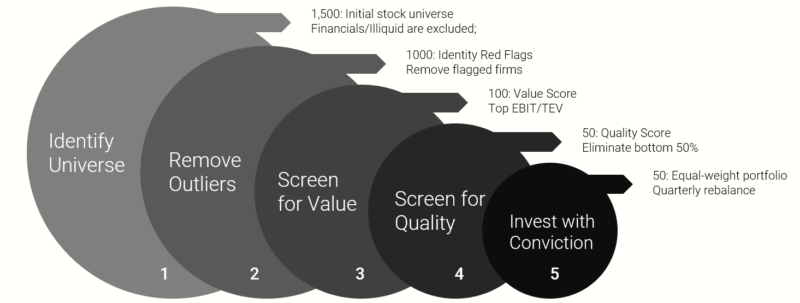

Quantitative Value Index: We seek to buy the cheapest, highest quality value stocks

- Identify Universe: Our universe generally consists of the largest 1500 liquid U.S. exchange-traded stocks.

- Remove Outliers: We leverage algos derived from academic research to eliminate stocks with red flags.

- Screen for Value: We screen for stocks with the highest ratio of operating earnings to price.

- Screen for Quality: We rank the cheapest stocks on their current financial strength.

- Investment with Conviction: We seek to invest in a concentrated portfolio of the cheapest, highest quality value stocks. This form of investing requires disciplined commitment, as well as a willingness to deviate from standard benchmarks.

And how about our momentum approach?

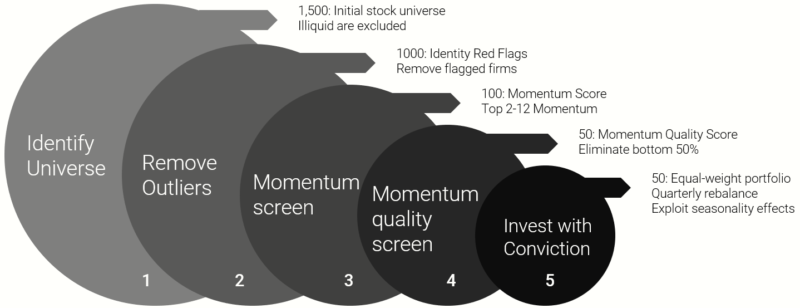

Quantitative Momentum Index: We seek to buy stocks with the highest quality momentum

- Identify Universe: Our universe generally consists of the largest 1500 liquid U.S. exchange-traded stocks.

- Remove Outliers: We leverage algos derived from academic research to eliminate stocks with red flags.

- Screen for Momentum: We screen for stocks with the strongest momentum.

- Screen for Momentum Quality: We seek high-quality momentum action that is less dependent on large return gaps.

- Investment with Conviction: We seek to invest in a concentrated portfolio of stocks with the highest quality momentum. This form of investing requires disciplined commitment, as well as a willingness to deviate from standard benchmarks.

The goal of both approaches is to systematically capture the global focused value and momentum premiums (e.g., portfolios are approximately 50 stocks per system, which maps to a 200 stock global value and momentum portfolio). For those interested in understanding why we combine value and momentum into one portfolio, please read this post.

Components 3: Trend Strategy

The third component of the GVMT process is a dynamic trend strategy that manages our generic market exposure at any given point in time. Important to note, the goal of our trend strategy is not to eliminate risk.(3) Our goal is to minimize the impact of extreme equity market drawdowns via low-turnover slow-moving long-term trend-following rules. Of course, being less ‘reactive’ is good for capturing the equity risk premium and keeping frictional costs low, however, the downside of being slower and less reactive is that we are more susceptible to short-run volatility — a trade-off we are willing to endure.

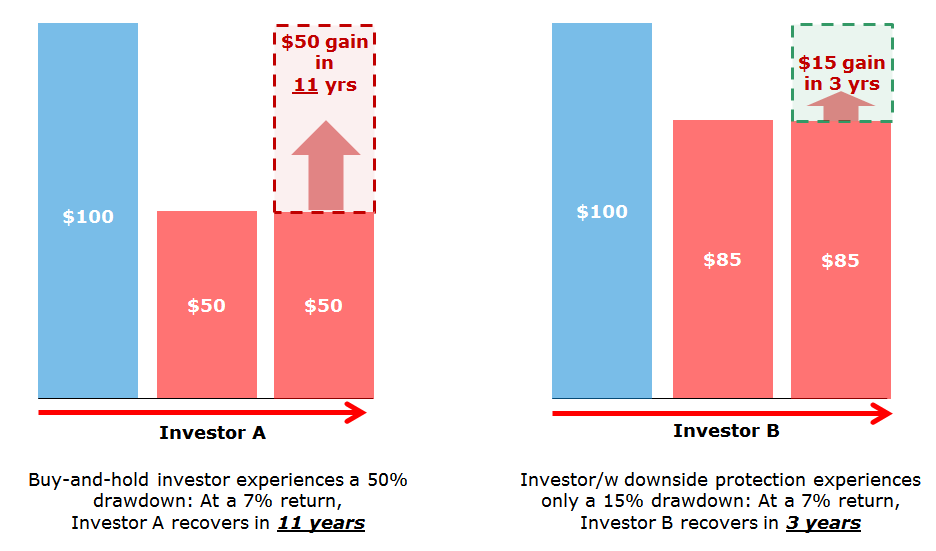

Many investors would love to enjoy the benefits of high expected risk premiums while avoiding the monster drawdowns. To many, this is an impossible mission. Perhaps they are right. However, while achieving zero risk with equity-like positive returns is a pipe dream, there is some evidence that extreme risk (e.g., massive drawdowns) can be avoided via trend-following methodologies. To reiterate why might the avoidance of large tail risks might be desirable, we present the hypothetical chart below:

The chart on the left highlights the problem with a permanent loss of capital events. A 50% loss of capital needs 11 years of compounding at 7% to break even. Some investors won’t be around in 11 years, let alone have the ability to sit tight for a decade just to break even. Clearly, huge losses need to be avoided. But as we mentioned, there is no such thing as getting returns and avoiding all risk. But “risk,” if it is defined as volatility, may not be a huge issue. The chart on the right makes this a bit more clear. In this scenario, the investor eats a 15% loss. Definitely not fun, but not devastating. The portfolio only needs 3 years to dig out of its hole and get back to breakeven. Three years of sitting on your hands is painful — no doubt — but a lot better than 11 years.

So what’s the lesson? Simple: losses are painful but manageable; large losses are disastrous!

Long-term trend-following is our proposed solution to manage large equity tail-risk. Trend-following is far from perfect, and as we point out, may represent the epitome of no pain no gain. However, we do believe in trend approaches if you are willing to trust the process.

Details for Our Trend-Following Model

Our Trend-Following Model is further described in our empirical analysis, but here are the high-level details:

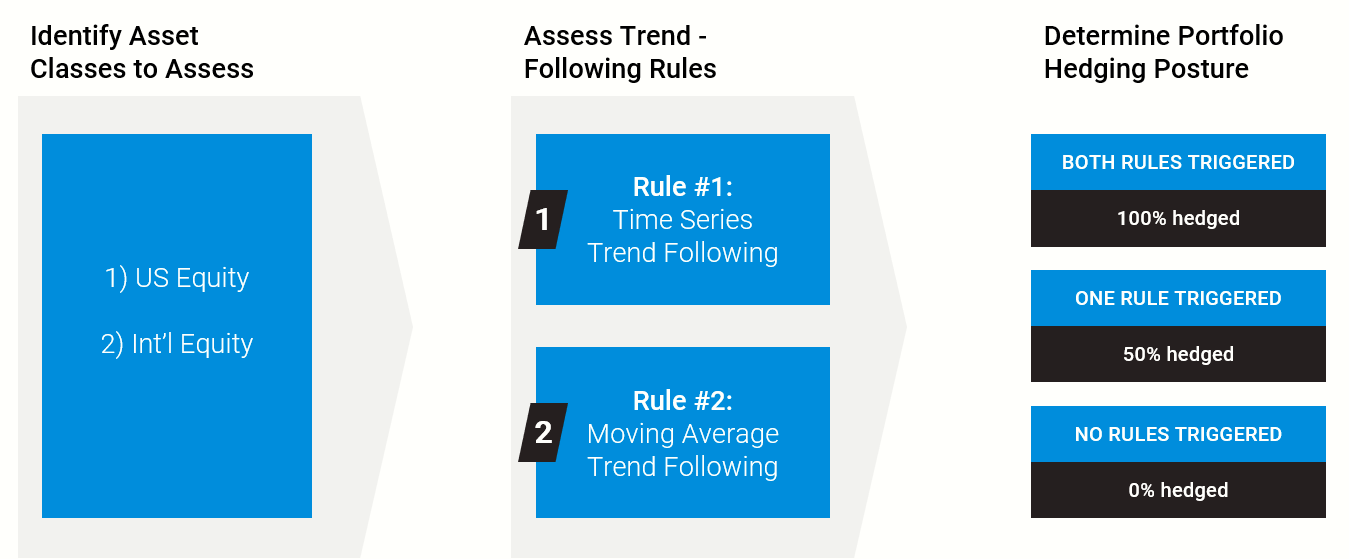

The mechanics of the rules are outlined below:

- Absolute Performance Rule: Time Series Momentum Rule (TMOM)

- Excess return = total return over past 12 months less return of T-Bills

- If Excess return >0, go long risky assets. Otherwise, hedge the position by shorting the passive index (S&P 500 and/or EAFE).

- A concept made popular by Gary Antonacci

- Trending Performance Rule: Simple Moving Average Rule (MA)

- Moving Average (12) = average of 12 monthly prices

- If Current Price – Moving Average (12) > 0, go long risky assets. Otherwise, hedge the position by shorting the passive index (S&P 500 and/or EAFE).

- A concept made popular by Meb Faber

- Our Trend-Following System: Combination of TMOM and MA (ROBUST model)

- 50% TMOM, 50% MA

The process above is deployed in both US and International stock markets. The hedges for each market are determined independently.

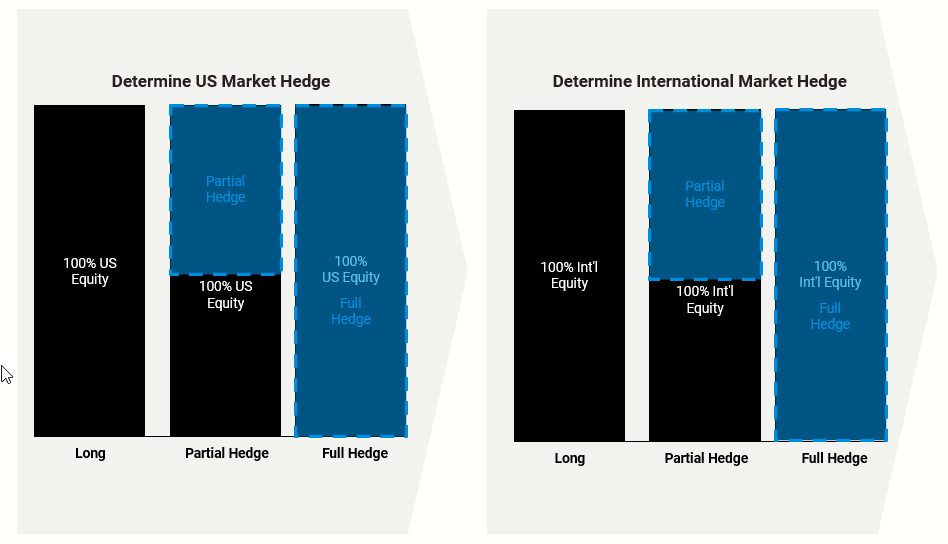

The visual below maps out the process:

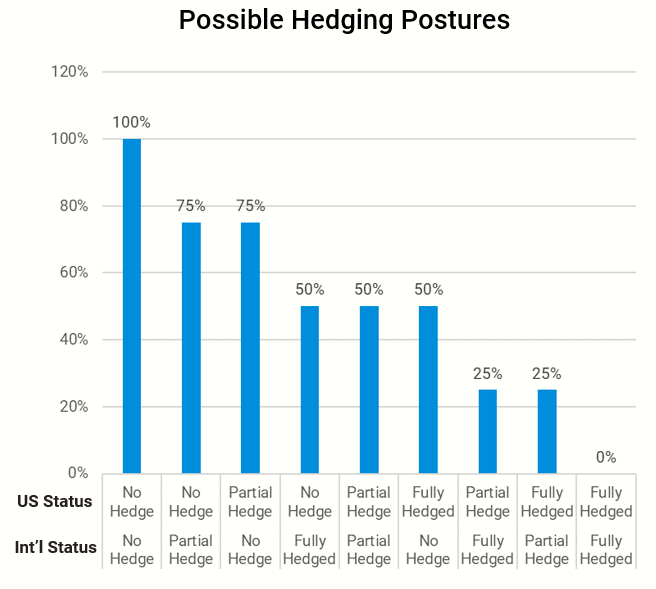

And the chart below maps out the possible hedging postures for the GVMT Index system:

The reader should take note that although the GVMT trend system is simple (by design) because there are 2 rules operating in 2 different markets, the Index’s potential market exposures across US and international stocks can vary dramatically.

Compiling the Components of the Global Value Momentum Trend Index

If you’ve made it this far — congrats — we’re almost there!

To recap, we’ve covered the three core components of the GVMT Index:

- Value Strategy

- Momentum Strategy

- Trend Strategy

But how do we combine these three components into an integrated system?

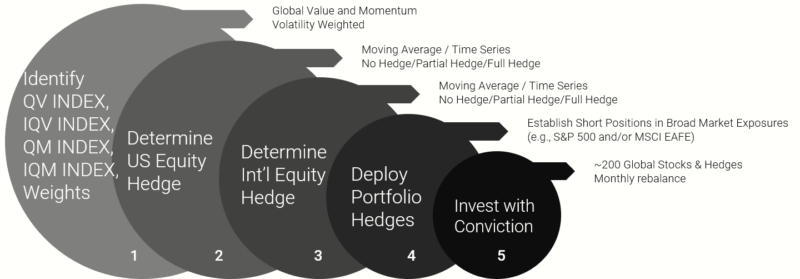

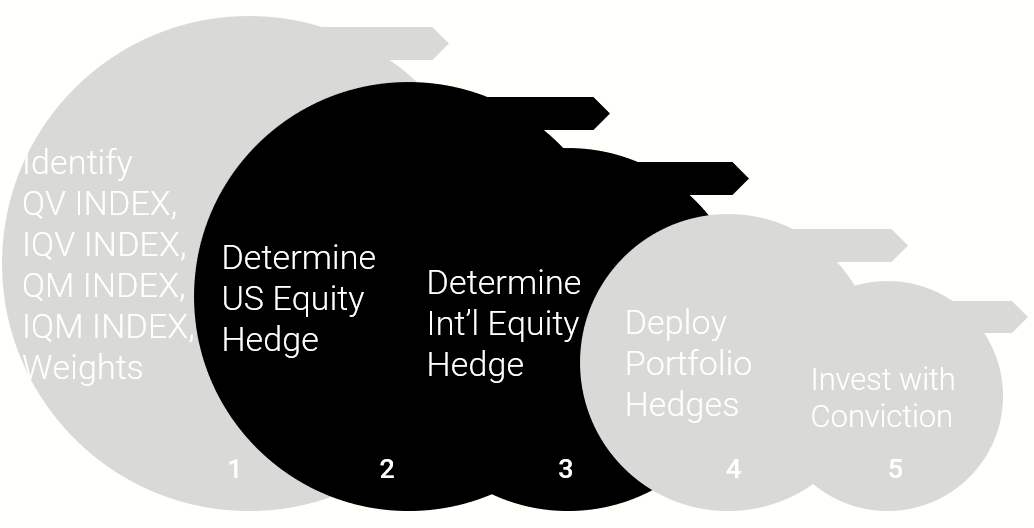

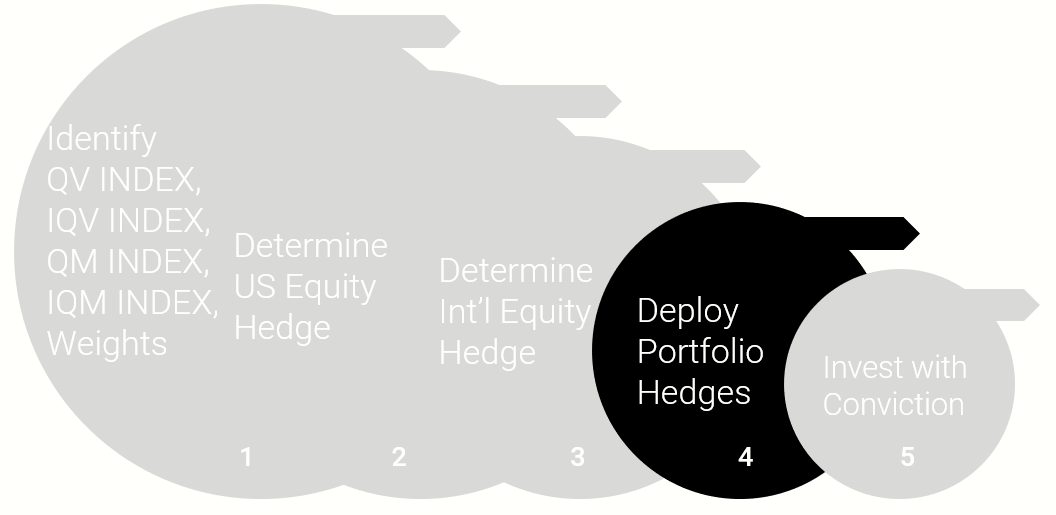

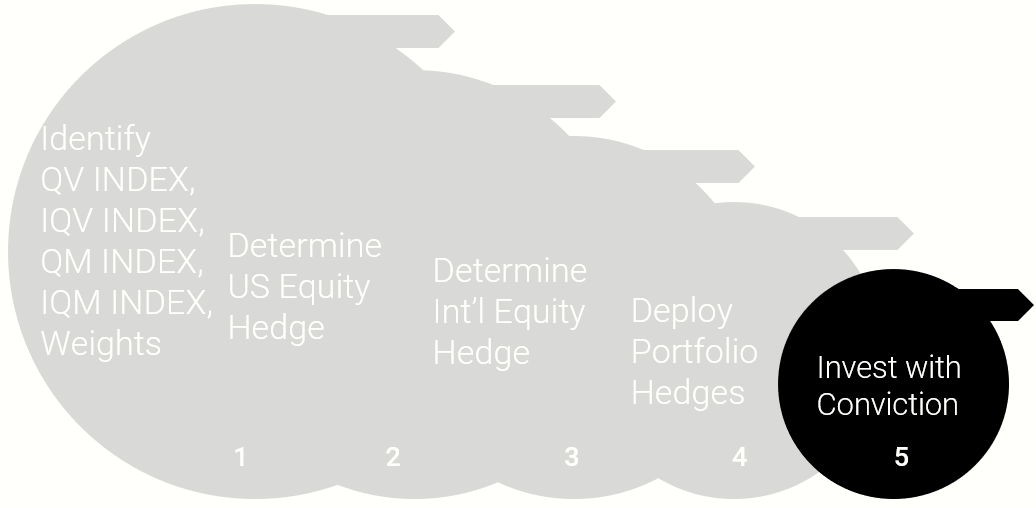

The process can be broken into 5 steps:

- Identify global value and momentum allocations

- Determine US hedge exposure

- Determine International hedge exposure

- Deploy hedges, when applicable.

- Invest with conviction

Here is a figure that maps out the details:

Step 1: Identify Global Value and Momentum Exposures

As mentioned in the global value and momentum section, we have 2 core equity strategies: Quantitative Value and Quantitative Momentum. However, because we divvy the world into U.S. and developed markets, we end up with 4 equity strategies in total:

- U.S. Quantitative Value Index (QV Index)

- International Quantitative Value Index (IQV Index)

- U.S. Quantitative Momentum Index (QM Index)

- International Quantitative Value Index (IQM Index)

Each stock index contains 50 stocks, so when all four indexes are combined into a global value and momentum portfolio there are 200 stocks in the overall portfolio.

How do we allocate across these 4 indexes (which represent 200 stocks)?

When allocating across equity risk we lean on the volatility-weighted approach because we seek to equalize our risk exposure (as opposed to dollar exposure) across the 4 Indexes.(4) Our process for volatility weighting is often deemed “simple risk parity.”(5)The downside of volatility-weighting the positions is an added layer of complexity. However, to avoid frictional costs we conduct an annual rebalance.(6)

Step 2/3: Determine the US and International Hedge

As is described above, our trend strategy consists of several long-term trend-following rules — a time-series rule (“TMOM) and a moving-average rule (“MA”). We calculate these trend-following rules for US exposures and the International exposures, separately. The rules are calculated and deployed on a monthly basis.

To further describe how this may work in practice, let’s work through an example.

To start, the trend rules are calculated for the U.S. market and the International market, separately.

- Domestic trend rules: Each month end, calculate the TMOM and MA rule on the S&P 500 Total Return Index.

- International trend rules: Each month end, calculate the TMOM and MA rule on the MSCI EAFE Total Return Index.

A hypothetical example illustrates the calculation of the trend rules:

- We are sitting at the close on March 31, 2018.

- The 12-month cumulative total return on treasury bills are 2%, S&P 500 Total Return Index is 5%, and MSCI EAFE Total Return Index is -1%.

- S&P 500 TR Index is above the 12-month moving average, MSCI EAFE Total Return Index is below the 12-month moving average.

Let’s first look at the domestic equity trend-following rules:

- Domestic TMOM: The S&P 500 TR Index has earned 5% relative to the treasury bill return of 2%. No rule trigger.

- Domestic MA: The S&P 500 TR Index is above the 12-month moving average. No rule trigger.

Let’s first look at the international equity trend-following rules:

- International TMOM: The MSCI EAFE TR Index has earned -1% relative to the treasury bill return of 2%. Rule triggered.

- International MA: The MSCI EAFE TR Index is below the 12-month moving average. Rule triggered.

In summary, the Robust Trend Rules (combo of the TMOM and MA rules) will look as follows:

- Domestic Robust Trend Rule: No rules triggered, which implies no hedge.

- International Robust Trend Rule: Both rules triggered, which implies a full hedge.

Step 4: Deploy Portfolio Hedges

The penultimate step in the GVMT process is taking the signals from the prior step and then translating these rules into a hedged exposure.

Let’s work through a hypothetical example to illustrate the idea. Consider the following situation:

In step 1 we determine via the risk parity algorithm that our investment should look as follows across geographic and factor exposures:

- 48% domestic equity; 52% international equity

- 50% value exposure; 50% momentum exposure

The two items above imply the following exposures:

- 24% US Quantitative Value (QV)

- 24% US Quantitative Momentum (QM)

- 26% International Quantitative Value (IQV)

- 26% International Quantitative Momentum (IQM)

Next, we review steps 2 and 3 and determine the following:

- Domestic TMOM: No rule trigger

- Domestic MA: No rule trigger

- International TMOM: Rule triggered

- International MA: Rule triggered

In summary, our hedges for our domestic equity exposure and international equity exposure will be as follows:

- Domestic exposure = No hedge

- International exposure = Full hedge

Operationally, this implies we will short an equity instrument that tracks the MSCI EAFE Index (e.g., EFA). The position will equal 52% of the total value of the portfolio. There will be no short position for the domestic equity exposure because we are not required to hedge.

In aggregate, the portfolio will be 100% long the four underlying value and momentum exposures (i.e., US/Int’l Value and US/Int’l Momentum), and have a short position equal to 52% of the portfolio value. U.S. equity exposure will be 100% and international equity exposure will be in a “market neutral” status (i.e., we are long IQV and IQM and short an MSCI EAFE exposure).

Step 5: Invest with Conviction

Our GVMT Index seeks to capture the collective benefits of the three factors where we have the highest conviction: Value, Momentum, and Trend. And because the strategy is unique, the GVMT Index should not be expected to closely track a broad passive global equity exposure. In fact, the GVMT Index has a higher correlation with the HFR Global Hedge Fund Index than it has with long-only equity indices.(7)

From a correlation perspective, the GVMT Index system certainly acts more like an alternative exposure than it acts like a long-only equity exposure. In some sense, the Index replicates many of the exposures delivered by traditional hedge funds (especially those who focus on long/short equity). One should expect that GVMT will experience many periods where the Index outperforms the long-only passive indexes, but more importantly, there will be many periods where the Index underperform passive indexes. Investors following the GVMT Index should keep this in mind when attempting to benchmark and communicate the GVMT system to their counterparties (see here for some ideas on benchmarking trend-following strategies).

Our recommendation for benchmarking is a global hedge fund index, a global long/short equity index, or a blended global equity/bond index (e.g., 70/30 equity/bond). Nonetheless, regardless of the benchmark chosen, one should expect the GVMT Index to have large deviations from other common exposures available in the marketplace.

Conclusions Regarding the Global Value Momentum Trend Index

We’ve spent a lot of time thinking through an approach that can combine our three favorite investment themes into a single coherent package. The GVMT Index is the outcome of this research and development. In the end, the Global Value Momentum Trend Index seeks to deliver focused exposure to our favorite investment ideas: value, momentum, and trend.

The GVMT mantra is simple and we believe it stands the test of time:

Buy cheap stocks; buy strong stocks; own beta if trend is your friend.

Note. More information on our Global Value Momentum Trend Index is available here.

Appendix

In this section, we address common technical questions regarding the Index. We recommend you contact us if you are interested in more details.

Why Do We Hedge As Opposed to Going to Cash?

Let’s say a trend rule triggers and we now need a short position to hedge our long portfolio. For illustration purposes, let’s also assume we need to fully hedge the portfolio (“Full Hedge”).

What happens next?

As we discussed above, the GVMT INDEX is always long a portfolio of Value and Momentum stocks. Let’s say the Index value is $100. If the Index wants to short $100 of a passive index to maintain a fully hedged stance (Note one can also use futures), typically done via an ETF vehicle such as the SPY or EFA, the Index can rely on the fully paid securities ($100) as collateral to open a short index ETF position.

The Index could also sell all the Value and Momentum stocks to minimize market risk on the portfolio and invest the proceeds in cash or Treasury Bills.

So why did we choose to have our Index always own the underlying Value and Momentum stocks and hedge via a passive instrument, as opposed to selling down the equity?

Aside from the greatly enhanced frictional and tax costs of trading in and out of the holdings, we believe there are potential investing benefits of maintaining the underlying factor stock positions during hedging events.

Operational Costs of Hedging

To open a short position, a prime broker will assess the collateral and decide the margin requirement. Typically professional investors access what is referred to as portfolio margin (as opposed to Reg-T margin), which accounts for portfolio characteristics when assessing margin requirements. This is important in our context because the margin requirements to enter our short positions, which are negatively correlated with our long positions, means that our margin requirements will often be much less than 50% (Reg-T requirement). Let’s say the prime broker determines that the margin requirement to hold the short position is 20%. We have a portfolio with a net asset value of $100. In this case, the portfolio would need to borrow $20 ($100*20%) from the prime broker and will pay an interest rate on this borrowed amount. The interest rate is typically, Borrow Rate = Fed Funds + markup, where the markup ranges across brokers.

Once the prime broker determines there is the necessary collateral in place, the portfolio can initiate the short ETF position, and will receive $100 in cash from the short sell. The portfolio will pay a cost to borrow the position (often called the short rebate) to maintain the position (SPY is around 30-35bps/year), but the portfolio will also receive interest on the $100 in short proceeds. The interest rate received on the short position is typically the Fed Funds rate minus some haircut.

So in total, the carry cost to the portfolio to initiate the short position is given below:

Cost = (Margin Requirement %)($100)(Fed Fund Rate + Markup) + ($100)(Short Rebate Cost) – ($100)*(Fed Funds Rate – haircut).

Let’s say the margin requirement is 20%, Fed Funds is 1%, the markup/haircut is 50bps, and the rebate is 30bps. The overall carry cost of the short position will be as follows:

Annual Costs = 20%*$100*(1.5%) + $100*0.30% – $100*(0.50%) ~ 0.10% or 10bps.

In other words, there is a 10bps negative carry for holding the short position. In general, with higher interest rates the carry becomes more positive and with lower interest rates, holding a short position will have a negative carry.

Last, it should be pointed out that the portfolio, like any other portfolio that engages in short-selling or other derivative transactions, does take on some counterparty risk by employing such a strategy.

References[+]

| ↑1 | There are many great ideas out there and we don’t stake a claim on having the perfect answer. |

|---|---|

| ↑2 | If you are reading this post, you are probably a good fit. |

| ↑3 | Note, we build trend systems for a variety of use cases, some of which are more complex and trade with much greater frequency. However, these trend systems have different goals and objectives. |

| ↑4 | This is important because our Quantitative Momentum Indexes can have a dramatically different volatility profile than our Quantitative Value Indexes |

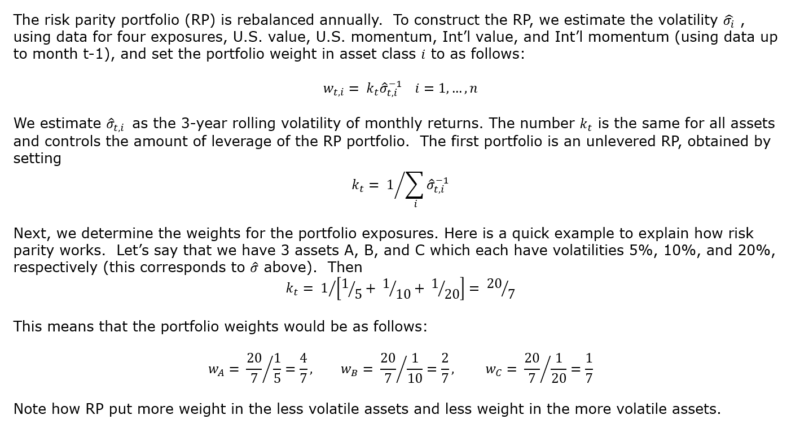

| ↑5 | see risk parity for dummies for background or review the image below.

|

| ↑6 | We also have a dynamic trigger to rebalance if our exposure gets out of wack by a large margin. Details are available upon request. |

| ↑7 | In a more detailed analysis we examine the beta of our GVMT Index against a variety of factor models (CAPM, FF 3-factor, Carhart 4-Factor, FF 5-factor, and AQR 6-factor) and confirm that the beta is typically around .5 to .6, depending on the factor model used. |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.