Analyst Optimism and Stock Price Momentum

- Li, Lockwood and et al.

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

We examine the effect of security analyst recommendations on stock price momentum. Results show that momentum profits are directly linked to analyst optimism. Specifically, we find that a 1-unit change in recommendation quintile translates to about a 50 basis point change in subsequent 3-month momentum profits. We also examine uncovered stocks by using parallel projection methods to project analyst recommendations from covered stocks onto uncovered stocks. For uncovered stocks, projected recommendations are unrelated to subsequent momentum profits. Our findings show that investor optimism alone does not generate stock price momentum. Analyst affirmation is a key catalyst for stock price momentum.

Alpha Highlight:

Academics have struggled to identify risk factors that can explain momentum premiums. By contrast, behavioral arguments seem to have had more success. The behavioral story is that momentum is due to investors’ underreaction to an ongoing flow of new information, such as earnings releases and analyst recommendations. Behavioralists also argue that investors sell winners too early and hold losers too long. While these explanations have been embraced by some academics and practitioners, they share a common theme — they relate to the behavior of investors. This paper provides an alternative explanation for momentum that is more focused on the behavior of sell-side analyst behavior.

The authors provide evidence that analyst behavior also plays an important rule in momentum profits. In this view, it is not only behaviorally-challenged investors who drive the momentum effect — it’s also behaviorally-challenged analysts! The authors hypothesize that higher analyst optimism is associated with higher subsequent momentum returns.

So how does one go about investigating this intriguing idea?

Key Findings:

The authors want to answer a simple question: Is higher analyst optimism associated with higher subsequent momentum profits? The authors use a sample that includes stock recommendations from the Thomson Financial Institutional Brokers’ Estimate System (IBES) database from the 3rd quarter of 1993 to the 1st quarter of 2011. These recommendations were posted on popular financial websites such as Yahoo Finance, MSN money, Market Watch, and Morningstar. Thus, investors had easy access to them.

For any quarter, the authors examine stocks that receive at least one recommendation; these are “covered stocks.” For each covered stock, the authors create a “consensus recommendation,” which averages the analyst recommendations over the trailing four quarters at the end of each quarter. The covered stocks are then sorted into five ordered categories: strong buy = 5; buy = 4; hold = 3; sell = 2; and strong sell = 1. These categories form quintiles, denoted in columns in the tables below as “Rec 1,” “Rec 2,” etc.

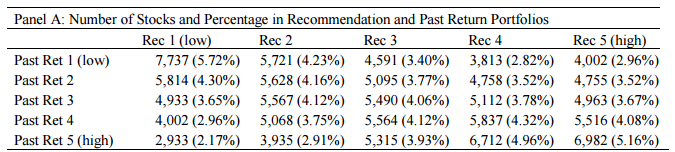

Next, the authors sorted each recommendation quintile by prior 6-month returns. Consistent with prior research by Jegadeesh et al. (2004), they find that analyst recommendations are related to prior stock returns. For example, note in the table below how stocks with high prior 6-month returns (“Past Ret 5 (high)”) are more likely to receive a strong recommendation (5.16% of total recommendations) than to receive a low recommendation (at 2.17% of total recommendations).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Thus, analysts seem more likely to give high recommendations to stocks that have done well in the recent past. Conversely, they also tend to give lower recommendations to stocks that have done poorly in the recent past.

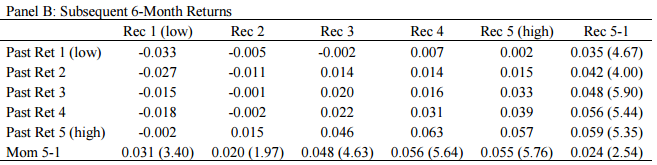

But what happens going forward? Are these recommendations predictive? If these analyst recommendations had no effect on subsequent returns, then we would expect to observe that the recommendations have no relationship to future performance of stocks within a given past return quintile.

Is this what we find? No.

As hypothesized, the results show that:

- Higher analyst optimism is associated with higher subsequent momentum profits.

Consider “Past Ret 5” in Panel B (below); this row shows that subsequent momentum profits, double sorted based on past high returns, generally rise with recommendation optimism, from -0.002 (low recommendation), to 0.057, (high recommendation). In fact, the analysts seem to be driving subsequent momentum profits within each quintile of past returns (although the effect is strongest for stocks with the highest past returns). The 6-month momentum strategy profits equal 3.1% for the low recommendation quintile and 5.5% for the high recommendation quintile. The authors conclude that analyst sentiment fuels momentum!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The double sorts are the easiest analysis to understand, however, they fail to control for other factors that might explain the results. To address these concerns the authors conduct a battery of regressions and come to the same conclusion: analyst recommendations are related to future momentum profits.

Interesting stuff.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.