Do political connections help or hinder SEC oversight?

- Jonas Heese, Mozaffar Khan, Karthik Ramanna

- Journal of Accounting and Economics

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Previously published studies have suggested that a firm’s political connections (PC) can act to reduce the probability of SEC enforcement actions and the magnitude of penalties imposed by the SEC. However, the SEC is also responsible for oversight with respect to compliance with disclosure and accounting regulation. This review process is conducted by the SEC’s Division of Corporation Finance (DCF) via the issuance of “comment letters.” The likelihood that the firm will receive comment letters where the SEC questions or otherwise expresses concern about the firm’s financial reporting practices may also be reduced by PC. Hence the terms “SEC capture” referring to a hypothesized inverse (i.e., lax) relationship between PC firms and SEC oversight actions. Previous studies that claim SEC capture may overstate the issue, as they are based on corporations that are facing enforcement actions, and utilized small sample sizes. None have looked at the extent of SEC capture associated with the comment letter review process.

- Is there an inverse relationship between a firm’s political connectedness and the probability that a firm receives a comment letter regarding its financial statements from the SEC? Does the evidence support a lax relationship between SEC oversight and corporate political connectedness?

- If the SEC is indeed captured, are there competing variables that explain the relationship?

What are the Academic Insights?

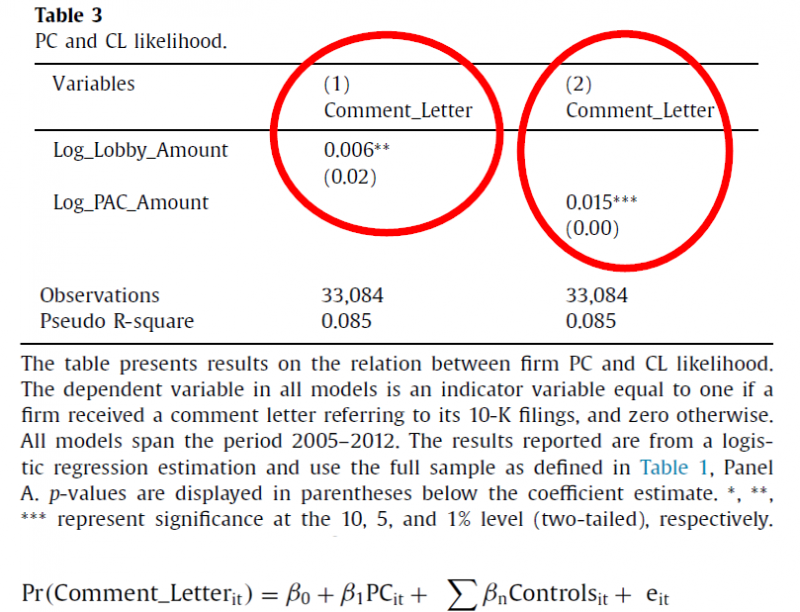

The probability of receiving a comment letter was estimated using two models utilizing two independent definitions of politically connected (PC) firms: (model 1, “Log_Lobby_Amount”) firms with contemporaneous lobbying expenditures; and (model 2, “Log_PAC_Amount”) firms with contemporaneous PAC donations.

- NO. The authors find a positive and significant relationship between the two measures of political connectedness and the likelihood of receiving an SEC initiated comment letter. In the context of the comment letter review process, political connectedness is associated with greater, not less, SEC oversight.

- NO. Apparently, political connections are a separate and distinct risk factor associated with corporate financial reporting. Each model was estimated with a comprehensive set of control variables, including company characteristics, governance characteristics, auditor characteristics, restatements, volatility, market capitalization, market-to-book ratio and strength of audit controls.Further, the authors report PC firms receive comment letters related more to core earnings issues, take longer to conclude and are more likely to include a higher level SEC supervisor in the process. This suggests a more stringent review is applied.

Why does it matter?

This paper is interesting in that it produces results that are contrary to prior research on SEC capture. Using a methodology that accounts for alternative explanations and conducts an exhaustive examination of competing explanations, the authors report that PC firms are more, not less, likely to receive a comment letter than non-PC firms.

A larger sample size (upwards of 33,000 letters) was used and the empirical methodology was rigorously implemented. Control variables, competing explanations, and possible endogeneity issues were addressed.

CAVEAT: The authors conclude that, in the context of comment letters, the SEC review process is not superficial nor perfunctory. They also recognize that PC firms may exhibit a greater magnitude of resistant behavior during the review process itself. Perhaps PC firms are more confrontational and this explains the results?

The most important chart from the paper

Abstract

SEC oversight of publicly listed firms ranges from comment letter (CL) reviews of firms’ reporting compliance to pursuing enforcement actions against violators. Prior literature finds that firm political connections (PC) negatively predict enforcement actions, inferring SEC capture. We present new evidence that firm PC positively predict CL reviews and substantive characteristics of such reviews, including the number of issues evaluated and the seniority of SEC staff involved. These results, robust to identification concerns, are inconsistent with SEC capture and indicate a more nuanced relation between firm PC and SEC oversight than previously suggested.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.