Factor Premia and Factor Timing: A Century of Evidence

- Antti Ilmanen, Ronen Israel, Toby Moskowitz, Ashwin Thapar, and Franklin Wang

- Working paper

- A version of this paper can be found here

What are the research questions?

- Do the most prominent long/short factors — value, momentum, carry, and defensive — survive out of sample?

- Can long/short factors be timed?

What are the Academic Insights?

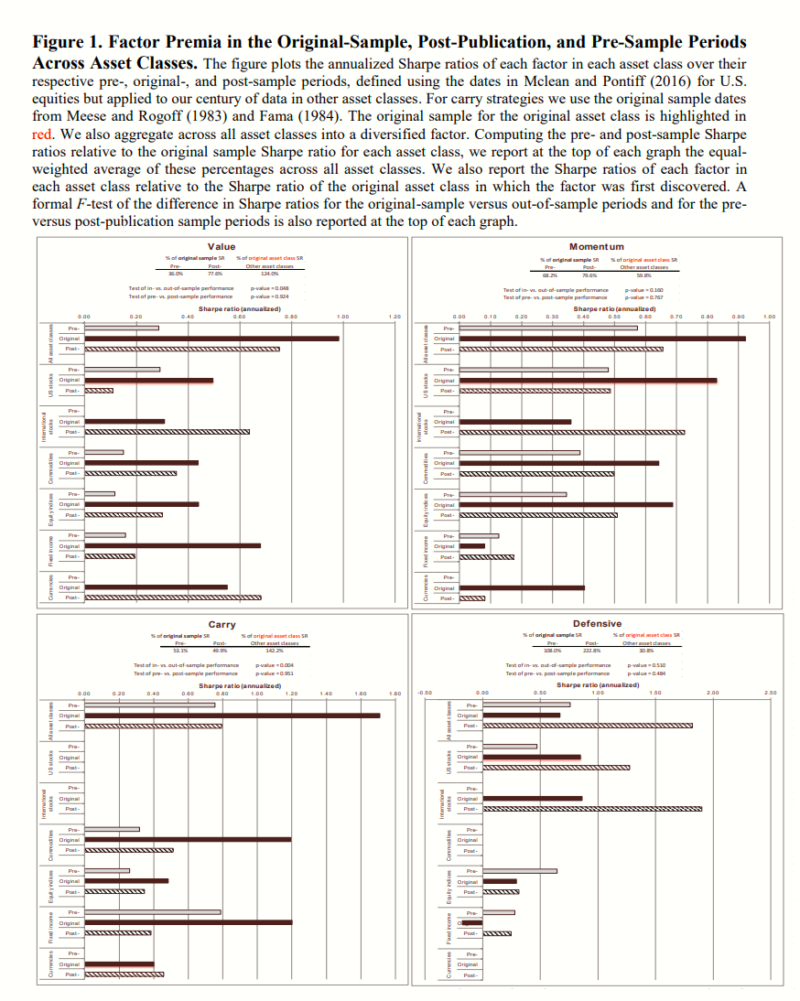

- YES. All of the factors exist out of sample, albeit their magnitudes are generally muted.(1)

- NOT REALLY. After a mind-numbing battery of tests, the evidence is mixed and inconsistent across the board. The other important note is that factor premia go through a lot of variation over time (i.e., definitely don’t reflect “easy money”).(2)

Why does it matter?

Factors have been on a relatively tough run the past 5 to 10 years. A gut reaction to this recent performance run is that “factors are dead?” Perhaps factors are dead, but we should first step back and understand why factors “worked” in the first place. The three theories boil down to 1) overfitting 2) tough to exploit mispricing and 3) fundamental risk.

On overfitting: Overall, we find that factor premia exist and are robust out of sample, and therefore not the result of spurious data mining. However, overfitting biases can account for about a 30% decline in out-of-sample efficacy of the factors.

On tough to exploit mispricing (i.e., bad behavior + limits of arbitrage)

This also indicates that either arbitrage activity did not commence in a meaningful way post-publication or that such activity has little effect on correlations.

On fundamental risk:

Despite our long and broad sample of data that provides a rich set of macroeconomic movements and power to detect macroeconomic exposures, we do not find significant exposure of common asset pricing factors to economic activity or news.

The most important chart from the paper

Abstract

We examine four prominent factor premia – value, momentum, carry, and defensive – over a century from six asset classes. First, we verify their existence with a mass of out-of-sample evidence across time and asset markets. We find a 30% drop in estimated premia out of sample, which we show is more likely due to overfitting than informed trading. Second, probing for potential underlying sources of the premia, we find little reliable relation to macroeconomic risks, liquidity, sentiment, or crash risks, despite adding five decades of global economic events. Finally, we find significant time variation in factor premia that are mildly predictable when imposing theoretical restrictions on timing models. However, significant profitability eludes a host of timing strategies once proper data lags and transactions costs are accounted for. The results offer support for time-varying risk premia models with important implications for theory seeking to explain the sources of factor returns.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.