Time-series momentum (TSMOM) historically has demonstrated abnormal excess returns. Also called trend following, it is measured by a portfolio that is long assets that have had recent positive returns and short assets that have had recent negative returns. Trend following has attracted a lot of attention over the past decade due to its strong performance during the global financial crisis and the academic research findings showing its persistence across long periods of time and economic regimes, pervasiveness (across sectors, countries, and asset classes), robustness to various definitions (formation period) and implementability (low costs, as the markets for major indexes are highly liquid).

Hai Lin, Pengfei Liu, and Cheng Zhang contribute to the literature with their April 2020 paper “The Trend Premium around the World: Evidence from the Stock Market.” Their survivorship-bias-free data sample covered 49 equity markets and more than 72,000 stocks, and covered the period August 1, 1979, to December 31, 2017. The authors analyzed the performance of trend (TSMOM) relative to the performance of a cross-sectional momentum (CSMOM) strategy. They also tried to identify factors that can explain the difference in the trend premia across different markets. Following is a summary of their findings:

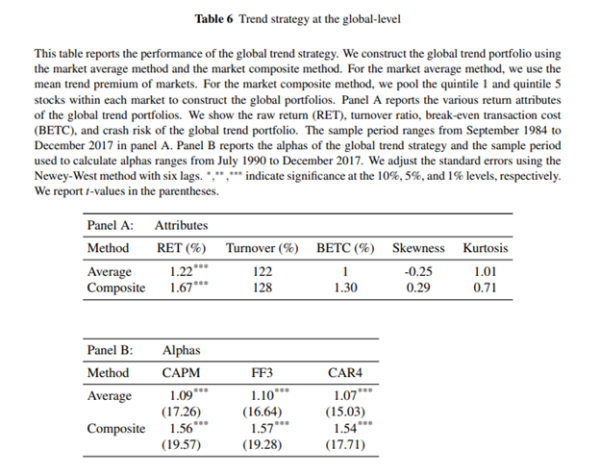

- The trend strategy generates significant returns in the international stock market. At the individual market level, in 39 out of 49 markets, the trend portfolio generated economically meaningful and statistically significant returns when employing the equal-weighted portfolios. At the global level, the trend strategy generated 1.22% and 1.67% monthly returns under the market average method and the market composite method, respectively, both significant at the 1% confidence level. For the market average method, they used the mean of the trend premia of different markets. For the market composite method, they pooled all stocks with the highest and lowest forecasted returns within each market together to form the long and the short leg, respectively, giving greater weight to markets with more stocks.

- The overall good performance of the global trend strategy is not driven by several extreme return points, and the global trend portfolio had positive returns for most of the months.

- The trend premium cannot be explained by either the Fama-French three-factor or Fama-French-Carhart four-factor models.

- The trend strategy performs better in weighting schemes that give more weight to small stocks.

- The average of the correlation coefficients between the U.S. trend portfolio and those of the other 48 non-US markets was 0.013, suggesting the trend premium is mainly driven by market-specific factors rather than a global factor.

- The trend strategy survives transaction costs, indicating that the trend premium in the international stock market is economically meaningful.

- Price information across different horizons jointly contributes to the performance of the trend strategy. While the most significant proportion comes from short-term information, adding intermediate- and long-term signals has improved performance. A global portfolio that employed only the short-term information generated a monthly return of 1.04% under the market average method. When adding the intermediate- and long-term information, the trend premium increased by 0.18%, statistically significant at the 1% level.

- The trend premium in the international stock market decays quickly as the holding period increases. The result is that the advantage of the trend strategy over the momentum strategy in the global stock markets mainly lies in the short investment horizon. The trend strategy becomes significantly less profitable than the momentum strategy when the holding period increases up to six months.

- The trend premium is more pronounced in markets with a more advanced macroeconomic status, a higher level of information uncertainty and individualism, and better accessibility to foreign investors.

- Most markets do not exhibit a fat tail—the risk associated with the highly negative return is not a concern for the trend strategy in the international stock market. However, fat tails did exist in four countries: the U.S. and the three Asian markets of Hong Kong, Malaysia and Singapore.

These findings are entirely consistent with those of Brian Hurst, Yao Hua Ooi, and Lasse Pedersen, authors of the June 2017 paper “A Century of Evidence on Trend-Following Investing,” and those of Abhilash Babu, Ari Levine, Yao Hua Ooi, Lasse Pedersen and Erik Stamelos, authors of the study “Trends Everywhere,” published in the Journal of Investment Management in 2020. They found that trend performance was consistent over long periods of time, across economic regimes, across asset classes, and is not explained by volatility scaling.

Summary

As an investment style, trend following has existed for a long time. The data from the research provides strong out-of-sample evidence beyond the substantial evidence that already existed in the literature. It also provides consistent, long-term evidence that trends have been pervasive features of global stock, bond, commodity, and currency markets. As to why investors should expect trends to continue, the most likely candidates include investors’ behavioral biases, market frictions, hedging demands, and market interventions by central banks and governments. Such market interventions and hedging programs are still prevalent, and investors are likely to continue to suffer from the same behavioral biases that have influenced price behavior over the past century.

The bottom line is that, given the diversification benefit and the downside (tail risk) hedging properties, an allocation to trend-following strategies does merit consideration. Note, however, that the generally high turnover of trend-following strategies renders them relatively tax-inefficient, and they can be susceptible to whipsaws. Thus, investors should strongly prefer to hold such strategies in tax-advantaged accounts and focus on the long-term benefits of trend following.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.