Momentum, Reversals, and Investor Clientele

- Andy Chui, Avanidhar Subrahmanyam, and Sheridan Titman

- Review of Financial Studies, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

I was listening to a great podcast with Sheridan Titman (from the famous Jegadeesh and Titman 93 momentum paper) with our friends over at Excess returns — Justin Carbonneau and Jack Forehand.

During the discussion on the history of momentum factor research, Prof. Titman mentioned one of their recent papers on the momentum factor, which seeks to identify if momentum is a risk-based factor, a behavioral-based factor, or a little bit of both. (see here, here, and here for some prior discussions). Prof. Titman made his stance clear on the matter — momentum is 100% a behavioral-based factor. And he pointed to the paper under discussion for clear evidence of this statement.

Naturally, I immediately ‘googled’ around for this new paper and gave it a read. I have always been curious why a lot of research on the Chinese stock market has found that momentum ‘doesn’t work’.

In their paper, “Momentum, Reversals, and Investor Clientele,” the authors exploit a unique dataset that provides a controlled setting to test momentum theories. They examine China A Shares and China B Shares, which share identical fundamentals, but the clienteles are different — A Shares are limited to domestic owners whereas B Shares are traded by global market participants. Next, they propose a model where a marketplace of noise traders (i.e., China A) will lead to reversals and a market with more informed investors (i.e., China B) will generally lead to momentum.

The authors ask the following:

- What is the momentum profile of China A Shares?

- What is the momentum profile of China B Shares?

- Is momentum driven by behavioral bias, fundamental risks, or a mix of both?

What are the Academic Insights?

The authors find the following:

- China A shares do not exhibit momentum; they tend to have reversals.

- China B shares do exhibit momentum and act like most globally traded securities in the world (e.g., value and momentum everywhere)

- The divergence in the characteristics and price action of China A and B shares strongly suggest that the momentum factor’s excess return profile is a behaviorally-driven phenomenon and unlikely to be driven by increased fundamental risks (because there are NO differences in fundamentals for subsets of A/B shares!)

Why does it matter?

This paper is important because it adds to an ongoing debate as to whether stock prices are driven by risk/reward characteristics (i.e., the efficient market hypothesis) or if stock prices are driven by investor behavior (i.e., behavioral finance hypothesis). We generally play the safe card and suggest that factors/characteristics are probably proxies for a mix of increased fundamental risks and a mix of mispricing. However, this paper provides strong evidence, that in the context of the momentum factor at least, behavioral bias likely drives the premium — not increased fundamental risks.

Of course, this result will likely feed into your prior beliefs. If you are coming from the EMH/DFA camp you will likely claim victory because behaviorally driven mispricing can’t exist and will eventually be arbitraged (which is incomplete logic because it doesn’t consider market mechanics and the incentives of arbitrage capital). On the other side, you will have non-EMHers (primarily discretionary stock-pickers) claim victory because this paper essentially suggests that stock prices are driven, in large part, by investor behavioral biases which create large mispricing opportunities and ‘easy money’ (which is incomplete logic because it doesn’t consider market mechanics and the incentives of arbitrage capital).

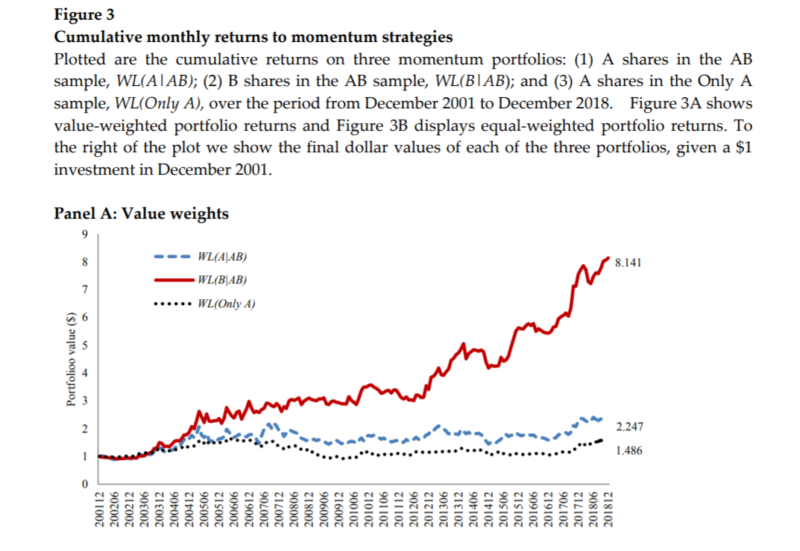

The Most Important Chart from the Paper

Abstract

Different share classes on the same firms provide a natural experiment to explore how investor clienteles affect momentum and short-term reversals. Domestic retail investors have a greater presence in Chinese A shares, and foreign institutions are relatively more prevalent in B shares. These differences result from currency conversion restrictions and mandated investment quotas. We find that only B shares exhibit momentum and earnings drift, and only A shares exhibit monthly reversals. Institutional ownership strengthens momentum in B shares. These patterns arise in a model with informed investors who underreact to fundamental signals, and retail investors who trade on noise.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.