Traditional asset allocation models involve increasing the allocation of the portfolio to bonds as clients near retirement in order to protect clients from the sequence-of-return risk that is presumed to arise from more volatile equity markets. However, increasing the allocation to bonds in a rising interest rate environment results in the bond portion of the portfolio taking heavy losses and exposing the clients to the same sequence-of-return risk that advisors were hoping to avoid by excessive exposure to equity markets. Life insurance products are a vehicle that can allow advisors the ability to protect clients’ bond investments from interest rate risk while also protecting the gains from taxation.

This summary article will summarize how life insurance products can help create better after-tax, risk-adjusted portfolio solutions in a rising interest rate environment by doing the following:

- Investing in tax-deferred or tax-free long-term bonds without interest rate risk;

- Increasing the equity allocation of the portfolio without increasing volatility;

- Investing in higher-yielding, tax-inefficient assets within a tax-free vehicle; and

- Investing in uncorrelated assets that provide better diversification than bonds in a rising interest rate environment.

Ultimately, in this rising interest rate environment, life insurance products can help create both portfolio and “tax-alpha”. Advisors who truly consider themselves fiduciaries should understand how they can utilize these products for the best interest of their clients.

Editor’s note: Alpha Architect is an independent financial advisor with a fiduciary duty to our clients. We do not get compensated for brokering insurance and we have no affiliation with the author. In general, we think complex insurance products are often too opaque and overpriced to have an after-brain-damage, after-fee benefit for our clients. But Rajiv is a unique individual who has helped us better understand the potential costs and benefits of insurance and we felt it was important to share his unique insights with our community.

Are bonds a useful diversification tool in a low-yield/rising interest rate environment?

Portfolio allocation has long relied on the assumption that bonds are negatively correlated to equity returns and can be used to diversify against equity risk. But does this correlation hold true equally in the low-yield environment we’re in now versus the high-yield environments of the past? What about the rising interest rate environment we’re in now versus the declining interest rate environments of the past?

Furthermore, given that the Fed has intentionally held interest rates low over the better part of a decade in order to facilitate growth in equity markets and the economy, is it possible that the high P/E ratios in equity markets we’ve experienced have at least partly been a result of the low-interest rate environment? And if that is the case, then a rising interest rate environment would cause both losses in the bond markets as well as reduced investment/unrealized appreciation in equity markets. This would mean that in the current environment, bonds and stocks may have a positive correlation and that rising interest rates may cause losses in the bond markets as well as losses/depressed returns in the equity markets at least over the short term. This potential for asymmetrical correlation risk between stocks and bonds in different environments was recently addressed by Alpha Architect a few weeks ago here, Cliff Asness here, as well as one from a few years ago here that pointed to different correlations in different economic regimes—with notable differences in the correlation during times of unexpected inflation.

A potentially positive stock-bond correlation poses a significant risk to clients who are nearing retirement and are increasing allocations to bonds in order to avoid investment risk in the equity markets in accordance with the belief that bond returns are always negatively correlated with equity returns. Such an allocation may expose clients to interest rate risk that poses the same sequence-of-return risk that they were hoping to avoid by being overallocated to equity markets.

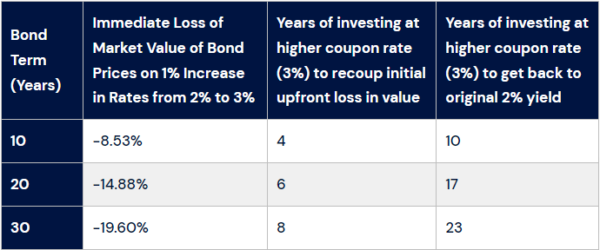

Figure 1: Effect of 1% rise in interest rates from 2% to 3% on bond prices of various terms

In a low-interest-rate environment, bond prices are more sensitive to an increase in rates. As the table above shows, a 1% increase in rates from 2% to 3% creates a large upfront loss that can take clients an extremely long time to recover from.

High taxation reduces the viability of bonds as a diversification tool

Another issue that is often neglected in discussing the use of bonds as a diversification tool is the issue of taxation. Bonds offer regular coupon payments that are taxed at high ordinary income rates on a yearly basis whereas equity investments offer significant tax-deferral and tax-free generational wealth transfer properties if invested over the long term. This taxation issue is often not addressed when looking at the value of diversification. Ultimately a low-yielding asset that is highly taxable and subject to interest rate risk in the short term is not a viable diversification tool, particularly for those nearing retirement. Even if we assume that interest rates aren’t definitively rising in the short term, the table below shows that on an after-tax basis increasing the bond allocation of the portfolio decreases the chance of a client meeting the 4% withdrawal requirement in a low-yield environment.

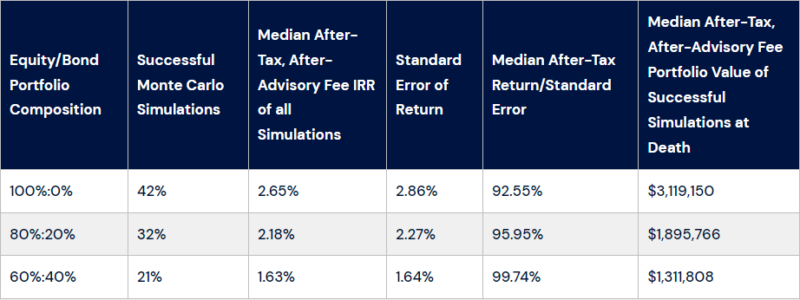

Figure 2: Chance of HNW client meeting 4% withdrawal rate in retirement at different equity-to-bond portfolio allocations

- Meeting 4% withdrawal rate in retirement at different Equity/Bond portfolio allocations:

- For HNW clients, large bond allocations actually decrease their chance of meeting their retirement goals due to the low yields and heavy taxation on bond portfolios in this low-yield environment even if we assume interest rates aren’t rising in the short term.

- Modeling assumptions:

- 1,000 Monte Carlo simulations

- No correlation between stocks and bonds

- Married, 65-year-old couple, $5M investable assets

- Equity Portfolio: 8% mean IRR, 15% standard deviation

- Bond Portfolio: 2% mean IRR, 3% standard deviation

- Taxes: Long-Term Capital Gains (37%), Ordinary Income (50%)

- Advisory Fee: 0.75% of AUM

As the above table shows, while a 60% equity/40% bond portfolio provides the highest return/risk ratio in retirement—as measured by the Median After-Tax Return/Standard Error ratio—the overall after-tax returns and chance of meeting a 4% withdrawal rate (as measured by successful Monte Carlo simulations) are the lowest.

Life Insurance: Protecting clients from interest rate risk and taxation

In order to create better risk-adjusted portfolio solutions, advisors should aim to find a way to do at least one of the following:

- Continue to invest in bonds but find a way to achieve higher after-tax yields and protection from interest rate risk

- Invest in other assets that either provide better diversification benefits and/or higher yields

Life insurance products can help advisors and their clients do both of these. Many advisors don’t realize that life insurance products can help solve the sequence-of-return and interest rate risk issues they are currently facing with their fixed income allocations simply by investing in bonds through a life insurance product. Life insurance companies invest in long-term bonds because their liabilities are long-term (future death benefit payouts, annuity payouts, etc). As such, life insurance companies can afford to hold long-term bonds and absorb short-term losses due to interest rate risk because they don’t need liquidity. However, everyday investors—particularly those nearing retirement—don’t have the same investment horizon. In fact, those nearing retirement will soon need to draw down on their portfolio in order to support their lifestyle without the income they were previously receiving from their careers.

At its core, the purchase of a life insurance product is an exchange between the buyer (client) who needs a retirement vehicle that provides interest rate risk protection and a seller (life insurance company) who is willing to provide such a vehicle in exchange for a spread earned on the long-term bond interest rate over what the insurance company credits to the policy owner. The life insurance company makes this exchange more attractive for the seller by providing tax benefits to the seller that the insurance company doesn’t have to pay for (the U.S. government does). While the ability to invest in long-term bonds without interest rate risk and with tax-deferred or tax-free benefits may sound like a no-brainer, the benefits afforded to the buyer come with the requirement that the buyer is able to manage the insurance risk, liquidity risk, and expenses involved here. And that’s where most buyers of life insurance products end up in trouble.

Life insurance products can be complicated and difficult to understand. Also, any life insurance product that has large commissions will have large expenses inside the product that can take away from the potential benefit. Failure to understand these risks—or properly manage them—can result in large insurance expenses eating up any tax benefits that these clients could have received. In order to properly benefit from these products, clients and their advisors need to understand both how these products can solve current portfolio issues in a rising interest rate environment as well as how to minimize the insurance expenses so that the client receives the most benefit.

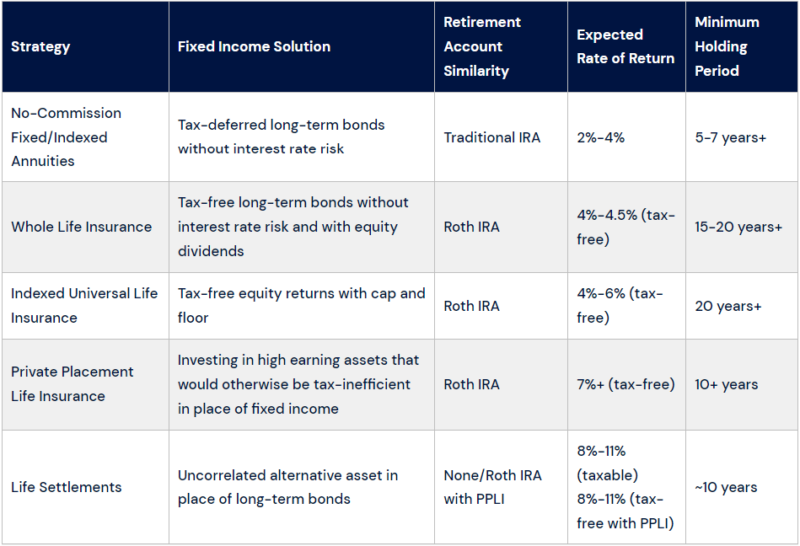

In this summary article we will cover five ways in which life insurance help create better after-tax portfolio solutions for the fixed income portion of their clients’ portfolios through the following ways:

Direct links for in-depth articles on these topics:

- No-commission annuities: Investing in Tax-Deferred Long-Term Bonds Without Interest Rate Risk

- Whole life insurance: Investing in Tax-Free Long-term Bonds Without Interest Rate Risk

- Indexed Universal Life Insurance (IUL): Increasing Equity Allocations of a Portfolio while Minimizing Volatility

- Private Placement Life Insurance (PPLI): Creating Tax-Efficient Investment and Estate Strategies for UHNW Clients in a Rising Interest Rate and High Tax Environment5) Investing in Life Settlements: Creating Better Risk-Adjusted Returns and Portfolio Diversification Through Uncorrelated Assets

- Investing in Life Settlements: Creating Better Risk-Adjusted Returns and Portfolio Diversification Through Uncorrelated Assets

No-Commission Annuities: Investing in Tax-Deferred Long-Term Bonds Without Interest Rate Risk

Most advisors don’t realize that investing in annuities is simply an investment in the long-term bond portfolio of an insurance company without the interest rate risk. In exchange for this protection from interest rate risk, insurance companies earn a spread on the difference between what their portfolio is earning and what they are crediting the policy owner. Also, in order to shield them from full interest rate risk, insurance companies often prevent clients from exiting the annuity all at once and typically mandate holding periods of 5-7 years. But even with this holding period, clients can typically take out up to 10% of their investment each year without penalty. This essentially means that clients can invest in long-term bonds without interest rate risk and take out 10% each year to invest in higher-yielding bonds as interest rates rise without absorbing the upfront loss. As an added bonus, the gains on the yields are all tax-deferred until the policy owner exits the annuity. The policy owner can continue the tax-deferral element of the annuity past the 5-7 year period if they choose to keep the funds and roll them over to a new annuity.

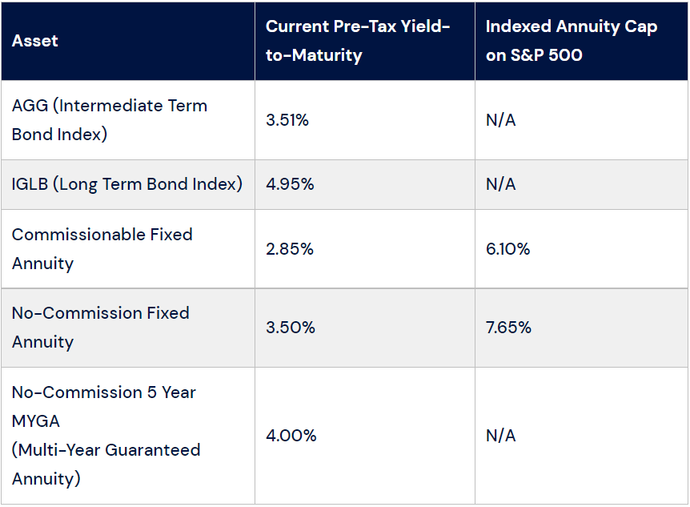

Figure 3: Pre-tax yields of bond indices vs annuities (2/21/2022)

Pre-tax yields of bond indices vs payout rates for annuities as of 5/03/2022:

The above table compares the current yield-to-maturities on two well-known bond indices with a commissionable fixed annuity, a no-commission fixed annuity, and a no-commission 5-year MYGA (multi-year guaranteed annuity). As shown in the table above, the no-commission annuities offer better yields and upside on the fixed indexed annuity than its commissionable counterpart and better yields than the AGG without any interest rate risk.

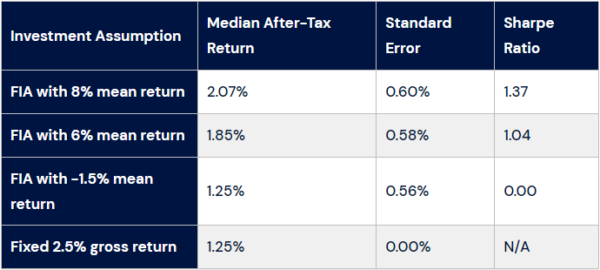

For clients that want higher returns in exchange for more risk, fixed indexed annuities (FIAs) offer the ability to take equity risk with a floor (typically around 0%) and a cap (currently around 6%). By giving up some of the upside of equity performance through the cap, clients can protect themselves from the downside return. Is investing in an equity index with a floor and cap better over 5-7 years better than just taking a fixed return? While it obviously depends on the assumptions of the underlying equity index over that time period, we can simulate the results through Monte Carlo simulations. As the table below shows, an indexed annuity offers the potential for significantly higher after-tax returns even when the mean return of the underlying index is negative.

Figure 4: After-tax returns of Fixed Indexed Annuity at different underlying mean return expectations

The above table compares the after-tax simulation results of a fixed indexed annuity based on an underlying equity index with different mean return assumptions. As the above table shows, even an FIA with a negative underlying mean return assumption outperforms the fixed annuity’s 2.5% gross return on an after-tax basis. Investors in the FIA are able to benefit from the volatility of the underlying index while being protected from the downside through the floor.

Assumptions:

- 1,000 Monte Carlo Simulations

- Equity standard deviation of 15%

- Fixed annuity standard deviation of 0%

- 7-year investment period

- Tax-deferred ordinary income taxation of 50%

Investors in fixed indexed annuities often fear that the underlying index will underperform or that the caps on those indices will be lowered. However, as the above table shows, the current low yield environment allows for a great risk-adjusted opportunity to capture the benefits of the upside of an equity index while being protected from the downside even if the underlying index were to underperform.

The real main downside of annuities is that typically agents earn a large upfront fee on the transaction that takes away from the benefit they can provide to clients. However, most fee-only advisors aren’t aware that there are no commission or fee-based annuities that are made specifically for RIAs. Instead of paying an agent a commission on the transaction, these annuities pay RIAs a fee from within the vehicle for managing the assets. This is similar to RIAs that manage retirement assets for clients and charge their fees from within the vehicle. The major upside here is that by RIAs charging their fees from within the vehicle they are essentially reducing the taxable gain on the product. This is significantly better than RIAs that charge their fee from an after-tax cash account.

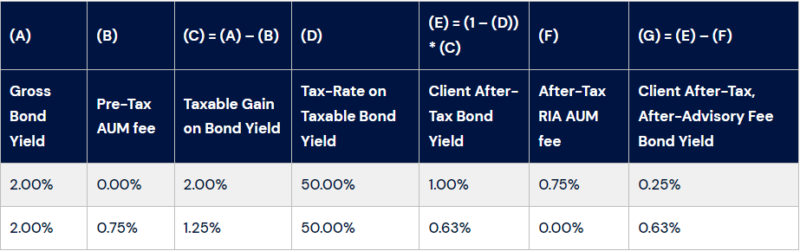

Figure 5: Improving after-tax, after-advisory fee bond returns by charging fees on a pre-tax basis

Charging RIA fee on a pre-tax basis reduces client taxes and improves after-tax bond returns:

The ability to simply charge its fee on a pre-tax basis allows RIAs the ability to more than double after-tax, after-advisory bond yields for client in this low-yield environment by reducing the client’s taxable gain.

As shown in Figure 3, the no-commission multi-year guaranteed annuities (MYGAs) offer the best-guaranteed rate for the clients—even better than the no-commission fixed annuity. The downside for RIAs who use these products is that at the current moment advisors can’t charge their fee from within the product the same way they can for a no-commission fixed annuity. Any advisory fee withdrawn from an MYGA is considered a taxable distribution.

For more information on how RIAs can use no-commission annuities to create better fixed income solutions for clients, read our full article here:

No-commission annuities: Investing in Tax-Deferred Long-Term Bonds Without Interest Rate Risk

Whole life insurance: Investing in Tax-Free Long-term Bonds Without Interest Rate Risk and With Equity Participation

As we’ve discussed above, a key problem with using bonds as a portfolio diversification tool is due to the tax inefficiency of the yearly bond coupons. No-commission annuities help improve upon this by adding a tax-deferral option that can be continually rolled after in 5-7 year intervals. An upgrade over this is whole life insurance which makes investments in long-term bonds entirely tax-free while adding tax-free equity dividend participation in later years as well. So we can think of whole life insurance as a tax-free convertible long-term debt option.

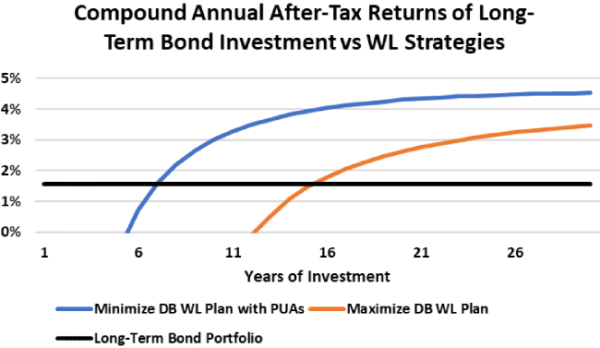

Whole life insurance also allows clients the ability to take out up to 80% of principal and gains tax-free via loans. In exchange for these additional benefits, clients need to have a longer investment horizon of 10 years+ and focus on structuring investment in the product in order to minimize the commissionable feature and the death benefit and maximize the paid-up addition (PUA) feature that allows large dump-ins into the policy with significantly fewer expenses. Structuring whole life insurance properly can help investors get a 4%-4.5% tax-free investment return which is significantly higher than what they could receive from investing in long-term bonds directly in a rising interest rate environment.

Whole life insurance can provide greater after-tax long-term bond returns than investing directly in long-term bonds. However, since early year expenses in the whole life policy are high, clients who use the whole life strategy need to commit to the strategy for a number of years in order to beat investing in long-term bonds directly. Clients using WL also need to focus on minimizing the death benefit in the policy and maximizing the PUAs which have lower expenses. Since the PUA WL strategy has better cash value growth than the Maximize DB WL strategy, it only takes 7 years for the compound annual return of the PUA strategy to outperform the long-term bond strategy whereas the breakeven point for the Maximize DB WL strategy is 16 years.

Investors in whole life insurance typically go wrong because they end up investing in the highly commissionable part of the policy and they then end up canceling the policy and get hit with huge surrender charges on exiting the investment instead of utilizing the tax-free loan feature. This essentially turns the whole life investment into a very expensive term life insurance policy that could have been acquired for pennies on the dollar. This is exactly what the life insurance company wants. In this scenario, insureds pay a lot of money to the insurance company for an overpriced term policy and then cancel the policy. This allows the insurance company to collect premiums without ever having to pay a death benefit. In fact, Society of Actuary lapse studies indicate that nearly 50% of policy owners will cancel their policy within the first 10 years and get hit with large surrender charges. While this is bad for the investors who cancel their policy early, it’s good for the investors who keep the policy for the long term. The insurance company is able to give large dividends in the later years of the policy to the policy owners who have kept the policy in large part due to the large number of investors who canceled the policy early and overpaid for the policy.

For those who want to learn how to use whole life products to improve the fixed income portion of their client’s portfolios, you can read our full breakdown here:

Whole life insurance: Investing in Tax-Free Long-term Bonds Without Interest Rate Risk

Indexed Universal Life Insurance (IUL): Increasing Equity Allocations of a Portfolio while Minimizing Volatility

As demonstrated in Figure 2, in a low-yield environment bonds don’t provide enough diversification value on an after-tax basis. In fact, simulating portfolio results for a sample client nearing retirement shows that our hypothetical client would be better suited by taking a 100% equity position than by using bonds as a diversification tool—and that doesn’t account for the impact of interest rate risk as interest rates rise or positive correlation of these assets.

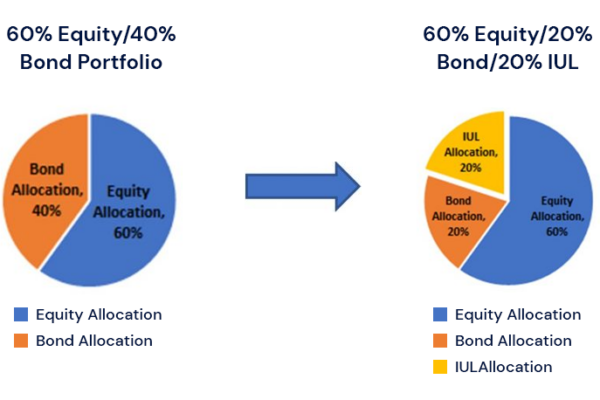

However, an all-equity solution also involves taking on more volatility in the portfolio which clients might not be comfortable with. One solution is to take a part of the allocation that would be allocated to bonds and invest it in an equity index with a cap and a floor. We saw this earlier with the description of the Fixed Indexed Annuity (FIA). However, an upgrade to this approach is an Indexed Universal Life (IUL) policy that makes the investment tax-free instead of tax-deferred by placing the strategy within a permanent life insurance product.

The downside with the approach is that it requires a significantly longer investment horizon than the 5-7 years that the FIA requires and there are significantly more insurance expenses to manage here. However, the upside is that the tax-free nature of the investment means that on a risk-adjusted basis the IUL strategy provides a better risk to return ratio than investing in equities or bonds directly.

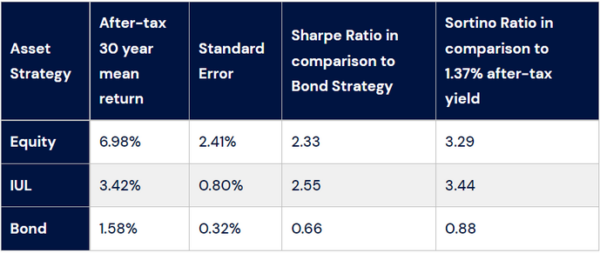

Increasing after-tax returns without increasing volatility by investing in IUL policies

In a low bond yield and increasing interest rate environment, financial advisors can provide higher risk-adjusted returns in their portfolio construction by taking assets out of the bond portfolio and allocating it to an IUL policy. Doing so allows higher after-tax risk-adjusted returns without exposing clients to the full volatility of the equity markets.

Figure 4: After-tax returns of IUL vs Equity and Bond strategies

As the table above shows, on an after-tax basis the IUL strategy has lower returns than the pure equity investment strategy—but it also has lower volatility than the equity strategy.

In comparison to the bond strategy, the IUL strategy has significantly higher returns with only a small increase in volatility. Therefore on a risk-adjusted basis, the IUL strategy can provide significant value over direct bond investing as the Sharpe Ratio comparison identifies.

Simulation assumptions:

- 1,000 Monte Carlo simulations of each strategy

- Equity: Mean return 10%, 8% is annual appreciation taxed at end of 15 years at long-term capital gains rates, 2% is yield (taxed yearly at long-term capital gains), standard deviation is 15%

- Bond: Mean return is 3.5%, standard deviation is 3.5%, taxed yearly at ordinary income

- IUL: Mean return is 8%, standard deviation is 15% (but capped at 8% and floored at 0%), No taxes, 2% insurance expense assumption

- Long-term capital gains taxation is 37.1%, long-term ordinary income taxation is 54.1%

- Risk-free rate is 3.0% pre-tax (1.37% after-tax)

To learn more and how to properly utilize an indexed universal life (IUL) policy as part of a holistic portfolio solution, read our full article:

Indexed Universal Life Insurance (IUL): Increasing Equity Allocations of a Portfolio while Minimizing Volatility

Private Placement Life Insurance (PPLI): Creating Tax-Efficient Investment and Estate Strategies for UHNW Clients in a Rising Interest Rate and High Tax Environment

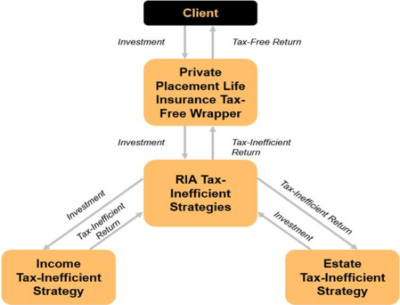

Another key way that advisors can add value to client portfolios is simply by creating more tax-efficient structures for their existing strategies as well as future diversification strategies they wish to explore. This “tax-alpha” can create just as much value as portfolio alpha and allow for exploration into asset classes that provide better diversification tools than bonds in a rising interest rate environment but which advisors have stayed away from because of the tax inefficiencies involved. By removing the tax inefficiencies of their existing or future strategies, advisors are able to create better after-tax portfolio solutions that can help offset the impact of some of the diminished returns that their existing strategies may be facing in the wake of this current economic environment.

When we talk about tax-inefficiencies we are typically referring to either 1) assets that are tax-inefficient from an income tax standpoint or 2) from an estate tax standpoint. Income tax-inefficient strategies are taxed at high ordinary income or short-term capital gains rates and often lack the ability of tax-deferral. Some income tax-inefficient strategies are high yield debt strategies, long/short strategies, high portfolio turnover strategies, volatility strategies, hedge fund strategies, and life settlements. Also, equity strategies can be tax-inefficient for clients living in states that charge high state income taxes on capital gains (California, Hawaii, New Jersey, Oregon, etc.).

Estate tax-inefficient strategies are assets that are expected to experience rapid growth in the future and could subject the client to an estate problem (especially with the future reduced exemption limits). These strategies include venture capital strategies, individual stock positions, and closely-held business interests.

Private Placement Life Insurance commonly referred to as PPLI or PPVUL (private placement variable universal life) is a customized version of variable universal life insurance (VUL) that allows policy owners and their financial advisors a significantly reduced expense structure and more flexibility in how the underlying investment strategy is chosen and who it is managed by. This allows clients to choose their preferred RIAs to manage their investment strategy and have all the principal and gains be tax-free and outside of the client’s estate.

Making Investing in Tax-Inefficient Assets Tax-Free through PPLI

PPLI allows RIAs to invest the parts of their clients’ portfolio that are tax-inefficient into a structure that makes the gains free from both income tax and estate taxes.

By using PPLI as essentially a tax-free wrapper with insurance costs significantly less than the tax savings, advisors can help create better risk-adjusted after-tax portfolio solutions for their ultra-high net worth (UHNW) clients. Furthermore, PPLI can act as an estate planning tool in addition to an investment vehicle that is an upgrade over existing grantor trust strategies like Grantor Annuity Trusts (GRATs) or Intentionally Defective Grantor Trusts (IDGTs) since grantor trust strategies are taxable to the grantor while all PPLI gains are tax-free.

To learn how to properly utilize PPLI as a portfolio solution for ultra-high net worth clients, read our full article here:

Private Placement Life Insurance (PPLI): Creating Tax-Efficient Investment and Estate Strategies for UHNW Clients in a Rising Interest Rate and High Tax Environment

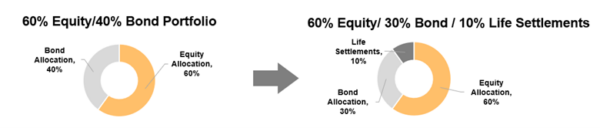

Investing in Life Settlements: Creating Better Risk-Adjusted Returns and Portfolio Diversification Through Uncorrelated Assets

Up until this point, we’ve described how life insurance can be used as a great vehicle to invest in assets that would otherwise be exposed to interest rate risk or high taxes and how using life insurance as a vehicle can create better after-tax portfolio solutions for clients. However, what advisors may not realize is that investing in life insurance itself as an asset class can provide access to uncorrelated cashflows that are otherwise difficult for retail investors to gain access to. The reason for this is that life insurance cash flows are largely dependent on mortality assumptions of a large population and understanding of life insurance risk. Both mortality risk and life insurance expertise are independent of market or interest rate risk. By investing in such life insurance cash flows investors can achieve better portfolio diversification than investing in bond cash flows that may be correlated with equity returns in a rising interest rate environment with net expected returns in the 8%-11% range.

Improving Risk-Adjusted Portfolio Returns by Allocating Portion of Bond Portfolio to Life Settlements

By taking a portion of a client’s portfolio that would otherwise be allocated to bonds and allocating it to life settlements instead, RIAs can achieve higher risk-adjusted returns and better portfolio diversification.

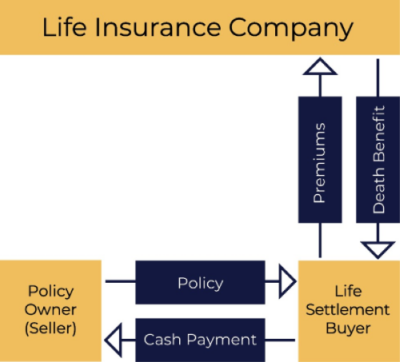

One way to invest in life insurance cashflows is through an asset class known as life settlements. A life settlement is the sale of an in-force life insurance policy to a third party for an amount greater than what the insured could receive from simply canceling the policy. In return for providing the seller with a cash payment, the third-party purchaser (investor) owns the life policy, pays all premium payments going forward, and eventually receives the entire death benefit at the time of the insured’s death.

Mechanics of a life settlement transaction

A life settlement allows the current policy owner (seller) to exit his investment in an asset that he or she no longer needs or can no longer afford. For the buyer, the investment offers greater risk-adjusted returns and cash flows that are not correlated to market or interest rate risk.

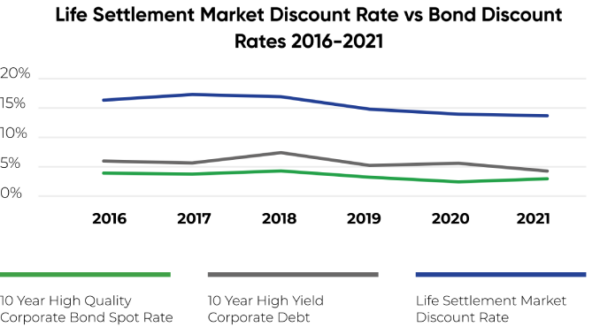

This transaction is a win for the seller who in the absence of a life settlement transaction would be forced to cancel the policy and receive significantly less from canceling the policy than what they could from selling it on a life settlement market. For the investor, the life settlement transaction provides access to uncorrelated cashflows that can be diversified with other policies to reduce the mortality risk and optimized by actuaries to improve returns and reduce tail risk. With gross discount rates in the life settlement space currently in the 12%-14% range, life settlements offer a large risk premium over high quality or high yield debt that investors with the appropriate actuarial and insurance experts can help capitalize on.

Gross discount rates on life settlements are significantly higher than both high yield or high-quality debt and offer investors with the requisite actuarial and insurance expertise the ability to capitalize on the large risk premium here.

To learn more about life settlements, read our full article here:

Investing in Life Settlements: Creating Better Risk-Adjusted Returns and Portfolio Diversification Through Uncorrelated Assets

Why Fiduciary Advisors Should Utilize Life Insurance Products in the Best Interests of Their Clients

Most high net worth clients are phased out of contributing to retirement vehicles like traditional IRAs that could afford them tax-deferral on their bond investments or Roth IRAs that could afford them the ability to invest in tax-inefficient strategies within a tax-free vehicle. For high net worth clients phased out of contributing to these more traditional retirement plans, life insurance is essentially the ideal asset location vehicle for these clients who can use the vehicle to improve bond portfolio returns while also protecting clients from interest rate risk. However, fiduciary fee-only advisors are reticent to use these tools.

Perhaps the primary reason fee-only fiduciary advisors hesitate to use them is due to the fact that many life insurance products have high commissions and expenses that negate any benefits they might offer and fiduciary fee-only advisors can’t distinguish the good ones from the bad ones, nor do they feel comfortable managing the insurance risk (even though insurance risk is a lot more predictable and easier to manage than investment risk). The other key reason is that fee-only fiduciary advisors are hesitant to use them—even if they are good, low expense products that are in the best interests of the client—is that recommending life insurance products is essentially taking assets that an advisor charges a fee on away from the advisor and investing into a life insurance product that the advisor doesn’t receive compensation for. This is a huge conflict of interest that is not materially different than the conflict of interest that exists between a life insurance agent looking to sell a client a poor product that maximizes his or her own commission at the expense of the client. If a life insurance product is better for the client, and a fee-only advisor chooses not to use a life insurance solution, they are abdicating their fiduciary responsibility.

Ultimately, it’s the end client that pays the price for fee-only fiduciary advisors not using these products properly. If fee-only fiduciary advisors don’t use these products properly, then there are a plethora of high commissioned agents willing to sell poor products to these clients that are definitively not in their best interests. For high net worth clients who want the tax advantages and interest rate protection that these products can provide, they have nowhere else to turn to get these products except the high commissioned agent.

This is clearly a flaw in our current financial advisory system. The most efficient system is ultimately one that properly aligns interests between the client and the advisor. Life insurance is a long-term investment vehicle that needs to be utilized and managed by experienced professionals in the same way their other investments are managed. In order to create this alignment of incentives, compensation needs to be paid over the long-term on these products instead of large upfront commissions that incentivize sales over product fit. But in order for life insurance companies to start creating fee-only life insurance products for fee-only fiduciary advisors to utilize and receive compensation on, fee-only advisors need to start understanding the value that these products offer in the first place.

About the Author: Rajiv Rebello

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.