In this article, we examine what the research says about gender pay gap transparency. We look at the research questions and academic insights with an eye toward why it matters.

Do Firms Respond to Gender Pay Gap Transparency?

- Bennedsen, Simintzi, Tsoutsoura, Wolfenzon

- Journal of Finance, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

In most developed countries there are gender pay disparities: when a man earns $100, a woman earns $77 in the US (Goldin, 2014), $78.5 in Germany, $79 in the UK, and $83.8, on average, across EU countries (Eurostat, 2016). One solution proposed is to increase pay transparency. This paper asks the following question:

- Do firms respond to gender pay gap transparency?

What are the Academic Insights?

By studying a 2006 legislation change in Denmark that requires firms with more than 35 employees to report salary data broken down by gender for employee groups large enough for individual’s anonymity to be protected, the authors find:

- After the passage of the law, wages of male employees in treated firms grow 1.7 percentage points slower than wages of male employees in control firms.

- By contrast, female wages in treated firms increase by 0.3 percentage points more than for female employees in control firms, although this difference is not statistically significant.

- Examining the dynamic effects, there is no evidence of pre-treatment trends, whereas there is a sharp drop in male wages in treated firms in 2006, which increasingly persists until up to the year 2008.

- Moving to a firm-level analysis, we confirm the reduction of the wage gap. The average ratio of male to female wages (gender pay gap) declines by 1.9 percentage points in treated firms relative to control firms, following the law passage, a 13% reduction relative to the pre-treatment mean. The study also shows the average decline is more pronounced at the bottom and the middle of the wage distribution.

- Treated firms hire more female employees than do control firms. This finding is in line with an argument that female employees might be more willing to seek employment in firms where the gender pay gap is reduced.

- In contrast, male employees are less likely to join treated firms, consistent with the fact that wage policies are less attractive for male employees in these firms following the legislation.

- The law has effects on promotion decisions that favor female employees. In fact, women are more likely to be promoted to higher-paid positions within the firm, whereas there are no significant changes in the promotion probability for male employees.

- As far as the implications of gender pay transparency on wage bill, firm productivity, and profits, the average wage per employee is reduced in treated firms relative to control firms. Despite the reduction in the average wages, there is no effect on firm profitability, which could be potentially explained by a decline in labor productivity, because previous research has shown that employees who learn they are earning less than their peers become less productive.

- In fact, the study finds a negative effect on productivity in some of its specifications.

Why does it matter?

The paper contributes to the literature on the effects of pay transparency, specifically on wages and firm outcomes. Its findings suggest regulatory mandates on pay transparency, as a means to overcome biases against women in the workforce, may be effective in closing the gender pay gap.

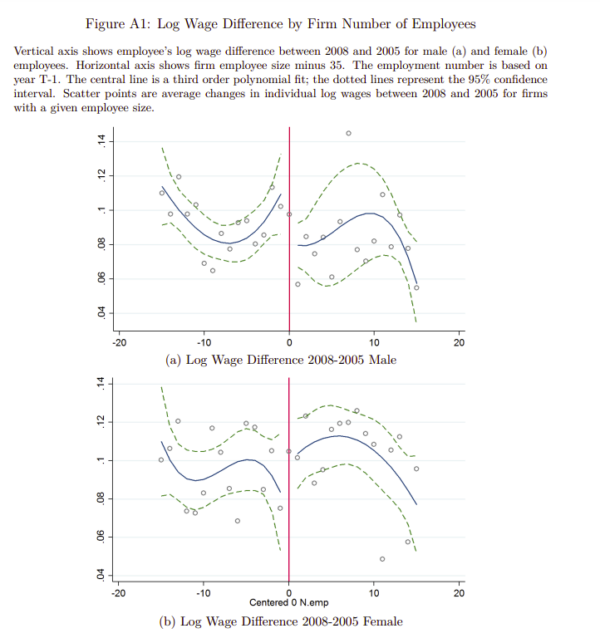

The Most Important Chart from the Paper:

Abstract on gender pay gap transparency

We examine the effect of pay transparency on gender pay gap and firm outcomes. This paper exploits a 2006 legislation change in Denmark that requires firms to provide gender disaggregated wage statistics. Using detailed employee-employer administrative data and a difference-in-differences and difference-in-discontinuities designs, we find the law reduces the gender pay gap, primarily by slowing the wage growth for male employees. The gender pay gap declines by approximately two percentage points, or a 13% reduction relative to the pre-legislation mean. Despite the reduction of the overall wage bill, the wage-transparency mandate does not affect firm profitability, likely because of the offsetting effect of reduced firm productivity.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.