In this article, we examine the question of whether or not women fund managers are better suited for the job in terms of their ability to judge market sentiment. Does gender matter in institutional investing?

The Effect of Sentiment on Institutional Investors: A Gender Analysis

- Monika Gehde-Trapp and Linda Klingler

- SSRN Working Paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

This research examines whether or not the gender of institutional investors (fund managers) affects their reaction to changes in market sentiment. The literature on gender differences for retail investors differs from that of institutional investors in specific ways. In the retail and institutional worlds, women invest more conservatively and are generally more risk-averse than men. Those differences in risk aversion do not affect performance. However, male investors in the retail world trade more frequently than females and this behavior does detract from performance. For male fund managers, the difference in observed trading behavior does not seem to matter.

Given that the evidence is mixed, the focus of this research is specifically geared to the differences between male and female fund managers. In the retail arena, gender reactions may differ especially where irrationalities may govern expectations about risk, cashflows, and ultimately market prices. If good sentiment leads to overpricing of securities and poor sentiment leads to underpricing of securities, rational fund managers will view irrational sentiment as an opportunity to be exploited. Therefore, as sentiment changes, fund managers will trade in reaction. It may be that those same forces are mitigated and even exploited by institutional fund managers.

- Does gender affect the ability of managers to exploit market irrationalities or their reaction to changes in levels of sentiment?

- Does the difference in gender have an impact on fund performance?

What are the Academic Insights?

- YES. Compared to male managers, females are less influenced by sentiment. They trade less, are less aggressive, less active, and less risky (lower total risk and unsystematic risk) in reaction to changes in sentiment. Levels of unsystematic risk were especially lower when sentiment was negative.

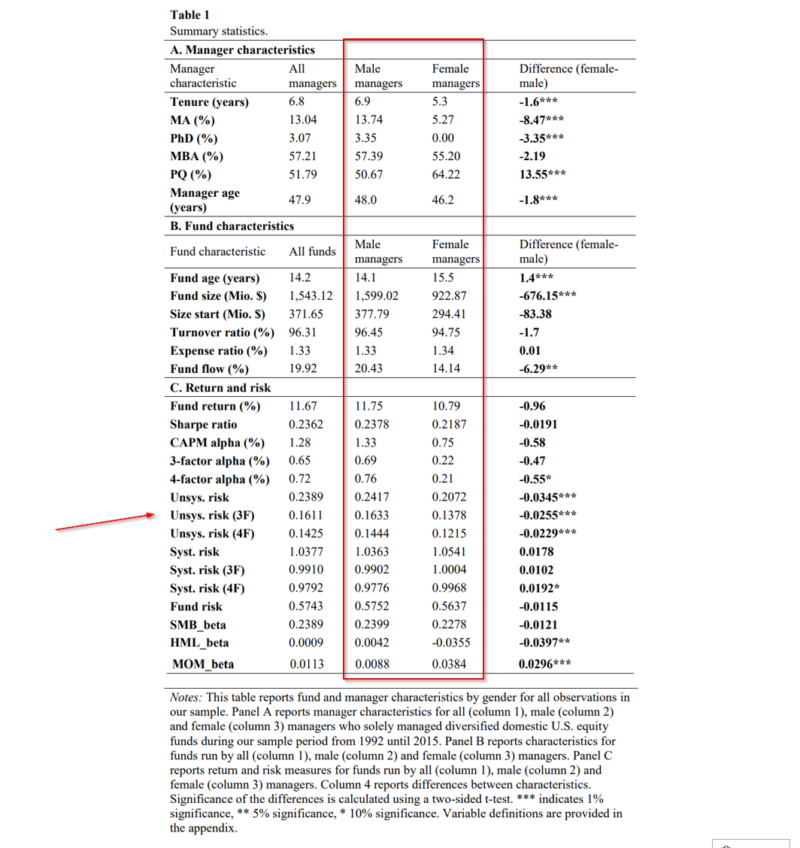

- NO. There were no significant differences in risk/return measures between male and female fund managers. See Table 1 Panel C, for stats on total return, Sharpe ratio, and various measures of alpha obtained from risk models.

Why does it matter?

This research contributes to the literature on the behavior of fund managers with respect to gender and market sentiment. Much of the literature in this area focuses on topics unrelated to gender and instead concentrates on demographics such as age and education. In this analysis, the authors present evidence that although male fund managers are less risk averse than female managers, this behavior apparently has no consequence in terms of fund performance. Table 1 (below) displays a compilation of manager characteristics, fund characteristics, and statistics on risk and return segmented by gender – a nice addition to what we know about the impact of gender on fund management.

The most important chart from the paper

Abstract

In this paper, we explore how fund managers react to sentiment shocks. Our main idea is that sentiment indicates mispricings of stocks relative to their fundamental values, and that rational fund managers should profit from these mispricings. As trading against the mispricing is risky, we hypothesize that female fund managers take on less aggressive positions compared to male fund managers. Indeed, our empirical results show that male fund managers hold portfolios with significantly higher total fund risk and unsystematic risk when sentiment is bad. For female fund managers, we find significantly lower levels in unsystematic risk when sentiment is bad. This difference in risk-taking behavior between male and female fund managers does not affect fund returns or risk-adjusted performance.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.