The Jegadeesh and Titman (1993) paper on momentum established that an equity trading strategy consisting of buying past winners and selling past losers, reliably produced risk-adjusted excess returns. The Jegadeesh results have been replicated in international markets and across asset classes. As this evidence challenged and contradicted widely accepted notions of weak-form market efficiency, the academic community took notice and started churning out research. As a result, a very large number of academic studies were published on momentum. The article summarized here has conveniently summarized 47 articles deemed as the highest quality and published in either the Journal of Finance, the Review of Financial Studies, or the Journal of Financial Economics, all three considered premier journals in the finance discipline. It is difficult to understate the importance of having a well-curated summary of momentum research. Keep it in your library.

Momentum: what do we know 30 years after Jegadeesh and Titman’s seminal paper?

- Tobias Wiest

- Financial Markets and Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.(1)

What are the research questions?

- What is the origin of momentum profitability consistent with traditional rational markets?

- What is the origin of momentum profits as held by proponents of behavioral finance?

- How do Industry and Factor momentum fit in to the momentum story?

What are the Academic Insights?

- The origin of the momentum anomaly remains an issue under debate. Studies examining the source of profitability for momentum as a factor or a strategy are split between risk-based explanations and behavioral explanations. Consistent with efficient markets, the risk-based camp argues that momentum is actually a risk factor that arises as a result of recent outperformance. Future growth rate risks are directly extrapolated from the recent past. Momentum is correlated with growth rates and is therefore compensation for higher growth rate risk. Given that momentum in its various reincarnations have persisted over time and across markets, this rationale makes sense. “While there is room for rational investors to profit from near-arbitrage in the behavioral model and to neutralize any momentum effects, there are no profits without additional risk in the realm of risk-based models.“

- In contrast to rational risk-based theories of momentum, behavioral explanations rely on the irrationality of market participants. That irrationality stems from a biased reaction to news about a specific stock. The bias could occur in the form of a delayed overreaction to news, an initial underreaction to news, or both. Much of the behavioral research supports the delayed overreaction theory of Daniel, Hirshleifer, and Subrahmanyam (1998). That explanation holds that momentum results from overconfidence and self-attribution on the part of investors. It goes something like this: 1. Investors trade on information based on their own research; 2. If public reaction confirms that private signal, then investor overconfidence increases; 3. If that positive public confirmation follows an actual “buy”, then investors also attribute the trading success to their own skill, further driving the price up. The result is a type of feedback system that drives prices away from fundamental values in the long term.

- Corollary research on industry momentum documented profitability for short and intermediate term momentum strategies that subsume individual firm momentum and are weakly correlated at short and intermediate time frames. We have written on industry momentum here. Complicating the momentum picture at the firm level is the research documenting that various other factors exhibit momentum in returns, i.e., factor momentum. And similar to firm level momentum, industry momentum is also subsumed by factor momentum.

Why does it matter?

Over the last 30 years, momentum has been a dominant research topic in finance. The Jegadeesh and Titman (1993) research documented the outperformance of momentum strategies. When individual stocks were ranked on past one to four quarter returns, the long(winners)/short(losers) strategy returns almost 1.5% monthly. Given the sheer number of studies that followed and the quality of the research, momentum now represents a significant challenge to the weak-form market efficiency and consequently much of the foundation in asset pricing. The troublesome part is that the CAPM and its derivative forms are now directly contradicted in fundamental financial theory. This situation has essentially left the field with risk models that are factor-based and suggest that beta doesn’t play much of a role and needs to be replaced. Building out the expected return/risk model using the “correct” number of factors has occupied many a research agenda. A number of multi-factor models, almost all if not all include a momentum term, have been developed (remember APT?) and robustly tested, but all are really just loosely constructed empirical explanations of the variability in stock returns. The APT takes the view that systematic risk may not and need not be measured in only one way. It does not, however, specify exactly what the systematic risks are, or even how many risks exist. In any case, the idea is that the same procedures used to explain return can also be used to explain portfolio risk (Rosenberg,1974). If portfolio risk can be explained, then it can be estimated and approaches to target or minimize it can be used during the portfolio construction phase, all using quantitative methods. Commercially available risk models (BARRA-MSCI, Northfield, etc.) are in widespread use and are quite effective at this task. That is a considerable achievement and a significant benefit to money managers and investors. With the help of a practical quantitative model to effectively control risk, managers can concentrate on the task of finding assets that are potentially mispriced.

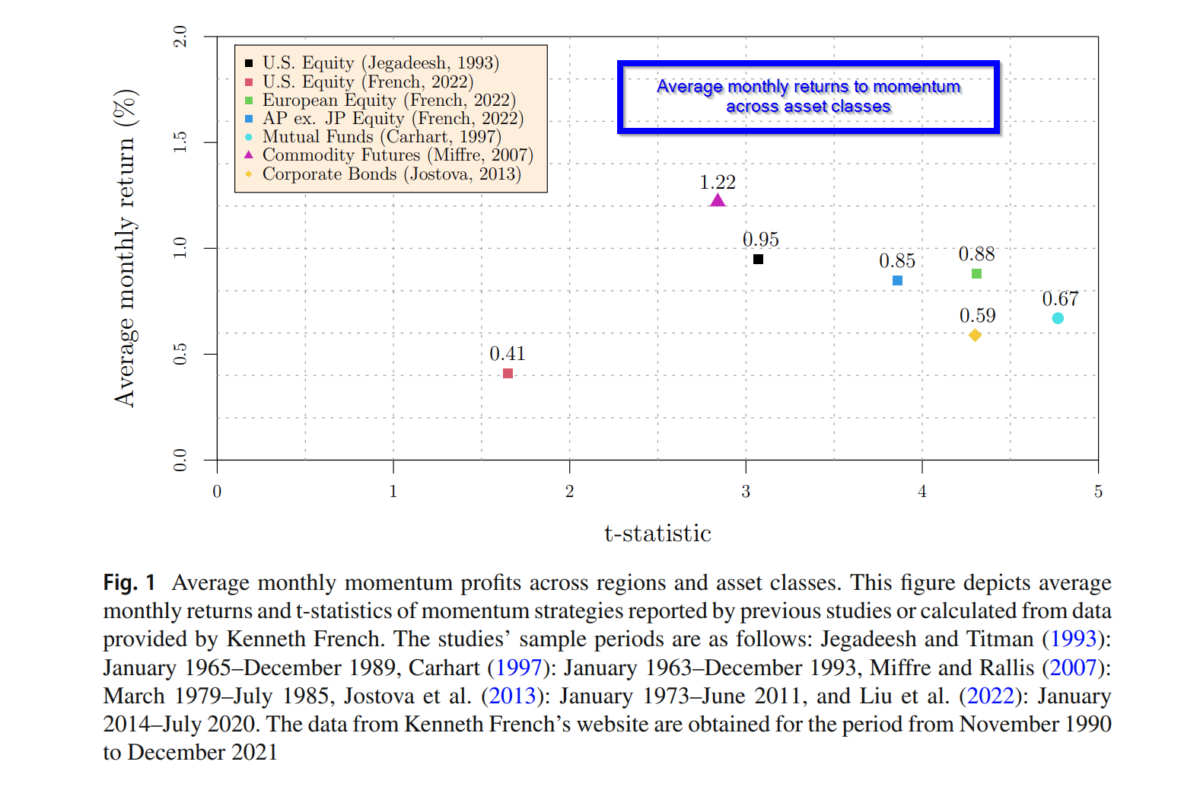

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

For over 30 years, extensive research has found corroborating evidence that past winners continue to yield higher returns than past losers. This momentum effect is robust across various asset classes and across the globe and presents perhaps the most pervasive contradiction of the efficient market hypothesis. This article reviews three strands of literature on momentum. First, I outline the construction of momentum strategies, emphasizing improvements and alternatives such as time-series momentum, residual momentum, and risk-managed momentum. Second, I summarize the most prominent

behavioral-based and risk-based explanations for the origin of momentum. Finally, I present in detail the findings on commonality in stock momentum, namely on industry and factor momentum.

References[+]

| ↑1 | this piece was already covered here, but Tommi was so excited about momentum she wrote up another blog on the topic. |

|---|

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.