The paper aims to provide insights into the dynamics of benchmark selection, the effectiveness of Relative Performance Evaluation ( RPE ) incentivization, and the broader implications for fund performance and market competition.

Self-Declared Benchmarks and Fund Manager Intent: “Cheating” or Competing?

- Chen, Evans and Sun

- FMA working, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

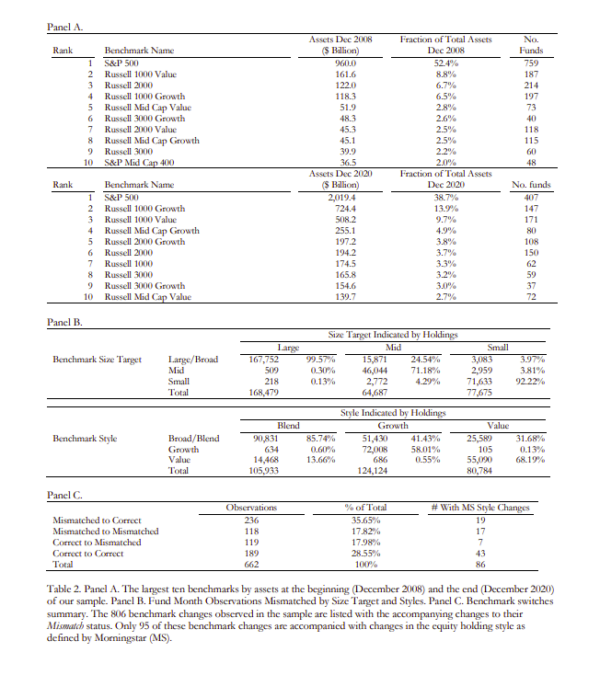

Recent research (Cremers et al., 2022) shows that 24% of funds experience a significant level of benchmark mismatch. These findings underscore how strategic manipulations in selecting comparison groups or benchmarks undermine the efficacy of RPE incentivization. The authors ask the following questions:

- How do strategic distortions, influenced by executives or fund managers, affect the practical effectiveness of RPE incentivization?

- What are the economic forces behind these distortions, and how do they manifest in the evolution of fund benchmarks?

- What are the trends in benchmark selection among U.S. equity funds over time?

- How does the breadth of a fund manager’s investment strategy influence benchmark selection?

- What is the relationship between investor sophistication, benchmark sensitivity, and fund flows?

- How does competition among funds drive benchmark selection?

- What impact does product differentiation have on the choice of benchmarks, and how does it affect fund performance and investor perception?

What are the Academic Insights?

By studying 3,706 unique actively managed equity funds using 154 individual benchmarks

making 662 benchmark changes across the sample, the authors find:

- When executives or managers exert influence over the selection of comparison groups or benchmarks, they introduce biases that can compromise the integrity of the RPE system. Such strategic distortions undermine the intended purpose of RPE, which is to align incentives with organizational goals and mitigate moral hazard. By manipulating benchmark selection, executives or managers can create scenarios where their performance appears more favorable than it is relative to peers or benchmarks. This can distort decision-making processes and hinder the effectiveness of performance-based compensation structures.

- There are a number of economic forces at play such as: Managerial Influence: Executives and fund managers exert significant influence over benchmark selection, potentially motivated by self-interest or agency conflicts; Principal-Agent Dynamics: Managers may prioritize their own interests by selecting benchmarks that reflect favorably on their performance, even if it diverges from the interests of shareholders; Investor Learning and Oversight: The sophistication of investors and the effectiveness of institutional oversight also play a role. As investors become more educated and institutional oversight improves, there’s greater scrutiny over benchmark selection practices. This may incentivize managers to align benchmarks more closely with fund objectives to avoid negative repercussions; Product Market Competition: Competitive pressures in the asset management industry influence benchmark selection. Managers may select benchmarks that differentiate their funds from competitors or enhance their perceived performance relative to peers. Additionally, as competition increases, managers may adapt their benchmarking strategies to maintain competitiveness and attract investor flows.

- The article notes that while 34.2% of funds (representing 45.4% of fund assets) had mismatched benchmarks at the start of the sample period, this figure decreased to 27.2% of funds (27.8% of fund assets) by the end of the sample period. This trend suggests a gradual improvement in benchmark selection practices among U.S. equity funds over the years covered by the study.

- The breadth of a fund manager’s investment strategy significantly influences benchmark selection, as discussed in the article. Fund managers with broader investment strategies, which extend beyond a single investment objective category, face unique challenges in selecting appropriate benchmarks compared to those with more specialized strategies.

- The article suggests that as investors become more sophisticated, they are better equipped to assess both the appropriateness of benchmarks used by funds and the efforts of fund managers to manipulate performance metrics. Sophisticated investors are more likely to scrutinize fund performance relative to benchmarks and make investment decisions based on this analysis. Benchmark sensitivity, on the other hand, refers to the responsiveness of investor flows to changes in fund performance relative to benchmarks. As investors become more educated and informed, they can better discern whether a fund’s benchmark accurately reflects its investment strategy and objectives. Consequently, they may allocate capital based on their assessment of benchmark sensitivity, favoring funds that demonstrate consistent performance relative to appropriate benchmarks.

- Competition among funds drives benchmark selection by incentivizing fund managers to strategically align benchmarks with their investment strategies, differentiate their funds, enhance perceived performance, attract investor capital, and adapt to changing market dynamics.

- Product differentiation influences benchmark selection by guiding funds to choose benchmarks that align with their investment strategies. This alignment can positively impact fund performance, investor perception, and competitive positioning within the asset management industry.

Why does this study matter?

Addressing strategic distortions in benchmark selection promotes transparency and fairness in financial markets. Investors rely on accurate performance metrics to assess fund performance and make investment decisions. By mitigating strategic distortions, the study contributes to a more transparent and fair investment environment, where investors can have confidence in the integrity of performance evaluations.

The Most Important Chart from the Paper:

Abstract

Using a panel of self-declared benchmarks, we examine funds’ use of mismatched benchmarks over time. Mismatching is high at the beginning of our sample (45% of TNA in 2008), consistent with prior studies, but declines significantly over time (27% in 2020), driven by existing specialized funds changing benchmarks to match their style. Market forces including investor learning, institutional investor governance, market competition, and product positioning all play a role in the benchmark correction decisions. For broad funds, mismatched benchmarks are not associated with a performance bias. Our study highlights the value of market solutions in aligning manager-investor interests.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.