Tail Hedging Is Not As Easy As You Think

By Jose Ordonez|April 3rd, 2024|Crisis Alpha, Volatility (e.g., VIX), Options, Skewness, Smarter in 10 Minutes, Podcasts and Video|

Convexity can provide explosive payoffs from unlikely events. It’s a powerful weapon to wield, but like most weapons, it could be inefficient or even dangerous in the hands of the untrained.

DIY Trend-Following Allocations: April 2024

By Ryan Kirlin|April 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Full exposure to REITs. Partial exposure to commodities. Partial exposure to intermediate-term bonds.

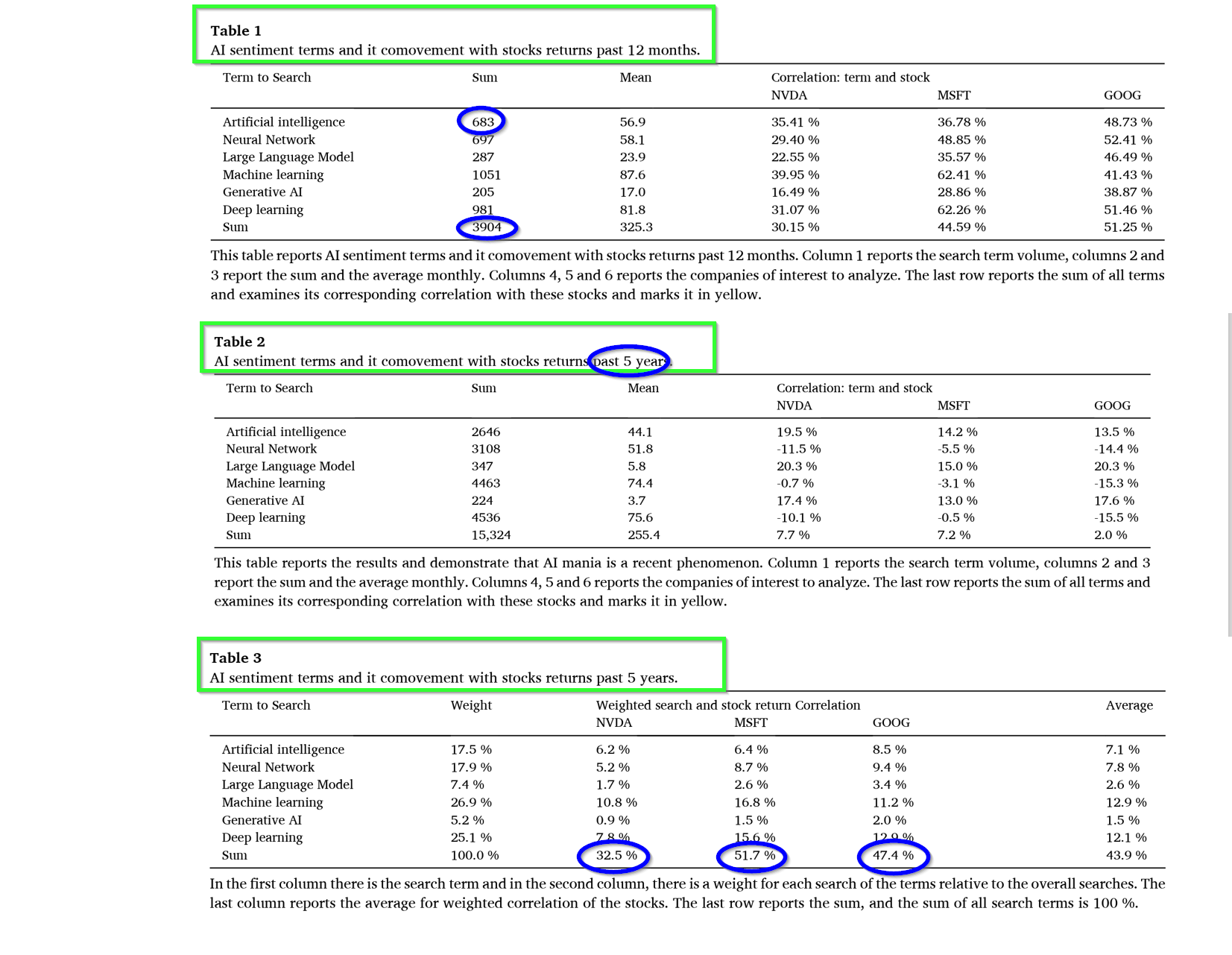

Valuing Artificial Intelligence (AI) Stocks

By Tommi Johnsen, PhD|April 1st, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

While there is literature that describes the "domain" of artificial intelligence, there are very few, if any that analyze the valuation and pricing of AI stocks. The authors attempt to fill the void with a two part methodology.

Economic Momentum

By Larry Swedroe|March 29th, 2024|Larry Swedroe, Factor Investing, Research Insights, Other Insights, Momentum Investing Research|

Strong empirical evidence demonstrates that momentum (both cross-sectional and time-series) provides information on the cross-section of returns of many risk assets and has generated alpha relative to existing asset pricing models.

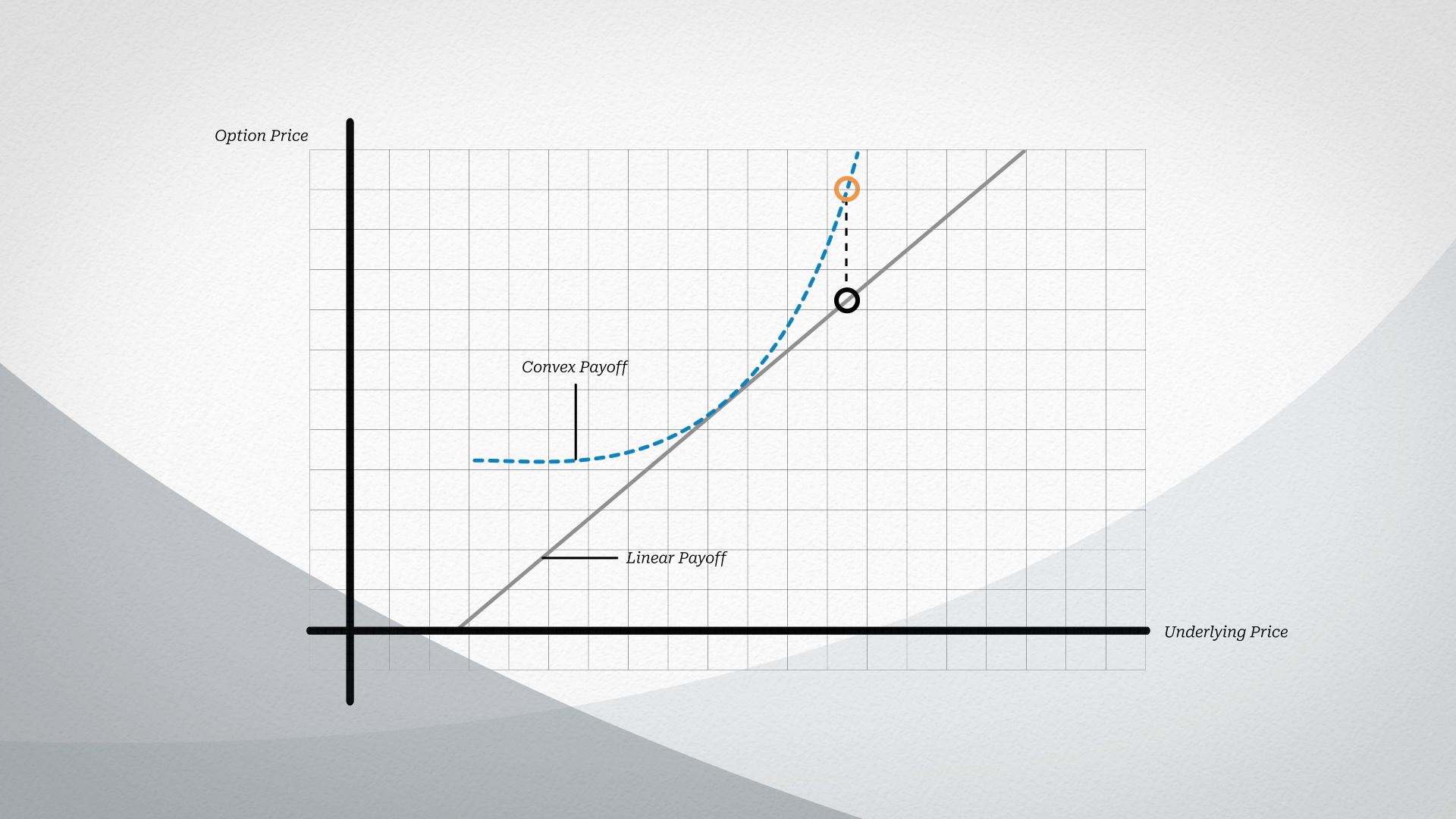

Options 101: Understanding Options Basics

By Jose Ordonez|March 27th, 2024|Options|

Options have a bad reputation, and for good reason. After all, our friends at Wall Street Bets have taken over and turned the options market into a casino. But just like options can be used for gambling, they can also be used to structure risk and formulate payoffs that have the potential to reduce risk at the portfolio level. In fact, options are one of the best tools at our disposal to manage portfolio risk, if used correctly.

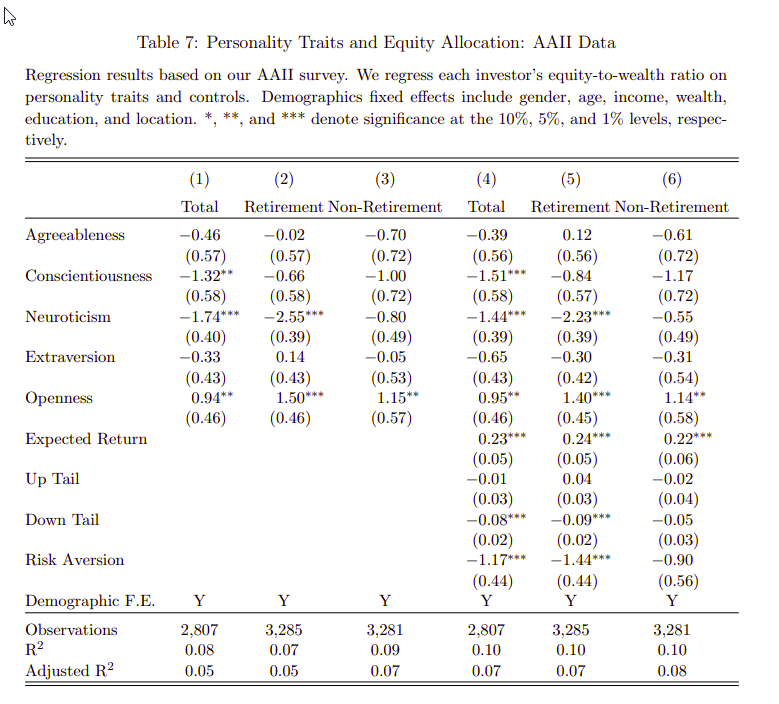

Personality Differences and Investment Decision-Making

By Elisabetta Basilico, PhD, CFA|March 25th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance|

This study offers valuable information to provide insights into the underlying mechanisms driving investment behavior. For example, recognizing the impact of Neuroticism on belief formation and risk perception can help explain why some investors exhibit greater aversion to stock market volatility. Similarly, understanding how Openness influences risk preferences can shed light on why certain individuals are more willing to take investment risks than others.

Tracking Error is a Feature, Not a Bug

By Larry Swedroe|March 22nd, 2024|Empirical Methods, Larry Swedroe, Research Insights, Other Insights, Active and Passive Investing|

The benefits of diversification are well known. In fact, it’s been called the only free lunch in investing. Investors who seek to benefit from diversification of the sources of risk and return of their portfolios must accept that adding unique sources of risk means that their portfolio will inevitably experience what is called tracking error—a financial term used as a measure of the performance of a portfolio relative to the performance of a benchmark, such as the S&P 500.

Short Campaigns by Hedge Funds

By Tommi Johnsen, PhD|March 18th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

Our analysis highlights the importance of short campaigns for understanding the economic impact of activist hedge funds.

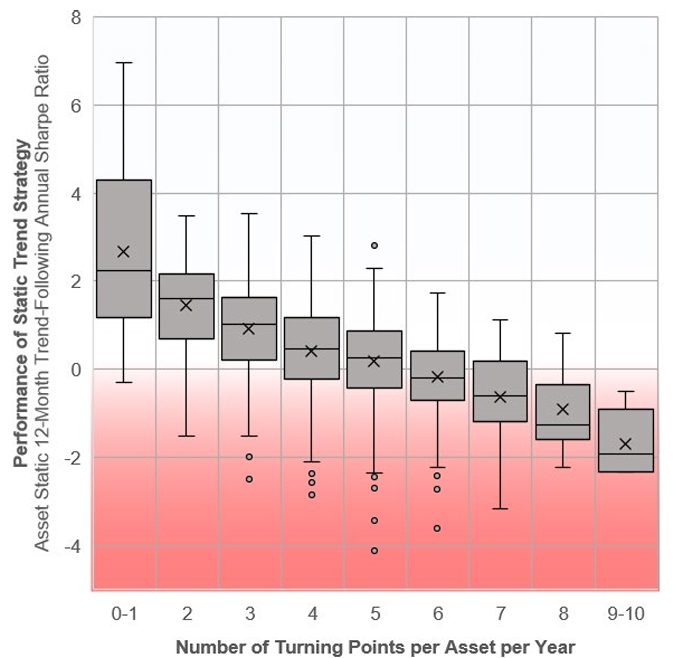

Breaking Bad Momentum Trends

By Larry Swedroe|March 15th, 2024|Larry Swedroe, Factor Investing, Research Insights, Other Insights, Momentum Investing Research|

In their two papers, Goulding, Harvey, and Mazzoleni showed that observed market corrections and rebounds carry predictive information about subsequent returns and showed how that information could be utilized to enhance the performance of trend-following strategies by dynamically blending slow and fast momentum strategies based on four-state cycle-conditional information.

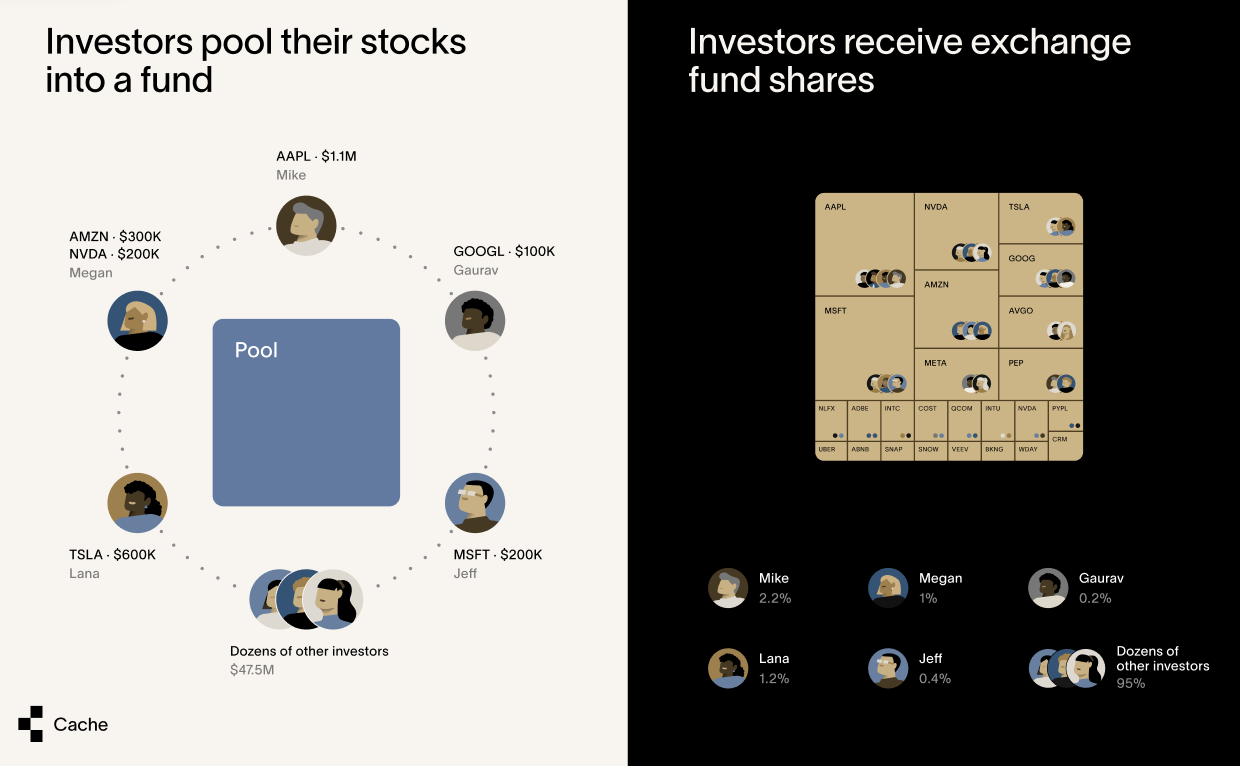

Exchange Funds 2.0: A Newly Accessible Way to Diversify Concentrated Positions

By Mike Allison|March 14th, 2024|Research Insights, Tax Efficient Investing|

When investors have a concentrated stock position that has performed well, they eventually face the same tough question: Should they continue to hold the position (and the outsized exposure it brings to their portfolio) or diversify – and face significant capital gains taxes?