Global Factor Performance: December 2020

By Wesley Gray, PhD|December 7th, 2020|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

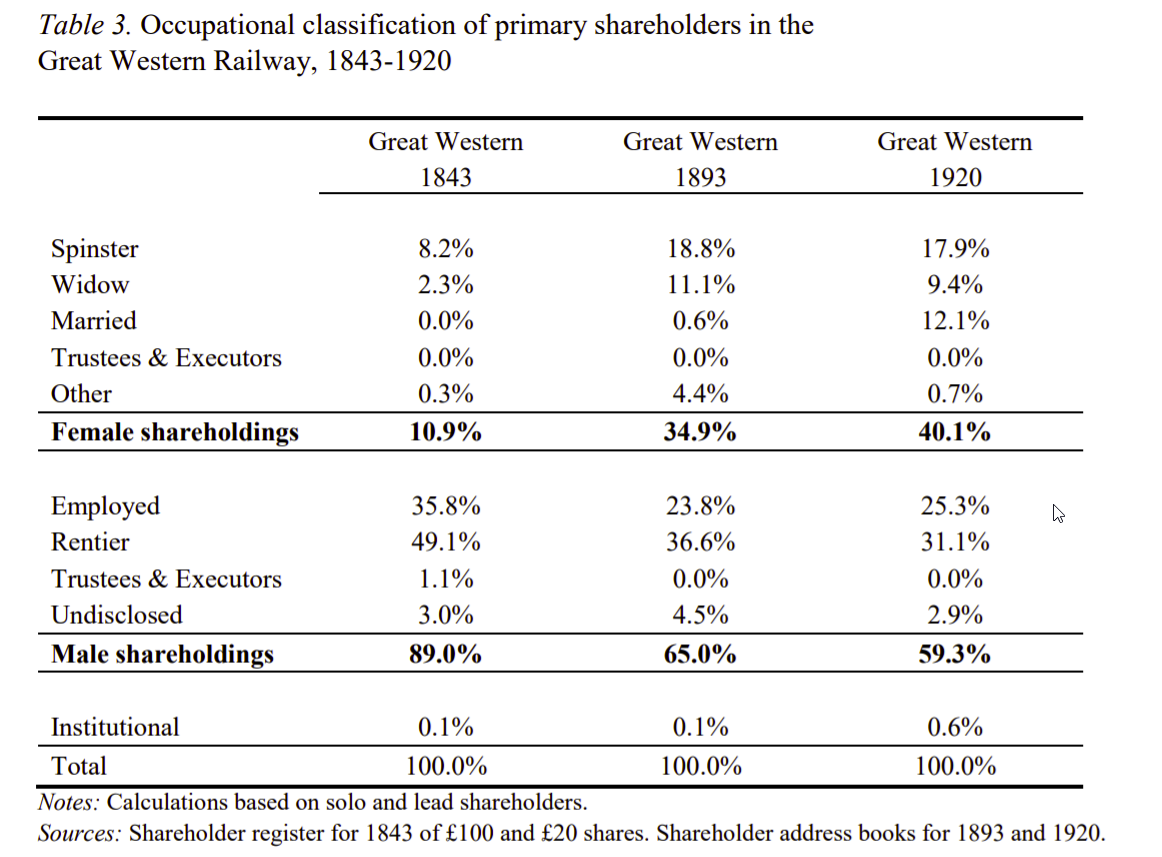

Early Female Investors, More Independent than Previously Thought?

By Wesley Gray, PhD|December 7th, 2020|Research Insights, Women in Finance Know Stuff, Basilico and Johnsen, Academic Research Insight|

Independent Women: Investing in British Railways, 1870-1922 Graeme G. Acheson; [...]

Profitability Factor Details: Taxable Income is Tied to Future Profitability and Returns

By Larry Swedroe|December 3rd, 2020|Quality Investing, Larry Swedroe, Factor Investing, Research Insights, Other Insights|

Robert Novy-Marx’s 2013 paper “ The Other Side of Value: [...]

A Short Research Library Outlining Why Traditional Stock Picking is Challenging

By Wesley Gray, PhD|December 2nd, 2020|Factor Investing, Investor Education, Key Research, Behavioral Finance|

There are no "right" answers when it comes to financial [...]

DIY Asset Allocation Weights: December 2020

By Ryan Kirlin|December 2nd, 2020|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

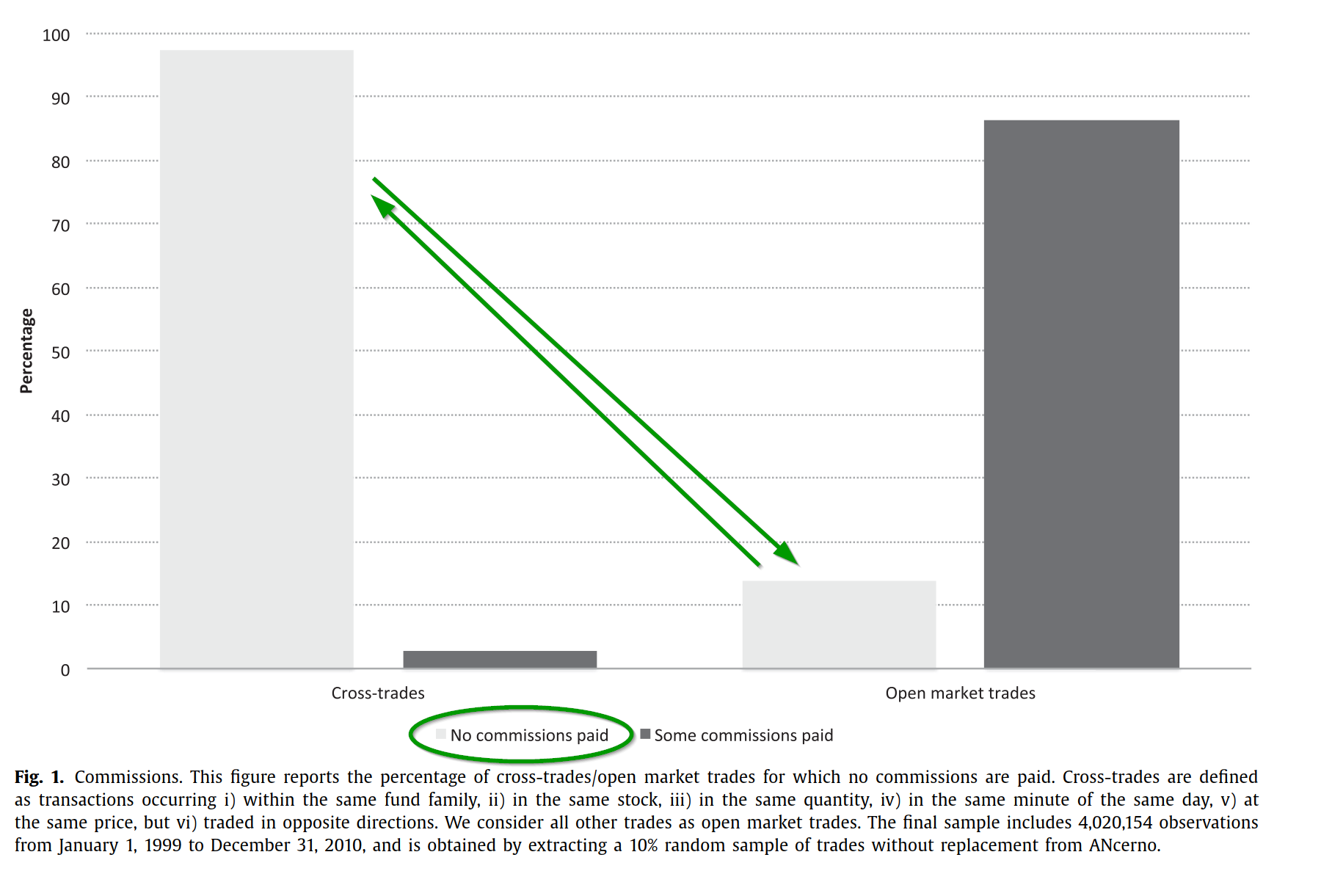

Mutual Fund Trading When No One Is Watching: It’s Not Pretty

By Tommi Johnsen, PhD|November 30th, 2020|Transaction Costs, Research Insights, Basilico and Johnsen, Academic Research Insight|

Trading out of sight: An analysis of cross-trading in mutual [...]

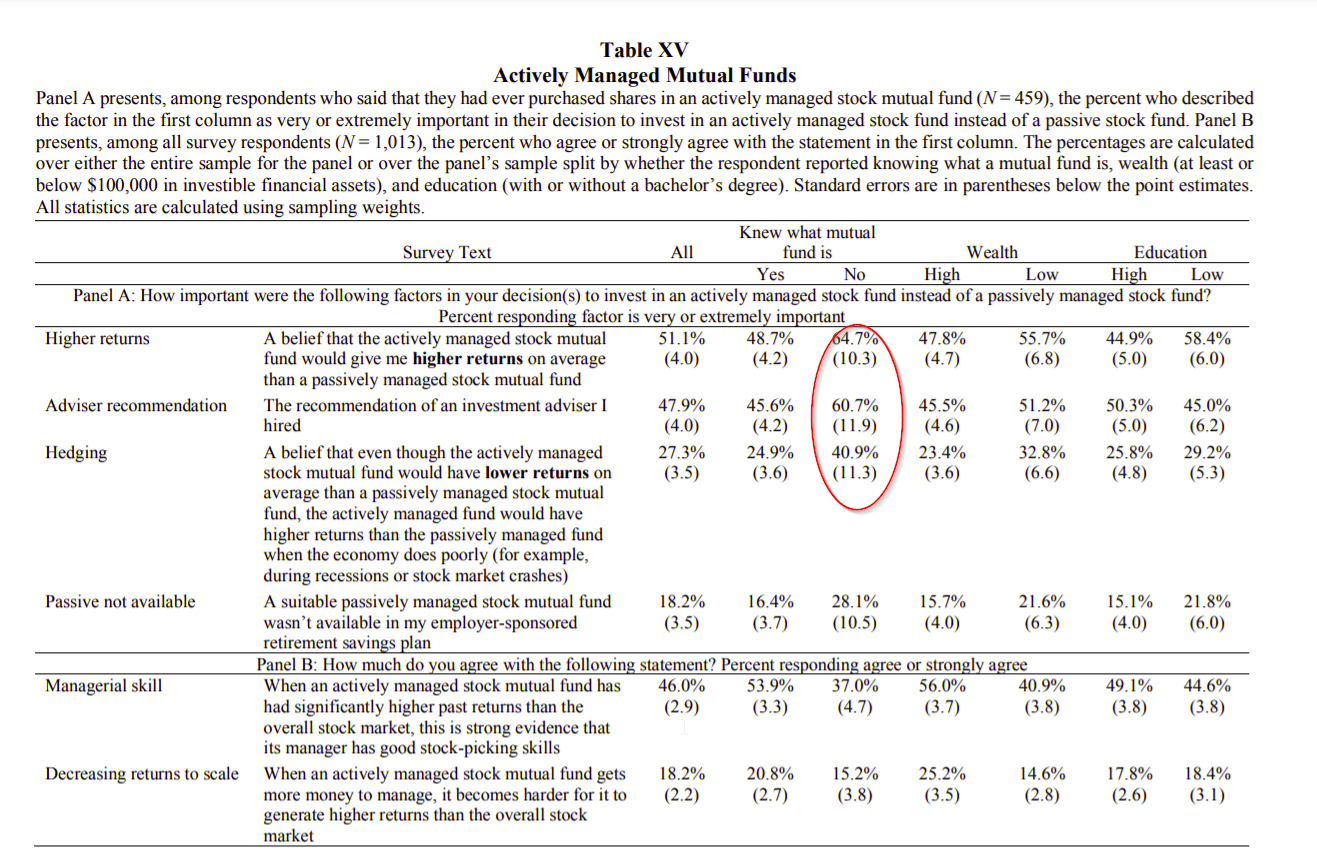

What Matters to Individual Investors? Evidence from the Horse’s Mouth

By Wesley Gray, PhD|November 23rd, 2020|Financial Planning, Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

What Matters to Individual Investors? Evidence from the Horse's Mouth [...]

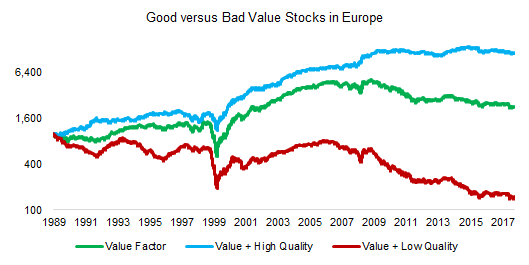

Using “Quality” to Separate Good and Bad Value Stocks

By Nicolas Rabener|November 19th, 2020|Quality Investing, Factor Investing, Research Insights, Guest Posts, Value Investing Research|

Trying to avoid value traps.

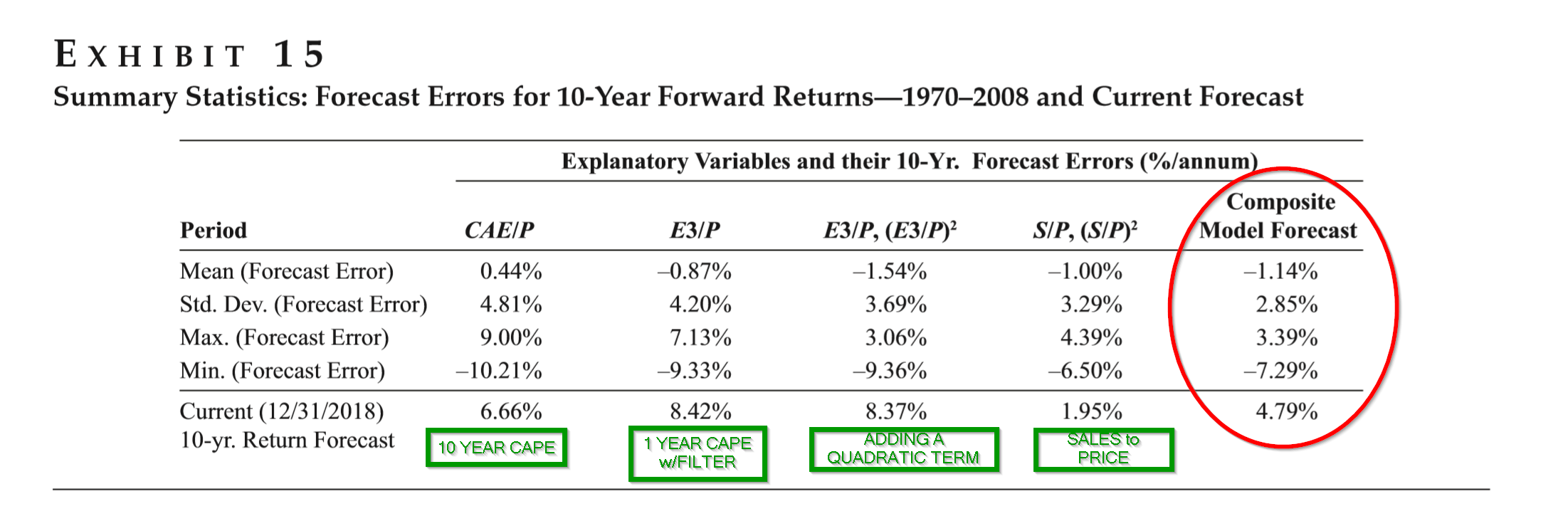

An Easy Way to Simplify and Improve the Shiller CAPE Ratio as a Prediction Tool

By Tommi Johnsen, PhD|November 16th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Ultra-Simple Shiller’s CAPE: How One Year’s Data Can Predict Equity [...]

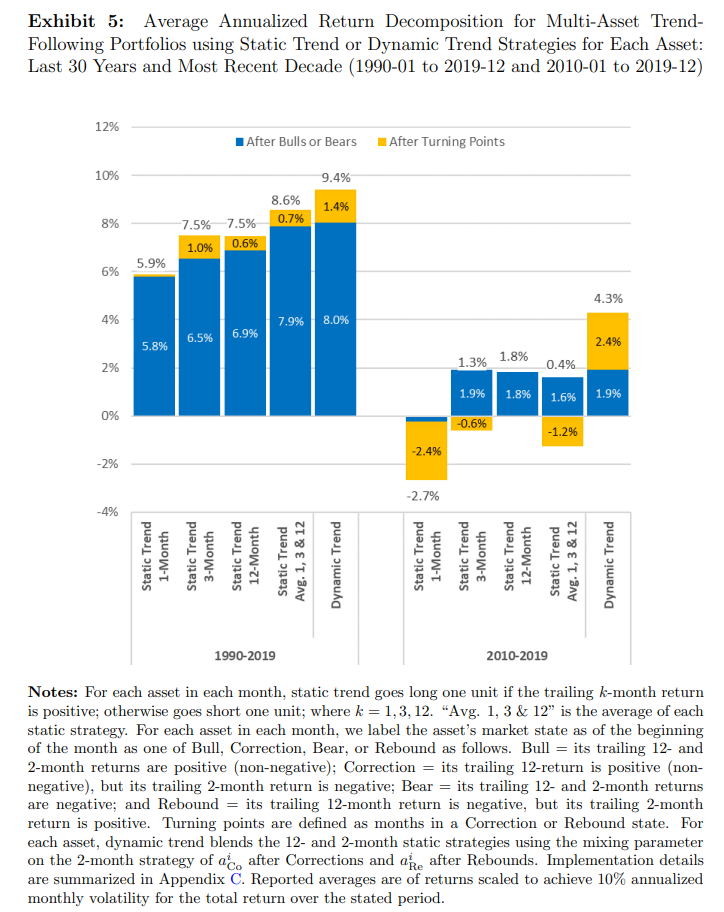

Trend Following Research: Breaking Bad Trends

By Larry Swedroe|November 12th, 2020|Larry Swedroe, Research Insights, Factor Investing, Trend Following, Academic Research Insight, Other Insights, Momentum Investing Research|

Momentum is the tendency for assets that have performed well [...]