Family Descent as a Signal of Managerial Quality: Evidence from Mutual Funds

- Oleg Chuprinin and Denis Sosyura

- Review of Financial Studies, 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- Are there differences in performance between fund managers depending on the wealth of their families?

- What are the possible channels that may contribute to the performance gap?

- Is the underperformance of managers coming from a wealthy family due to market timing or security selection?

- Do mutual fund companies derive nonperformance benefits from employing managers from wealthy families?

What are the Academic Insights?

By using a number of datasets (Morningstar U.S.-domiciled mutual funds, Factset, the Nelson’s Directory of Investment Managers, the National Student Clearinghouse, the College Handbook of the College Entrance Examination Board, the Lexis Nexis Public Records, and the Federal Census), the authors find the following:

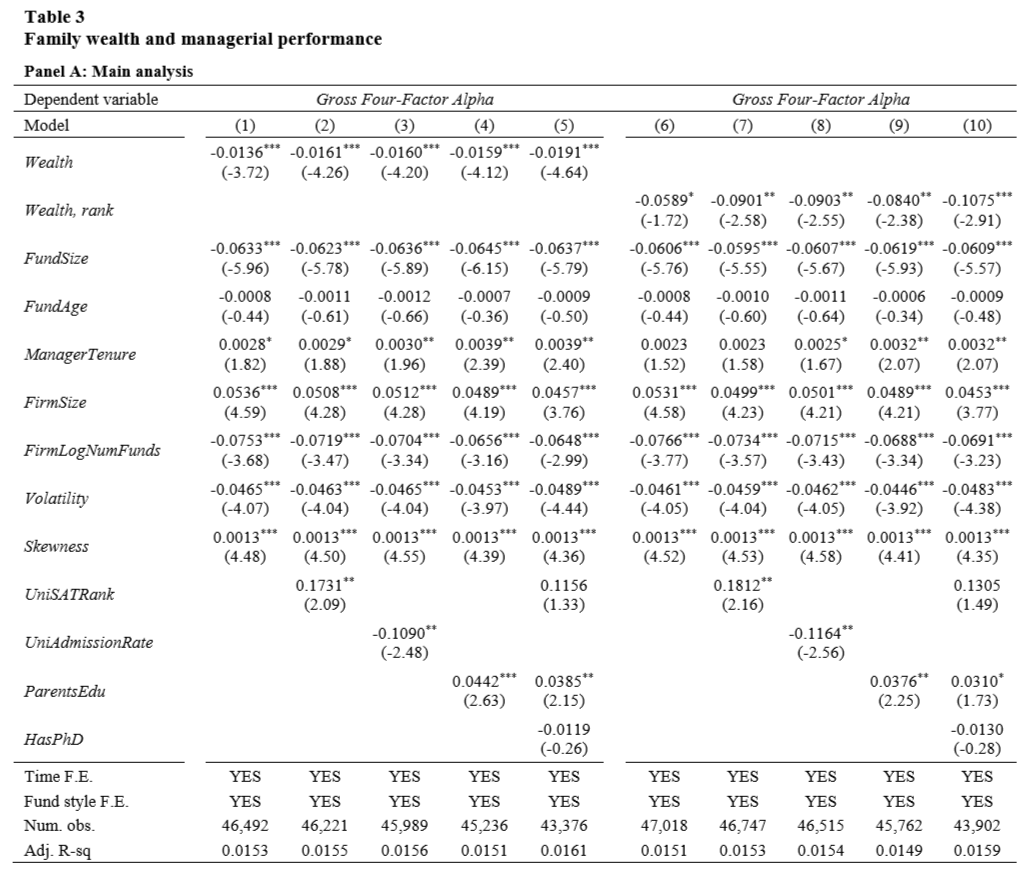

- YES- the authors find that fund managers from wealthy families underperform managers from poor families. For example, managers from families in the top quintile of wealth underperform managers in the bottom quintile by up to 1.36% per year (significant at 1%) on the basis of the four-factor gross alpha. Similar results hold for alternative measures of performance, such as benchmark-adjusted fund returns and the dollar value extracted from capital markets.

- The authors explore two channels: a) effort and b) ability. The first channel posits that managers from poorer families exert more effort because they obtain higher marginal utility from incentive pay under the assumption of a declining marginal utility of wealth. The second channel posits that managers from poorer backgrounds have a higher innate ability, since only high-ability managers are able to overcome stringent selection.

- The relative underperformance of the managers from wealthy families is concentrated in security selection. An interquartile range decrease in family wealth improves the stock-picking component of fund returns by 39% relative to its sample mean. There is no difference in the market timing component of returns.

- The authors do not find reliable evidence of such benefits. In particular, neither capital flows nor management fees are significantly higher for funds run by wealthy managers. This result points to possible agency problems or frictions in the asset management industry that require further research.

Why does it matter?

This paper provides evidence that public information about a manager’s family descent serves as a powerful signal of managerial ability in professions with high barriers to entry, like the asset management industry.

The Most Important Chart from the Paper

Table 3, panel A, reports the estimation results, beginning with specifications without manager controls (Columns 1 and 6) and gradually adding controls for manager characteristics correlated with wealth. Both measures of wealth are reliably negatively related to alpha, and this relation becomes stronger and economically larger as controls for manager characteristics are added. This pattern is consistent with the predictions of the model.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Using data from individual Census records on the wealth of managers’ parents, we find that mutual fund managers from poor families outperform managers from rich families. We argue that managers born poor face higher entry barriers into asset management. Consistent with this view, managers born poor are promoted only if they outperform while those born rich are more likely to be promoted for reasons unrelated to performance. Overall, we establish a first link between fund managers’ family descent and their ability to create value.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.