Surveys often reveal investor behavior that is challenging to understand. For example, Preqin’s Alternative Investor Outlook for H2 2019 highlighted the following:

- 65% of institutional investors believe that real estate is overvalued and a correction likely to occur in 2019, 2020, or beyond.

- However, 45% want to allocate the same amount of capital to real estate and 28% want to allocate even more…

It seems odd that a majority of investors plan to allocate the same or more capital to an asset class that they believe is about to head into a correction. However, perhaps these survey responses simply reflect that investors are cautious about their own abilities to time market cycles correctly, which is a rational assumption given the difficulty of forecasting asset prices.

Determining the current point in the real estate cycle is as difficult as for any other asset class. Broadly speaking, the real estate cycle mirrors the economic one as rents and real estate values increase when GDP grows and decline when the economy falters.

However, frequently the real estate cycle decouples from the economic cycle for various reasons, for example, a residential building boom created government subsidies, which makes the asset class attractive from a diversification perspective. This as well as the income and notion of owning a real asset explain why real estate is the second most popular alternative asset class for institutional investors with a 10.2% target allocation, after private equity.

Capital allocators can invest in real estate directly or indirectly via real estate stocks. Buying buildings directly or investing in real estate private equity funds incurs due diligence and management expenses, high transaction costs, multi-year periods of locking up capital, and a lack of transparency on current asset values given lagged valuations. In contrast, real estate stocks offer daily liquidity and low transaction costs, but it is questionable if these provide the same diversification benefits as direct real estate investments.

In this short research note, we will investigate if real estate stocks are attractive for diversifying an equity portfolio. (Larry Swedroe, a frequent author at Alpha Architect, has a related piece here.)

Analyzing the Diversification Potential

EPRA, the European Public Real Estate Association, provides index data for real estate stocks on regional as well as country level. It is worth highlighting that real estate investment trusts (REITs), which is a unique type of corporate entity, were legislated in most countries over time, but not in all. However, even where the legal structure is not available most listed real estate companies model themselves after REITs. We, therefore, use real estate stocks and REITs synonymously in this research note.

We calculate the 12-month rolling correlations of real estate stock indices and stock markets in the US, Europe, and Japan for the period between 1990 to 2017. We observe the following:

- The correlations exhibited similar trends, which indicates that real estate stocks were correlated across markets.

- The correlations to the stock market were between 0.6 and 0.8 on average, which should make REITs attractive for diversifying an equity portfolio.

Evaluating Diversification Benefits from Investing in REIT’s

In the period from 1990 to 2017, real estate stocks generated higher returns per annum than the stock markets in the US and Japan, but not in Europe. Despite high returns being attractive for most investors, it should be noted that the returns from real estate stocks can be partially explained by exposure to the following factors:

- Size factor: REITs had smaller market capitalizations, historically.

- Bonds: REITs feature high levels of leverage, which results in positive exposure to bonds.

A cautious investor might argue that real estate stocks represent small-cap bond-proxies and simply benefitted from small caps outperforming large caps and a bull market in bonds over the last 30 years. These exposures can be acquired more efficiently via small-cap stock and bond ETFs.

Furthermore, the hybrid characteristics of REITs also raises the question of where they sit within an investment portfolio, although most investors consider them as part of their equity allocation given that REITs are technically stocks.

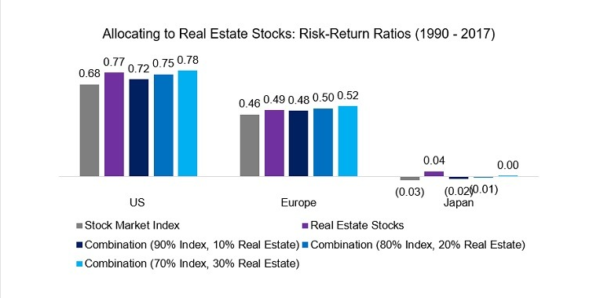

In order to evaluate the diversification benefits for an equity portfolio, we create several combination portfolios comprised of all stocks and REITs with annual rebalancing. We observe that real estate stocks have generated higher risk-adjusted returns than stocks across markets, therefore allocating to REITs would have been accretive for an equity portfolio, albeit only marginally.

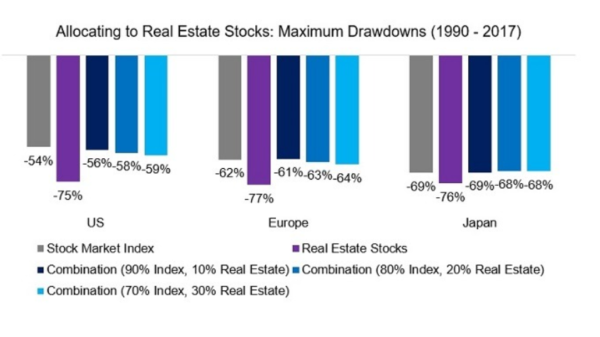

Although real estate stocks would have increased the risk-adjusted returns of an equity portfolio, they would have also increased the maximum drawdowns. Naturally, this can be explained by real estate representing the epicenter of the global financial crisis in 2008 to 2009, where REITs severely underperformed stock markets.

Alternative Strategies to REITs

The analysis only reveals marginal benefits from investing in real estate stocks and it might be worth comparing REITs with alternative strategies. Investors primarily allocate to real estate for equity income and decreasing portfolio risk, which are characteristics that can be acquired via other strategies.

- Equity income: US REITs currently yield 3.03%, compared to 3.60% for a US dividend strategy and 4.83% for US high yield bonds.

- Risk reduction: Low volatility and PutWrite strategies historically featured lower drawdowns than the general stock market.

It is worth noting that dividend and low volatility portfolios tend to contain a meaningful amount of real estate stocks, so there is some overlap in portfolios.

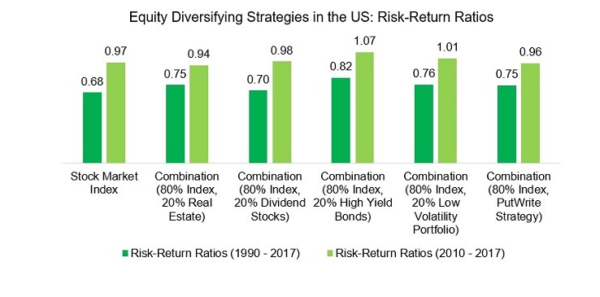

Next, we compare allocating to REITs versus these alternative strategies and focus on the US market given the longest data history. The analysis covers the period from 1990 to 2017 as well as from 2010 to 2017, which excludes the global financial crisis as some investors might consider including the event as overly penalizing for real estate stocks.

We observe that three out of the four alternative strategies provide the same or better improvement in risk-return ratios compared to real estate stocks over the entire sample period, which makes REITs somewhat less attractive from a diversification perspective.

Post 2010, real estate stocks represent the only strategy that would have decreased the risk-adjusted returns of an equity portfolio, which can be primarily explained by the high volatility of REITs during the period.

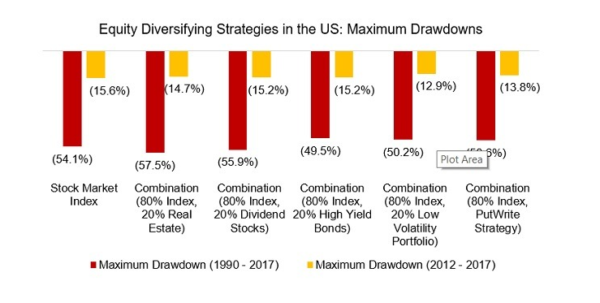

Finally, we compare the maximum drawdowns when allocating 20% to real estate stocks versus alternatives and again include two lookback periods, one for the entire sample period and a shorter one excluding the global financial crisis.

We observe in both scenarios that allocating to strategies like low volatility or Put-Write would have reduced the maximum drawdowns more effectively than real estate stocks.

Further Thoughts

This research note does not make a particularly strong case against allocating to real estate stocks, but the results are also not supportive either.

Despite REITs featuring only moderately positive correlations to stocks, the diversification benefits were marginal over the last 30 years. Stated differently, real estate stocks are just not unique enough and introduce additional, unnecessary complexity for asset allocation models.

Furthermore, the real estate asset class is largely a bond proxy and has benefited significantly from declining interest rates over the last 30 years. Given that bond yields have reached zero or negative levels in many countries, this likely makes the outlook for real estate less appealing.(1)

References[+]

| ↑1 | editor’s note: While the appeal of buy and hold REIT exposure is iffy at best, trend-following a REIT exposure is arguably still interesting in the context of a global diversified portfolio. An example of how to deploy this exposure is outlined in the Robust Asset Allocation system. |

|---|

About the Author: Nicolas Rabener

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.