Zooming In on Equity Factor Crowding

- Valerio Volpati, Michael Benzaquen, Zoltán Eisler, Iacopo Mastromatteo, Bence Tóth, and Jean-Philippe Bouchaud

- Working Paper, SSRN

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

This study is one of several studies reviewed here and here, attempting to measure factor crowding. This article specifically examines the presence of factor crowding by estimating the correlation between market order flow with the magnitude of the factor signal to trade. They hypothesize that factor crowding can be identified via the correlations associated with supply-demand imbalances where investors trade in the same direction, and with rebalancing order flow. Two measures of order flow are used: anonymous (proprietary) microstructure data for the Russell 3000 and institutional order flow from a proprietary database. Results are limited to the 3 Fama-French factors including HML, SMB and Momentum studied. No other formulations of value, size, and momentum were tested.What are the Academic Insights?

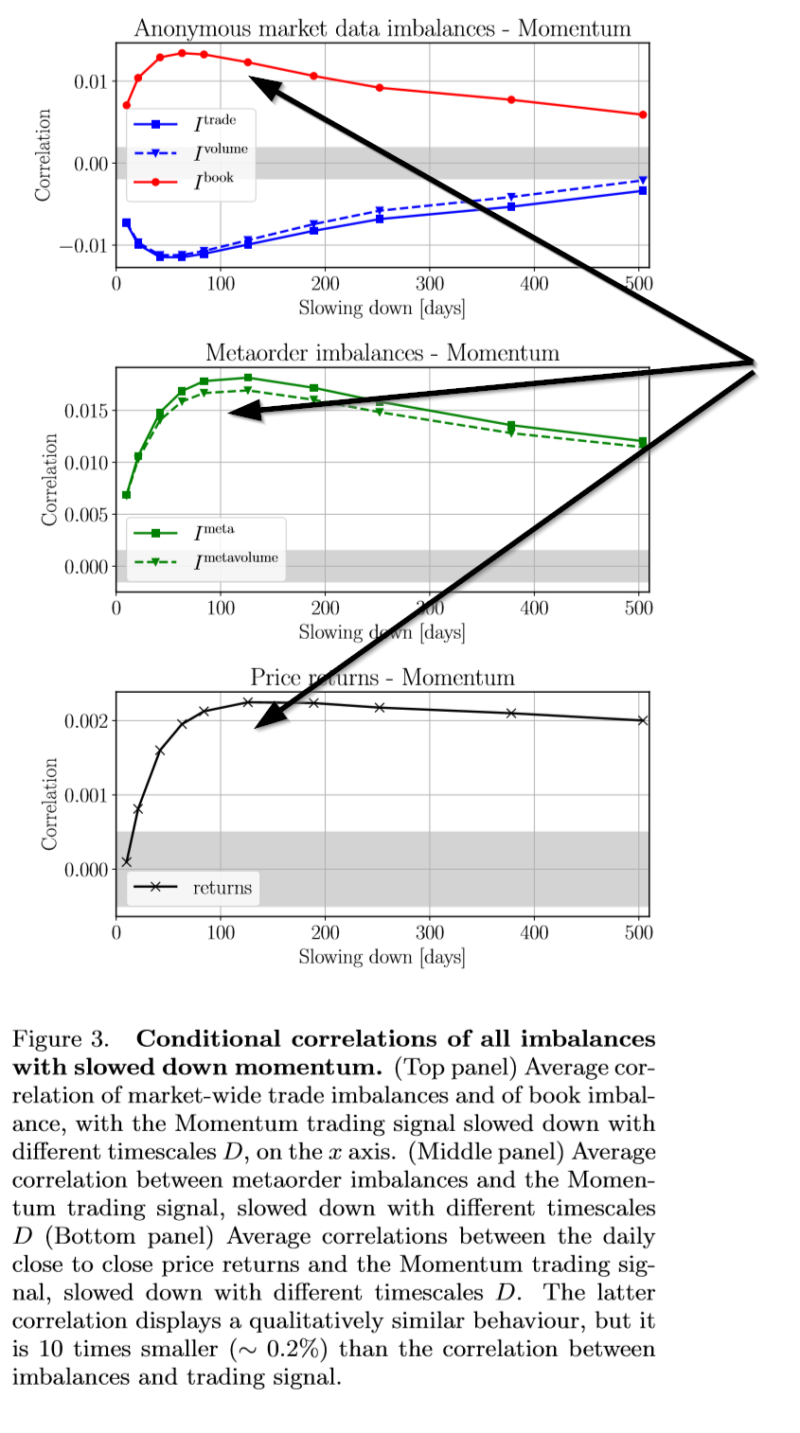

In general the authors find significant and mostly consistent results for all 3 factors, with Momentum exhibiting the strongest relationship. See Figure 3 below for Momentum results. Note that “the grey stripe denotes the significance band for correlations obtained by reshuffling the time series (in blocks of 6 months in order to preserve the autocorrelation structure) and calculating the standard deviation of the obtained correlations over 200 reshuffled samples.” Given that rebalance costs of FF factor portfolios are relatively high, the authors impose a slowing down of the trade signal across various period of time. None of the variations in time to trade affected the overall conclusions. For Momentum trades:- There is a significant, negative correlation between trade imbalance and order flow (signal to buy or sell). See top panel in Figure 3. There is a positive and significant correlation between book imbalance and order flow. The difference in the signs of the correlation are possibly explained by the use of passive orders in factor trading in the market-wide nature of the data set used in this test.

- The metaorder imbalance and volume imbalance also exhibit significant and positive correlations with the Momentum signal to trade. See Figure 3, middle panel. The authors hypothesize that the imbalance variable in this data set is not sensitive to type of trading (passive vs. active) as is the data set used in #1. Possibly true.

- The correlations reported in Figure 3, bottom panel are for the daily close returns and the Momentum signal computed for the Russell 3000 universe. While significant, the magnitude of the average correlation is low, approximately 0.2%. It is used to estimate market impact cost of Momentum trades. The authors report that although the overall correlation is low, it did increase over an examination of subperiods tested between 1999 and 2018. Thus supporting an increase in the magnitude of crowding over time.

- The results for FF Value and Size are similar to Momentum for market-wide imbalance data. However, significance levels for Size were lower. Not a surprising result given the holding periods for the Size and Value factor are much longer and require smaller amounts of rebalancing activity.

- For the metadata imbalances, the correlations were only marginally significant.

Why does it matter?

The authors are able to make a strong case for the measurement of crowding in the momentum factor, however, the results for HML and SMB were encouraging, but not as convincing. Nonetheless, the need for identifying conditions of crowding in factor strategies remains and is motivated by at least 3 complications for investors pursuing such systematic strategies:- An increase in cash flowing into a factor, potentially reducing excess returns to the strategy;

- An increase in transactions costs and market impact costs as trade flows follow the strategy, potentially decreasing excess returns; and

- An increase in systemic risk as the number of new vendors offering the strategy overlap with existing portfolios; most likely taking the form of liquidation/loss events that cascade across all vendors and investors.

The most important chart from the paper

Abstract

Crowding is most likely an important factor in the deterioration of strategy performance, the increase of trading costs and the development of systemic risk. We study the imprints of crowding on both anonymous market data and a large database of metaorders from institutional investors in the U.S. equity market. We propose direct metrics of crowding that capture the presence of investors contemporaneously trading the same stock in the same direction by looking at fluctuations of the imbalances of trades executed on the market. We identify significant signs of crowding in well known equity signals, such as Fama-French factors and especially Momentum. We show that the rebalancing of a Momentum portfolio can explain between 1–2% of order flow, and that this percentage has been significantly increasing in recent years.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.