Value stocks sharply underperformed growth stocks from 2017 to 2020, exacerbating a longer period of lackluster performance dating back to the Global Financial Crisis. The Death of Systemic Value Investing is not new news for frequent readers of the blog nor are the possible pathways to Resurrecting the Value Premium. From 2007 through August 2020, this drawdown was the deepest and longest in value’s history (on some measures). Some have blamed the interest rate environment—the low level of interest rates, falling bond yields, or the flattening yield curve.

In their study “Value and Interest Rates: Are Rates to Blame for Value’s Torments?,” published in the May 2021 issue of The Journal of Portfolio Management, AQR’s Thomas Maloney and Tobias Moskowitz examined the evidence to determine empirically if the fall in rates and the flattening of the curve were, in fact, the cause of value’s underperformance. The literature does at least suggest possible links between the value premium and rates. For example, several papers (e.g., the 2020 study “Duration-Driven Returns”) have characterized value stocks as low-duration assets with near-term cash flows, and growth stocks as high-duration assets. Another explanation relates to differing debt characteristics of value and growth companies, suggesting value firms have higher levels of shorter-dated debt and are therefore more vulnerable to rises in short rates, whereas growth firms have higher levels of longer-dated debt and benefit more from falling long rates. The implication is that falling bond yields from 2010 to 2020 acted as a strong tailwind for growth stocks and a headwind for value stocks, driving value-tilted portfolio returns lower.

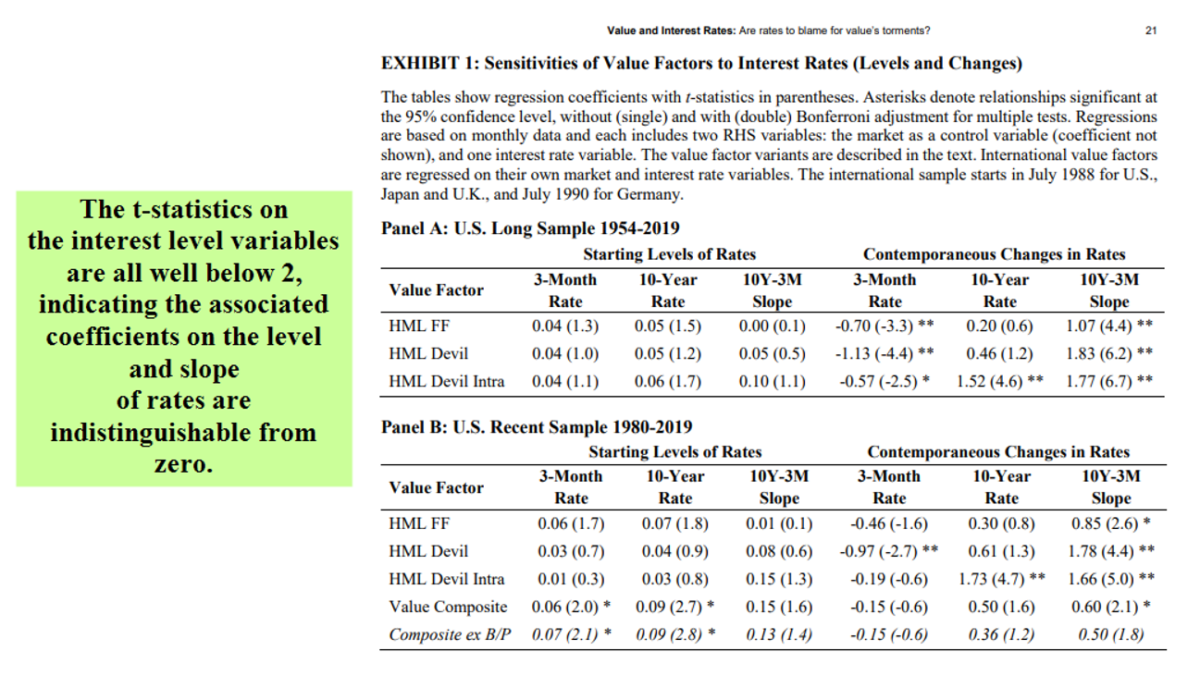

Maloney and Moskowitz analyzed various aspects of the yield curve (levels and changes in short- and long-term rates, as well as the slope of the yield curve) applied to different measures and implementations of the value factor: the Fama-French HML, using book-to-market; AQR’s HML Devil, which updates the book-to-market data using timelier price information; AQR’s HML Devil Intra, which is designed to be industry neutral; and a value composite factor, which uses multiple measures of value in addition to book-to-market to sort stocks. They also examined different periods as well as global evidence (the U.K., Germany, and Japan). These varying choices served to provide a broad and robust view of the relationship between value and interest rates.

Following is a summary of their findings:

- There were no statistically significant value sensitivities to the levels of short- or long-term rates and no significant exposure to the yield curve slope.

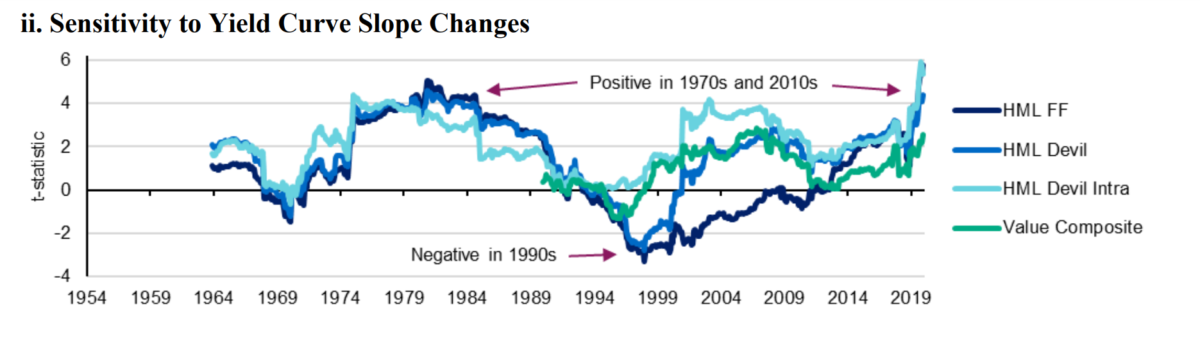

- Evidence of a mild relationship between changes in interest rate variables and value’s performance was found for some value specifications but not others—the findings were not robust.

- There is no evidence that companies with a higher proportion of short-term debt tend to be value firms or exhibit any sensitivity to rates factors—there is little support for the theory that shorter debt duration explains value’s sensitivity to changes in yield curve slope.

- There is some evidence of a relationship between value factor returns and changes in yields or changes in the yield curve slope. However, the economic magnitude of this relationship suggests falling rates may have been more of a mild headwind than a major driver of value losses in recent years. For example, although the yield curve steepened by around 100 basis points in the 12 months after August 2019, further value losses occurred.

- Despite eye-catching patterns during a few episodes in recent years related to changes in bond yields or the yield curve slope, the economic significance of any relationship between interest rates and the value premium was small and not robust in other samples. For example, the results were weaker in the period 1926-1953 than in the period 1954-2019.

- The performance of value is not easily assessed based on the interest rate environment. Thus, factor-timing strategies based on interest rate-related signals are likely to perform poorly.

- The results were even weaker internationally—inconsistent with an economic reason for value to be affected by interest rate regimes. In fact, Japan had by far the highest average value return during the sample period and the lowest interest rates.

- There is no evidence in the historical data that a change in interest rate environment (level of interest rates) is a necessary condition for a value recovery.

Their findings led Maloney and Moskowitz to conclude:

“The potential connection between the interest rate environment and value returns is suspect. The strongest and most statistically reliable result we find is between changes in the slope of the yield curve and value returns. However, the economic significance of this relationship is weak. During the period of 2017 to 2019, when a steep value drawdown coincided with a flattening yield curve slope, this connection can only explain a small part of value’s losses, leaving the majority of value’s underperformance unconnected to interest rate changes.”

Mahoney and Moskowitz did acknowledge that their analysis had limitations, and thus they could not rule out the possibility that interest rates played some role in value’s losses. And referring to the lack of sensitivity to levels in rates, they added:

“The clear implication is that the low-yield environment that pervaded the last decade and continues at the start of the 2020s says very little about the past performance or future prospects of value investing.”

Providing an explanation for the lack of causation, they explained:

“Interest rate changes reflect economic conditions, which almost surely are reflected in cash flows and risk premiums, and the combined effect of these changes may dominate the duration effect.”

And finally, they explained:

“The right explanation is often the simplest one (albeit less satisfying perhaps)—large drawdowns are simply an unwanted feature of factor premiums such as value (and the market premium). The paucity of evidence that these drawdowns can reliably be explained or predicted by observable variables—despite narratives with the benefit of hindsight—may be precisely why these factors are risky and therefore why they provide long-term positive return premiums that are not easily arbitraged away.”

Important Disclosures

The information presented herein is for educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Certain information may be based on third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Performance is historical and does not guarantee future results. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners® (collectively Buckingham Wealth Partners). LSR-21-100

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.