Financial education affects financial knowledge and downstream behaviors

- Kaiser, Lusardi, Menkhoff and Urban

- Journal of Financial Economics, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Empowering investors through education is a foundational tenet of our firm and a big reason why we write these posts. The article we cover here is a meta-analysis of 76 randomized studies on the impacts and design of financial education, a topic we’ve hit on before.

It’s almost cliche now to hear parents and educators demand schools take the initiative to make financial education a high priority. However, it’s reasonable to ask, does financial education even work?

Research on financial literacy exploded(1) but there is still an ongoing debate on its effectiveness.

The authors take stock of the recent empirical evidence documented in randomized experiments and provide an updated and more sophisticated analysis of the existing work.

What are the Academic Insights?

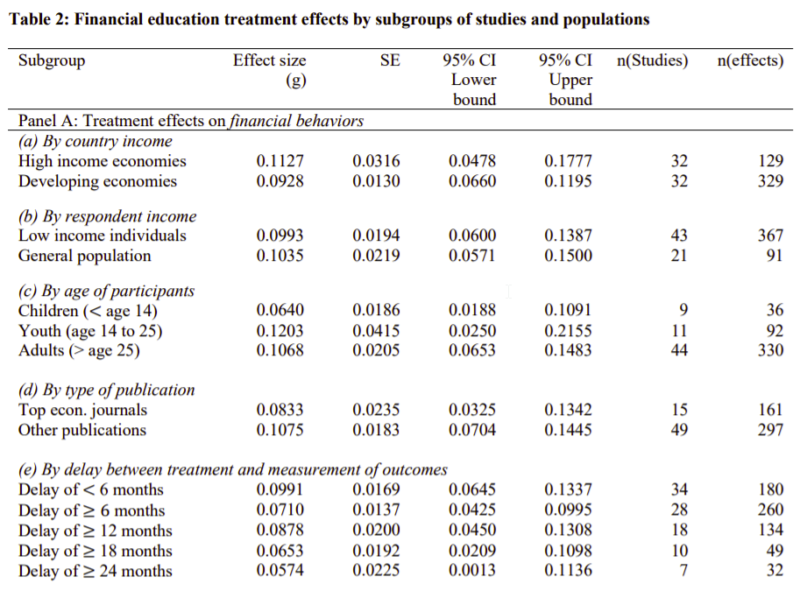

By studying 76 randomized experiments with a total sample size of 160,000 individuals in 33 countries, the authors find:

- Effects of financial education on financial knowledge are comparable to studies on math and reading.

- Effects of financial education on financial behaviors are comparable to meta-analyses of interventions in other domains (anti-smoking, energy conservation).

- Using Kraft’s (2019) scale of educational interventions, effects are “medium/large.”

- Average intervention has low cost per participant.

- No significant differences between high-income and developing economies (effects on behavior).

- No significant differences between low-income individuals and general population

- Financial Education works for all age groups

Why does it matter?

This paper is important because it updates and expands the investigation of the literature on the effectiveness of financial education. Prior literature was outdated ( Fernandes et al., 2014) and was much more limited in scope and data. As readers of this blog, I’m fairly certain we all know the value of good financial education and how it sets the stage for long-term compounding returns. Finding the most effective and efficient means to achieve a basic level of financial literacy is a critical piece to add to the cliche of simply “adding financial education.”

The Most Important Chart from the Paper:

Abstract

We study the rapidly growing literature on the causal effects of financial education programs in a meta-analysis of 76 randomized experiments with a total sample size of over 160,000 individuals. The evidence shows that financial education programs have, on average, positive causal treatment effects on financial knowledge and downstream financial behaviors. Treatment effects are economically meaningful in size, similar to those realized by educational interventions in other domains, and are at least three times as large as the average effect documented in earlier work. These results are robust to the method used, restricting the sample to papers published in top economics journals, including only studies with adequate power, and accounting for publication selection bias in the literature. We conclude with a discussion of the cost-effectiveness of financial education interventions.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.