In our book The Incredible Shrinking Alpha, Andrew Berkin and I presented the evidence demonstrating that the markets have become more efficient over time, making it more difficult to outperform the market on a risk-adjusted basis. Market efficiency explains the lack of persistent outperformance of actively managed funds beyond the randomly expected. Among the reasons we cited for the shrinking alpha opportunities was that in the zero-sum game (on a gross basis; it’s a negative-sum game on a net basis) that is alpha generation, the pool of victims (naive retail investors) that could be exploited had shrunk dramatically. We showed that while retail investors directly owned about 90% of all stocks at the end of WWII (there was a large pool of exploitable victims), by 2008 that figure had fallen to about 20%. In addition, institutions were responsible for as much as 90% of trading.

Retail Investors Are Noise Traders

A large body of research has found that in both stock and bond markets, retail investors tend to be irrational, naive “noise traders” who display herd-like behavior, trading on sentiment rather than fundamentals. Further research shows that noise trading leads to mispricing (overvaluation), especially for hard-to-arbitrage stocks, and during periods of high investor sentiment. Eventually, mispricings are expected to be corrected when the fundamentals are revealed, making investor sentiment a contrarian predictor of stock market returns. In addition, overpricing is more prevalent than underpricing because investors with the most optimistic views about a stock exert the greatest effect on the price; their views are not counterbalanced by the relatively less optimistic investors inclined to take no position if they view the stock as undervalued rather than a short position. Thus, when the most optimistic investors are too optimistic, overpricing results—providing opportunities for sophisticated short sellers.

The Role of Short Sellers

The importance of the role of short sellers has gained increased attention from academic researchers in recent years. Short sellers help keep market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. In an efficient market, capital is allocated appropriately and economically. If short sellers were inhibited from expressing their views on valuations, securities prices could become overvalued and excess capital would be allocated to those firms. Limits to arbitrage, including the risks of unlimited losses when selling short, the high costs of shorting (borrowing fees can be high), and regulations that prohibit some institutions from shorting, allow anomalies to persist. The empirical research finds that market anomalies tend to derive their profitability mainly from short-selling overpriced stocks rather than buying underpriced counterparts—it’s simpler and less risky (losses are not unlimited and there are no borrowing fees) to correct underpricing.

Research into the information contained in short-selling activity includes “The Shorting Premium and Asset Pricing Anomalies (2016),” “Smart Equity Lending, Stock Loan Fees, and Private Information (2017),” the 2020 studies “Securities Lending and Trading by Active and Passive Funds” and “The Loan Fee Anomaly: A Short Seller’s Best Ideas,” the 2021 studies “Pessimistic Target Prices by Short Sellers” and “Can Shorts Predict Returns? A Global Perspective,” “Anomalies and Their Short-Sale Costs (2022), and “Mining the Short Side: Institutional Investors and Stock Market Anomalies (2023).” The studies consistently found that short sellers are informed investors who are skilled at processing information (though they tend to be too pessimistic). That is evidenced by the finding that stocks with high shorting fees earn abnormally low returns even after accounting for the shorting fees earned from securities lending. Thus, loan fees provide information in the cross-section of equity returns.

Retail investors tend to be on the other side of short sellers. Historically, they have been exploited. However, the recent GameStop episode, in which retail investors using social media banded together with sufficient capital to engineer a short squeeze by attacking the short positions of well-capitalized hedge funds, demonstrated just how risky shorting can be. In January 2021, a short squeeze resulted in a 1,500% increase in GameStop’s (GME) share price over two weeks. The increase was fueled by social media users on Reddit’s WallStreetBets. That type of risk had never been experienced and almost certainly was not expected—the previously highly successful hedge fund Melvin Capital lost about $7 billion betting against GME. And their short bets on some of the other high-flying meme stocks (shares of companies that gained viral popularity due to heightened social sentiment) of 2021, such as AMC, dug them deeper in the hole, leading to the shutdown of the fund in June 2022.

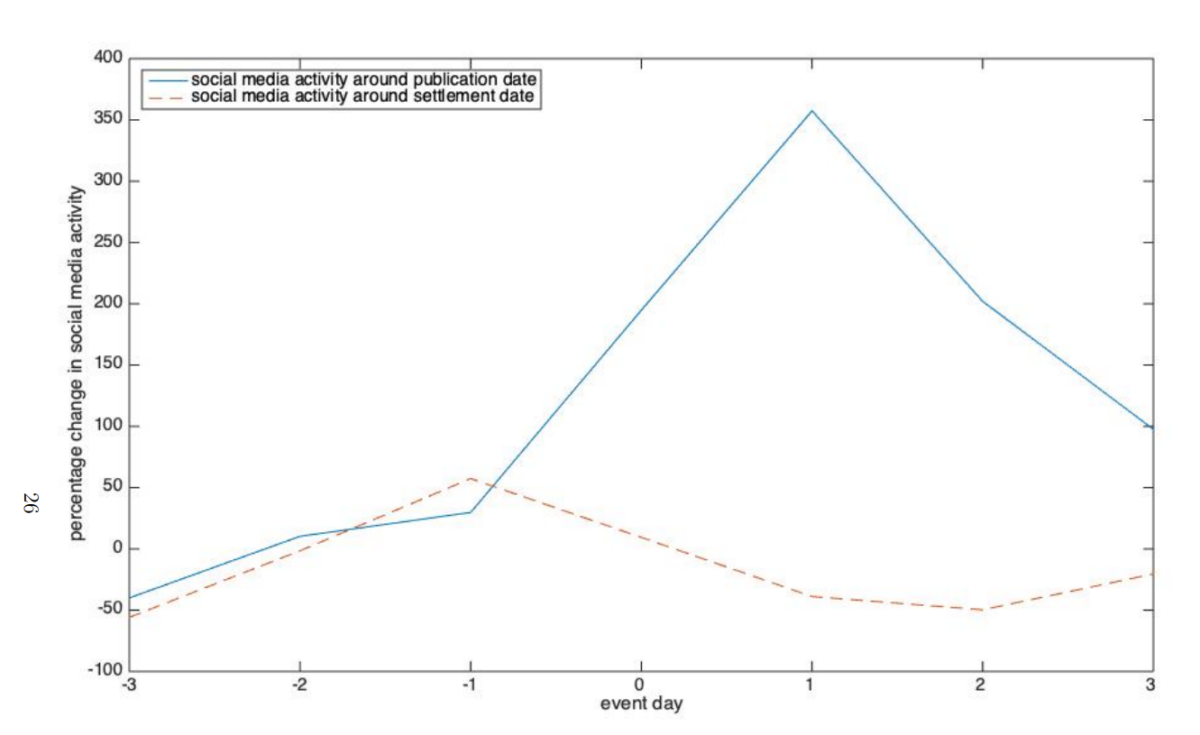

Investors can target short sellers because they are required to report their short positions to the Financial Industry Regulatory Authority (FINRA) by the 15th of each month (or the preceding business day if the 15th is not a business day). FINRA compiles the short interest data and discloses it to the public eight business days later.

Game Over?

Jun Chen, Byoung-Hyoun Hwang, and Melvyn Teo, authors of the October 2023 study “Did the Game Stop for Hedge Funds?” analyzed whether retail investors on social media platforms target hedge funds’ short positions; whether they succeed in pushing prices of stocks shorted by hedge funds; how hedge funds respond to the new threat posed by retail investors on social media platforms; and what the broader implications are for asset prices and market efficiency.

To test whether retail investors on social media platforms target hedge funds’ short positions, they used Reddit’s WallStreetBets (13.5 million subscribers as of the end of 2022). They examined how social media activity for a specific stock changed with the publication of that stock’s short interest level. Their data sample covered all U.S. stocks from January 2020 through March 2022, “a period characterized by intense social media activity on WallStreetBets.”

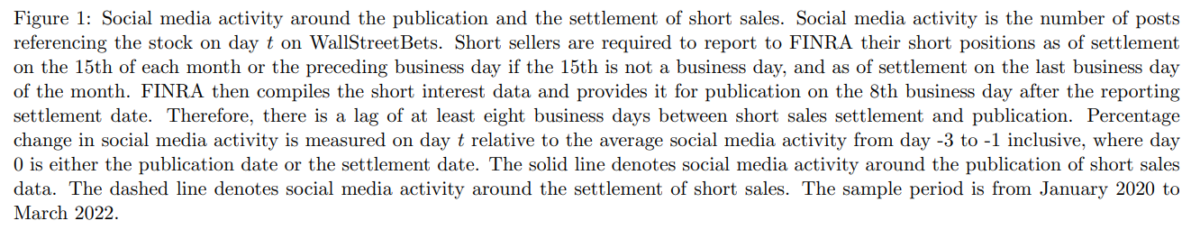

To measure the level and intensity of social media activity on a stock, they evaluated the number of posts, comments to posts, unique posters writing posts, emojis used in posts, and meme stock lingos employed in posts that referenced the stock. They classified as heavily shorted/high-short interest those stocks in the top one percentile relative to all other stocks based on short interest. They also restricted the sample to firms mentioned on WallStreetBets at least five times during the sample period. Their hedge fund data was from Morningstar, covering the period January 2020-March 2022, and included 2,551 U.S. hedge funds.

They began by noting that retail investors’ share of trading volume had increased 10 percentage points from 13% in 2011 to 23% in 2021 and that surveys had found that they frequently drew from social media when deciding which stocks to buy and sell. Their reliance on social media could lead to coordinated actions banding together to drive prices—it is illegal for institutional investors to engage in that behavior. The growing prevalence of retail investors and their increasingly coordinated action means that retail investors are becoming more important in setting prices—creating a threat to short sellers. Following is a summary of their key findings:

- During the sample period, at any point in time there were 27 highly shorted stocks. A total of 138 stocks were classified as highly shorted at some point during the sample period.

- Highly shorted stocks attracted 6.3 posts and 249 comments a day, while non-highly shorted stocks only elicited 0.2 posts and 2.3 comments a day.

- Consistent with the view that social media users react to the publication of short interest, social media activity on a stock increased following the publication date of short interest.

- A one standard deviation increase in short interest (i.e., a 7.5% increase) precipitated a meaningful 22.8% increase (t-statistic = 4.47) in the number of posts referencing the stock the day after the publication date.

- Social media attention in a stock increased following the disclosure of hedge fund put option positions (required every quarter on Form 13) in the stock, but not after the purchase of those put options—retail investors targeted hedge fund short positions once they were revealed to the investment public.

- A one standard deviation increase in the number of posts on a stock relative to the mean precipitated an economically meaningful 2.3% increase (t-statistic = 3.55) in stock returns the next day for high short-interest stocks relative to a similar increase in the number of posts for other stocks.

- For stocks affected by trading restrictions of platforms (i.e., Robinhood) social media activity no longer impacted future stock returns when those trading restrictions were in effect—providing evidence that social media activity and stock prices are causally related.

- The impact of social media on stock returns was stronger when the words “short seller,” “shorts” and “squeeze” were referenced in social media posts about the stock.

- Social media activity was a better harbinger of higher stock returns when hedge funds publicly disclosed put option positions on a stock or were mentioned in social media posts about that stock.

- A one standard deviation increase (relative to the mean) in the monthly number of posts on the heavily shorted stocks led to a 0.4% decrease in fund returns and a 0.7% reduction in fund Fung and Hsieh seven-factor alpha the next month. Conversely, hedge fund performance was unrelated to social media activity on the non-heavily shorted stocks that a fund sold short.

- After the first quarter of 2021, hedge funds reduced by 57% both the dollar value of and the equivalent number of shares outstanding associated with their publicly disclosed short positions on high short-interest stocks. They also sold short 67% fewer shares in high short-interest stocks. However, there was not a reduction in hedge funds’ publicly disclosed short positions on other stocks, nor a reduction in their non-publicly disclosed short positions on high short-interest stocks.

- In the process of squeezing hedge fund short positions in high short-interest stocks, social media users moved stock prices above fundamental values—heavily shorted stocks that experienced high social media traffic, and therefore were more likely to appreciate, were also less likely to announce positive cash flow news.

Their findings led Chen, Hwang, and Teo to conclude:

“Retail investors encourage each other on social media to pile into stocks that hedge funds currently short either for ideological reasons or in an attempt to engineer a short squeeze. The buying pressure from retail investors, perhaps exacerbated by the ensuing squeeze with hedge funds also buying to cover their short positions, cause stock prices to rise.”

They added:

“Our findings validate concerns raised by practitioners that it has become increasingly risky to short sell heavily shorted stocks as social media platforms allow retail investors to mount coordinated attacks against short sellers.”

Investor Takeaways

A large body of evidence demonstrates that short sellers are informed investors who play a valuable role in keeping market prices efficient—short-selling leads to faster price discovery. If retail investors were informed, their coordinated actions would lead to more market efficiency. However, since the research shows they tend to be noise traders, their increased trading can lead not only to less efficiency but even to destabilization of financial markets. They have already demonstrated that they are a threat to hedge funds that serve to keep markets efficient through their price discovery efforts and their shorting of stocks whose prices have been driven up (by sentiment-driven retail investors) to levels not supported by fundamentals.

Compounding the risks of shorting, as Xavier Gabaix and Ralph Koijen demonstrated in their 2021 study “In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis,” markets have become less liquid and thus more inelastic. Gabaix and Koijen estimated that today $1 in cash flow results in an increase of $5 in valuation. One explanation for the reduced liquidity is the increased market share of indexing and passive investing in general. Reduced liquidity increases the risks of shorting. The result has been that while the game of short selling isn’t over for hedge funds, the threat of retail investors banding together has led to a significant decrease in their shorting activities in heavily shorted stocks. The limits to arbitrage have increased, allowing for more overpricing of “high sentiment” (typically glamour growth) stocks, making the market less efficient. Thus, one takeaway for advisors and investors is that we are likely to see more persistent overpricing on the wrong side of anomalies—and ultimately crashes as the fundamentals are revealed. For example, GameStop reached a high of about $120 on January 21, 2021 ($483 adjusted for the 4:1 stock split on July 18, 2022). On November 13 it closed at $12.15 (a fall of about 90% from its peak).

Another takeaway for advisors and investors is to avoid being a noise trader. Don’t get caught up in following the herd over the investment cliff. Stop paying attention to prognostications in the financial media or posts on social media. Most of all, have a well-developed, written investment plan. Develop the discipline to stick to it, rebalancing when needed and harvesting losses as opportunities present themselves.

Finally, advisors and investors should be aware that fund families that invest systematically have found ways to incorporate the research findings on the limits to arbitrage and the evolving changes we have discussed to improve returns over those of a pure index replication strategy. It seems likely this will become increasingly important, as the markets have become less liquid, increasing the limits to arbitrage and allowing for more overpricing. The evidence demonstrates that you should not own stocks with high borrowing fees. Forewarned is forearmed.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. The securities mentioned in this article are for informational purposes only and should not be construed as a recommendation. Investing involves risk. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-587

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.