Doug Talks with Belle about 1042 QRP ESOP Solutions

By Wesley Gray, PhD|November 1st, 2023|Podcasts and Video, Media, 1042 QRP Solutions, Tax Efficient Investing|

In this episode host Belle Osvath, CFP® talks with Doug Pugliese who is the Head of 1042 QRP Strategies at Alpha Architect. They discuss 1042 exchanges which allow the owner of a closely held C-Corp to sell their equity to an employee stock purchase plan and defer long-term capital gains as long as they rollover the proceeds into a qualified investment. Doug talks about the benefit to a company and the employees when creating an ESOP and does an excellent job at breaking down the strategy behind the decision. Doug also identifies which business owners are ideal candidates for this type of exchange and discusses the limited investment options that business owners have historically faced and how his team is working to change that. If you have business owner clients our are just curious about this innovative approach to 1042 exchanges this is the show for you.

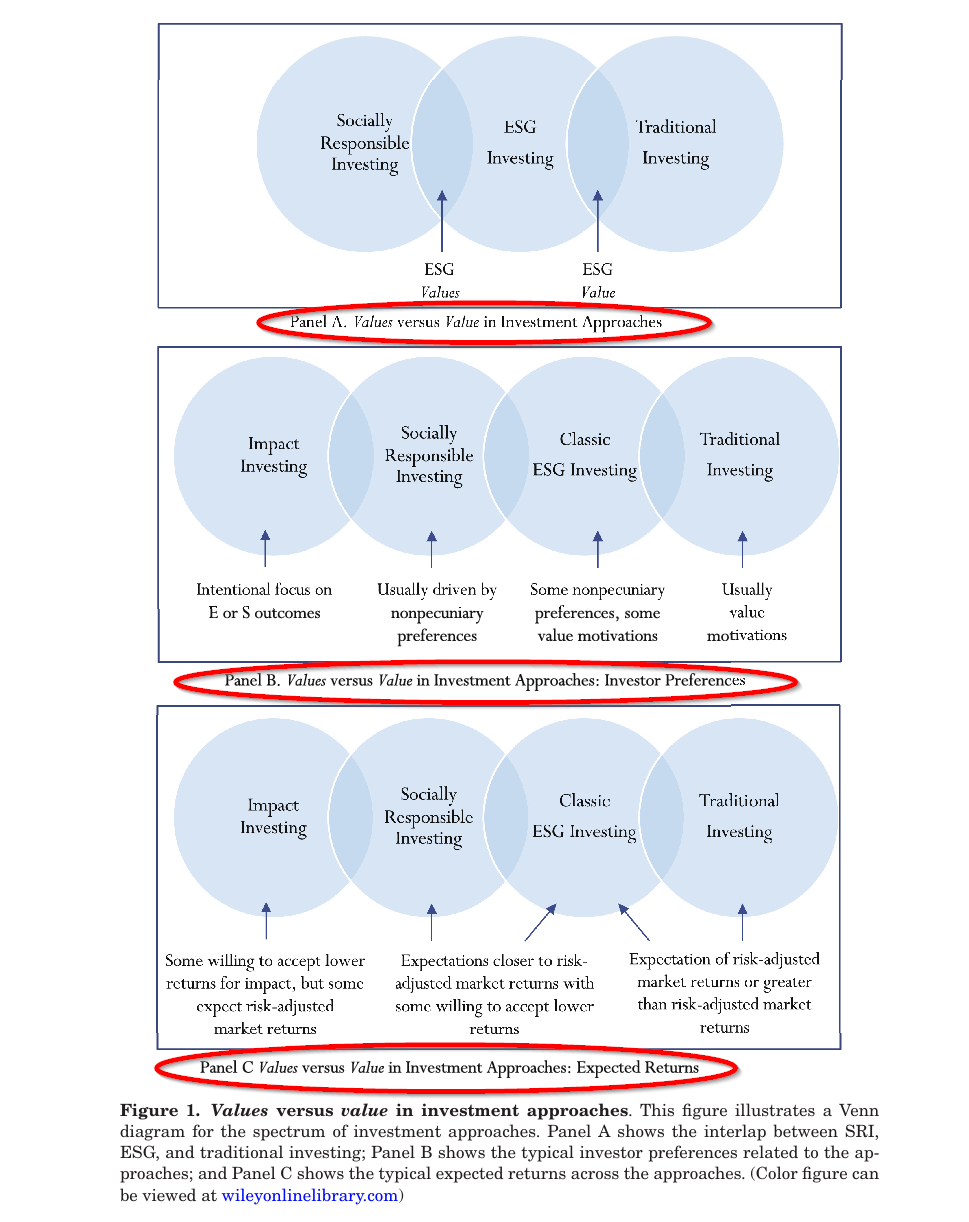

Value versus Values in ESG Investing

By Tommi Johnsen, PhD|October 30th, 2023|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

The relationship between financial markets and ESG investing is obscured by the lack of clarity regarding motivations for investing in ESG strategies. Is the motive to align the investor’s values with the ESG theme? Or is the ESG term a misnomer for a set of stocks that are systematically undervalued, for some reason as a function of its ESG characteristics?

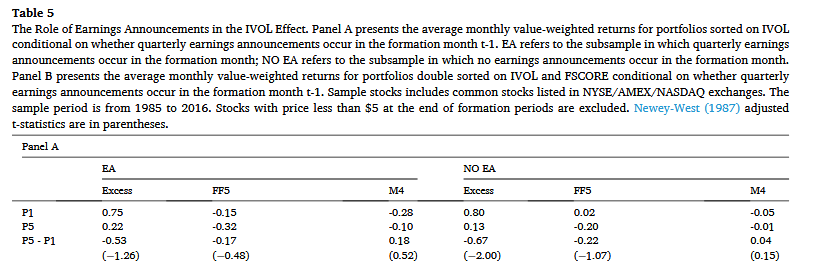

Dissecting the Idiosyncratic Volatility Puzzle

By Larry Swedroe|October 27th, 2023|Volatility (e.g., VIX), Research Insights, Larry Swedroe, Low Volatility Investing|

Idiosyncratic volatility (IVOL) is the volatility of a security that cannot be explained by overall market volatility—it is the risk unique to a particular security. IVOL contrasts with systematic risk, which is the risk that affects all securities in a market (such as changes in interest rates or inflation) and, therefore cannot be diversified away. On the other hand, the risks of high IVOL stocks can at least be reduced through diversification.

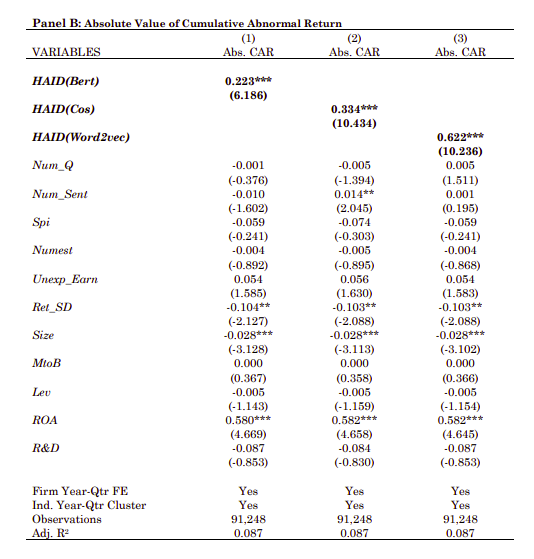

Executives vs. Chatbots in Earnings Conference Q&A

By Elisabetta Basilico, PhD, CFA|October 23rd, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning, Corporate Governance|

In this study, we introduce a novel measure of information content (Human-AI Differences, HAID) by exploiting the discrepancy between answers to questions at earnings calls provided by corporate executives and those given by several context-preserving Large Language Models (LLM) such as ChatGPT, Google Bard, and an open source LLM.

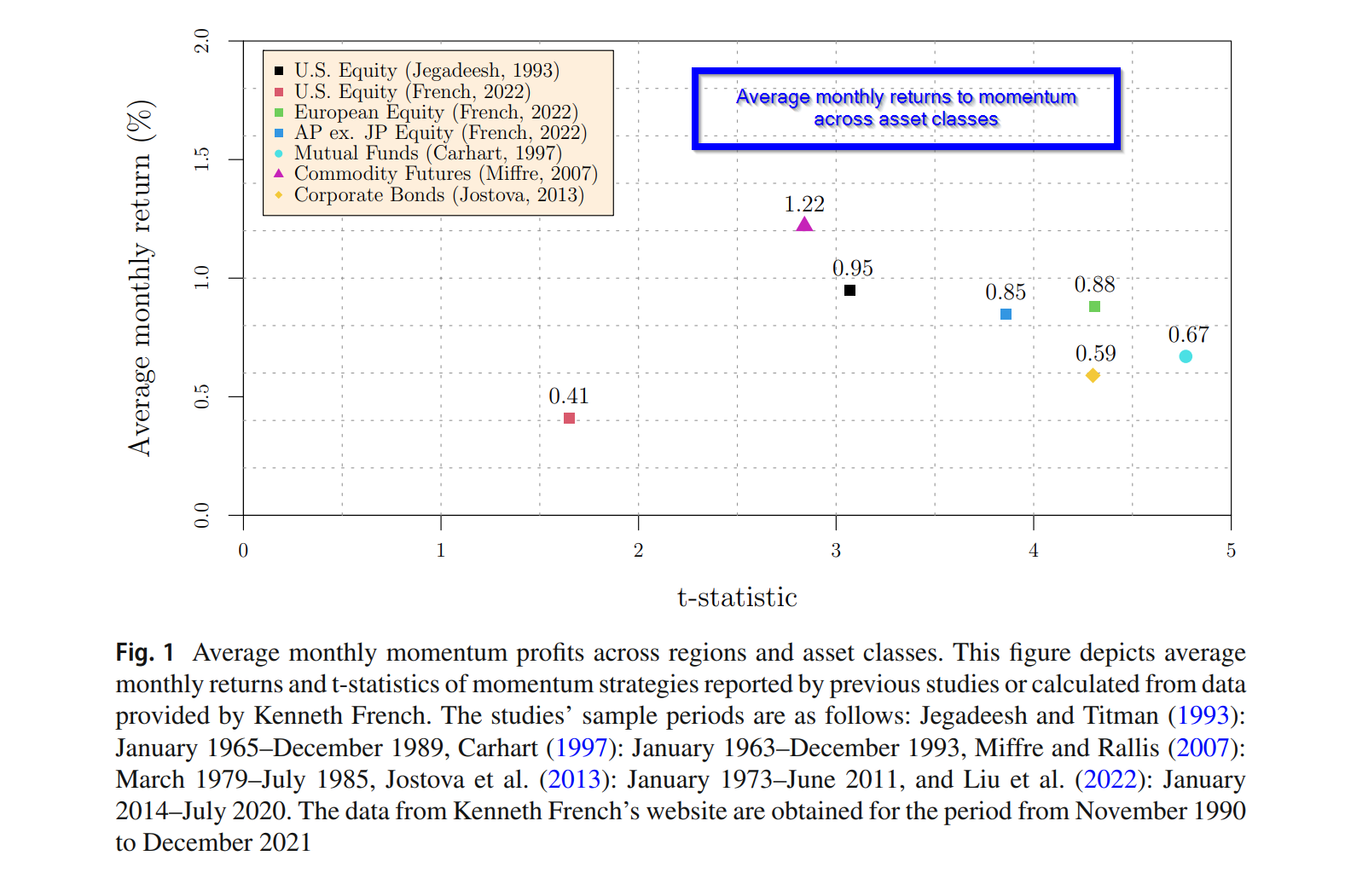

Factor Investors: Momentum is Everywhere

By Tommi Johnsen, PhD|October 16th, 2023|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Momentum Investing Research|

The Jegadeesh and Titman (1993) paper on momentum established that an equity trading strategy consisting of buying past winners and selling past losers, reliably produced risk-adjusted excess returns. The Jegadeesh results have been replicated in international markets and across asset classes. As this evidence challenged and contradicted widely accepted notions of weak-form market efficiency, the academic community took notice and started churning out research. As a result, a very large number of academic studies were published on momentum. The article summarized here has conveniently summarized 47 articles deemed as the highest quality and published in either the Journal of Finance, the Review of Financial Studies, or the Journal of Financial Economics, all three considered premier journals in the finance discipline. It is difficult to understate the importance of having a well-curated summary of momentum research. Keep it in your library.

Trend-Following Filters – Part 7

By Henry Stern|October 13th, 2023|Empirical Methods, Research Insights, Trend Following, Guest Posts|

This article examines four digital filters commonly used for trend-following: moving average linear weighted moving average exponential smoothing time series momentum

Global Factor Performance: October 2023

By Wesley Gray, PhD|October 10th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

Institutional Investing and Manager Forbearance

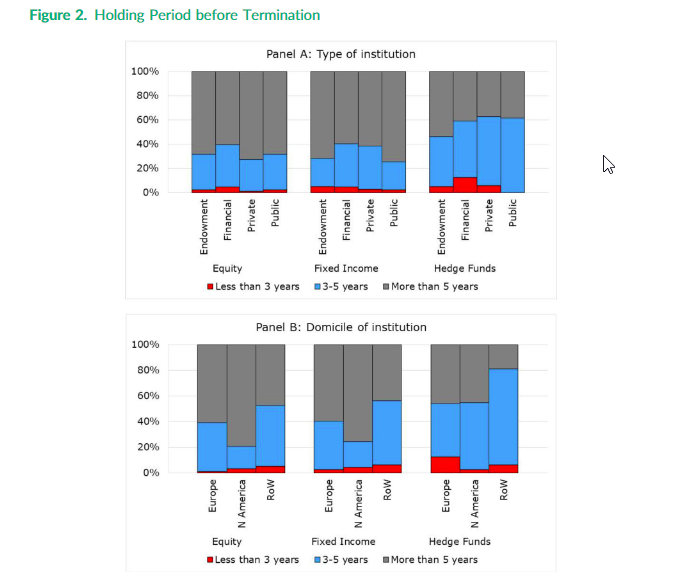

By Elisabetta Basilico, PhD, CFA|October 9th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

Forbearance is important and we argue that performance evaluation should be multifaceted, akin to a Bayesian decision-maker who conducts continued due diligence and updates beliefs about returns with process information.

How to Crush the CFPⓇ Exam ????: Part 2

By Jess Bost|October 6th, 2023|Women in Finance Know Stuff, Guest Posts, Other Insights, Investor Education|

As discussed in Part 1 of this blog series, the Certified Financial Planner (CFPⓇ) exam can be a stressful and intimidating experience. With eight areas of content to cover – both as siloed financial knowledge and also as an integrated approach to building a comprehensive financial plan – it's important to be organized and intentional in your study efforts.

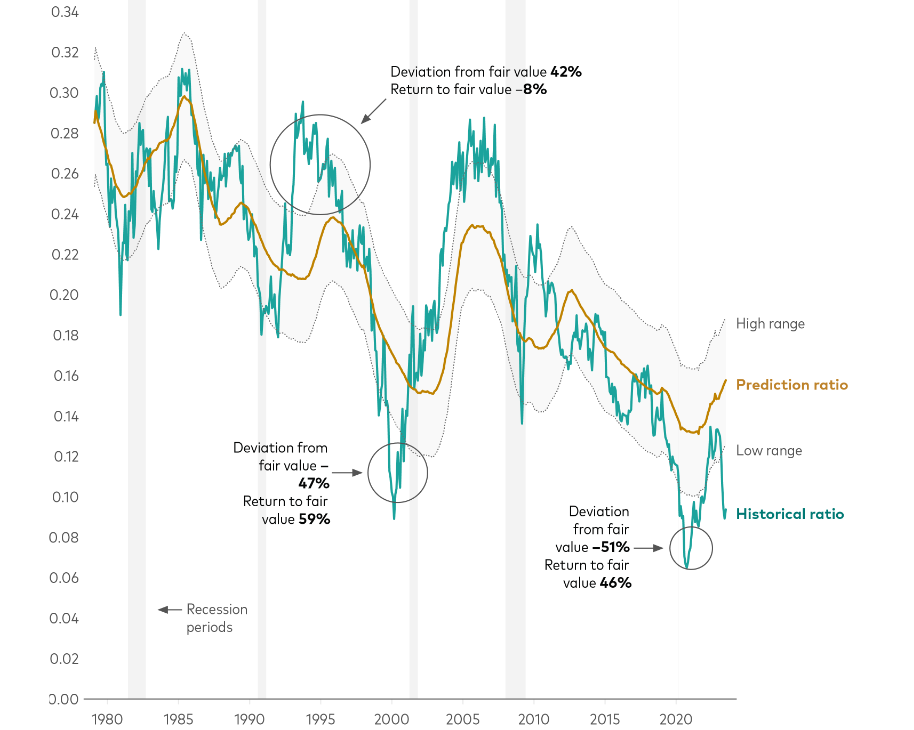

International Value Stocks Offering “More Bang for the Buck”

By Larry Swedroe|October 5th, 2023|Larry Swedroe, Research Insights, Guest Posts, Other Insights, Value Investing Research|

Over the very long term, while value stocks have been less profitable and have had slower growth in earnings than growth stocks, they have provided higher returns.