Factors Timing is a Difficult Practice

By Wesley Gray, PhD|June 21st, 2021|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Factor Exposure Variation and Mutual Fund Performance Ammann, Fischer and [...]

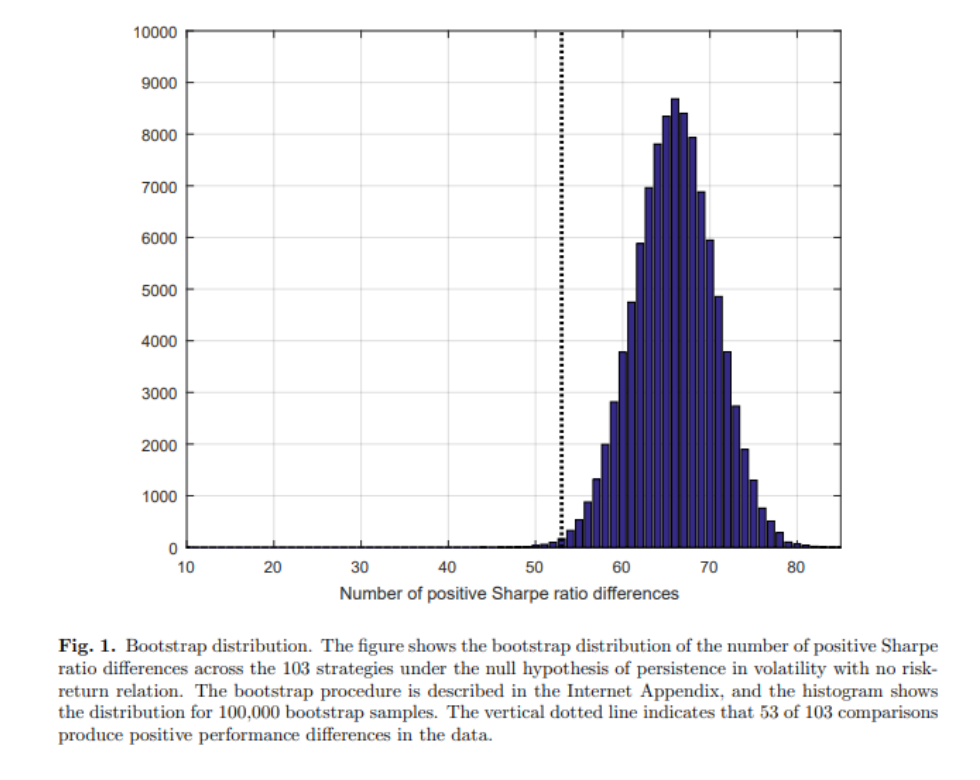

The Performance of Volatility-Managed Portfolios

By Larry Swedroe|June 17th, 2021|Volatility (e.g., VIX), Larry Swedroe, Factor Investing, Research Insights, Trend Following, Tactical Asset Allocation Research|

As far back as 1976, with the publication of Fischer [...]

How to NOT Sound like a Washing Machine Salesman on LinkedIn

By Sara Grillo|June 15th, 2021|Guest Posts, Investment Advisor Education, Other Insights|

I’m constantly hearing from financial advisors who are getting nowhere [...]

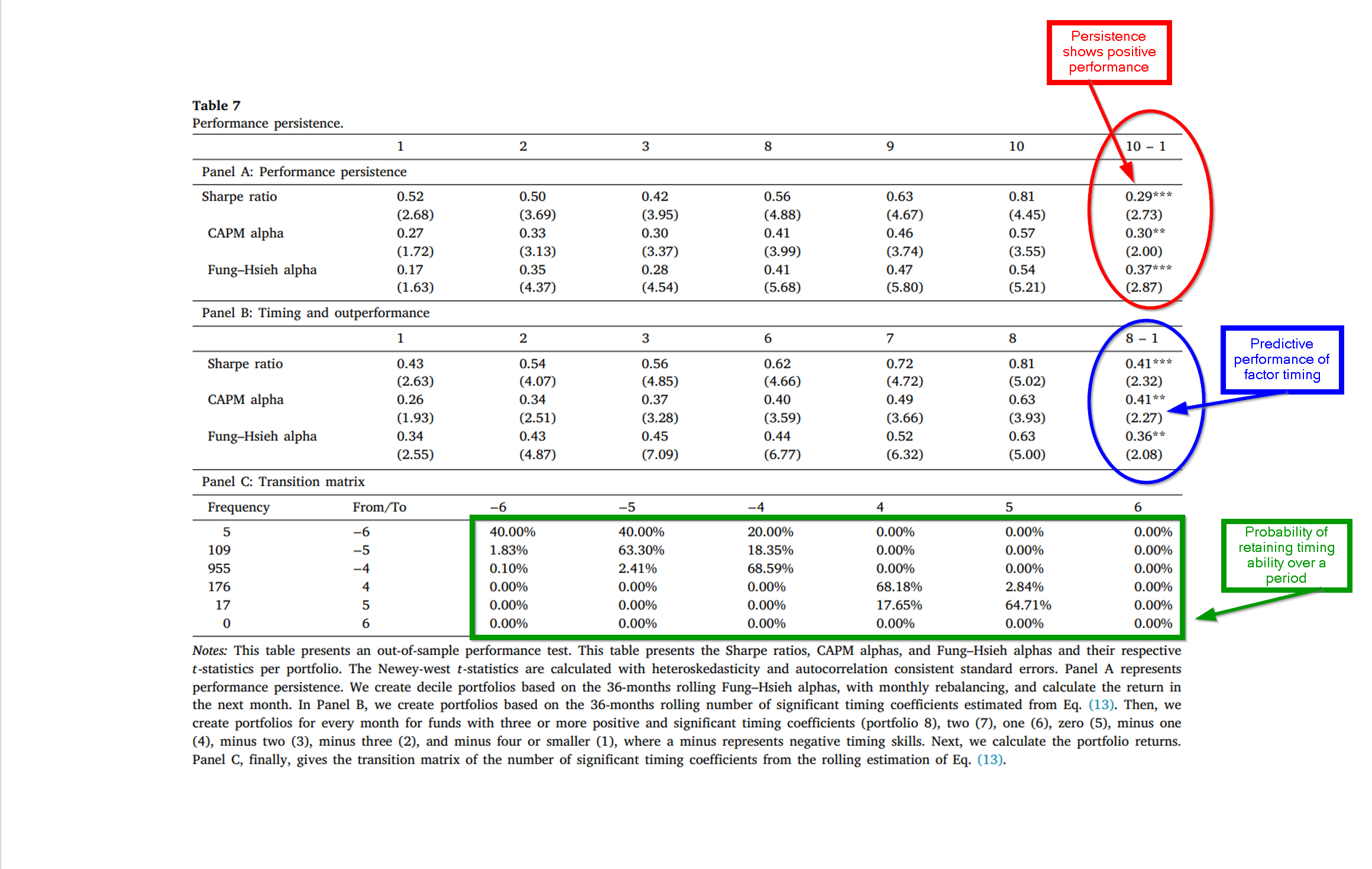

Can Hedge Funds Successfully Time Factors?

By Tommi Johnsen, PhD|June 14th, 2021|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Timing is money: The factor timing ability of hedge fund [...]

The Costs and Benefits of Tax-Loss-Harvesting (TLH) Versus an ETF

By Wesley Gray, PhD|June 11th, 2021|Research Insights, Tax Efficient Investing, ETF Investing|

Recently, we have experienced a rush of questions from investors/clients [...]

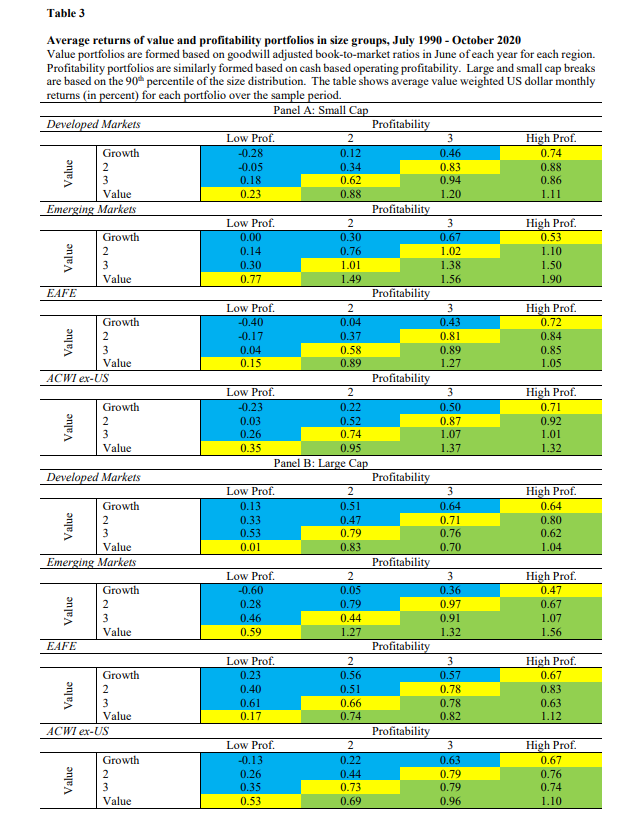

Combining Value and Profitability Factors: the International Evidence

By Larry Swedroe|June 10th, 2021|Quality Investing, Larry Swedroe, Factor Investing, Research Insights, Value Investing Research|

My October 29, 2020, article for Alpha Architect examined the [...]

Selling a Business? Here are 8 Ways to Minimize Your Taxes:

By Adam Tkaczuk|June 8th, 2021|Research Insights, Guest Posts, 1042 QRP Solutions, Tax Efficient Investing|

When an owner sells their business, the IRS and state [...]

Global Factor Performance: June 2021

By Wesley Gray, PhD|June 8th, 2021|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

Still Using Book to Market for a Value Metric? Read This.

By Wesley Gray, PhD|June 7th, 2021|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Going by the Book: Valuation Ratios and Stock Returns Choi, [...]

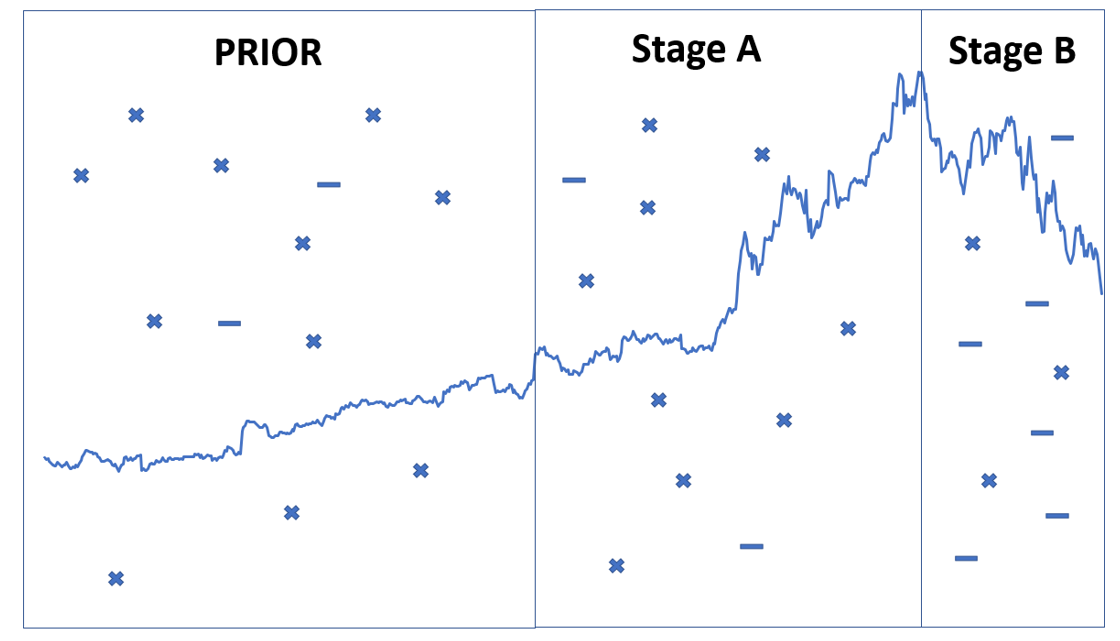

This Time is Different? Consider Quantifying Subjective Priors

By David Primer|June 4th, 2021|Empirical Methods, Research Insights, Academic Research Insight, Guest Posts, Behavioral Finance|

This time is different. --John Templeton "This time is different," [...]