Academic Research Insight: Political Connections May Actually Increase SEC oversight

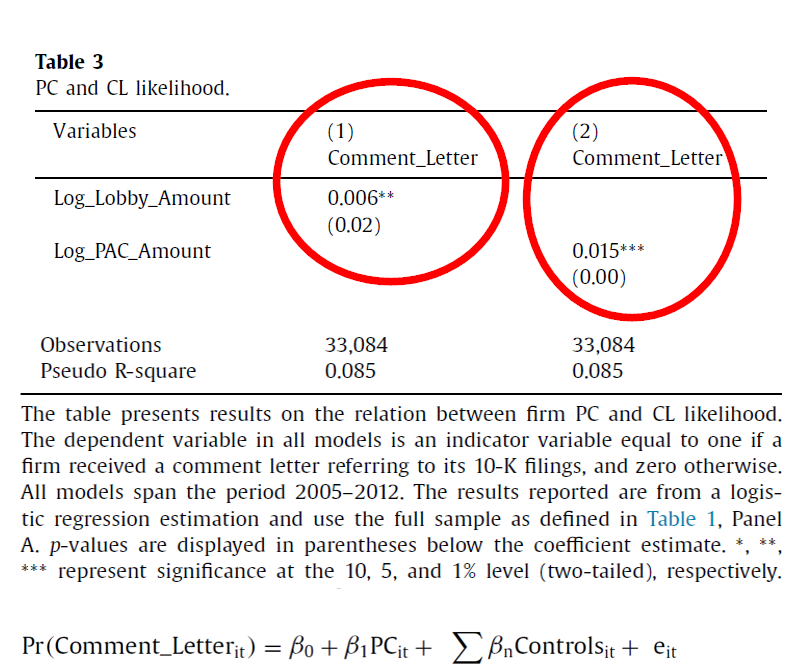

Do political connections help or hinder SEC oversight? Jonas Heese, Mozaffar Khan, Karthik Ramanna Journal of Accounting and Economics A version of this paper can be found here Want to read our summaries of academic finance papers? [...]