We’ve covered momentum investing extensively over the years, to include 94 posts, a book on the subject, and numerous discussions on various podcast outlets.

There are a few things one notices after thinking about a topic for so long:

- You forgot half of the things you read and/or wrote (yes, we have redone research on specific ideas and realized after that fact that we had already done the same research project in the past. Pathetic, we know.)

- Certain questions continually come up.

This post is a recap of a presentation I gave at the 2018 CMT Annual Symposium. (Click here if you want to sign up for next years event).

A PDF version of this is available here.

Figure 1: A Rare Shot of Wes Wearing Business Casual Attire

The title of the talk was, “Momentum Investing: Simple, But Not Easy.”(1)

And the lecture addresses four key questions that are most common:

- What is momentum?

- Do transaction costs destroy momentum profits?

- Is momentum too crowded?

- Can momentum work in the future?

We’ll discuss each of these throughout this post and link to supporting materials so you can go down the wormhole of momentum investing.

Here are the summary answers to the questions above:

- Buying winners

- No, but capacity is limited.

- No, at least as measured via the ETF market.

- Yes, because of fundamental risk and costly arbitrage.

Here are the associated powerpoint slides and below is a video of the lecture on momentum investing:

Can the answers to the questions above change? Sure. And if you identify a research collective that suggests otherwise, please let us know. Love to investigate and explore further!

Additional Reading Materials

What is Momentum?

There is sometimes confusion associated with so-called momentum strategies. When we discuss momentum in this piece we are talking about what is commonly referred to as “relative strength” by practitioners. However, relative strength is referred to as “momentum” in academic research and factor geek-speak. The confusion lies in the fact that “momentum” can mean something else to practitioners (e.g., trend-following).(2)

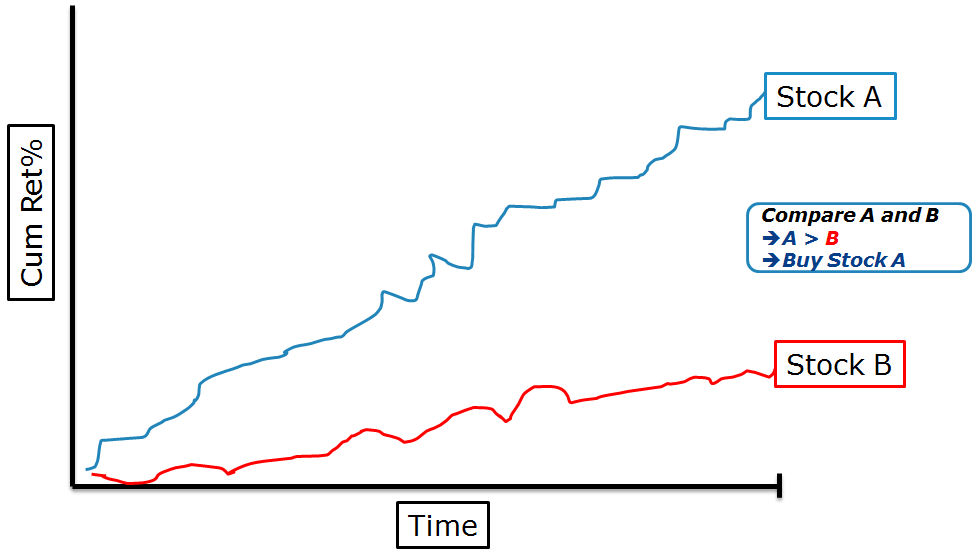

A simple example will illustrate the type of momentum under consideration. Consider a hypothetical scenario where we have two stocks in our universe: Stock A and Stock B.

Stock A is up 100% and stock B is up 25% over the past 12 months. The chart below illustrates the situation:

The relative strength “momentum” rule will buy a stock if the stock’s past performance over the past 12 months is relatively stronger than the past performance of other stocks in the universe (and will sell a stock if it has poor relative performance to other stocks). In the example above, stock A is a buy and stock B is a sell (or avoid if this is a long-only strategy).(3)

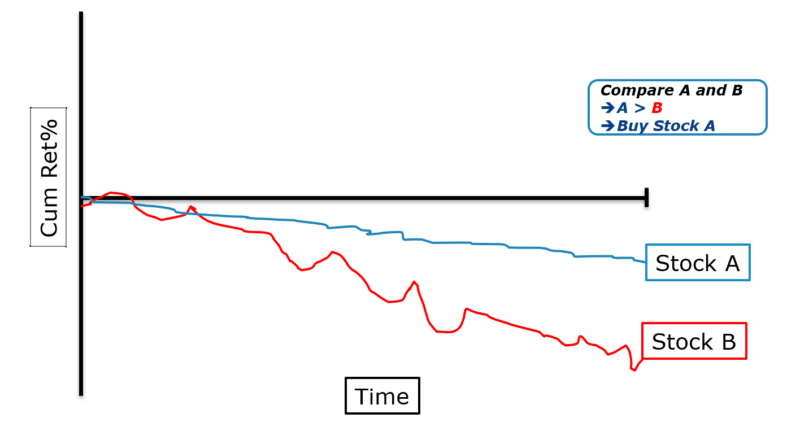

Let’s look at another scenario and see how the rule reacts. Consider a case where stocks A and B are both losing, but stock A has done relatively better than stock B.

In this scenario, the relative-strength momentum rule would buy stock A and short stock B. We highlight this example because some “momentum” strategies would avoid both stocks A and B. These momentum strategies are NOT what we will be discussing in this post. This post if focused exclusively on relative strength momentum.

Why is the relative strength momentum rule so interesting to academics? The historical performance is incredible and Eugene Fama, the 2014 co-recipient of the Nobel Prize in Economics and father of the efficient market hypothesis, and his equally well-credentialed co-author, Ken French, have summarized the academic research on momentum as follows:(4)

The premier anomaly is momentum.

When the greatest empirical finance researchers suggest momentum is the leading academic anomaly, we take note.(5)

As natural skeptics, we have independently verified many of the empirical results associated with momentum.

Do Transaction Costs Destroy Profits?

In order to capture the so-called momentum premium the strategy requires a high degree of turnover relative to other investment factors, such as value, quality, size, and everything else in the factor zoo. A natural question arises: Can momentum profits survive transactions costs?

Some posts on the topic:

- Factor Investing and Trading Costs

- The Best Research Paper Ever Written on Trading Costs

- Surprise! The Size, Value, and Momentum Anomalies Survive After Trading Costs

Is Momentum Too Crowded?

Momentum seems to be a hot topic these days, primarily due to the fact that the largest public momentum fund (iShares MTUM) has been crushing it recently. One also can identify plenty of recent ETF product launches with the word “momentum” in the title.(6)

A natural hypothesis is that perhaps momentum is too crowded, and therefore might be “dead.”

To test this claim, David Blitz conducts a study and finds that there doesn’t appear to be any systematic pressure on momentum-based strategies. Buyers and sellers appear in balance.

Can an Open Secret Work in the Future?

Momentum is not a secret. In fact, momentum has probably been part of investing nomenclature since the dawn of time. But how can an open secret work in the future? Nobody really knows the answer, but our best guess is that “open secret” strategies, which have undeniable evidence backing them, subject investors to more pain to generate their excess gains (in the form of fundamental risk and/or career risk).

Here are some posts on the subject:

- The Sustainable Active Investing Framework

- Trust the Process

- Academic Factor Portfolios are Extremely Painful. Unless you are an Alien.

References[+]

| ↑1 | This title is used in similar presentations we’ve given on value investing and active investing more broadly. |

|---|---|

| ↑2 | We think most of this confusion stems from a 1997 paper by Mark Carhart, where he proclaims the announcement of the so-called “momentum factor”, which is built upon the research by Jegadeesh and Titman (1993), who refer to their strategy as relative strength and never even use the term “momentum” in the source paper. Nonetheless, because Carhart’s paper got so much traction the original Jegadeesh Titman paper is also now referred to as the original “momentum paper.” |

| ↑3 | There are generally two types of momentum rules: 1) a time-series momentum rule and 2) a simple relative strength, or “cross-sectional,” momentum rule. The time-series rule, which we are not discussing in this piece but describing for clarity’s sake, will buy a stock that has positive performance over the past 12 months and will sell a stock if the stock has negative performance. Using our example above, a time-series, or “trend-following,” momentum strategy would like both stocks A and B. One could use elements of both types of momentum to develop a momentum strategy. For example, we could consider both momentum elements and invest based on both the time series rule and the cross-sectional rules. However, this approach is not part of this discussion. |

| ↑4 | Fama, E. and K. French, 2008, Dissecting Anomalies, The Journal of Finance, 63, pg. 1653-1678. |

| ↑5 | Fama and French make this statement because the empirical research on the momentum effect is compelling. For example, academic researchers have examined stock data going back over 200 years and identified a significant and robust historical performance record. Geczy, C. and M. Samonov, 212 Years of Price Momentum, University of Pennsylvania Working Paper, accessed 10/31/2015 |

| ↑6 | A recent post on the subject highlights the nuance of this result, which seems to be more driven by mega-cap exposure than momentum exposure. |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.