An Introduction to Investing in Carbon Markets

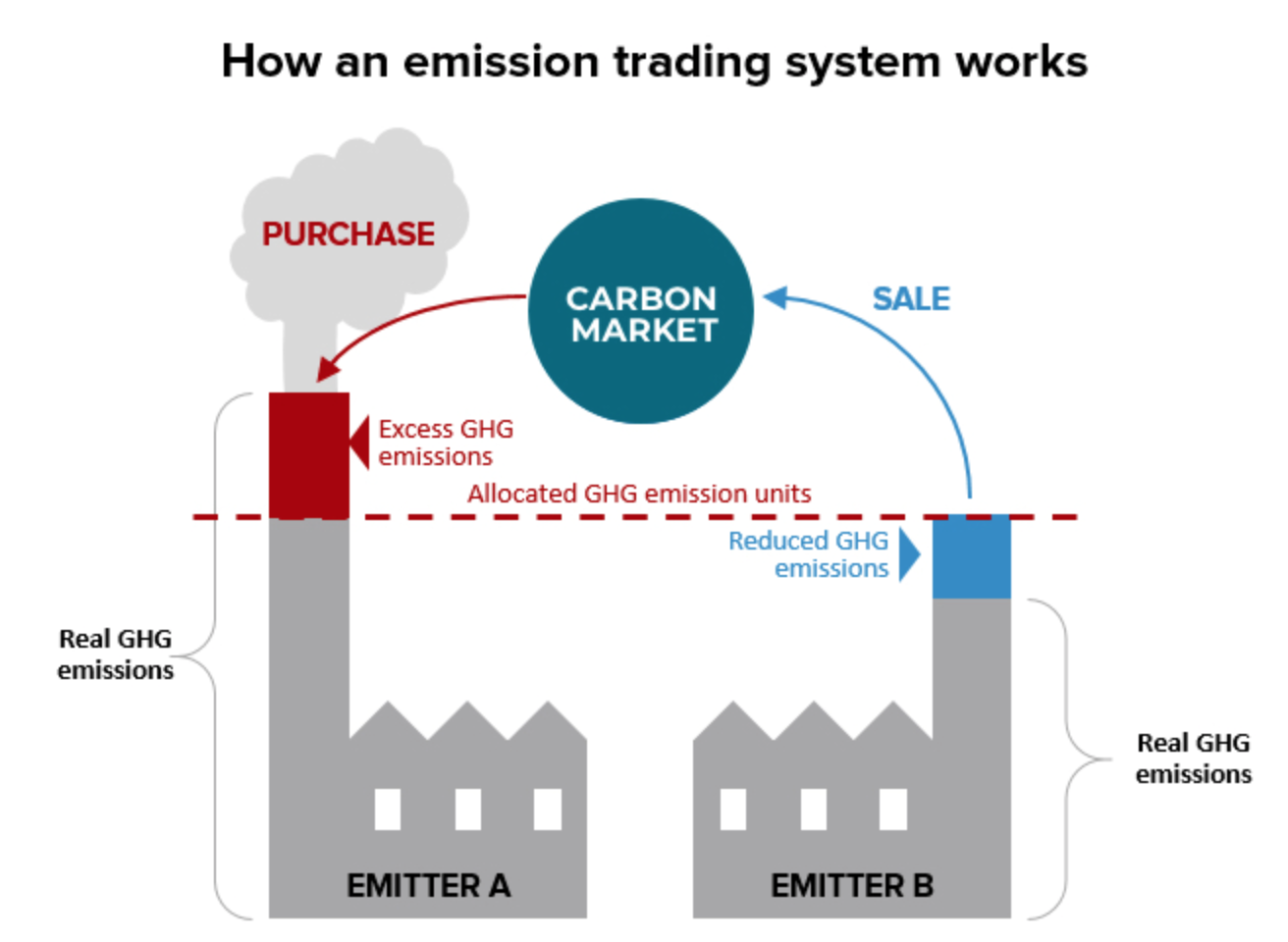

Carbon markets are quickly making their way to the forefront of Environmental, Social, and Governance (ESG) investing, as well as the finance community as a whole. The Kraneshares Global Carbon ETF, (Ticker: KRBN) (whose holdings I’ll dive into shortly) was one of the top 5 performing ETFs in 2021 on a % return basis (Ferringer, Best performing ETFs of the Year - etf.com). However, it doesn’t appear that 2021 was a one-hit-wonder for Carbon Markets, but instead, the beginning of a new and very real trend.