Can Machine Learning Improve Factor Returns? Not Really

By Tommi Johnsen, PhD|April 29th, 2024|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

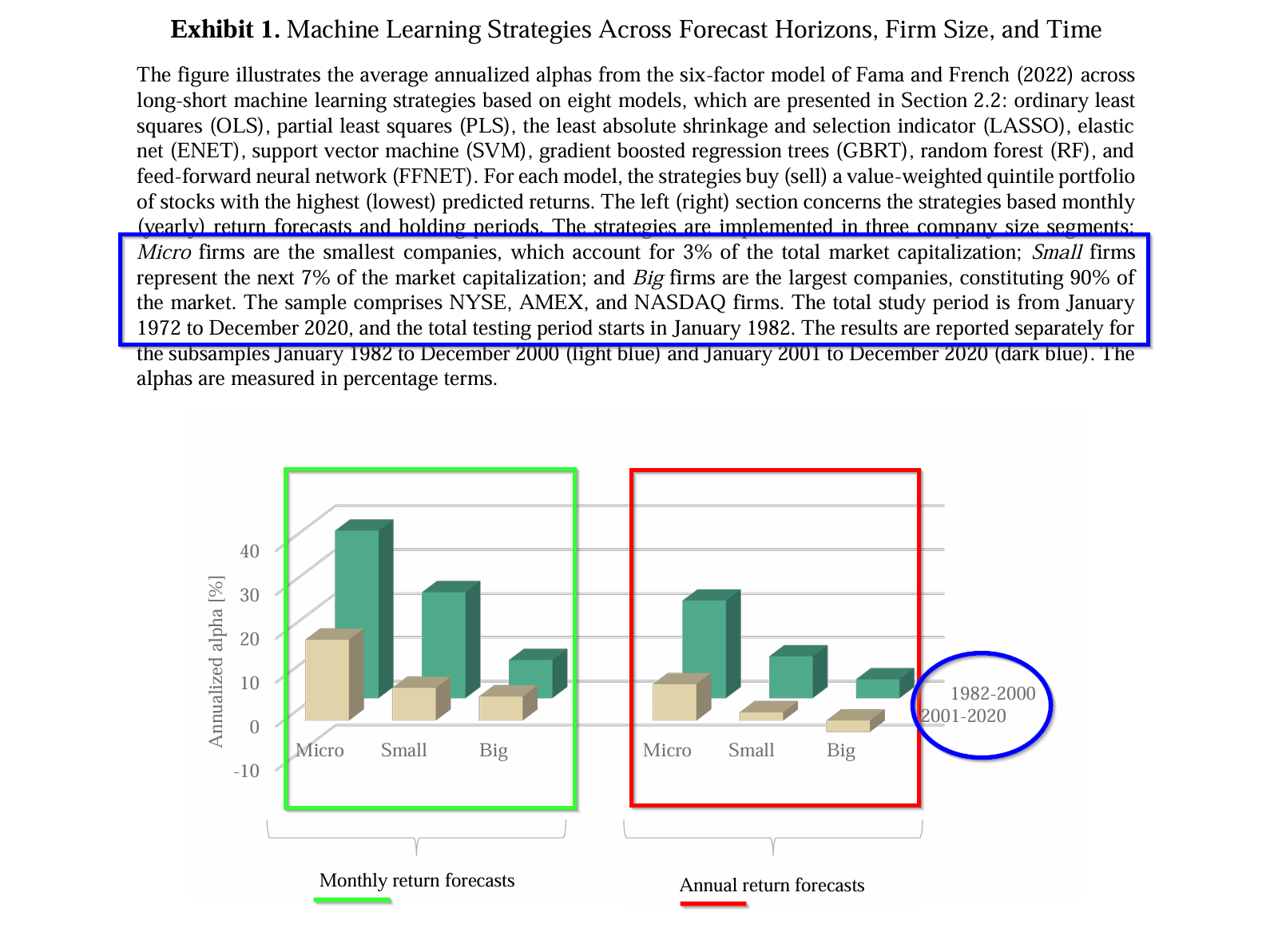

Can AI models improve on the failures in predicting returns strictly from a practical point of view? In this paper, the possibilities are tested with a battery of AI models including linear regression, dimensional reduction methods, regression trees and neural networks. These machine learning models may be better equipped to address the multidimensional nature of stock returns when compared to traditional sorting and cross-sectional regressions used in factor research. The authors hope to overcome the drawbacks and confirm the results of traditional quant methods. As it turns out, those hopes are only weakly fulfilled by the MLM framework.

Social Media, Analyst Behavior and Market Efficiency

By Larry Swedroe|April 26th, 2024|Larry Swedroe, Research Insights, Guest Posts, Other Insights, Behavioral Finance|

Hibbert, Kang, Kumar and Mishra provided us with yet another explanation: social media is providing analysts with information that reduces their forecasting errors. The result has been an increase in market efficiency, leading to a reduction in the PEAD anomaly. The bottom line is that the ability to generate alpha continues to be under assault—trying to outperform the market by stock selection is becoming even more of a loser’s game.

How to Crush the CFA Exams On Your First Attempt: Part II

By Jose Ordonez|April 25th, 2024|Compound Your Knowledge, Investor Education|

The key to success is studying for Level I and Level II not for the sake of passing that level, but for the sake of passing Level III.

How investors form beliefs and make decisions

By Elisabetta Basilico, PhD, CFA|April 23rd, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance|

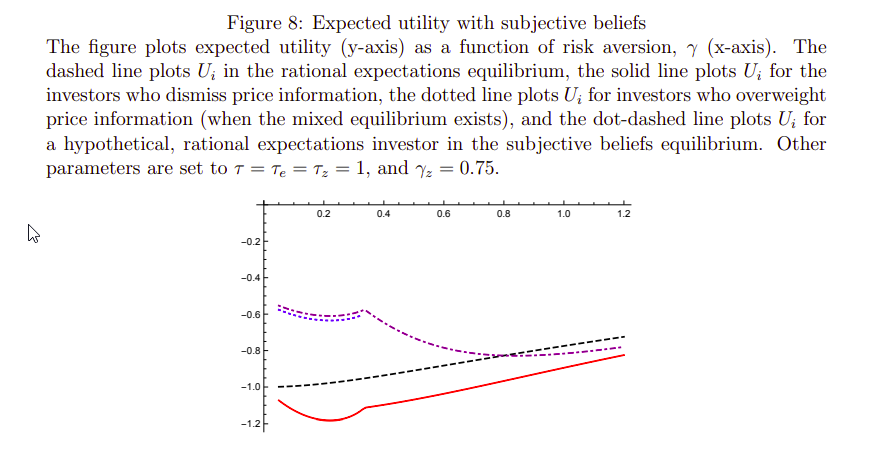

The implications of wishful thinking and subjective belief choice for endogenous disagreement among investors are substantial and can vary with economic conditions:

The Performance of the Hedge Fund Industry

By Larry Swedroe|April 19th, 2024|Empirical Methods, Transaction Costs, Larry Swedroe, Research Insights, Other Insights|

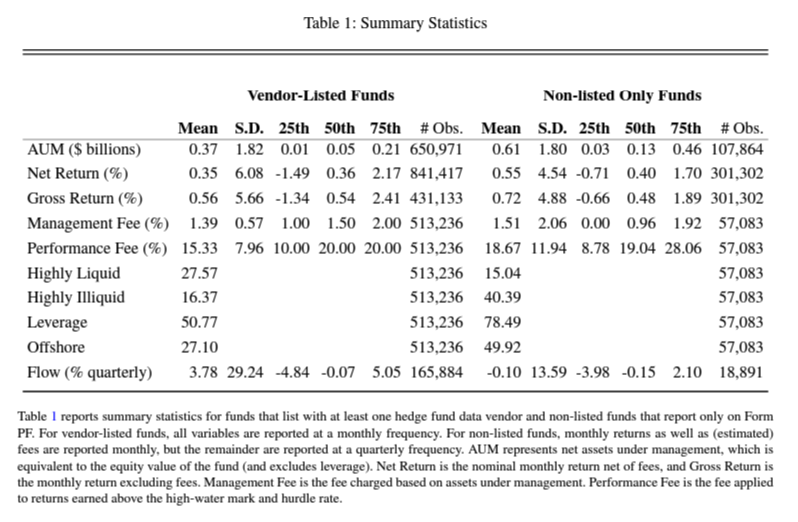

New research reveals that the performance of the hedge fund industry has not been as bad as the results from studies that relied on hedge fund data providers.

How to Crush the CFA Exams On Your First Attempt: Part I

By Jose Ordonez|April 17th, 2024|Investor Education, Uncategorized|

The CFA designation has for long been recognized as the gold standard for investment analysts. But like anything that is worth pursuing, obtaining the charter is no easy task.

Is Sector Neutrality in Factor Investing a Mistake?

By Tommi Johnsen, PhD|April 15th, 2024|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

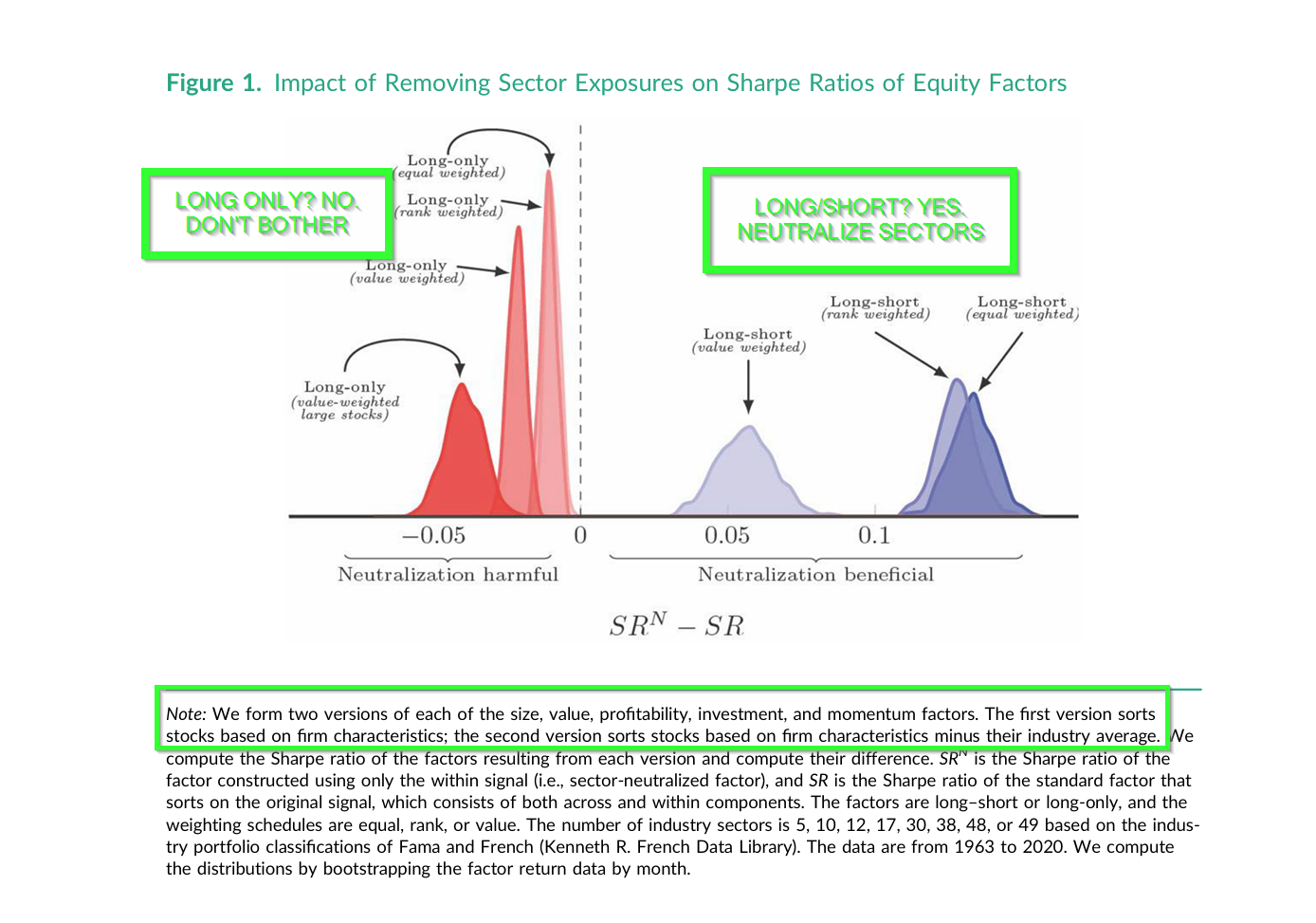

The justification for neutralizing sectors in factor strategies is a work in progress. To date, academic researchers haven't had an empirical model to mimic the impact of removing sector "effects" on the measurement and performance of factor strategies. The authors develop and test a two-component model to address the question of, "Is Sector Neutrality in Factor Investing a Mistake?"

Minimizing the Risk of Cross-Sectional Momentum Crashes

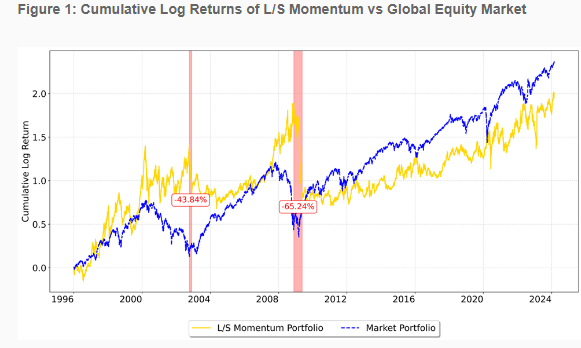

By Larry Swedroe|April 12th, 2024|Larry Swedroe, Factor Investing, Research Insights, Other Insights, Momentum Investing Research|

While the empirical research on cross-sectional (long-short) momentum has shown that returns have been high, investors have also experienced huge drawdowns—momentum exhibits both high kurtosis and negative skewness. Since 1926 there have been several momentum crashes that featured short, but persistent, periods of highly negative returns. For example, from June to August 1932, the momentum portfolio lost about 91%, followed by a second drawdown from April to July 1933.

Global Factor Performance: April 2024

By Wesley Gray, PhD|April 9th, 2024|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

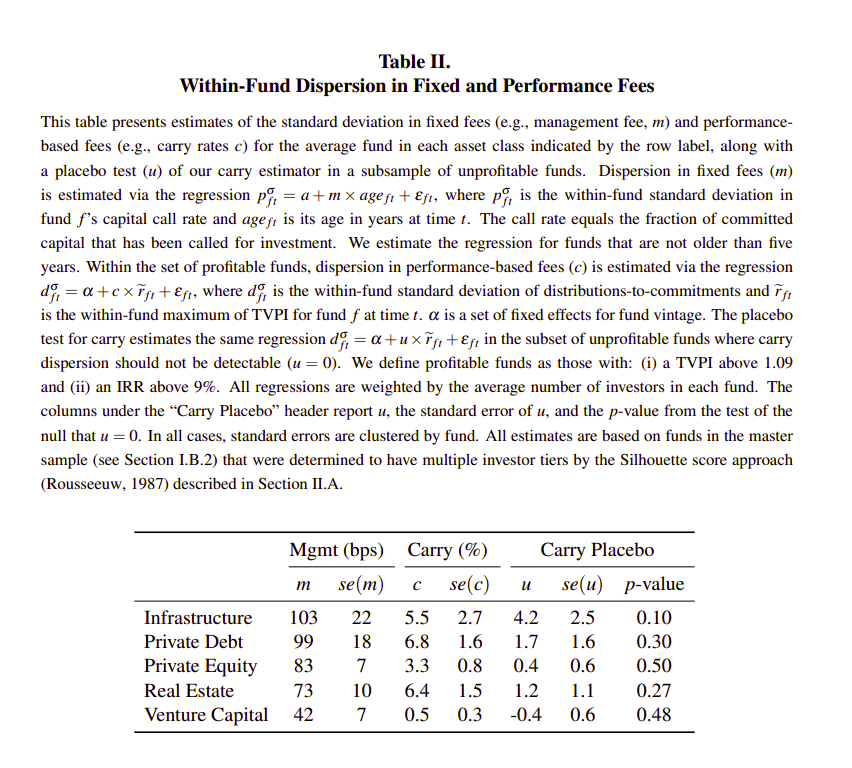

Fee Variation in Private Equity

By Elisabetta Basilico, PhD, CFA|April 8th, 2024|Private Equity, Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights|

Given the significant growth of investment in private markets, there have been increasing demands for greater transparency in the operation and structure of private market funds. This paper aims to address questions such as whether fees are set uniformly within most funds, and if not, by how much do they vary.