Frog in the Pan Momentum: International Evidence

By Tommi Johnsen, PhD|December 9th, 2024|Tommi Johnsen, Research Insights, Factor Investing, Academic Research Insight, Other Insights, Momentum Investing Research|

Underreaction to continuous news plays a key role in generating momentum internationally.

Global Factor Performance: December 2024

By Wesley Gray, PhD|December 9th, 2024|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

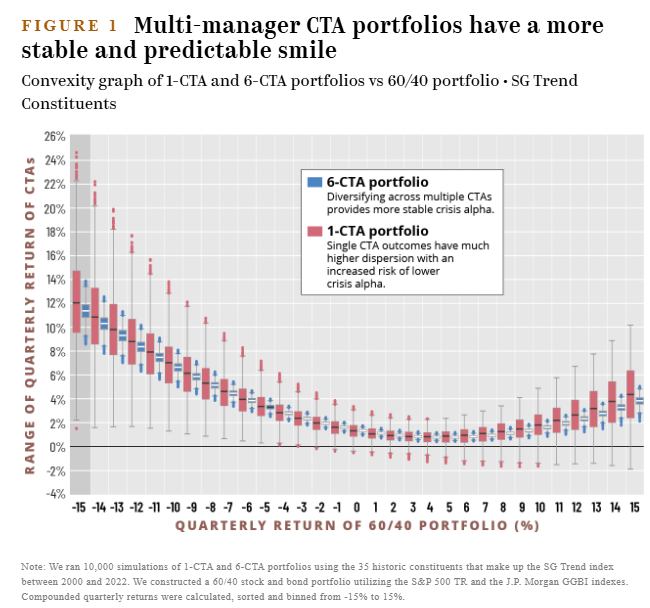

Diversifying Trend Following Strategies Improves Portfolio Efficiency

By Larry Swedroe|December 6th, 2024|Research Insights, Trend Following|

Allocation to trend following can further improve the efficiency of their portfolio by also adding allocations to the other uncorrelated strategies, further reducing tail risks by reducing the dispersion of potential outcomes.

DIY Trend-Following Allocations: December 2024

By Ryan Kirlin|December 3rd, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation [...]

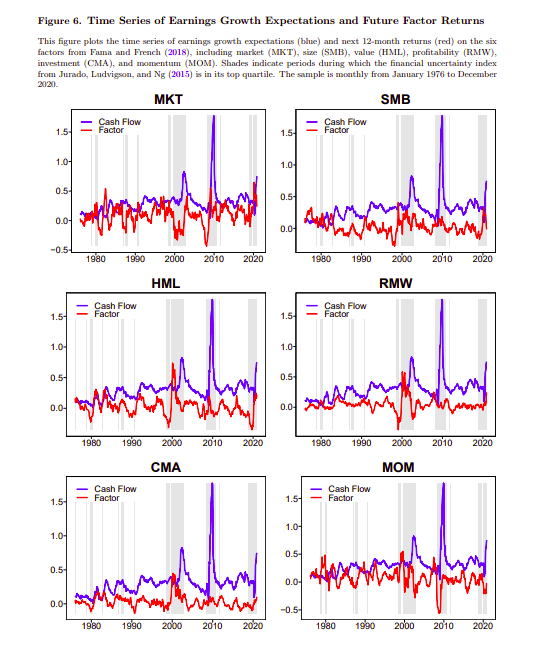

Time-Varying Drivers of Stock Prices

By Elisabetta Basilico, PhD, CFA|December 2nd, 2024|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

This paper examines the time-varying roles of subjective expectations in driving stock price and return variations.

Calendar Anomalies, Much Ado About Nothing

By Larry Swedroe|November 29th, 2024|Seasonality, Research Insights, Factor Investing, Larry Swedroe, Other Insights|

An anomaly is a pattern in stock returns that deviates [...]

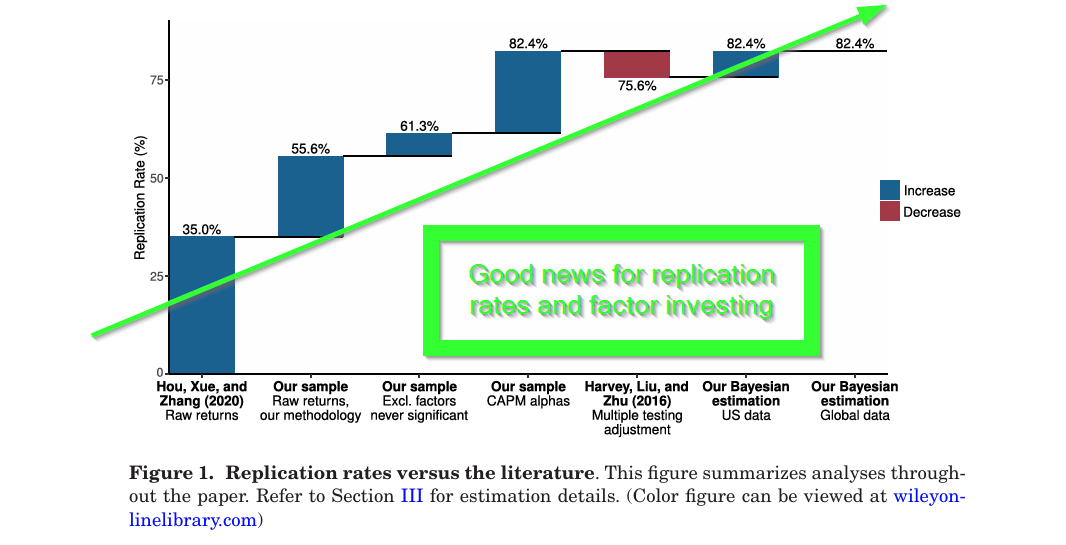

Factors are global, respectable and repeatable

By Tommi Johnsen, PhD|November 25th, 2024|Empirical Methods, Tommi Johnsen, Research Insights, Factor Investing, Academic Research Insight, Other Insights|

The propagation of factors actually reflect valid characteristics of the markets and market fluctuations.

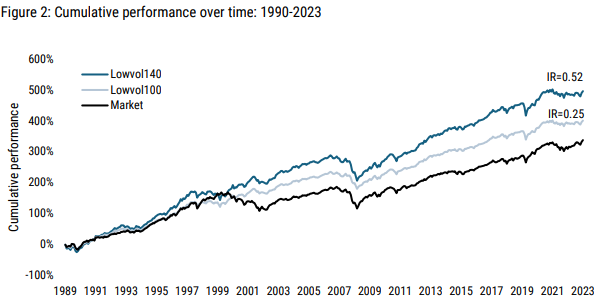

Improving Low Volatility Strategies

By Larry Swedroe|November 22nd, 2024|Volatility (e.g., VIX), Research Insights, Larry Swedroe, Other Insights, Low Volatility Investing|

The bottom line is that returns to the low volatility anomaly have only justified investing when low-volatility stocks were in the value regime, after periods of strong market performance, and when they excluded high-volatility stocks that have low short interest (providing clues as to how to improve its performance). This may be why live funds have been generating large negative alphas once we account for common factor exposures.

Financial Knowledge in Europe: Women Lag Men in their financial Literacy

By Elisabetta Basilico, PhD, CFA|November 19th, 2024|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

This paper examines the level of financial literacy across the 27 EU member states, using data from the 2023 Flash Eurobarometer 525 survey.

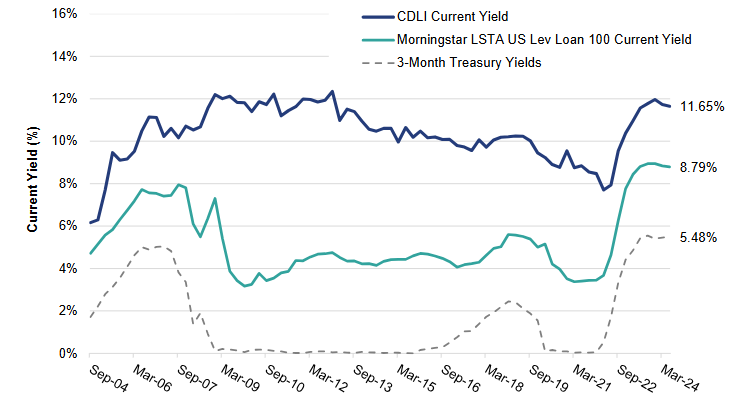

The Explosive Growth of Private Credit: Is There a Bubble?

By Larry Swedroe|November 15th, 2024|Transaction Costs, Private Equity, Research Insights, Larry Swedroe, Other Insights|

The growth rate of private credit has been so rapid (growing to nearly $2 trillion by the end of 2023, roughly ten times larger than it was in 2009), that concerns about there being a bubble have been raised.