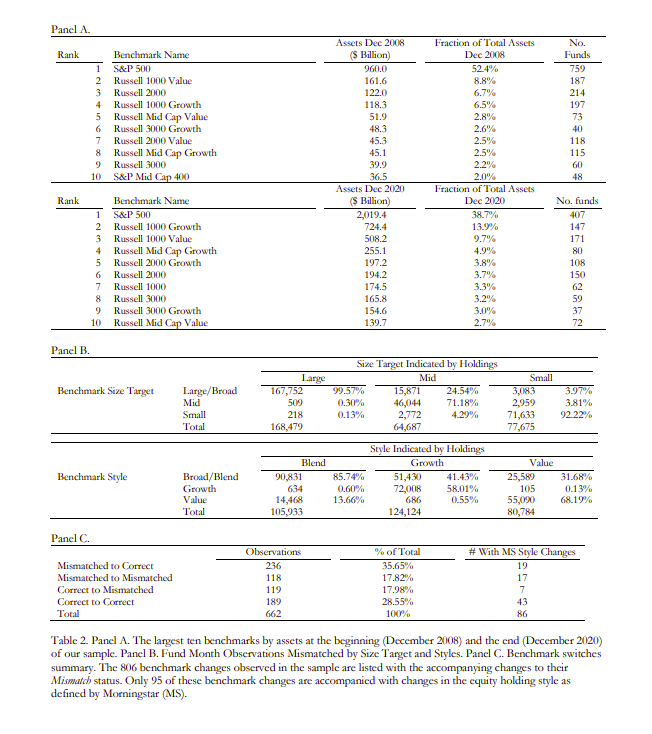

Self-Declared Benchmarks and Fund Manager Intent: “Cheating” or Competing?

By Elisabetta Basilico, PhD, CFA|February 20th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Corporate Governance|

The paper aims to provide insights into the dynamics of benchmark selection, the effectiveness of Relative Performance Evaluation ( RPE ) incentivization, and the broader implications for fund performance and market competition.

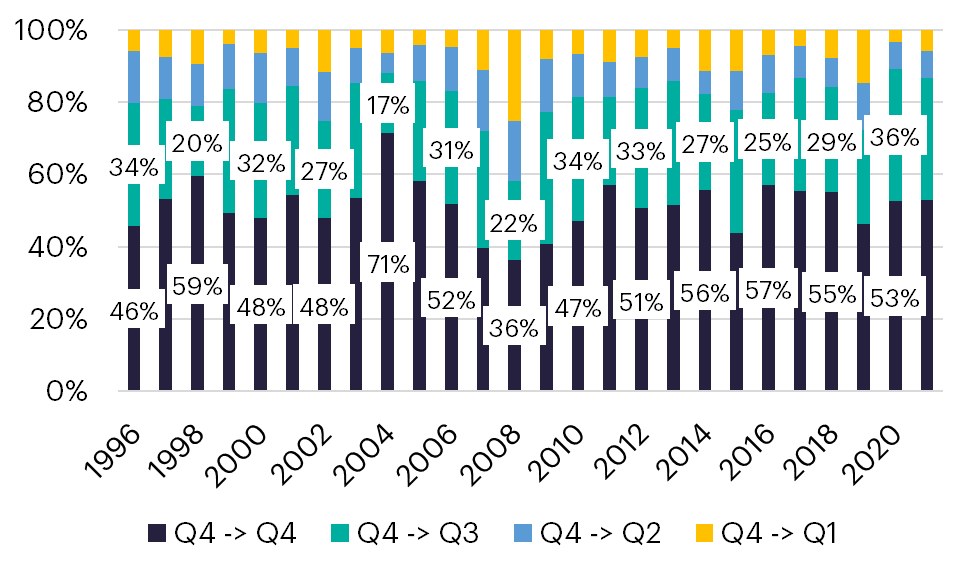

On the Persistence of Growth and Value Stocks

By Larry Swedroe|February 16th, 2024|Asset Growth, Larry Swedroe, Research Insights, Value Investing Research|

While analysts underwrite high growth for companies that have grown quickly and slow growth for companies that have grown slowly in the past, a large body of evidence demonstrates that reversion to the mean of both positive and negative abnormal earnings growth is the norm.

Can ChatGPT Improve Your Stock Picks?

By Tommi Johnsen, PhD|February 12th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

One use of the NLP (natural language processing) features of ChatGPT is to search out patterns in the immense amounts of news, data and other sources of information about specific stocks, and then efficiently convert them into summaries valuable for all types of investors. Can this be accomplished with useful results? The authors use the Q2_2023 period to test performance around earnings announcements. Earnings announcements and earnings surprises are informationally rich as well as challenging events for investors to analyze.

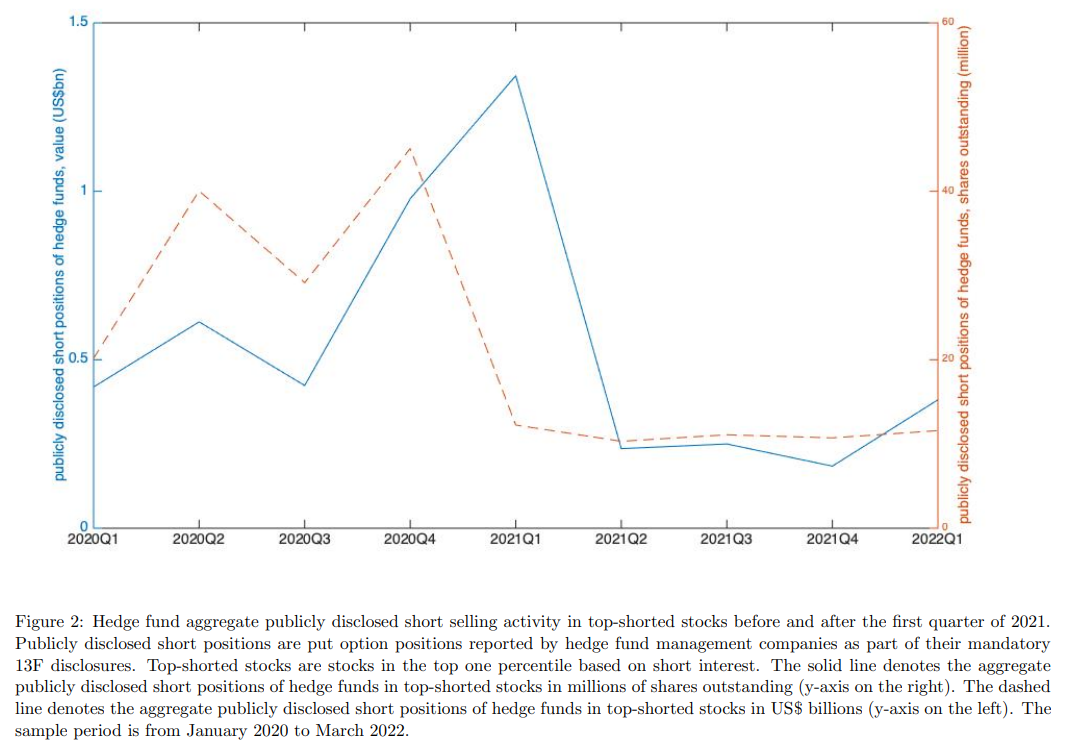

Band of Brothers Attacking Short Sellers: Game Stop for Hedge Funds

By Larry Swedroe|February 9th, 2024|Liquidity Factor, Price Pressure Factor, Larry Swedroe, Research Insights, Other Insights, Behavioral Finance|

Advisors and investors should be aware that fund families that invest systematically have found ways to incorporate the research findings on the limits to arbitrage and the evolving changes we have discussed to improve returns over those of a pure index replication strategy. It seems likely this will become increasingly important, as the markets have become less liquid, increasing the limits to arbitrage and allowing for more overpricing.

Global Factor Performance: February 2024

By Wesley Gray, PhD|February 6th, 2024|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

Professional Athletes and Money Skills

By Tommi Johnsen, PhD|February 5th, 2024|Financial Planning, Research Insights, Basilico and Johnsen, Academic Research Insight|

Until that framework is defined, an assessment of the financial acumen of professional athletes will remain unfocused. This research addresses that gap.

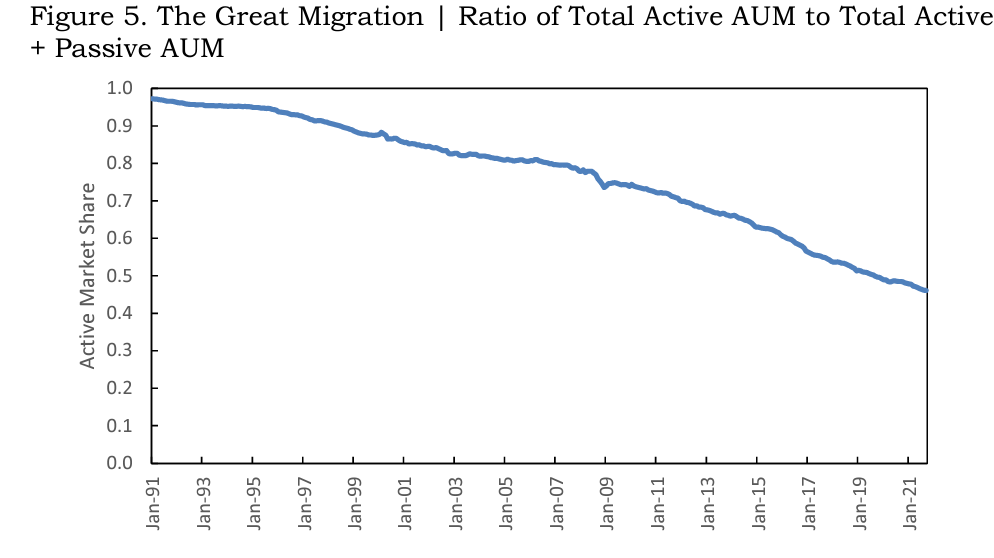

Trend to Passive Investing Negatively Affecting Active Funds

By Larry Swedroe|February 2nd, 2024|Larry Swedroe, Research Insights, Guest Posts, Other Insights, Active and Passive Investing|

While the evidence makes clear that active management is a loser’s game (one that it is possible to win but so unlikely you should not try), we don’t want active managers to disappear. Hope should continue to triumph over evidence, wisdom, and experience because active managers help eliminate market anomalies and inefficiencies created by the misbehavior of investors (such as noise traders). That helps to ensure that capital is allocated efficiently.

DIY Trend-Following Allocations: February 2024

By Ryan Kirlin|February 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. No exposure to commodities. Partial exposure to intermediate-term bonds.

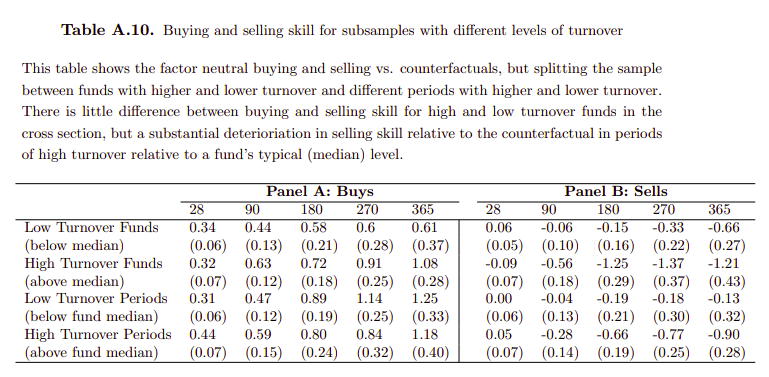

The Smart Money Can Buy Stocks, but They Can’t Sell Them

By Elisabetta Basilico, PhD, CFA|January 29th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Corporate Governance|

The paper aims to investigate whether experienced institutional portfolio managers (PMs) exhibit behavioral biases in their decision-making processes, specifically focusing on the selling decisions.

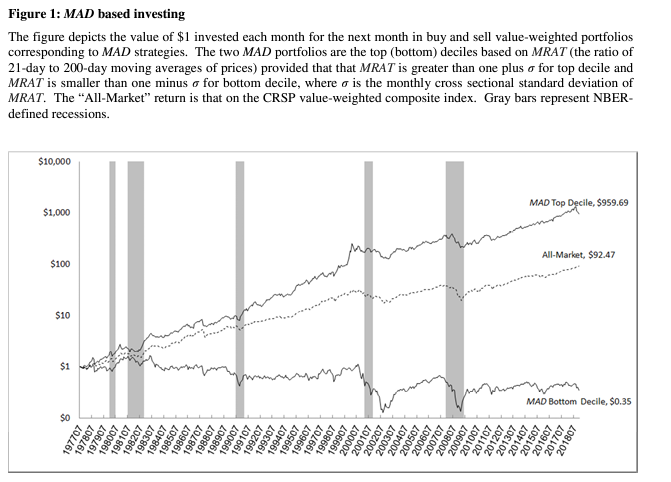

Moving Average Distance and Time-Series Momentum

By Larry Swedroe|January 26th, 2024|Research Insights, Larry Swedroe, Factor Investing, Trend Following, Momentum Investing Research|

For investors that use trend-following strategies, Avramov, Kaplanski, and Subrhmanyam provided new evidence supporting momentum strategies and showed that the distance between short- and longer-term momentum signals provides additional explanatory power in the cross-section of equity returns.